Sean Gallup/Getty Images News

Investment Thesis

TikTok (BDNCE) combines its addictive entertainment with highly successful advertising to create a Shoppertainment approach that is a massive threat to Meta’s (FB) eCommerce and Social Media strategy. In Meta’s recent earnings call, the company acknowledged the growing demand for TikTok’s short format video, which was adapted into Instagram’s Reels format in August 2020. However, despite the launch, Meta has yet to successfully master the market in FY2021, while TikTok’s parent company, ByteDance, reported massive YoY revenue growth of 70% in the same year. Nonetheless, considering how Meta has navigated multiple competitions through technology adaptation or acquisition over the years, we are confident in its ability to turn this situation around.

For this article, we will focus on how Instagram will fare against the intense competition from TikTok.

The Superiority Of TikTok’s Shoppertainment

By combining its addictive entertainment and successful advertising as a Shoppertainment strategy, TikTok has shown itself as a force to be reckoned with in the Social Media and eCommerce industry. The innovative approach led more advertisers to switch from traditional social media platforms like Facebook and Instagram, to its highly creative and engaging platform, TikTok, especially during the widespread COVID-19 lockdowns.

In addition, TikTok had trended their For You Page and hashtag #TikTokMadeMeBuyIt, due to its highly effective and accurate algorithms. With more than 3B views of the hashtag, the influencers-led phenomenon drove massive global eCommerce growth in the last two years. As a result, TikTok reported nearly $4B of advertising revenues in FY2021.

TikTok’s Shoppertainment Strategy

TikTok

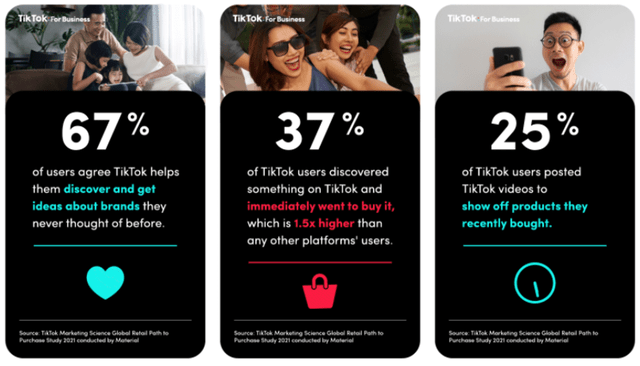

TikTok achieved the feat due to its highly connected platform, which encourages two-way public interaction, by enabling entertaining advertisements and community participation. It allowed TikTok users to reach out to a more extensive community based on similar interests than Instagram, which encourages interactions based on the existing circle of followers. These proved highly effective during the COVID-19 lockdowns as many turned to TikTok communities for social interactions, especially for the Gen Zs and Millenials who form the majority of TikTok users at 63%. In addition, TikTok’s short video format allows for more entertaining advertisements content, which users commented as less disruptive and more entertaining than other social media platforms.

TikTok’s Advertising Success

As a result, more users have indicated that they are more inclined to discover and purchase new products from the new advertising format. The more engaging platform and seamless discovery had led to TikTok’s 37% consumer product engagement, which is 1.5 fold higher than any other platform. It is evident that TikTok had redefined the popular social media experience into distinctly communitive engagements, while also reinventing the global eCommerce experience.

TikTok’s Massive Growth Likely Tempered By New Regulations And Algorithm Changes

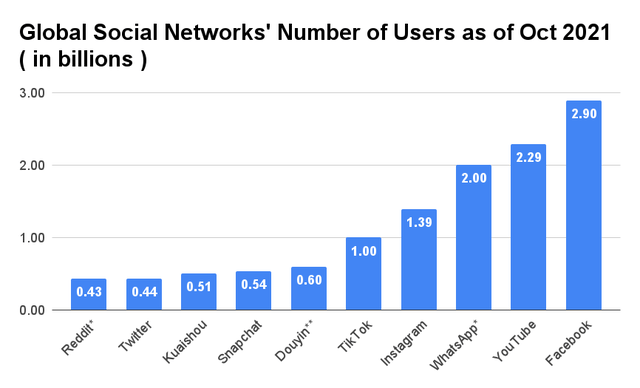

Global Social Networks’ Number of Users as of Oct 2021

As of September 2021, TikTok reported 1B of global Monthly Active Users (MAUs), representing an astronomical CAGR of 93.84% in the past four years. In addition, TikTok intended to grow its MAUs by another 50% in FY2022 to over 1.5B, which would then be nearer to Instagram’s existing MAUs of 2B. For reference, TikTok took only five years to grow its MAUs to their current levels, while Instagram took 11 years. It is also important to note that as of October 2021, Snapchat (SNAP) only had a total of 538M MAUs since its inception in 2011. Furthermore, 1.5B of MAUs would bring TikTok closer to Meta’s Whatsapp at 2B, Alphabet’s (GOOG) Youtube at 2.29B, and Meta’s Facebook at 2.89B.

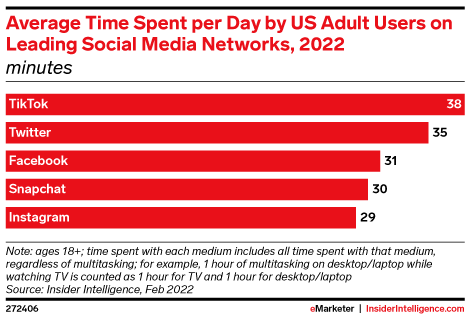

Average Time Spent on Leading Social Media Networks

eMarketer

Based on eMarketer, TikTok is also the most widely used social media application at an average of 38 minutes a day amongst the top five platforms. Instagram lagged behind at 29 minutes, representing a 23.6% difference from the reigning king. As a result, it is evident that Instagram needed to up its social media game while weathering the headwinds from TikTok.

TikTok’s parent company, ByteDance, reported an approximate $58B advert revenue in FY2021, which is 21.7% more than Instagram’s estimated revenue at $47.62B over the same period. It is also estimated that TikTok had generated nearly $4B of revenues from advertising in FY2021, with ByteDance expecting to triple TikTok’s revenues to $12B in FY2022. ByteDance’s revenues also showed consistent YoY growth in the past few years. For FY2021, ByteDance reported YoY revenue growth of 69%, compared to FY2020’s revenue of $34.3B, which is also more than double FY2019 revenues. No wonder Meta had lower guidance for its FQ1’22 revenues, given the intense competition from TikTok and headwinds from Apple’s privacy changes. As a result, it sent Meta’s shares downhill from $323 on 2 February 2022 to $224.91 on 7 February 2021, representing a massive 43.6% decline.

Nonetheless, ByteDance’s slower growth in FY2021 could mean that the company faced some headwinds from the tightening regulation for big tech companies in China. As part of the new regulation in China, apps using algorithmic recommendations must allow users to turn off personalized content and product suggestions from March 2022 onwards. These were reportedly to prevent “content intoxication” and the shaping of unfavorable public/ social opinion. However, we expect these legislations to only apply to its Chinese-based app Douyin, without much effect on its global TikTok platform.

Nonetheless, TikTok had also pledged to modify its award-winning algorithm to avoid reinforcing certain harmful content types such as extreme dieting and sadness. In addition, TikTok also just updated its policies to ensure age-appropriate content for its younger users, with an additional Family Pairing parental control feature. These changes would then be counterproductive to its highly successful algorithms, which have allowed a massive surge in consumer engagement since its inception five years ago. Moreover, given the Chinese government’s propensity for control, it is also uncertain how Big Tech companies such as ByteDance will emerge at the end of the path. As a result, we expect TikTok’s revenue growth to be slightly moderated moving forward, given that its consumer engagement may be less effective after the implementation of changes to its algorithms after the legislation.

Instagram Had Survived By Copying Its Competitors – Most Notoriously Snapchat

In August 2016, Meta notoriously launched its Instagram Stories, which was decidedly “a carbon copy of Snapchat Stories, lifting everything including the name.” At that time, it was a wise decision for Meta given the popularity of Snapchat in early 2016. By making multiple critical updates to engage its young users in 2016, Snapchat had briefly overtaken Instagram as the most popular social media platform with 28% of votes. Snapchat’s robust demand was then attributed to its departure from text-based platforms to picture/video-based media.

However, as a result of Meta’s “technology adaptation,” Snapchat’s growth was clipped, and its stock performance had remained stagnant from 2016 until the end of 2020, when Snapchat’s demand returned. Snapchat’s MAUs also reported minimal growth for four years before the pandemic boom. In the meantime, Instagram’s popularity returned as it managed to recapture its audiences through multiple iterations and improvements on the Instagram Stories. Based on Business of Apps, Instagram had reported excellent growth in its MAUs from 600M users in 2016 to 2B in 2021.

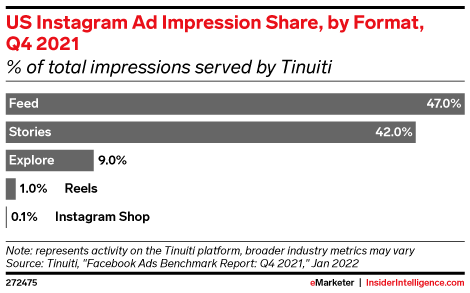

US Instagram Advertisement Impressions

eMarketer

Recently, Meta has begun to move into Reels, another adaptation of TikTok’s short video format. So far, Meta’s reels have not been as viral and profitable as TikTok’s platform, given the former’s late entry and users’ preference for the latter. In the US, Instagram still relied on Feed and Stories for the bulk of its advertisement revenues, with Reels contributing only 1% to the US Instagram’s FY2021 revenue of $26.46B.

Nonetheless, we are confident of Meta’s competence in turning the situation around, given that it has successfully navigated multiple competitions over the years through technology adaption or acquisitions. Social media will continue to evolve, and TikTok will be dethroned by another application sooner or later. As a social media giant, Meta ultimately has more than enough resources to implement the necessary adaptation and innovation to stay ahead of the game. For example, its massive Research and Development expenses of $10B into the Metaverse in FY2021 has shown Meta’s conviction of the social media’s future.

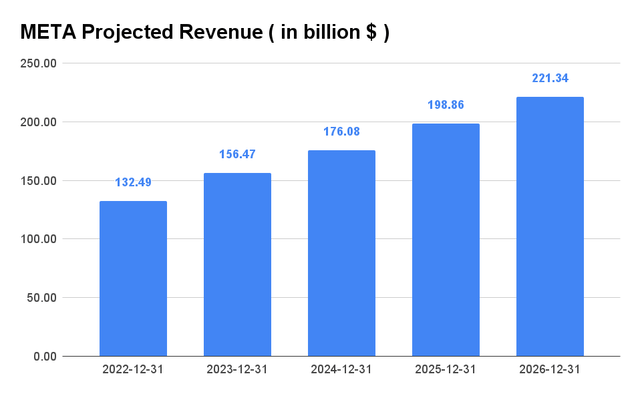

Meta Projected Revenue

Despite the headwinds faced by Meta from TikTok and Apple’s privacy changes, Meta is still projected to record massive revenues moving forward. In the next four years, Meta is expected to report excellent revenue growth at a CAGR of 13.69%. However, it still represents a deceleration of revenue growth from the past five years at 33.67%. Nonetheless, we also consider Meta a maturing social media company that may have grown too big over the years. As a result, Meta’s growth may slow down moving forward.

So, Is Meta Stock Still A Buy?

Meta is currently trading at an EV/NTM Revenue of 4.62x, lower than its 3Y mean of 6.93x. Consensus estimates also rate Meta stock as fair value now, given that it has been a money-making machine for the past few years. Since ByteDance is currently privately owned, an IPO is highly speculative and improbable given the current political climate in China. In addition, with algorithm changes coming TikTok’s way, we may expect a less effective consumer engagement moving forward.

In addition, Meta has previously successfully adapted multiple social media strategies such as Snapchat’s ‘Stories’ and Timehop’s ‘On This Day’, while going on massive acquisitions such as WhatsApp and Instagram. As a result, though there are some headwinds moving forward, we do not expect Meta’s potential growth to falter too much. Meta is also currently trading at $220.18, almost at its 52-weeks low of $216.15. Therefore, aggressive investors may use this chance to buy more during the dip, who do not mind the headwinds from Apple’s recent privacy changes.

As a result, we rate Meta stock as a Buy for aggressive investors.

Be the first to comment