Leon Neal

Q2 recap and thesis

I wrote a preview article on Meta Platforms, Inc. (NASDAQ:META) earlier previewing its Q2 earnings entitled Brace For Impact. The article highlighted the areas that I would pay special attention to in Q2 earnings, particularly softened growth, margin pressure, and competition. The impacts did come after all.

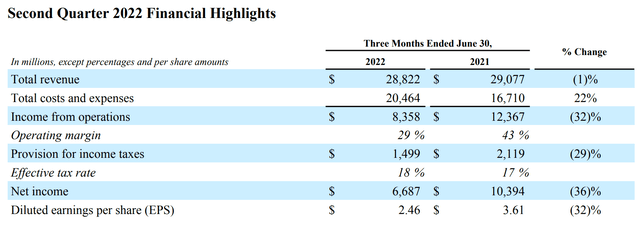

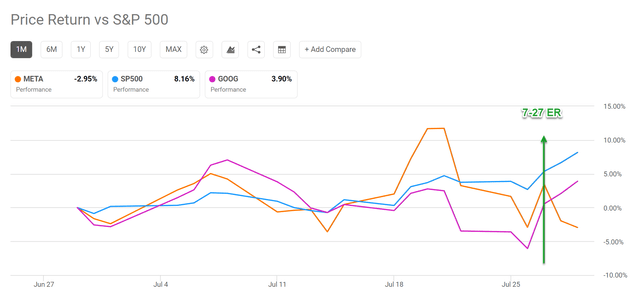

Among other things, Meta’s Q2 earnings reported a decline in both the top line and bottom line. Net income declined by 36%. What’s more worrisome is the top line declined. Its Q2 revenue came in at $28.82 billion, down 1% from $29.08 billion YoY. It was the first quarterly revenue decline since the company went public 12 years ago. As a result, its share prices plunged by about 8% last Thursday after it reported its Q2 earnings against a broader market rally. Both the S&P 500 and META’s close peer Google (GOOG, GOOGL) have enjoyed a sizable price rally over the past month (by 8.16% and 3.9% respectively) and in the past week. However, after its plunge since Q2, META suffered a 2.95% loss this month and an almost 15% decline from its peak price this month.

The remainder of this article will detail the Q2 earnings in the areas highlighted in my preview article. I will analyze what went as expected, what did not, and what to expect next.

Margin headwinds worse than my expectation

The item that concerned my preview article the most was margin pressure. As mentioned in my preview article:

The growth pressure and margin pressure are likely to continue, or even worsen, in Q2. Since the Q1 earnings report, all the factors that have been pressuring its margins (growth deacceleration, Russian/Ukraine war, monetization difficulty, foreign exchange rates) either persisted or even worsened since the Q1 report.

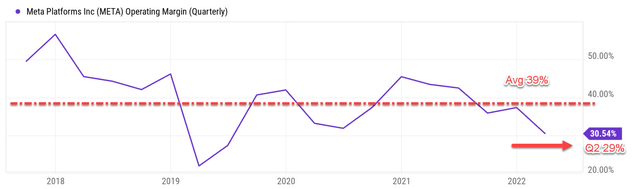

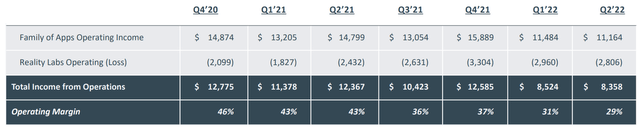

The actual Q2 numbers turned out to be even a bit worse than I expected. Operating margins fell to 29% this past quarter from 42% a year ago as you can see from the following chart. To put things under a broader perspective, the second chart below shows its historical operating margin over the past five years. As you can see, its margin has been at a spectacular level above 50% in 2018 (and before 2018 too). Then the margin started fluctuating around an average of 39% in recent years. Q2’s 29% margin is substantially below the 39% average by a whole 10%.

The following comments from its CFO Dave Wehner touched on the causes of the margin pressure (abridged and emphases added by me):

Foreign currency was a headwind in all international regions, with Europe and Asia Pacific experiencing the largest impacts. In Q2, the total number of ad impressions served across our services increased 15% and the average price per ad decreased 14%. Impression growth was driven by Asia Pacific and Rest of World. The year-over-year decline in pricing was driven by a reduction in advertiser demand, the mix shift in ad impressions towards lower monetizing services in regions and foreign currency depreciation. Family of Apps other revenue was $218 million, up 14%, driven by the WhatsApp business API.

Foreign currency headwinds increased throughout the second quarter as the dollar strengthened. And the company is now assuming a foreign currency headwind of 6% going forward. Its current core segment, Family of Apps, saw a small increase in revenues ($218M) but expenses went up considerably to $17.2 billion, up 23% YoY. The higher costs were mainly caused by employee-related expenses, legal costs, and infrastructure costs (and we will revisit this later in the risk section).

META Q2 earnings report Seeking Alpha

Capital allocation

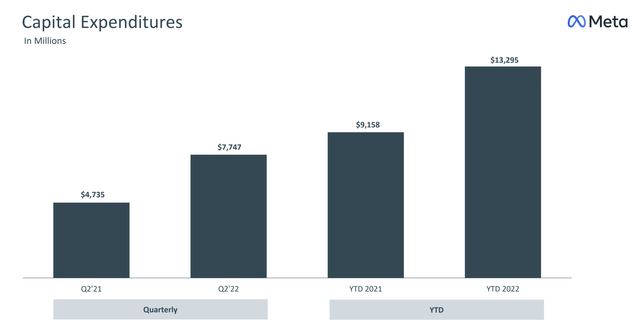

Capital expenditures went up and reached $7.7 billion, almost doubled from the $4.7B a year ago. The large increase in capital expenditures is mostly driven by server spending and AI infrastructure. The full year 2022 capital expenditures, including principal payments on finance leases, are expected to be in the range of $30-34 billion. The company aggressively invests in futuristic technologies such as AI and virtual reality (more details next).

Despite the margin pressure, the company is in a strong financial position to support these capital investments. The company does not have any long-term debt (although it does have a capital leasing obligation of around $15.3 billion as of Q2). And it has a cash position of $40.5 billion on its ledger. Although the cash burn rates need to be carefully monitored with its heavy capital investments in recent quarters. Its cash position was more than $64 million a year ago and about $44 billion a quarter ago.

Reality labs

META is placing a heavy bet on its reality lab. And there are some bright spots in this area as commented by its CFO Dave Wehner (abridged and emphases added by me):

Within our Reality Labs segment, Q2 revenue was $452 million, up 48%, driven primarily by Quest 2 sales. Reality Labs expenses were $3.3 billion, up 19% due to growth in employee-related costs and R&D operating expenses that were partially offset by the previously mentioned reduction in loss reserves. Reality Labs’ operating loss was $2.8 billion in the second quarter.

The 48% revenue increase is certainly a good start. And META has been hiring aggressively in this area (the 19% increase in costs was largely due to employee costs). Also, its Q2 R&D increased 43%, which was primarily driven by hiring to support Family of Apps and Reality Labs. Although to put things under perspective, Reality Lab has shown no clear sign of becoming profitable. Its operation losses have been fluctuating in the $2B to $3B range over the past few quarters (even with a slightly increasing trend) as you can see from the chart below. And currently, its Reality Labs only contributes a minor portion of its income (less than 2%).

Final thoughts and other risks

Q2 operating margin turned out to be worse than I expected. Operating margins fell to 29% (compare to 42% a year ago). The dollar strengthening was stronger than expected and the foreign currency headwind is expected to be 6% for 2022. Monetization difficulty persisted due to a range of reasons such as privacy changes on Apple’s iOS system and competition from peers such as Google and TikTok. However, in the long term, I am still seeing an industry leader well-positioned to capitalize on our secular shift toward a digital life. Digital ads already surpassed traditional ads in 2023 with a 54.2% market share. And it’s projected that it will exceed 2/3 of total media spending by 2023. And META, together with Google, are still the undisputed leaders in this space. META also has the financial strength (no debt, more than $40B cash position, plus a healthy cash flow from its existing app family) to aggressively pursue new directions.

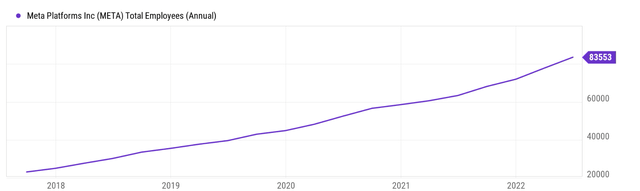

Finally risks. In the near term, the foreign currency headwinds are always uncertain for a global business like META. It is assuming a 6% headwind now. But in reality, it is really unpredictable in my mind and can create both downward and upward risks. Also, META has very likely over-expanded in the past few years and has some overcapacity to digest in the incoming quarters. Management has mentioned during Q2 earnings that META has reduced hiring and there are reports projecting its hiring slowdown may transform into Layoffs. META indeed has overexpanded in my view as you can see from the following chart. Its total headcounts have more than quadrupled over the past five years from about 20K to the current level of 83.5K. And since 2021 alone, its head counts have increased from about 60K to 83.5K, an almost 40% increase. To put it in other words, out of every 2.5 employees currently working there, one of them is hired after 2021.

Be the first to comment