Justin Sullivan

Truth be told, I never believed that there would come a day that I would buy into Facebook from a business perspective. But sure enough, after shares of its parent company, Meta Platforms (NASDAQ:META) plunged nearly 25% after reporting financial results covering the third quarter of the company’s 2022 fiscal year, I could no longer hold back. So far this year, shares of the business are down by 70.5%. This decline has been driven by increased spending in areas that investors have become skeptical about. At the end of the day though, I do believe that concerns are significantly overstated. And given where shares are priced today, I do believe that a ‘strong buy’ rating is warranted.

Why the market has it wrong

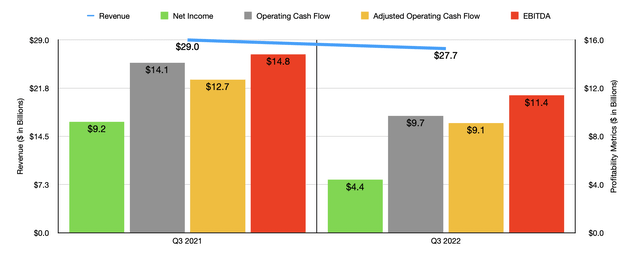

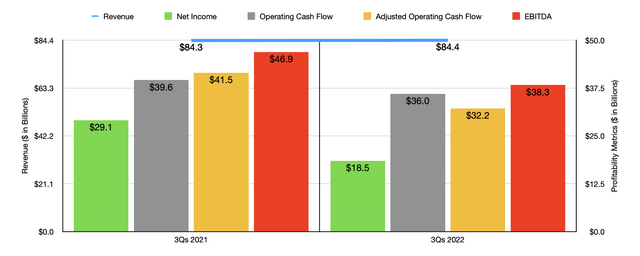

By the time this article is published, all of the major headline news regarding Meta Platforms has already been thoroughly digested. Because of this, I will spare you a rehash of things like its revenue and its earnings relative to what analysts expected for the quarter. Instead, I would dig into the meat of the conversation. The fact of the matter is that investors right now are concerned about deteriorating financials for the firm. For instance, revenue during the third quarter of the 2022 fiscal year came in at $27.71 billion. This represents a decline of 4.5% compared to the $29.01 billion generated in the third quarter of 2021. Even worse has been the company’s bottom line. Net income of $4.40 billion paled in comparison to the $9.19 billion generated the same time last year. Operating cash flow plunged from $14.09 billion to $9.69 billion. Even if we adjust for changes in working capital, it would have fallen from $12.71 billion to $9.12 billion. On top of this, EBITDA for the company also declined, dropping from $14.80 billion to $11.39 billion.

We will come back to the revenue discussion in a moment. But when it comes to profitability, there really is one key driver behind this pain. Costs for the company have increased across the board. The biggest increase came from research and development, which rose from 21.8% of sales in the third quarter of last year to 33.1% of sales this year. This surge, amounting to $2.85 billion, was driven mainly by higher payroll and related expenses due to a 32% growth in employee headcount year over year in the engineering and other technical functions of the business. Technology development costs associated with Reality Labs, the division of the company focused most on its metaverse operations, also contributed to this increase. When I say ‘most’, I mean to say that management claims that while all of its operations are now focused on the metaverse, Reality Labs if focused on specific features like Horizon Worlds.

Personally, I don’t mind seeing profits fall because of research and development. This serves as an investment in the future. And, given the nature of Meta Platforms, it could easily cut back on this category without experiencing any downside. Other areas where the company saw meaningful increases included marketing and sales, and general and administrative. The first of these grew from 12.3% of revenue to 13.6%, while the second increased from 10.2% of sales to 12.2%. Again, a lot of these cost increases seem to relate to higher payroll costs as the company grows. For instance, in its marketing and sales functions, the company grew its headcount by 14%, while in the general and administrative functions category, the increase was 30%.

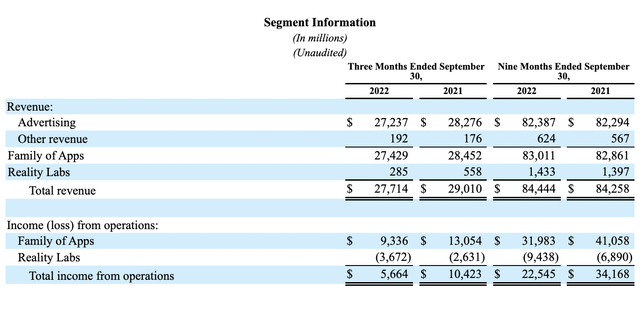

Some of the expansion-related activities that Meta Platforms is engaged in are virtually guaranteed to bear fruit. For instance, the company is continuing to invest more on data center operations. It is undeniable that the company is, as a result of this spending and other investments such as technical infrastructure, experiencing pain across the board. For instance, during the quarter, the Family of Apps portion of the business that comprises most of its operations saw profits decline by around 28% from $13.05 billion to $9.34 billion. As the firm seeks to continue its growth, the hope is that this will ultimately push revenue and profits higher. But at the end of the day, management always has the option to scale back these efforts in order to cut costs.

I don’t believe that this side of the business is anything that investors have any particular gripes about. Instead, I think most of the fear is centered around Reality Labs. During the latest quarter, this portion of the business generated revenue of only $285 million. This was down from the $558 million reported the same time last year. This was mostly driven by a decrease in volume of its consumer hardware products that were sold. If that weren’t bad enough, it’s also worth noting that profits for this unit are non-existent. In fact, during the quarter, the enterprise lost $3.67 billion on Reality Labs. This was up from a $2.63 billion lost the same time last year. And for the first nine months of 2022 as a whole, the loss came out to $9.44 billion, up from $6.89 billion one year earlier.

To make matters worse, management expects the situation to get even more extreme next year. You see, for 2022 as a whole, management is anticipating total expenses of between $85 billion and $87 billion. But for next year, expenses should be between $96 billion and $101 billion. And unfortunately, we don’t know what to expect when it comes to revenue. We do know that management is forecasting revenue in the fourth quarter to be between $30 billion and $32.5 billion. Either way, that’s down from the $33.67 billion the company generated in the final quarter of 2021. So what weakness the company is experiencing on the top line is expected to persist at least for the rest of this year. And more likely than not, this will continue into next year.

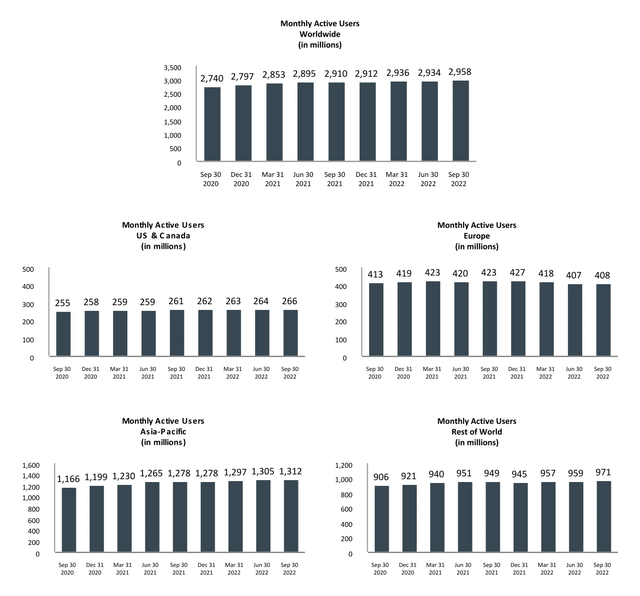

If all of this bad news was all that I had to work on, I would stay far away from Meta Platforms. But what changed my mind is that the underlying business seems to be pretty solid. Consider, for instance, the number of users on its platform. Monthly active users at the end of the third quarter totaled 2.958 billion. That’s the highest on record and represents an increase of 0.8%, or 24 million, compared to what it reported just one quarter earlier. Year over year, growth is 1.6%, while compared to the same time two years ago growth has amounted to 8%. Throughout the US and Canada, the company continues to grow, with the number of monthly active users up 2 million sequentially. Throughout Europe, the company grew from 407 million monthly active users in the second quarter of this year to 408 million in the third quarter. Having said that, user counts are still down from the peak time of the fourth quarter of 2021 when the company had 427 million users there. In the Asia-Pacific region, growth continues to increase, with the number of monthly active users hitting 1.312 billion compared to the 1.305 billion seen at the end of the second quarter. And in all other parts of the world combined, the company grew from 959 million users to 971 million.

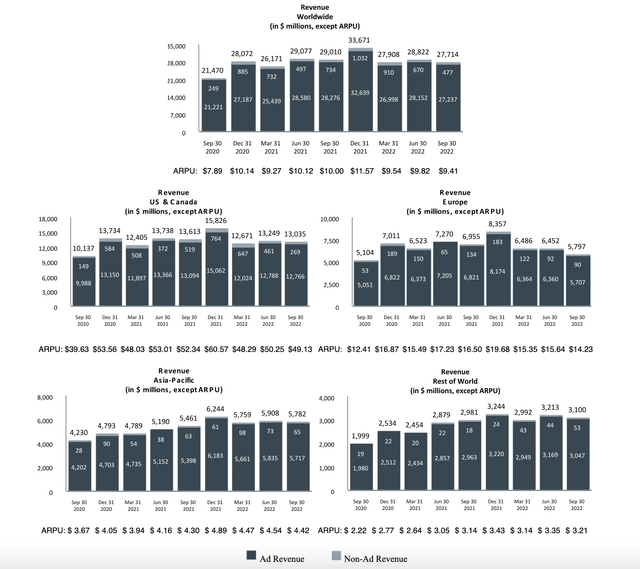

This is not to say that everything is grand for the company from a user perspective. We have seen some weakness when it comes to monetization. During the latest quarter, global ARPU for the company came out to $9.41. That’s down from the $9.82 experienced one quarter earlier and represents a decline from the $10 experienced one year ago. This kind of decline can be seen in pretty much all of the companies operating regions. But management did say that, on the whole, the faster-growing places for the company could affect the metric in a negative way since they are where ARPU is lowest. This doesn’t really concern me though because, as the rest of the world continues to develop, online markets and apps should become more profitable, ultimately aiding companies like Meta Platforms. In the near term, the pain experienced in the more developed parts of the world can be attributed to reduced advertising spending caused by a variety of factors. For the latest quarter, for instance, management attributed lower advertising revenue to a mixture of things such as an increase in the number of ads that monetize at lower rates because of the way in which they are delivered, an unfavorable foreign exchange impact, and a reduction in advertising demand. This last point is likely attributable to the challenging macroeconomic environment and to other related things.

With the economy eventually destined to recover, advertising spending should rise again. And, as I mentioned already, certain investments the company is making, while painful today, don’t need to take place. The company’s continued growth from a user perspective makes its operations incredibly viable for the long haul to the point where management could cut a lot of the pain overnight and significantly boost cash flows as a result. I don’t believe that management is likely to do that in the near term though. Instead, some continued investment will likely occur as planned, either resulting in significant financial success for the company or an eventual abandonment of said investments at a substantial loss.

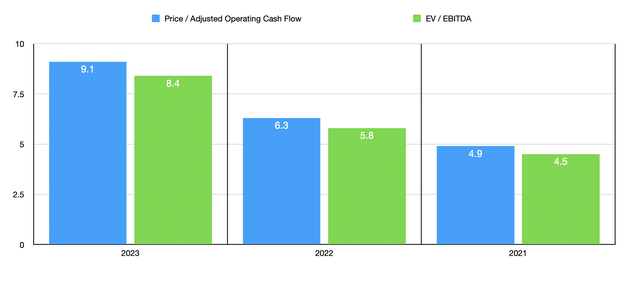

If shares of the enterprise were still trading at lofty levels, I would not be willing to make an investment on such uncertainty. It is real money that management is putting toward what could ultimately be considered some rather costly mistakes. But even if that does continue, I think that shares are cheap enough to warrant consideration. For instance, right now, using data projected for the 2022 fiscal year, the company is trading at a price to adjusted operating cash flow multiple of only 6.3 and at a forward EV to EBITDA multiple of 5.8. These numbers are admittedly higher than the 4.9 and 4.5, respectively, that we get using data from 2021. As part of my analysis though, I took management’s own guidance for cost for next year, assumed that revenue next year will match what the company should see this year, and factored in the tax rate that management assumed would be the case for 2023. At the end of the day, this gave me operating cash flow of $30.71 billion and EBITDA of $29.49 billion. These numbers would translate to a price to operating cash flow multiple of 9.1 and to an EV to EBITDA multiple of 8.4. For a cash cow and a market leader that is continuing to grow its footprint globally while still hemorrhaging cash on what could be considered a very risky gamble, I see this pricing as a no-brainer.

Takeaway

For me to stand here and tell you that everything is great regarding Meta Platforms would be me lying to you. Personally, I wish management would cut back significantly on its metaverse operations. I see very little value in there without the company having to eventually incur far more capital than anybody could ever imagine. I also acknowledge that there is some weakness on the advertising side, with that being driven by the company’s lopsided growth and weak economic conditions. But in those cases, I see the picture eventually clearing up on its own. Add on top of this the fact that the company’s footprint continues to expand and that shares look cheap even if current projections hold for next year, and I see very little downside with a potential for significant upside should the picture change materially.

Be the first to comment