Fritz Jorgensen

Meta Platforms, Inc. (NASDAQ:META) is set to report its second quarter earnings on July 27 after the market closes. The company is expected to report flat revenues and a declining EPS when compared to last year. If the company misses revenue expectations, it could mark the first yearly decline in revenue in its history. However, numerous downward revisions may cause it to beat expectations and lead investors to become bullish again. These downward revisions are due to changes to data sharing, as well as the rise of TikTok among consumers and advertisers. To better compete with TikTok, Meta is changing its algorithm to be more similar to TikTok and bring back its users. Furthermore, the Reality Labs segment appears to have long-term promise and will help protect the company from future advertising downturns. Overall, Meta is facing short-term headwinds but likely has a bright long-term future and makes the stock very attractive at this price.

Meta is Reporting Earnings on July 27, Missing Estimates Could Be Devastating

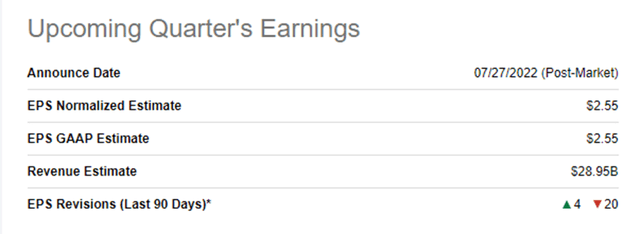

Meta Platforms is reporting its second quarter earnings on July 27 after the market closes. The company is expected to report total revenues of $28.95 billion. This represents a Q/Q increase of 4% but is about flat when compared to 2Q21. EPS is expected to come in at $2.55, down 6% Q/Q and 29% Y/Y.

META 2Q22 Earnings Expectations (Seeking Alpha)

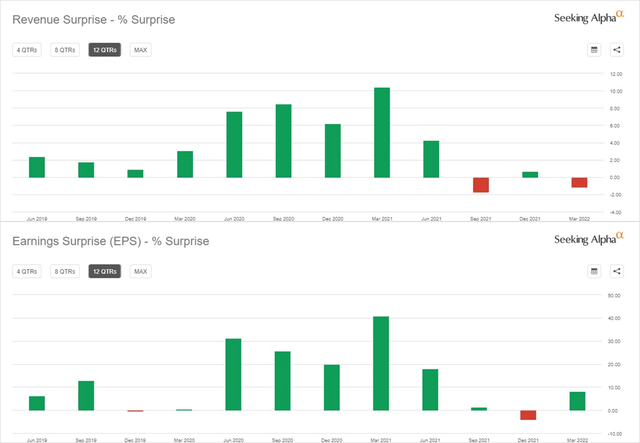

If Meta misses estimates for revenue, it will experience its first-ever revenue drop in its history. In its previous quarter, revenue grew by only 7% and marked the first time it experienced single-digit revenue growth on a yearly basis. Since missing its estimates could be devastating to the share price, looking at the company’s past surprise data may be beneficial. Over the past 12 quarters, Meta has missed revenue and EPS estimates twice while beating estimates 10 times. It is important to note that both revenue misses are within the past year, including 1Q22 and 3Q21.

Revenue & EPS Surprise Data (Seeking Alpha)

An important factor with estimates is how revisions have been trending. In the past three months, estimates for Meta’s revenue have been revised downward 38 times and upward only once. Furthermore, EPS estimates have been revised downward 20 times and upward only four times. With revisions being so pessimistic recently, it could be likely that Meta will beat estimates and surprise investors. However, management’s guidance in its first quarter report places Q2 revenue between $28-$30 billion. If revenue is reported at or below the lower guidance, the company will experience its first Y/Y decline.

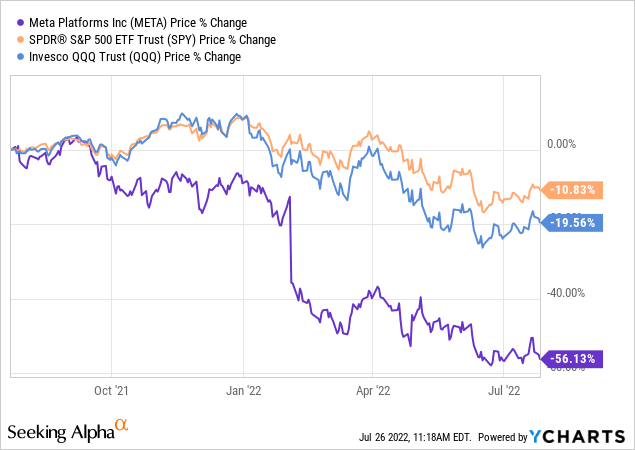

Due to these pessimistic estimates and other factors, Meta’s share price has dropped by over 56% YTD. This is far underperforming both the S&P 500 and Nasdaq. However, this could allow investors who believe in the company to get great value for their investment. Therefore, this earnings report is becoming a major deciding factor for many investors.

Why Are Analysts Bearish on Meta?

The main reason why analysts are becoming so pessimistic on Meta is because of Apple’s (AAPL) changes to privacy regarding the IDFA tag. The IDFA tag allows for better ad targeting and Meta relied heavily on this system. However, Apple announced last year that it will give iOS users the option to not share its IDFA tag with third parties, including Meta’s apps. This caused advertising on Facebook and Instagram to become less attractive among advertisers, therefore leading to lower revenue growth. This is even more detrimental to Meta because of the popularity among consumers of not sharing their IDFA tag. It was reported in October that about 62% of iPhone users are opting out of sharing their tag.

Meta is not the only company being affected by this change. Snap (SNAP) recently reported its second quarter earnings and came in below analyst expectations. The company reported revenues of $1.11 billon, missing by 3%. Management placed part of the blame for this slowdown on Apple’s changes to privacy. However, the company is combating the privacy changes by launching Snapchat+, a paid subscription plan that lets users have access to more features. This is an advantage Snap (and other companies that relied on the IDFA tag) have over Meta. To further combat Apple’s changes, Meta should begin exploring opportunities to better monetize its apps through paid products. Along with Snap’s bad earnings, management supplied no guidance for the future. This could mean the advertising industry will continue to struggle in the near future, directly hurting Meta’s top line.

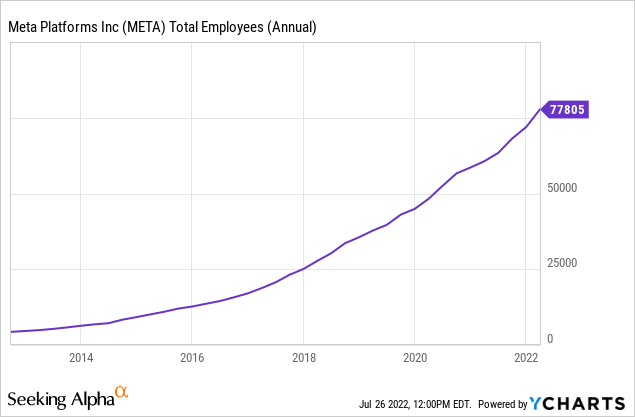

Like other tech companies, Meta is cutting its hiring plans to lower costs. Previously, the company planned to hire about 10,000 new engineers, which has now been revised to 6,000-7,000. However, many investors are expecting Meta to follow its peers and begin laying off employees since Zuckerberg recently said, “Realistically, there are probably a bunch of people at the company who shouldn’t be here.” Meta’s employees are also expecting layoffs as high as 10% of the company’s total workforce. This would cause just under 8,000 employees to be out of a job in the upcoming future.

The Rise of TikTok and Meta’s Response

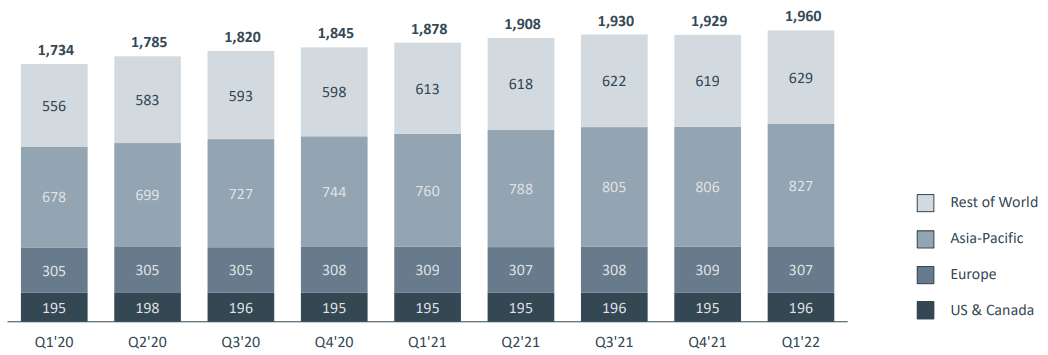

The next biggest reason as to why analysts are bearish on Meta is because of the rise of TikTok. TikTok is becoming one of the most popular forms of social media among Meta’s target audience, as well as becoming more favorable among advertisers. This is because of TikTok’s well-built algorithm and the popularity of its For You page. This caused Facebook’s daily active users to fall in the fourth quarter of 2021 to 1.929 billion while TikTok claimed it had more than 1 billion global users. However, Facebook’s DAUs recovered to 1.96 billion in the first quarter of 2021 and followed its long-term trend of rising users. Including Meta’s other apps, its family daily active people increased to 2.81 billion in 4Q21 and 2.87 billion in 1Q22.

Facebook DAUs (Company Presentation)

To further improve Meta’s competitiveness with TikTok, the company is redesigning its apps to focus less on connecting users with their friends and more on consuming content. This is meant to make Facebook and Instagram more similar to TikTok, especially through the use of Reels. Instead of seeing your friends’ posts first, users will now be initially placed on the Home page with Reels and other content pushed by the apps’ algorithms. Similar to TikTok, users will have to go to the Feeds page to see what their friends have posted.

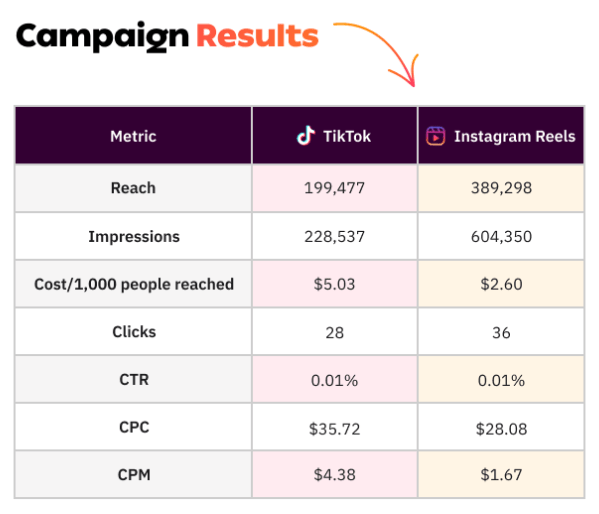

The next step is properly advertising its new system and making it more popular among businesses. To do so, Instagram and Facebook are providing better value for advertisers and enhancing a post’s reach. A study by Creatopy used the same budget and criteria for an ad on TikTok and Instagram. The study showed that the reach on the Instagram ad nearly doubled the reach of TikTok’s ad, while also outperforming in impressions by almost 3x. This could cause Instagram and Facebook to become more attractive among advertisers, especially small businesses with lower budgets.

TikTok vs. Instagram Ad Performance (Digital Information World)

On top of this, Meta’s management is focusing heavily on advertising its short-form videos and new algorithm. In the past, the company has effectively adapted to new forms of media and properly monetized them to become industry leaders. In Meta’s first quarter earnings call, Zuckerberg stated:

We’ve seen this type of media format transition multiple times before. Back in 2012, when we transitioned from desktop feed to mobile feed, we saw mobile feed growing massively, but not monetizing well yet, and we leaned into it, went through some tough quarters, and then it became the foundation of our business today. Similarly, in 2018, when people started using Stories more instead of Feed, but Stories didn’t monetize as well as Feed yet, we still doubled down on Stories, had another tough period but came out stronger than ever. So we’ve run this play before, and we’re running it again now.

Reality Labs Has Long-Term Potential

Meta’s current attempt to generate revenue outside of advertising is through its Reality Labs segment. This segment sells the company’s virtual reality headsets and other related products and is gaining steam among consumers. Reality Labs has promise over the long term as higher volumes would allow for more revenue through in-game purchases.

An example right now is Nike (NKE), who is becoming an advocate for the metaverse and wants to sell virtual apparel. When Nike sells its products in the metaverse, Meta could take a percentage of the revenue. This concept has worked well in the past, as companies like Apple and Google (GOOG) (GOOGL) take a portion of revenue from digital in-app purchases. Other game companies like Roblox (RBLX) generate revenue through the sale of their in-game currency, which could also be a solution for Meta. With the metaverse becoming more popular among consumers and companies, the company may begin to generate higher revenue and protect itself from current and future changes to advertising.

META Stock Valuation

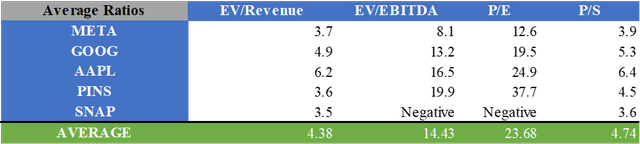

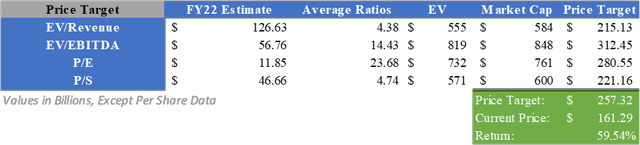

To value the stock, I created a relative valuation and DCF. For the relative valuation, I combined consensus analyst estimates for FY22 with the average valuation multiples for EV/Revenue, EV/EBITDA, P/E, and P/S of Meta and its peers. This calculated a price target of $257.32 after adjusting for net debt and implies an upside of 59.54%. This is also in line with the average analyst price target of $262.28, which implies an upside of 62.61%.

Created by Author Relative Valuation of META (Created by Author)

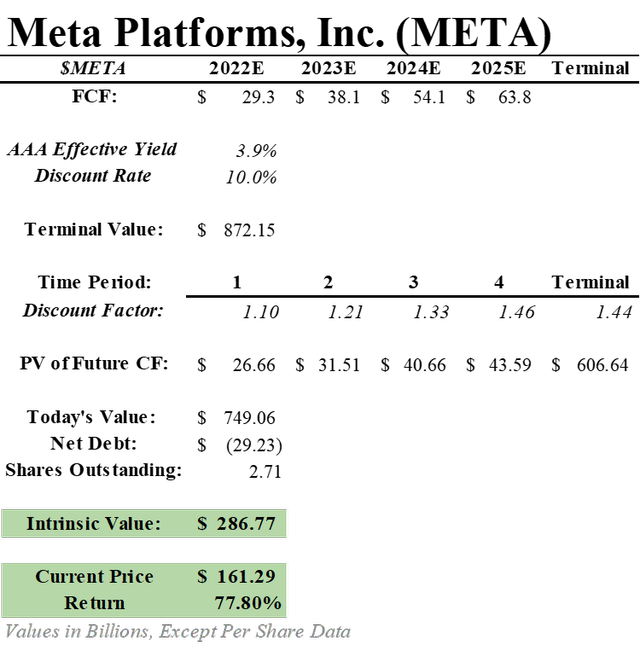

For the DCF, I used consensus analyst estimates for free cash flows in the upcoming years. I then discounted these future free cash flows by 10% to give a premium over current AAA corporate bonds. After discounting the free cash flows back to present value, adjusting for net debt, and dividing by the shares outstanding, a fair value of $286.77 can be calculated. This implies an upside of 77.8%.

META DCF with 10% Discount Rate (Created by Author)

What Does This Mean for Investors?

Meta Platforms is reporting earnings on July 27 after the market closes. Analysts expect the company to report revenues of $28.95 billion and an EPS of $2.55. If the company misses on revenue estimates, it would mark the first time it recorded a Y/Y decrease in revenue. This is mainly due to Apple’s changes to privacy making Meta’s apps less popular among advertisers. Furthermore, the rise of TikTok is causing many consumers and advertisers to shift away from Facebook and Instagram. However, Meta is changing its algorithm and advertising to better compete with TikTok and regain its popularity. The company’s long-term future with its Reality Labs segment also appears to be promising and could help protect it from future downturns in advertising. All in all, Meta appears to be facing short-term struggles but has long-term potential. Therefore, I will apply a Buy rating to the stock.

Be the first to comment