Chip Somodevilla/Getty Images News

Meta Platforms, Inc. (NASDAQ:META) stock took a large dip on Tuesday, falling 4% when the market rallied nearly 3%. On the day that Meta crashed, no material news was released, apart from a DoJ settlement affecting a tiny percentage of the business. The crash did coincide with some Facebook posts by Mark Zuckerberg, but none of those posts contained news that would qualify as “material” (i.e., having a measurable impact on financial performance). Many investors were dismayed.

On the day Meta fell, I scoured the internet looking for possible causes of the crash. I eventually found reports that Meta would forego revenue cuts on creator payments until 2024. I found it unlikely that that alone would cause Meta to fall so severely, as temporarily “free” services are known to attract users/customers. So, I went on Facebook to see what Mark Zuckerberg was saying about the revenue cut. After looking at the broader context, I believed I had found the source of the crash. I took to Twitter (TWTR) to share what I had found.

Basically, Zuckerberg’s announcement about influencer revenue was within the context of a larger thread containing many things investors don’t want to hear. Not only did Zuckerberg pledge to give influencers 100% of their revenue until 2024, he also re-affirmed his commitment to the Metaverse. The Metaverse is a huge project for Meta, one so big it inspired the company’s recent name change. An entire division of Meta–Reality Labs–is dedicated to building the Metaverse, and it is losing money. Generally speaking, investors don’t like hearing about Zuckerberg’s enthusiasm for the Metaverse, as many believe it is a long shot bet that may never pay off.

It may well be that the Metaverse won’t pay off. Certainly, VR business meetings aren’t anybody’s idea of “tried and true.” What investors forget is that Meta is a wildly profitable company even with $3 billion being spent on the Metaverse every single quarter. In its most recent 12 month period, Meta had $119 billion in revenue, $96 billion in gross profit, $43 billion in operating income, and $31 billion in free cash flow (“FCF”). Simply staggering levels of profit. A company with 80% gross margins (that’s not a typo) can afford to invest some money in growth initiatives, and META is taking advantage of its strong financial performance to do so.

Given this peculiar combination of high profitability, decent revenue growth and a falling stock price, it’s hard to avoid comparing Meta to Alibaba Group Holding Limited (BABA, OTCPK:BABAF) at its lowest levels. Following China’s re-imposition of lockdowns, BABA hit truly absurd lows at which it was barely trading above liquidation value. It has since rallied 38% off its all-time lows and is down less than the S&P 500 this year. FB is not exactly identical to BABA, as it doesn’t quite have a price to book ratio barely above 1. On the flipside, it is exposed to fewer risk factors, especially extreme tail risks, which makes it a worthy addition to a value oriented portfolio.

Meta Stock Trades Below Fair Value in a Discounted Cash Flow Model

If you follow Meta stock closely, you’ve probably heard about its notoriously low multiples. In brief, it trades at just 9.4 times free cash flow and the earnings multiples are similarly low. I’ve covered this fact in past articles–there is little to add today other than to say that the multiples are even lower now.

There is, however, a different valuation approach we can take:

A discounted cash flow valuation. This is where you discount a few years’ worth of cash flows during a period of growth and then add a terminal value for a period of slower growth. This gives you a price target, which multiples don’t, as they are just ratios.

Normally in a discounted cash flow model you’ll take 5 or 10 years’ cash flows, discount them, and then add the terminal value. In past articles I have used this method to value stocks. However, in Meta’s case, we can skip the “growth period” entirely, as the stock is undervalued assuming 0% perpetual growth in FCF.

A stock’s “terminal value” is defined as:

Terminal cash flow/(discount rate – sustainable growth rate).

Let’s say that Meta does not grow at all for the rest of eternity. To sweeten the pot, we’ll assume that the 10 year treasury yield rises from the current 3.167% to 3.5%. A truly brutal set of assumptions that will imply severe downside, right?

Wrong.

Meta’s trailing 12 month FCF was $14.3. Since we’re assuming no growth, the denominator is simply the 3.5% discount rate. Our terminal value equation then is:

14.3/0.035.

The result?

$408.50!

That’s more than double today’s stock price and we’re assuming no growth here. Of course, some DCF models use more punishing discount rates than the treasury yield. The website valueinvesting.io, for example, uses an 8.9% WACC in their META model. They get a price target of $258 with some assumed growth. Using their discount rate and no growth assumption, you get a terminal value of $160, which is still upside to today’s price.

After trying a few different DCF models with different inputs, I really struggled to get PV results below Meta’s current stock price. The only one that worked was swapping out FCF for EPS and using WACC. Using those inputs and assuming no growth you get a PV lower than the current stock price, but keep in mind, this is a hand-picked collection of the most unfavorable inputs possible. Using the more conventional FCF over EPS and assuming no growth, you get upside.

Competitive Landscape

As I showed above, Meta Platforms, the business, is worth more than META, the stock, if it never grows again for the rest of eternity. It certainly looks like a compelling value. However, we need to address the possibility of negative growth. Were Meta’s earnings to decline forever, a discounted cash flow analysis might produce a different result than the one I calculated above. So, we need to explore the company’s competitive position, to see whether it could lose out to competitors so badly that its earnings go down long term.

As I’ve covered extensively in past articles, Meta was on the losing end of some developments in the ad-tech industry last year. Apple (AAPL) brought in changes in IOS 14.5 that required advertisers to ask for permission before tracking them. Only 25% opted in to tracking. As a result, Meta’s revenue growth declined to 7% in the first quarter. In the same quarter, Alphabet (GOOG, GOOGL) managed 23% revenue growth.

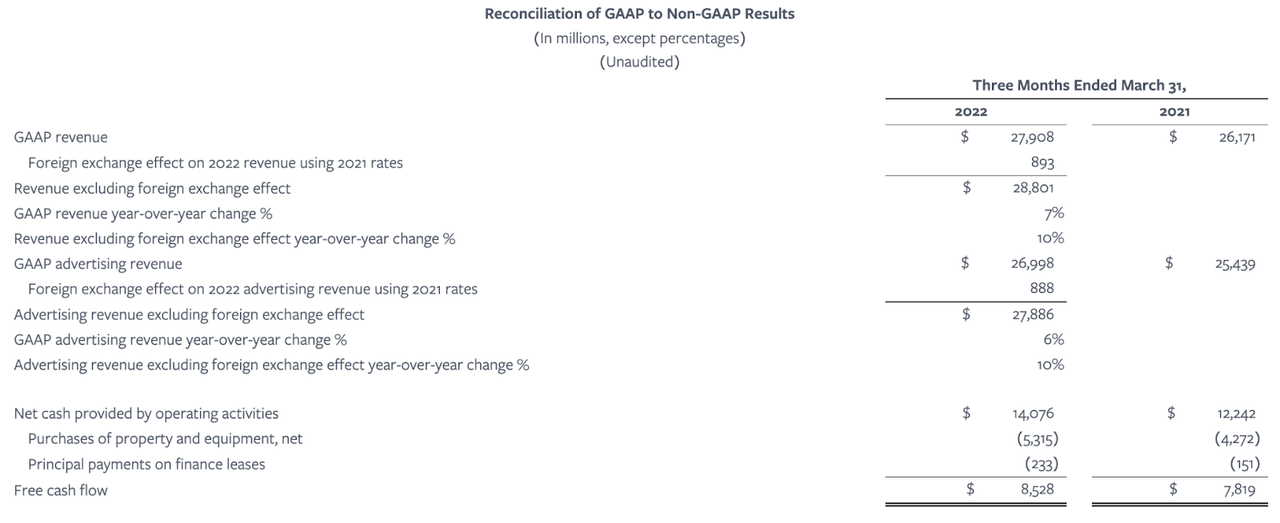

If you suspect that Meta lost revenue to Alphabet, you’re right. Google Search doesn’t require anywhere near as much user data as Facebook/Instagram ads do, so it was hurt by Apple’s privacy changes much less than Meta was. In the fourth quarter earnings call, Meta CFO David Wehner said that Apple’s ATT changes would cost Meta $10 billion in 2022. In the first quarter, we saw that revenue did indeed slow down a lot. So, that $10 billion hit is probably a real thing. However, Meta’s growth did not actually flip negative. 7% revenue growth is slow for a tech company, sure, but it’s still positive, and the FCF growth (calculated with the table below) was 9%. So, we’re still well ahead of the 0% growth Meta needs in order to be a good value play.

9% free cash flow growth (Meta Platforms)

Risks and Challenges

As I’ve shown in this article, META stock is priced lower than the fair value of Meta Platforms as a business. Certainly, it looks like a winning combination. There are risks and challenges to be on the lookout for, as I’ve written in past articles. Some noteworthy ones include antitrust lawsuits, excessive Metaverse spending, and Apple’s privacy policy. In my opinion, these risk factors do not outweigh the simple fact that Meta is undervalued under zero growth assumptions. However, there is one risk factor that could be considered serious enough to justify avoiding the stock:

Time horizons.

If your intended holding period is only a few months to a year, you could lose a fair bit of money trading Meta stock. Meta has its second quarter earnings release coming up, and it’s going to be a tough one. The second quarter of the previous year was very strong. In it, the company grew revenue by 56% and earnings by 101%. In that quarter, most Apple customers hadn’t opted into IOS 14.5 yet. So, Meta still had full ad-targeting power.

This time around, it won’t have that advantage. Beating a quarter where revenue grew 56% is always tough, and Meta’s going into this one with one hand tied behind its back. I think the likelihood of a dip following Q2 earnings is pretty high. So, short term investors might want to stay away.

The thought process that goes into a DCF analysis doesn’t say anything about timeframes. It can take many years for a stock to rise to fair value. The kinds of results that Meta needs to rise from its current level long term will be pretty easy to achieve. But that won’t prevent the stock from dropping after Q2 earnings. I think there’s a decent chance that it will.

The Bottom Line

Putting it all together, Meta Platforms has the makings of a value play similar to Alibaba when it was trading for $72. Much like BABA, META trades for less than the fair value of its future cash flows even with extremely modest growth assumptions. Does that mean that Meta is going to rally overnight? No. But it does make it a worthy pick for long term, buy-and-hold investors.

Be the first to comment