Derick Hudson

Third quarter earnings of Meta Platforms, Inc. (NASDAQ:META) were not great amid slowing growth, but the degree to which the stock sold off post-earnings strongly suggests that the market has lost its senses about the fundamental value of the stock.

The social media company saw a 25% valuation cut after earnings, and while the fourth-quarter sales growth forecast is soft, I believe investors are making a big mistake by ignoring META at such a compelling valuation. I’ll keep buying as long as the market panics.

Investors Panic Over Earnings Miss And Meta’s Q4 2022 Forecast

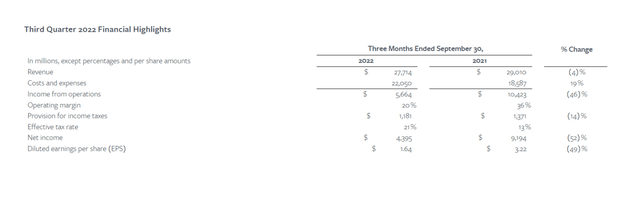

Meta generated $27.71 billion in sales in the September quarter, a 4% decrease YoY. The sales decline was predicted based on Meta’s previous quarter guidance.

At the same time, earnings per share fell 49% to $1.64 from $3.22 in the previous quarter. Meta fell 25 cents short of the average earnings forecast of $1.89 per share, resulting in a major stock meltdown following earnings.

Q3-22 Financial Highlights (Meta Platforms Inc)

What investors were most interested in was the sales forecast. According to guidance, Meta expects total sales to be in the $30-32.5 billion range, implying that sales will continue to fall in the fourth quarter amid a global correction in digital advertising.

Because investors are hypersensitive to uncertainty and slowing sales growth, I can understand how the market reacted after earnings were reported. Having said that, the market is still vastly overreacting to the forecast.

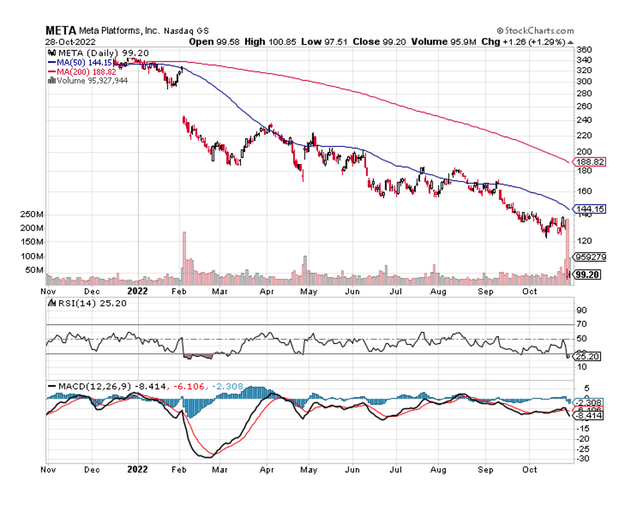

Meta Lost About A Quarter Of Its Market Value And The Stock Is Now Oversold

Meta lost roughly a quarter of its market value after earnings, which I believe is not only exaggerated, but unwarranted. Meta is profitable, and the advertising business is still profitable for the social-media company.

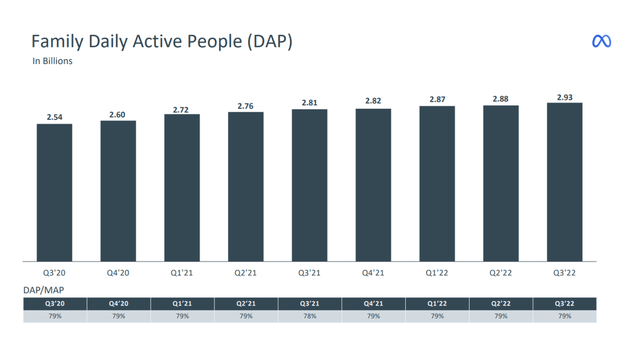

Meta earned $4.40 billion in net income in the third quarter and remains the world’s largest social media company, with nearly 3 billion daily active users. A daily active person is someone who is registered and logs in to Facebook, Instagram, Messenger, and/or WhatsApp on a daily basis.

Daily Active People (Meta Platforms Inc)

Meta’s stock dropped 25% after an investor panic caused the stock to become oversold. According to the Relative Strength Index, the stock is now significantly oversold, which could be interpreted as a contrarian buy signal.

Reels And TikTok-Style Short-Video Formats Are The Future

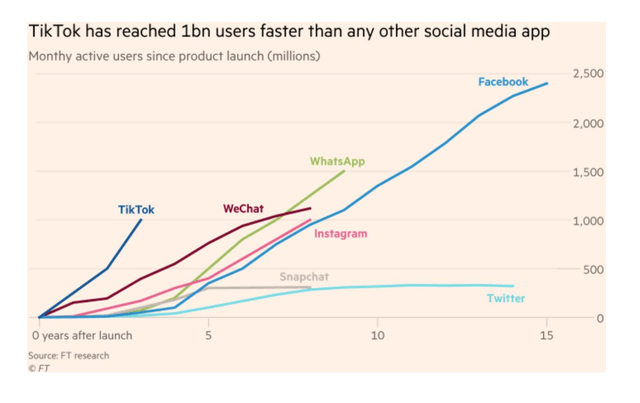

TikTok is the most popular social media platform right now, with over 1 billion active users, many of whom share user-generated content in the form of short videos.

In my article, “Meta Platforms Stock: Q1 Could Be The Most Important Quarter Ever,” I highlighted the risk that TikTok represents for Meta. In recent years, no other social-media app has grown as quickly as TikTok.

The Rise Of TikTok (FT Research)

The rise of TikTok is obviously a problem for Meta, despite the fact that its total user count has continued to rise in the last quarter. With TikTok gaining traction, Meta may need to either double down on its investments/scale of the Facebook Reels or find a way to improve monetization.

In my opinion, Facebook’s focus on the metaverse is a huge disadvantage, and the time and resources spent on the metaverse would be better spent growing the appeal of Facebook’s own short-video streaming product.

Meta Is A Steal

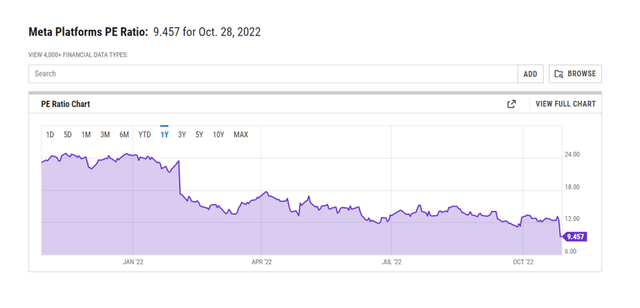

Despite being the world’s leading social-media company and producing an ungodly number of sales and profits every quarter, Meta’s collection of social media apps and platforms is currently valued at less than 10x earnings. The panic has reduced Meta’s earnings multiple to 9.5x, down from 24x at the start of 2022. In my opinion, the stock is a total steal.

Why Meta Might See A Lower/Higher Valuation

Meta’s sales expectations for 4Q-22 were disappointing, but there was probably a lot of panic involved in Meta’s 25% valuation haircut, which is why I think the stock is interesting in the first place.

Yes, large social-media companies may be unable to avoid the correction in the advertising landscape, but a company the size of Meta should be able to weather the downturn better than any other.

My Conclusion

The 25% valuation cut for Meta’s stock last week, in my opinion, is greatly exaggerated and unjustified. Yes, Meta is experiencing some difficulties in its advertising business, but which company isn’t these days?

This is what truly matters. Meta has nearly 3 billion daily active users on its platforms and generated $27.71 billion in revenue while profiting $4.40 billion.

Despite a sales slowdown, the social media company is expected to remain profitable. And this company is selling for only 9.5 times earnings? I’m taking advantage of the panic and buying Meta Platforms hand over fist.

Be the first to comment