Eoneren/E+ via Getty Images

Investment Thesis

Most analysts seem to agree that Merck & Co (NYSE:MRK) – the big pharma concern, and fifth-largest pharmaceutical in the US by market cap, presently $208bn, is in a healthy place financially, and in terms of product portfolio and pipeline.

I’m not about to disagree with this bullish sentiment. In 2021, Merck delivered revenues of $48.7bn – up 17% year-on-year – and earnings per share of $4.86 on a GAAP basis, and $6.02 on a non-GAAP basis, for a GAAP PE ratio of ~17x.

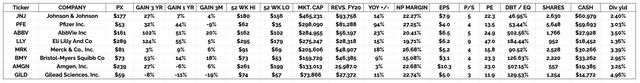

It’s impressive growth for such a large, global enterprise, and Pfizer (PFE) (+92%) and AbbVie (ABBV) (+23%) aside, none of what I refer to as the “Big 8” US Pharma giants can match it.

Performance of “Big 8” US Pharmaceuticals Compared (my table using data from TradingView, Google Finance)

As we can also see from the table above, Merck’s PE ratio is the third lowest in the sector, after Pfizer and Gilead (GILD), and its net profit margin of 27% is second only to Pfizer’s, whilst its debt to equity ratio is only bettered by Pfizer and Johnson & Johnson (JNJ), and its dividend yield of ~3.4% is slightly above average for the sector.

When we review share price gains over a three-year, one-year and three-month period however, Merck’s performance is significantly worse than any of the other seven big pharmas except for Gilead sciences, so could it be that Merck’s share price is finally about to take flight, after a challenging few years?

Prior to last year, Merck had failed to generate much revenue growth, reporting top line revenues of $40.1bn, $42.3bn, $39.1bn, and $41.5bn in the period 2017 – 2020, and a lack of growth tends to lead to a stagnant share price, even factoring in dividends, and share repurchase programs.

There’s also a tendency to think of Merck of being overly reliant on a single drug – the immune checkpoint inhibitor (“ICI”) Keytruda, indicated for a very wide range of solid tumors cancers, across 1st, 2nd and 3rd treatment lines, often in combo with other drugs such as tyrosine kinase inhibitors (“TKIs”), and generally delivering best-in-class results.

Last year, Keytruda revenues rose to $17.2bn – up 20% year-on-year, meaning the drug accounts for ~35% of Merck’s total revenues, which is a substantial amount. The drug will eventually lose its patent protection – this is due to happen after 2028 – and perhaps investors are concerned about whether Merck can deliver new drugs to replace Keytruda’s falling revenues when a flood of generic and biosimilar versions of the drug enter the market.

That’s an issue that is common to almost every big pharma however, and two of my favorite pharmaceutical companies, AbbVie and Bristol Myers Squibb (BMY), have found ways to get over their own significant patent expiry cliffs by making mega-money acquisitions of Allergan and Celgene respectively, and bolstering both their existing product portfolios, and their late stage drug development pipelines.

In 2021, Merck actually did the opposite, opting to downsize its business by spinning out its Women’s Health, Biosimilars and Legacy Brands division into a separate entity, Organon (my note here).

It seems to have been a deal that has worked out for both parties, however, allowing Merck to focus more on its growing blockbuster brands, from Bridion, which earned $1.53bn in 2021, up 28% year-on-year, to ProQuad, $2.14bn sales, up 14%, Januvia, $5.3bn, flat year-on-year, Gardasil, $5.7bn of sales, +44%, Keytruda of course, and a thriving Animal Health division, which made $5.6bn revenues, +18% year-on-year.

Then there is the COVID antiviral Molnupiravir, which is expected to earn $5bn of revenues for Merck this year, which Merck management says will be sufficient to drive revenues to between $56.1 – $57.6bn in FY22, up another ~17% year-on-year.

I wouldn’t rule out Merck making a big money acquisition in the next few years to try to protect itself against Keytruda’s loss of exclusivity (“LOE”) in 2028, but frankly, it doesn’t need to happen for another two to three years at the earliest, in my view, and therefore investors should not worry about it, and see Merck as the fast-growing, diversified, and newly streamlined business it is.

In terms of a share price target, Merck stock is buoyant today relative to recent years performance, as mentioned, and I would not necessarily get too carried away because Merck does not have too many game changers in its pipeline ready to contribute tens of billions of revenues, as e.g. AbbVie and BMY do, but a triple-digit share price doesn’t look entirely out of the question, provided the focus remains on performance in the shirt to medium term, as I believe it should do.

In the rest of this post I will take a brief look at prospects for Keytruda, and Merck’s other key assets, take a high level look at the pipeline, and speculate about how Merck can effectively plan for Keytruda’s LOE, possibly with some major M&A.

Personally, I think investors would not be unwise to buy Merck stock, even at the current higher price, and passively accept a decent dividend for a few years, and perhaps 15 – 20% upside as revenues grow in 2022, before management decides where it is going to take the company next.

Keytruda Will Likely Become The World’s Biggest Selling Drug – But Merck Is Making Gains In Other Areas Also

Evaluate Pharma estimates that Keytruda will be the world’s best selling drug in 2026, perhaps earning 2x more than any other product, driving ~$24.3bn in sales. That’s less than Pfizer’s Comirnaty COVID vaccine is expected to earn this year – the forecast is for $32bn of sales – but it’s interesting to note that Comirnaty revenues could decline by 70%-80% in 2023, if governments decide mass vaccination is no longer necessary – it will probably take a decade or more for Keytruda revenues to decline by that amount after its LOE in 2028.

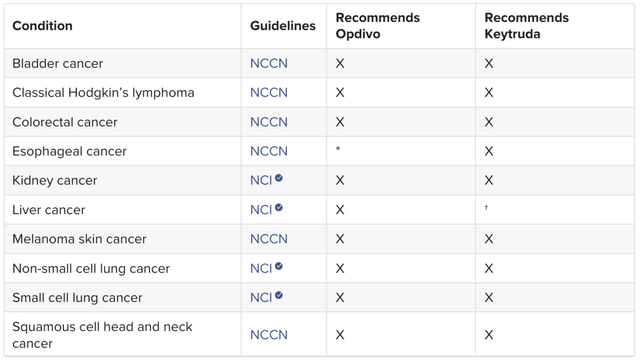

Keytruda is simply a powerhouse, and a very effective drug across almost all solid tumors, as shown below.

Cancers in which guidelines promote treatment with Opdivo of Keytruda (Medical News Today)

Bristol Myers Squibb’s Opdivo is the only genuine challenger to Keytruda’s extraordinary dominance, based on demonstrable results and dozens of pivotal trials, and typically, it’s Keytruda that drives the superior efficacy results.

Speaking on Merck’s Q421 earnings call, Caroline Litchfield, Chief Finance Officer summarized Merck’s 2021 as follows:

KEYTRUDA continues to demonstrate durable momentum across all key tumors and is benefiting from the recent launches in neo-adjuvant and adjuvant triple-negative breast cancer, renal cell carcinoma and in cervical cancer.

KEYTRUDA continues to extend its strong IO class leadership and maintain its position in non-small cell lung cancer, capturing 8 out of 10 eligible new patients, despite competition. Outside the U.S., KEYTRUDA growth continues to be driven by lung cancer and the ongoing launches in head and neck and RCC.

Eight out of 10 NSCLC patients is a staggering achievement, especially when we consider that lung is the most prevalent of all cancers. No other pharma has been able to successfully challenge the drug’s dominance, despite Roche (OTCQX:RHHBY), with Tecentriq, BMY, with Opdivo, AstraZeneca (AZN), with Imfinzi, and Sanofi (SNY) and Regeneron (REGN), with Libtayo all trying desperately to eat into the PD1 inhibitor’s market share. But the wins keep coming for Keytruda – approvals in cervical, endometrial and triple-negative breast cancer all arrived in 2022 – and there is evidently much more to come.

Lynparza, an oral poly ADP ribose polymerase (PARP) inhibitor indicated for the treatment of ovarian cancer, breast cancer, pancreatic cancer, and prostate cancer, jointly developed with AstraZeneca, is an exciting prospect that some analysts believe could bring in nearly $10bn per annum peak sales, whilst Merck suggests in its Q421 earnings presentation that sales of Gardasil – a vaccine against Human Papillomavirus – could double by 2030.

When we add ProQuad, indicated for simultaneous vaccination against measles, mumps, rubella and varicella, Januvia, facing LOE but likely to make multi-billion-dollar sales for a few years yet, and a thriving Animal Health and Hospitals division into the mix, plus Molnupriavir, the outlook certainly looks very bright this year.

FY22 EPS is expected to be $5.76 and $5.91, which implies a forward PE of ~14x. Based on an average big pharma PE of 22x, we can be relatively confident that the share price can grow perhaps as much as 20%-30% higher, although as stated above, I would be a little more conservative than that, because the market is always conscious that pharmas have to have a long-term growth plan in place.

Driving Long-Term Growth Is Trickier For Merck – Is A Mega Money Acquisition On The Cards?

The outlook for 2023 does not look quite as promising as this year, in my view, since there will be sales impact on Januvia as a result of the LOE, and it’s also questionable whether Molnupiravir will generate another $5bn in sales, if pandemic pressures continue to subside, although that’s a big “if.”

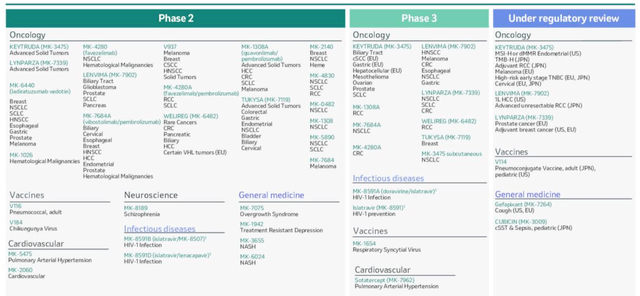

Merck achieved 30 product approvals, and submitted 20 New Drug Applications (“NDAs”) or Supplementary NDAs (“sNDAs”) in 2021, which is a testament to its pipeline strength – the full picture is shown below:

Merck Pipeline in full (earnings presentation)

Keytruda, Lynparza, and Lenvima may dominate the late stage prospects – and those three alone could compensate easily for e.g. lost Molnupiravir / Januvia revenues, whilst helping Merck to climb toward and beyond the $60bn annual revenue mark, but there also are other intriguing prospects, such as two HIV targeting therapies, and in Phase 2, more vaccines, infectious disease therapies, neuroscience opportunities, and cardiovascular.

My slight concern here would be the advent of new approaches to treatment in most of these fields, most notably messenger-RNA technology. Moderna (MRNA), BioNTech (BNTX), and Pfizer (PFE), as well as a host of smaller biotechs, are attempting to build on the success of the two COVID vaccines Comirnaty, and Moderna’s SpikeVax, with vaccines against almost all known viruses – a market where Merck has traditionally been strong – infectious diseases, and even oncology.

It’s interesting to note that one of Merck’s best prospects – the pulmonary arterial hypertension therapy Sotatercept – was the centerpiece of Merck’s ~$11bn acquisition of Acceleron, which took place in November last year. Sotatercept is expected to generate peak sales ~$2bn if approved, but that may be not be quite enough to help Merck maintain e.g. $60bn sales per annum after 2028, when Keytruda sales begin to fall.

Could or would Merck therefore consider splashing out on a company such as Moderna, BioNTech, to gain access to a pioneer in a coming field of medicine? Or outside of mRNA, would Merck consider bidding for an RNAi specialist such as Alnylam, or a gene therapy / CRISPR company such as Intellia Therapeutics or CRISPR Therapeutics, or even CRISPR’s partner in sickle cell disease, Vertex (VRTX).

There are no pharmas out there that have quite the revenue generating capacity of a Celgene or an Allergan, sadly for Merck, or the pipeline strength, so the chances of it making a transformative deal such as BMY or AbbVie did, to shift the focus away from Ketruda, as AbbVie has done with its $20bn per annum selling blockbuster Humira, seem remote.

Biogen is an option, potentially, but the company is somewhat troubled thanks to its disastrous launch of its Alzheimer’s therapy Aduhelm and the failure of several other CNS projects. Thinking even further outside the box, Eli Lilly (LLY) is arguably substantially overvalued owing to its Alzheimer’s therapy Donanemab, which has a similar mechanism of action (“MoA”) to Aduhelm. If Donanemab fails, and Eli Lilly’s valuation crashes, could a mega-merger be a possibility between Lilly and Merck?

Conclusion – Merck Is Safe To Buy and Hold For A Decent Dividend and A Shot At $100 Per Share – Forget The Keytruda LOE For Now

Whilst it’s interesting to speculate about what Merck might do with Keytruda’s 2028 LOE in mind, I would encourage investors not to let it cloud their judgement at present.

When looking at the “Big 8” US pharma companies, personally, I look at BMY and ABBV and as I predicted they would last year, both have seen a share price surge thanks to their successful mega-money buyouts of Celgene and Allergan, and management’s detailed planning around growing revenues while stomaching LOE losses (see my notes on either company for more info).

Pfizer’s share price has also grown substantially, but Pfizer, more than any other company, has shrinking revenues to worry about, as $55bn of its ~$100bn projected revenues in 2022 are from COVID therapies, and their futures revenues streams are highly uncertain. Johnson & Johnson, the only US pharma now larger than Pfizer (market cap of ~$465bn, vs. Pfizer’s ~$300bn), is such a vast company that rapid share price growth is probably out of the question.

Eli Lily looks somewhat overvalued – its market cap is larger than Merck’s even though its revenues in 2021 were $28bn, vs. Merck’s $49bn, which is based on Donanemab, and I would not want to bet on the success of an Alzheimer’s therapy in the current climate.

Gilead has deep-lying issues, based around the collapse of its Hepatitis B empire, and a succession of M&A deals that have failed to provide any value, although it remains a highly profitable company with upside potential, I believe, while Amgen is a solid company, with slightly uninspiring growth prospects and pipeline.

That leaves Merck, which has no immediate concerns on any front, in my opinion. Its revenues grew 17% last year and will likely do so again in 2022. It has arguably the world’s best drug in its stable, which countless biotechs develop complementary drugs for, at no charge to Merck. It has other oncology drugs, such as Lynparza, helping generate organic topline growth, and several others besides.

Despite all this, Merck’s share price hasn’t made any major moves – up 12% across the past 12 months, although its PE ratio and growth forecasts hint fairly strongly at the fact the company is undervalued.

There are some issues that present themselves in the longer term, such as the Keytruda LOE, and the rise of new drugs in areas where Merck is traditionally strong, but with limited debt, and $30bn cash, and ~5 years in which to solve these problems, management has a great opportunity to solve these problems.

As such, if I were investing in a US major pharmaceutical today, of the “Big 8,” my choice would be Merck. Arguably, investors should wait and see if there is a dip below $75, as this is the range in which Merck typically trades, but there are many reasons to believe that dip won’t materialize in 2022, or perhaps for a while yet. On balance, in my view, the case for upside outweighs the case for downside.

Be the first to comment