krblokhin/iStock via Getty Images

Investment Thesis

MercadoLibre, Inc (NASDAQ:MELI) appears well poised for growth, given the massive ramp-up in its operations, successful user acquisition, and stellar penetration in the marketplace, logistics, fintech, and credit segments in Latin America. Given the potential doubling in e-commerce penetration by 2025, we expect to see MELI perform exemplarily ahead, due to its current lion’s market share of 30% in the region.

Nonetheless, it is also evident that MELI is trading at a premium now, potentially boosted by Amazon’s (AMZN) announcement of Prime Day in mid-June 2022 and stellar sales in mid-July 2022. Therefore, even though MELI is a solid stock, we prefer the margin of safety that $600s will offer to long-term investors. Interested buyers, do wait for the current rally to be digested.

MELI Has Reached The Inflection Point Of Its Future Growth

S&P Capital IQ

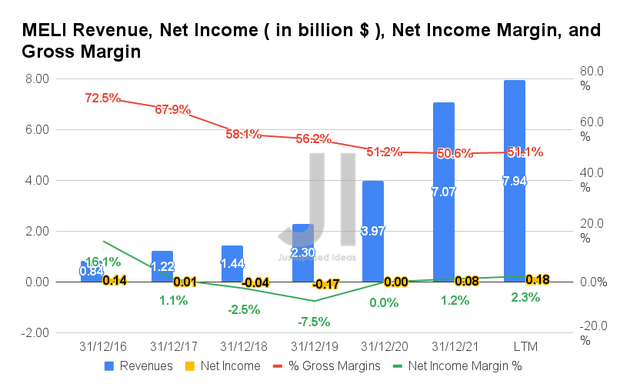

MELI had obviously benefited from the boom in e-commerce during the height of the COVID-19 pandemic, given the massive jump in its revenue CAGR at 75.33% between FY2019 to FY2021, compared to pre-pandemic CAGR of 39.9%. This has pulled forward its growth by two years, indeed.

By the LTM, MELI reported revenues of $7.94B and gross margins of 51.1%, representing massive growth of 345.2% though a moderation of 5.1 percentage points from FY2019 levels, respectively. In the meantime, the company managed to finally report profitability breakeven in FY2020, with net incomes of $0.18B and net income margins of 2.3% in the LTM, indicating an increase of 200% and 9.8 percentage points from FY2019 levels, respectively.

S&P Capital IQ

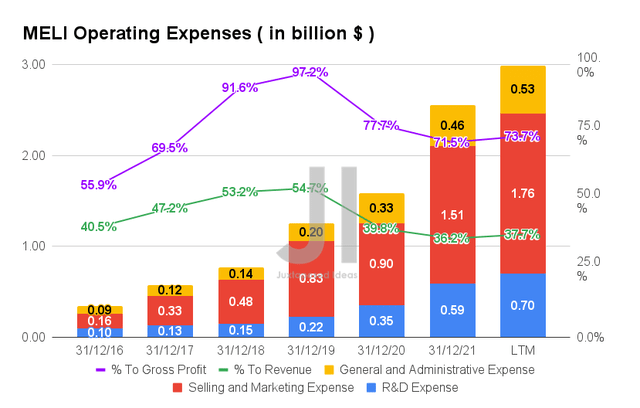

MELI had also grown its operating expenses prudently in the past two years, with total expenses of $2.99B in the LTM, representing an increase of 239.2% from FY2019 levels. However, it is essential to note that the ratio to its growing revenues and gross profits has been moderating thus far, accounting for 37.7% of its revenue and 73.7% of its gross profits in the LTM. Nonetheless, since MELI had guided a new hiring spree of 14K headcount for the rest of FY2022, we expect to see a notable spike in its operating expenses ahead.

S&P Capital IQ

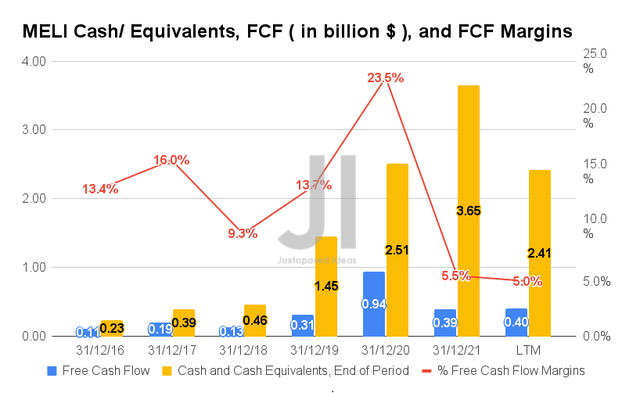

Due to its improved profitability, MELI has been reporting slight improvements in its Free Cash Flow (FCF) generation thus far, with an FCF of $0.4B and an FCF margin of 5% in the LTM. This represents an increase of 29% though a notable decline of 8.7 percentage points from FY2019 levels. Nonetheless, we are not overly concerned since MELI still reports robust cash and equivalents of $2.41B on its balance sheet simultaneously.

S&P Capital IQ

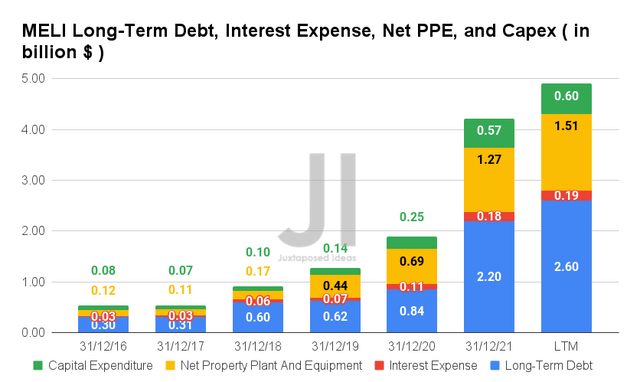

MELI has also been growing its capabilities thus far, with net PPE assets of $1.51B and capital expenditure of $0.6B in the LTM, indicating an increase of 343.1% and 428.5% from FY2019 levels, respectively. We are confident that these investments would eventually prove to be top and bottom lines accretive – given its aggressive expansion into emerging markets and growing market share thus far.

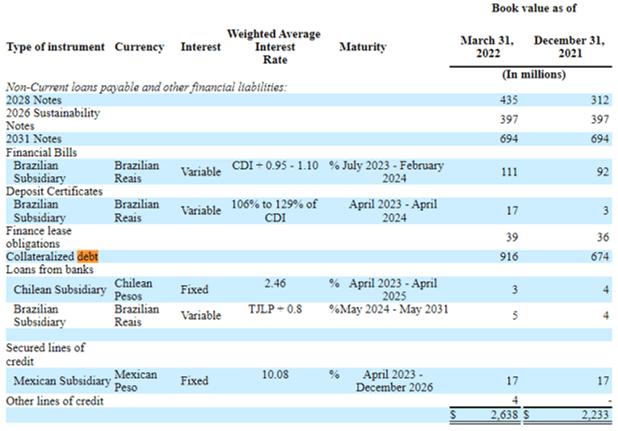

However, given its minimal profitability thus far, it is evident that MELI has taken up more debt obligations in the past few years. By the LTM, the company reported long-term debts of $2.6B and interest expenses of $0.19B, representing an increase of 419.3% and 271.4% from FY2019 levels, respectively.

MELI Debt Maturity

Seeking Alpha

In the meantime, we are not overly concerned about MELI’s debts since none are maturing within the year, though the company is looking at $128M of debt maturity by FY2024. Not a concern, though, given its war chest of cash and equivalents and improved profitability by then.

MELI Is Super-Charged For Growth Ahead

S&P Capital IQ

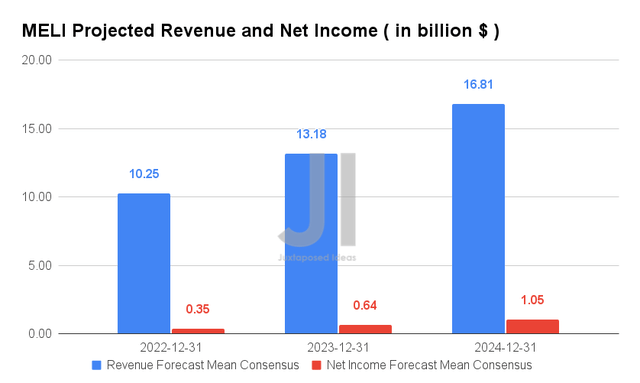

Over the next three years, MELI is expected to report impressive revenue and net income growth at a CAGR of 33.53% and 132.73%, respectively. Its net income margins are also likely to improve over time, from 1.2% in FY2021 to 6.2% in FY2024. For FY2022, consensus estimates that MELI will report revenues of $10.25B and net incomes of $0.35B, representing tremendous YoY growth of 45.1% and 421.6%, respectively.

MELI’s Operational Growth Metrics

Seeking Alpha

In the meantime, analysts will be closely watching MELI’s FQ2’22 performance, with consensus revenue estimates of $2.51B and EPS of $1.85, indicating a remarkable increase of 47.14% and 35.22% YoY, respectively, despite the reopening cadence. Since its peers, such as Amazon, had outperformed its recent Q2 earnings call ( with Prime Day incorporated in FQ3’22 no less ), we expect MELI to continue smashing estimates as well, as observed in FQ1’22. We shall see.

The eventual recovery of MELI’s stock price is highly dependent on the growth in its operating metrics in FQ2’22, which have proven stellar in FQ1’22. The slightest whisper of decelerating growth would likely reverse its current stock gains. However, we are cautiously optimistic, since we expect continued stickiness ahead for consumer behavior in its marketplace, logistics, fintech, and credit segments post-reopening cadence.

MELI’s Leading Market Share In Latin America

Forbes & Bloomberg

The e-commerce market in Latin America is also expected to grow from $209B in 2020 to $580B in 2025, at a CAGR of 29%. In addition, e-commerce penetration in Latin America is expected to double from 8% in 2020 to 16% in 2025, which indicates a massive opportunity for MELI’s growth since it has the lion’s market share of 27% in Brazil, 68% in Argentina, and 13.6% in Mexico as of March 2022, with an average of 30% for the whole of Latin America.

These numbers are almost as impressive as Amazon, which is expected to hit the majority at 39.5% of market share in the US e-commerce by the end of 2022. Therefore, we are highly encouraged that MELI’s aggressive expansion will start paying off handsomely over the next few years. Thereby, potentially triggering a long-term stock price appreciation.

In the interim, we encourage you to read our previous article on MELI, which would help you better understand its position and market opportunities.

- MercadoLibre: It’s The Perfect Time To Buy

So, Is MELI Stock A Buy, Sell, or Hold?

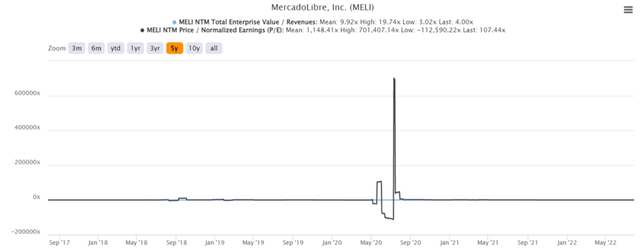

MELI 5Y EV/Revenue and P/E Valuations

S&P Capital IQ

MELI is currently trading at an EV/NTM Revenue of 4.0x and NTM P/E of 107.44x, lower than its 5Y mean of 9.92x and 1148.41x, respectively. The stock is also trading at $813.71, down 58.6% from its 52 weeks high of $1,970.13, though at a premium of 35.4% from its 52 weeks low of $600.69. It is evident that the stock has slightly recovered pre-FQ2’22 earnings, since hitting the bottom six weeks ago.

MELI 5Y Stock Price

Seeking Alpha

Nonetheless, despite the consensus estimates’ attractive buy rating with a price target of $1,420 and 74.51% upside, we believe that MELI is currently trading at a premium. Based on its price action, we think that $600s will be a more attractive entry point for any interested investors due to its historical support level.

In the meantime, we prefer to wait for MELI’s FQ2’22 earnings call, since the stock will likely recover in the short term. It would be good to glean more information about its performance thus far and forward guidance for H2’22, since we expect a notable normalization in its revenue and net income growth ahead. For those wanting to add MELI, do wait until the current rally is digested a little.

Therefore, we rate MELI stock as a Hold for now.

Be the first to comment