Editor’s note: Seeking Alpha is proud to welcome Quiver Quantitative as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Sundry Photography/iStock Editorial via Getty Images

Overview

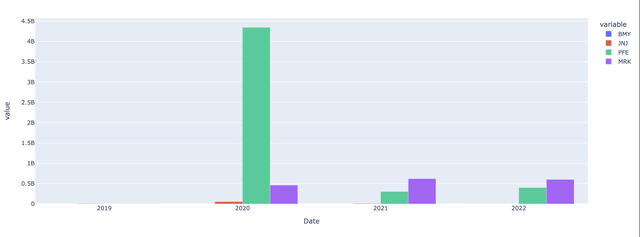

Merck’s (NYSE:MRK) government contracts have grown to provide a significant revenue stream for the biotech giant. Government contracts awarded to MRK have averaged more than half a billion dollars in both 2020 and 2021, and they are on track to win at least the same amount this year. Company revenue in 2020 and 2021 was third best and best, respectively, in its history. Year to date, among competitors like Pfizer (PFE), Bristol Myers (BMY), and Johnson and Johnson (JNJ), MRK leads the pack in awarded contracts by more than $200 million. You can see in the bar graph below how they’ve stacked up over the last several years:

We think tracking MRK and its competitors’ relationship to D.C. through government contracts will be important in identifying the companies that outperform. We also noticed several congressional figures buying MRK stock within the last quarter, as well as similarly timed buys last year. In both cases, the trades closely align with awarded government contracts. We advise that investors continue to monitor the companies’ ties to Washington’s leaders, and the contracts they award public companies. We expect the increase in government contracts to be a predictor for future earnings and performance.

Government Contracts

In 2021, MRK earned more than $620 million in government contracts. The data table below details the specifics of several of those arrangements. Year to date, the company has already locked in more than $600 million in government contracts. By comparison, the competitors we track – PFE, JNJ, and BMY – have been awarded $400 million, $210 thousand, and $312 thousand year to date, respectively. As we mentioned in the overview, recent annual revenues have set all-time company records. In 2020, YoY revenue was up about 6% and in 2021 it was up more than 17%. In 2021, only PFE outpaced them with revenue growth of 95%. MRK and many other pharmaceutical giants will release first-quarter earnings reports in late April and early May. Investors should compare those financials to government contract data from Q1 2022.

MRK’s ability to be active in COVID-19 vaccine production positioned it as a top receiver of lucrative government contracts, and has helped the company outpace many of its competitors. We also see this as somewhat of a downside risk, though. COVID-19 vaccine-specific federal funds are reliant on something we’re actively trying to beat. A majority of government funds that won in both Q1 2021 and Q1 2022 came from the Vaccines for Children program, a federally funded vaccination program. They awarded MRK with a contract worth more than $500 million in March 2021, and a $600 million contract in March of this year. That makes up a significant majority of total awarded contracts in both of those years.

| Ticker | Date | Description | Agency | Amount |

| MRK | 2021-06-25 | 2021 VACCINES FOR ADULTS | DEPARTMENT OF HEALTH AND HUMAN SERVICES (HHS) | $3,768,174.95 |

| MRK | 2021-03-30 | VACCINES FOR CHILDREN | DEPARTMENT OF HEALTH AND HUMAN SERVICES (HHS) | $511,400,368.19 |

| MRK | 2021-03-01 | ADDRESSING THE COVID-19 PANDEMIC: URGENT PRIORITIES | DEPARTMENT OF HEALTH AND HUMAN SERVICES (HHS) | $105,400,000.0 |

Note: All government contract data sourced here.

Congress Trading

We noticed several unusual congressional transactions as well. In September 2021, Representative Zoe Lofgren, who has generated a return of about 30% in the last year, disclosed a purchase of MRK. Additionally, Rep. Lofgren sits on the Congressional Biomedical Research Caucus. Rep. Lois Frankel disclosed a purchase of MRK shares in December 2021; she serves on the House Committee on Appropriations and its Labor, Health and Human Services, Education, and Related Agencies Subcommittee, which works directly with the Department of Health and Human Services (HHS).

If you look at the data table from government contracts you see the HHS as the awarding agency for the more than $500 million contracts from early 2021. They also awarded MRK with a $600 million dollar contract in March of this year. Since her purchase, MRK is up about 14%. Interestingly, Rep. Frankel disclosed a purchase of PFE in late February of this year, about a month before they received a $400 million dollar contract from the HHS. Since the disclosure on Feb. 22, 2022, PFE is up 12%.

| Date | Ticker | Representative | Transaction | Amount | Range |

| 2021-12-03 | MRK | Lois Frankel | Purchase | 1001.00 | $1001-$15000 |

| 2021-11-26 | MRK | Bob Gibbs | Purchase | 1001.00 | $1001-$15000 |

| 2021-09-30 | MRK | Zoe Lofgren | Purchase | 1001.00 | $1001-$15000 |

Note: All congressional trading data sourced here.

Conclusion

What we notice about MRK are its strong returns in the last several years, coupled with its relationship to Washington. The stock has a trailing five-year return of approximately 10%, and we’ve discussed some of the companies’ strong fiduciary ties with Washington and its officials. Federal expenditure has been abundant in the pharmaceutical sector, particularly to those companies capable of developing/manufacturing/distributing vaccines, as is the case for MRK.

The value of federal contracts awarded to MRK has gone from less than $100 thousand in 2019 to an average of more than $500 million in the last three years. As we’ve pointed out, revenue has grown alongside that. Investors should continue to watch the flow of these contracts along with earnings reports and the timing of congressional trades. We expect the impact of government contracts on the companies’ future revenues to grow, whether they beat or miss expectations.

Be the first to comment