Kelly Sullivan/Getty Images Entertainment

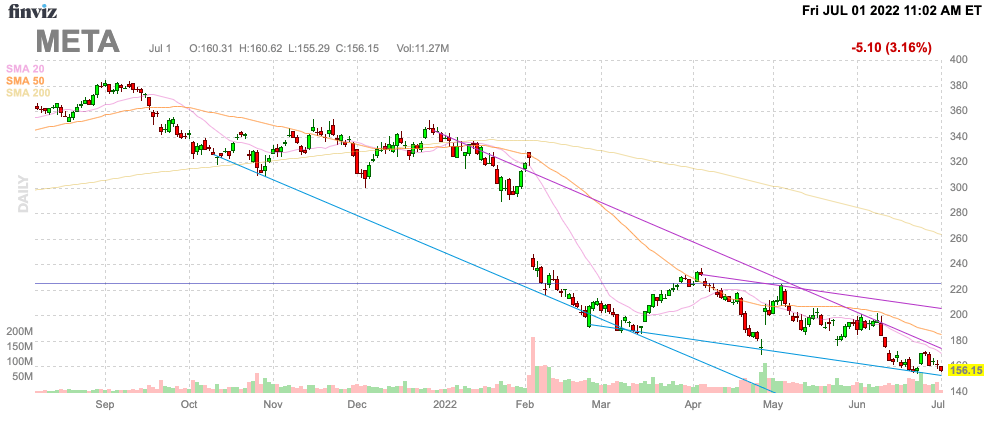

The market has crashed and Meta Platforms (NASDAQ:META) continues to hit new lows following the self-inflicted weak Q4 earnings report. While the company is planning to operate leaner and meaner, Meta is starting to gain against TikTok in short-form video. My investment thesis is ultra-Bullish on the stock after the wipeout period, with the company having the ability to boost earnings via improving leverage.

Source: FinViz

Short-Form Video

Meta Platforms via Facebook and Instagram controlled platforms was a dominant player in social media until TikTok arrived with compelling short-form videos. Snapchat (SNAP) had captured the messaging segment of social media amongst teenagers, but TikTok quickly became the platform for youth to share videos.

Meta introduced Reels on Instagram just 2 years ago and various forms of the US government continue to push for the block of TikTok from the app stores. The latest report has data being shared with Chinese mainland employees and appears to conflict with the moves by Apple (AAPL) to restrict data sharing via privacy controls. The US government doesn’t appear willing to force a block of TikTok, so Meta needs to just capture users to win the segment.

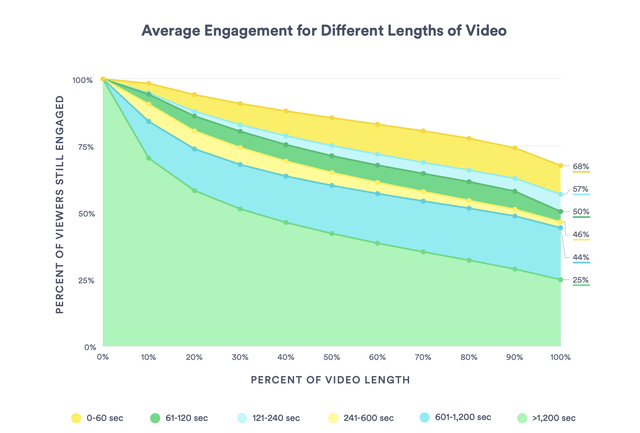

Although this research data is old, the user engagement is vastly higher when the length of videos are short. Videos shorter than 60 seconds had engagement up at 68%, while ones longer than 1,200 seconds (20 minutes) had meager engagement of only 25%.

Source: 2019 Video In Business report

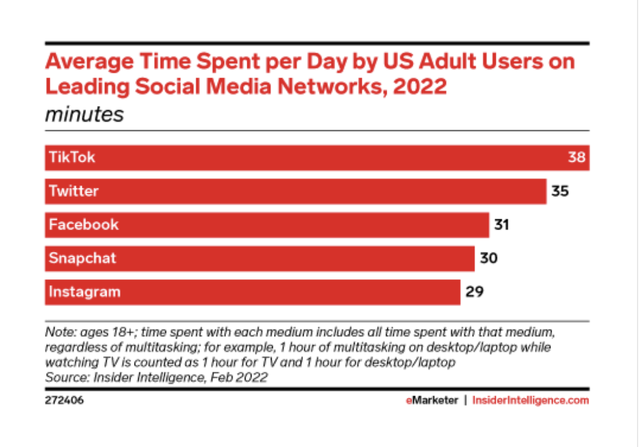

The short-form video offered by TikTok has become so popular that US adult users spend more time on the Chinese platform. According to eMarketer, adult users are spending 38 minutes on TikTok and just ~30 minutes on either Facebook and Instagram.

Anybody with teenagers knows that vastly more time is spent on TikTok followed by Snapchat suggesting Meta has lost a lot of influence in the social media space. Their platforms are still highly valued for the ability to share photos or messages with friends and family, but the more valuable short-form video usage has moved elsewhere.

According to Meta CEO Mark Zuckerberg on the Q1’22 earnings call, Reels is already very successful and gaining:

Short-form video is the latest iteration of this, and it’s growing very quickly. Reels already makes up more than 20% of the time that people spend on Instagram. Video overall makes up 50% of the time that people spend on Facebook, and Reels is growing quickly there as well.

The second point is that while we’re experiencing an increase in short-form video, we’re also seeing a major shift in feeds from being almost exclusively curated by your social graph or follow graph to now having more of your feed recommended by AI, even if the content wasn’t posted by a friend or someone you follow.

Truist analysts just predicted Meta would surpass TikTok in 18 months. If Meta is able to successfully compete with TikTok, the numbers would be huge for the business and beaten-down stock. Remember, the company doesn’t monetize video ads very well at this point despite the reality that users are very drawn to short videos. Meta has huge upside potential from improving such monetization.

Metaverse Isn’t Needed

The biggest complaint about the old Facebook was the insane spending levels the company embarked on to win the Metaverse. While the Metaverse offers a lot of long-term potential, the sector isn’t ready with the lack of fully functional devices on the market.

Apple is about to release a AR/VR device, but recent delays has the release date shifting towards 2023. Either way, the company can now focus on the success in short-form video to get the advertising revenues growth back considering TikTok generated an estimated $20 billion in revenues last year.

Once Meta makes the shift, the recent news of a slowdown in engineering hiring provides the substantial ability to boost profits. Meta Platforms lost $3 billion on the Reality Labs division in the last quarter alone. Cutting these losses in half via additional revenue growth from the Oculus Pro release for the holidays and the reduction in wild spending could deliver what amounts to an additional $0.50 per share in quarterly profits. Yes, quarterly profits.

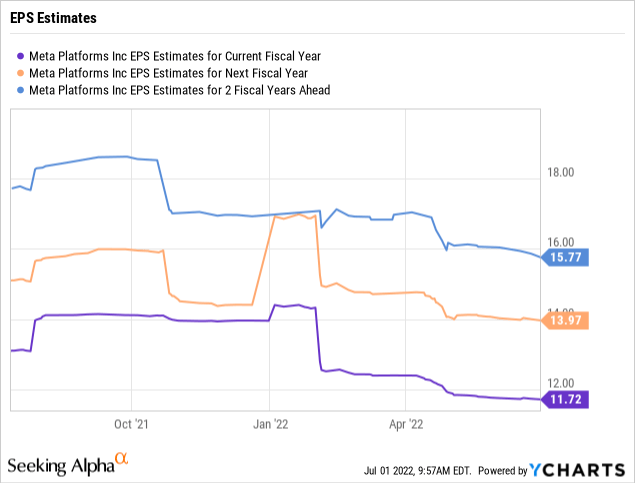

Due to the excessive spending and the questions about advertising revenues via both competition and a looming recession, analysts have cut EPS targets dramatically. At one point, the EPS target for 2023 was up at $18+ and the current target is only $14.

Meta Platforms only trades at 12x the lowered 2023 EPS targets. A lot of question exist on where the EPS targets end up on any weakness in the advertising market. Ultimately though, Meta has the ability to easily cut costs and reduce the losses in the Reality Labs division and progress on Reels could actually boost advertising revenues in a weak market.

Takeaway

The key investor takeaway is that Meta Platforms is now priced for a financial hurricane while the business has a lot of positive levers to boost profits over time. The success in monetizing short-form video is the key to the stock over the next couple of years with cost-cutting in the Metaverse providing a huge profit boost.

Investors should use further weakness to load up on a leading tech stock trading as if the economy is heading into a financial hurricane.

Be the first to comment