Editor’s note: Seeking Alpha is proud to welcome Overlooked Opprotunities as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

guvendemir/E+ via Getty Images

Bringing Silicon Valley to Aerospace & Defense

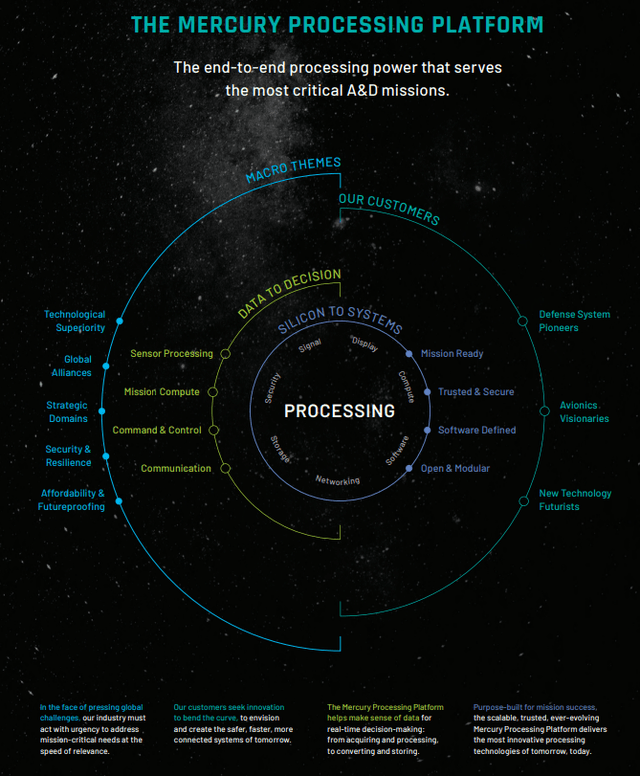

Mercury Systems (NASDAQ:NASDAQ:MRCY) is an industrial-tech hybrid company that manufactures commercial technology applications for the aerospace and defense industry. Their sophisticated end-to-end process powers critical solutions for missions such as surveillance, radar, and communications, which are vital to a safe and secure world.

The company maintains its competitive advantage by making next-generation technologies more accessible, investing in its intellectual property, and forming strategic relationships with semiconductor companies. Also, they maintain positive relationships with their customers by adapting to their needs by offering pre-integrated solutions so they can integrate their applications.

Tomorrow’s “wars” will be won hundreds of miles away as technology allows for shifting from conventional armies to modernized warfare. Like their Silicon Valley counterparts, Mercury leverages technology to disrupt an industry undergoing a significant transformation.

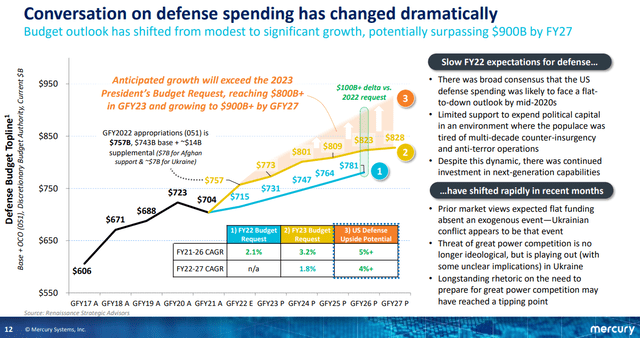

A New Era of Defense Spending

“Be greedy when others are fearful” is one of several Buffett quotes I try to remember during times of uncertainty. The current energy crisis in Europe, fueled by an ongoing war between Russia and Ukraine, and looming tensions with China and Taiwan, have understandably given us a scare. And countries are responding to the rising geopolitical pressures by significantly increasing defense budgets.

Mercury Corporate Investor Relations Presentation

In Europe, defense expenditures have risen for seven consecutive years, but spending as a percentage of GDP is less than 2% compared to 3% domestically. If Europe met the 2% GDP target, this would add roughly $10B annually by 2030. This outcome is coming to fruition as several European NATO members have recently pledged to increase defense spending in response to the Russia-Ukraine war.

In the U.S., the Biden administration is currently developing a new national defense strategy that will not be complete until later this year. There was a consensus that the new administration would keep the defense budget flat. That view has reversed sharply, with many analysts predicting the U.S. will increase defense spending above their budget, recognizing the need to address the rising risks in Europe. The decision will be critical for the industry, as the U.S. accounts for roughly 70% of NATO defense expenditures.

Mercury’s CEO, Mark Aslett, writes in his 2022 annual report on the impact increasing defense budgets could have on the company over the next decade.

Our advisors estimate that U.S. growth, combined with increases in NATO defense spending to 2% of GDP, could drive up to $1.5 trillion of additional defense spending over the next decade. This growth should lead to higher bookings for Mercury in the electronic systems associated with missiles and munitions, air and missile defense systems, unmanned systems, fixed-wing and rotorcraft, ground vehicles, and electronic warfare. [2022 Annual Report]

Financial Results

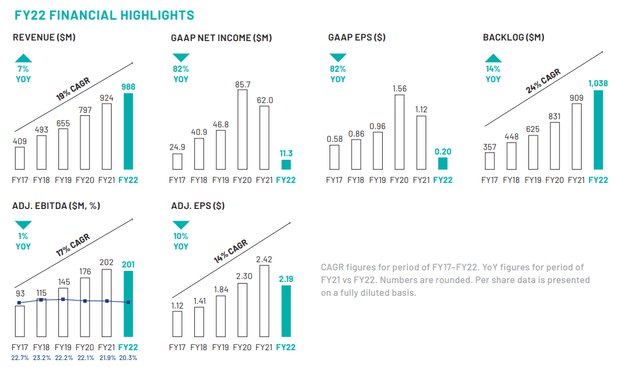

Mercury is growing both organically and through acquisitions. Over the last eight years, Mercury has completed 15 acquisitions, deployed $1.4B of capital, and acquired more capabilities. The company has seen impressive revenue growth of 19% per year over the last five years.

However, their latest 2022 Q4 earnings release shows a slowdown in growth from 2021 to 2022 (the fiscal year starts in July). Revenues increased by 7%, and adj EBITDA fell 10% YoY. On a positive note, they are entering 2023 with a record backlog of $1.04B, which has grown at 24% annually.

Mercury provided 2023 FY guidance with revenue growth of 1%-6% and adj. EPS decline in the range of 1%-11%. For the fiscal year 2022, free cash flow was ($46.5m) – the first loss in five years.

Additionally, Mercury has a healthy balance sheet and ended the year with a debt-equity ratio of 35% and a current ratio of 4.2x. They have the financial flexibility to continue to invest in the business organically and through acquisitions.

Valuation

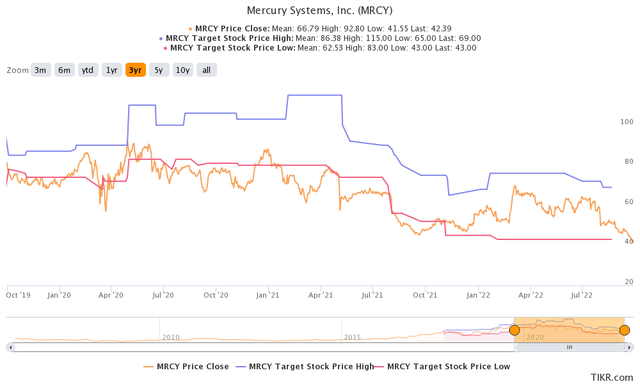

When uncertainty arises, investors can act irrationally and override their valuation models, potentially uncovering overlooked opportunities.

Mercury historically has had one of the highest valuations in the aerospace and defense industry, with an average EV/EBITDA multiple of 26.4x over the last five years. The recent market correction has made valuations more reasonable. The company has a total Enterprise Value of $2.8B, comprised of $2.4B in market cap and $0.4B in net debt. Mid-point EBITDA expectations for 2023 FY are $207M, which translates to a forward multiple of 13.8x. The lowest in three years.

Assuming the company can get back on track in 2024 and grow EBITDA at the five-year average growth rate of 17%, you arrive at $242M. Applying the current EV/EBITA multiple of 13.8x above, the stock’s fair value is $57.9, a 37% upside from its current price.

The graph below shows that Mercury’s share price has fallen outside Wall Street’s price target range.

Potential Risks

Mercury’s track record of being a serial acquirer risks possibly overpaying for deals or lack of integration. Furthermore, failure to reaccelerate organic growth following the recent revenue slowdown would likely make the price fall further from here.

Another caveat is that defense spending will take time to translate to revenues. I anticipate that Mercury will slowly see new awards to meet domestic and international demand, which should take shape over the next several years.

You may be asking yourself, what if the war in Europe subsides? Wouldn’t countries spend less on defense budgets and negatively affect the industry? While, yes, a warless world would be great news. But I believe governments will still prioritize defense spending because it’s not the actual threat of “defeat” they are worried about; instead, it’s the potential turmoil that could be created by having a stronger opponent in Russia or China.

Final Thoughts

The global defense landscape is fundamentally altering as countries prioritize national security and increase their need for advanced defense technologies. Investment implications for the aerospace and defense industry have changed dramatically post-invasion and opened the door for companies to capitalize on this opportunity.

Mercury is well-positioned to benefit from higher bookings as a vendor for defense prime contractors. Thus, allowing them to move up the value chain by providing pre-integrated subsystems rather than individual modules and gain market share in the supply chain.

I anticipate the next few quarters to be bumpy as they see more significant impacts on material inflation and higher input costs. These issues are not unique to Mercury and are temporary supply-related disruptions, not demand related. That said, the overall sentiment has been positive, and management has an optimistic outlook regarding the future. I see more upside than downside with this company and now is an excellent opportunity to take on a position.

Be the first to comment