Boarding1Now/iStock Editorial via Getty Images

In a previous report, I had a look at SkyWest Airlines (SKYW). It was the first regional airline I covered and especially at this point regional airlines are attracting a lot of attention due to labor shortages, which result in mainline carriers fishing more than ever in the pilot pools of regionals. In this report, I analyze the results of Mesa Air Group, Inc. (NASDAQ:MESA).

Mesa Air Group: Not Benefiting From Pent-Up Demand

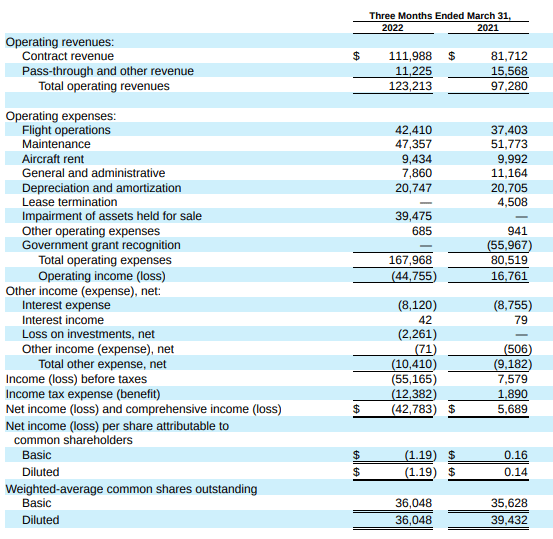

Mesa Air Group Q2 2022 results (Mesa Air Group )

For the second quarter, operating revenue grew 27 percent for Mesa Air Group which is lower than the growth SkyWest Airlines reported and also significantly lower than the growth we observed at mainline carriers. COVID-19 sick calls as well as COVID-19 related travel reductions play a role and to a minor extent the recovery trajectory of regional airlines advancing faster providing a higher comparison basis. The major reason for the moderate revenue growth is the reduction in flights due to pilot shortage.

Operating expenses doubled, and one thing to keep in mind is that this is not due to rising fuel costs. Regional airlines such as SkyWest and Mesa are to some extent shielded from high fuel costs because, with the exception for proration operations, the major airline partners are paying for the fuel. The $87.5 million in cost increase was driven by the absence of $56 million in government grant recognition and $39.5 million in impairment costs on some CRJ200 held for sale, partially offset by absence of lease termination costs and lower general and administrative expenses.

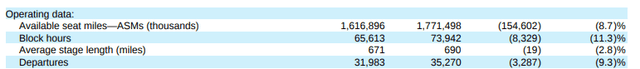

Mesa Air Group operating data (Mesa Air Group )

The operating data tells the story of Mesa quite well. As the airline is struggling with getting the pilots in the front seat to fly the aircraft, it had to reduce block hours by 11.3% and the number of departures declined by 9.3%.

Mesa Airlines Faces Challenges

Being a regional airline, Mesa Airlines is facing a significant pilot problem. The pay at mainline carriers is superior with better career opportunities as pilots can fly bigger aircraft types and earn more for flying the bigger aircraft. During the pandemic, many pilots took early retirement packages, and that is biting mainline carriers back now as they seek to rebuild capacity. Due to the superior pay, many pilots are making their way from regionals to mainline carriers, and that is putting pressure on regional airline schedules.

Mesa Airlines highlighted part of the problem quite clearly, as it shared that the average pilot gives a 14-day notice when leaving the airline and it takes 90 days to train a new pilot leaving the airline, leaving a 76-day gap in their schedule. I think that really does cut to the core of the immediate scheduling challenges. Mesa Airlines also shares that in the coming quarters production will likely be flat, meaning that whatever pent-up demand is being released to the market, the airline will not be able to benefit from it fully.

Somewhat encouraging is that Mesa Airlines has 200 pilots in training and said that if it would be able to bring those online instantly there wouldn’t be an issue scheduling flights. Mesa Airlines expects flat schedules for two quarters. One should be extremely careful with making calculations based on little data and information available, but the two quarters flat production estimate and the 90-day training would indicate that per quarter there would be around 100 pilots leaving Mesa Airlines. So, the challenge is in getting enough people in the training pipeline in time and retaining pilots, which is just extremely difficult at this point.

Mesa Airlines also slammed lawmakers, as Jonathan Ornstein, CEO of Mesa Air Group, believes there is zero evidence that a 1,500-hours rule as imposed on pilots is adding to safety while it does make it significantly more difficult for airlines to hire due to that rule. Additionally, he is in support of stretching the retirement age to 67 years, which would reduce the outflow of pilots at mainline carriers.

Those are two things that are going to depend mostly on lawmakers, but Mesa Air Group is also actively working on expanding its training capacity. In February, the airline added an E-Jet simulator and in July a CRJ simulator will come online, doubling the simulator capacity.

Conclusion

If you look at the results now, it is just really difficult for Mesa Airlines. The adjusted loss was $5.28 million compared to a $34.7 million loss last year. So, there is improvement in the profit/loss statements, however, the airline is not fully unlocking the potential of pent-up demand from volume perspective as well as unit cost perspective due to pilot shortages, which will result in flat production for the coming one to two quarters. That is unfortunate, because with fuel costs being passed through to the major airline partners, the current fuel price environment would have favored investment in regional airline stocks.

Looking at the current state of the industry, pilot shortages don’t make it attractive to invest in regional airlines. If you still want to hold any regional airline name I would opt for SkyWest Airlines instead of Mesa Air Group due to superior pay at SkyWest Airlines and better scale advantages.

Be the first to comment