gorodenkoff

Thesis

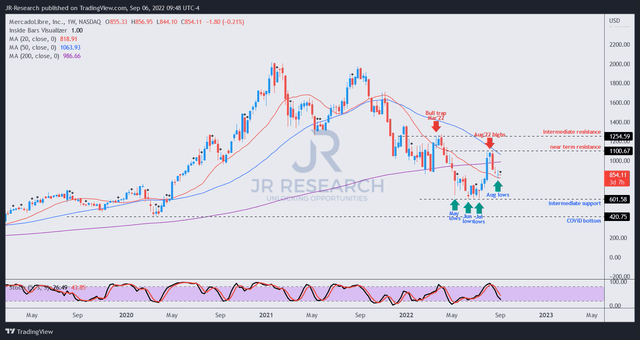

We highlighted in our pre-earnings article on MercadoLibre, Inc. (NASDAQ:MELI) that it has likely bottomed out in June despite facing massive headwinds in LatAm, particularly in Brazil. Therefore, we weren’t surprised that MELI went on to form its August highs with a rapid momentum spike before the market digested its gains.

As a result of the sharp pullback, MELI has fallen more than 20%, reminding investors not to chase rapid momentum surges. We observed that MELI is attempting to form a higher-low base above its long-term bottom in June. While the bottoming process is still ongoing, we remain confident of a medium-term re-rating moving ahead, as the inflation headwind in its largest commerce market, Brazil, is expected to subside.

Notwithstanding, MercadoLibre’s growth rates are expected to moderate through FY23, as it laps highly challenging comps from FY21. Therefore, investors need to adjust their expectations of a more normalized growth cadence, even as it gains operating leverage.

We reiterate our Buy rating but highlight that the potential for downside volatility remains as the price action is not ideal. Therefore, investors are encouraged to layer in and add exposure over time.

Brazil’s Growth Could Bottom Moving Ahead

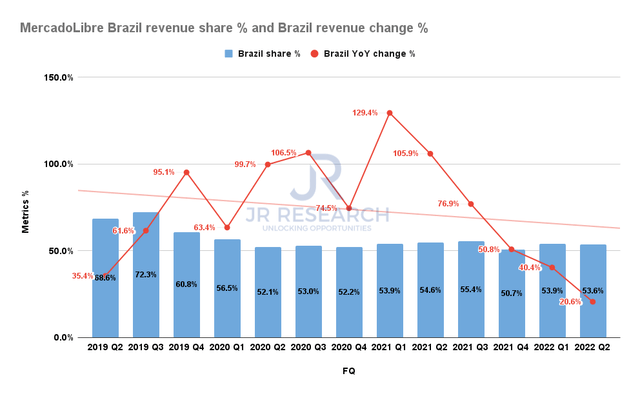

MercadoLibre Brazil revenue change % and revenue share % (S&P Cap IQ)

Brazil remains MercadoLibre’s most important revenue and profitability driver for its commerce and FinTech segment. As seen above, Brazil has consistently accounted for more than 50% of overall commerce revenue share over the past three years.

However, the region’s growth had moderated significantly since FQ1’21, when its commerce growth peaked at 129.4% YoY. Accordingly, Brazil posted revenue growth of 20.6% in Q2, down from Q1’s 40.4%, as it notched another below-trend growth momentum. It was also the fifth consecutive quarter of revenue growth deceleration, as Brazil was buffeted by record high inflation rates.

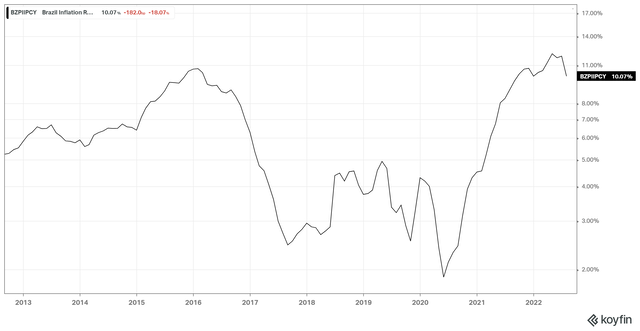

Brazil inflation rate change % (koyfin)

Brazil registered an inflation rate of 10.07% in July, which was still close to its previous 10Y high in 2016. However, it has dropped markedly from April’s peak of 12.13%, given the aggressive rate hikes by its central bank.

Furthermore, the central bank appears to be ready to pause its rate hikes after another possible increase in September, as its central bank President Roberto Campos Neto accentuated: “We need to send out a hard message. The message that’s still valid is that we’ll evaluate the need for a final rate hike in September.”

Economists forecast Brazil’s interest rates to fall to 11.25% by the end of 2023, down from the current 13.75%. While still elevated, we believe it should help stabilize the growth momentum for MercadoLibre’s most critical region and help it bottom out decisively.

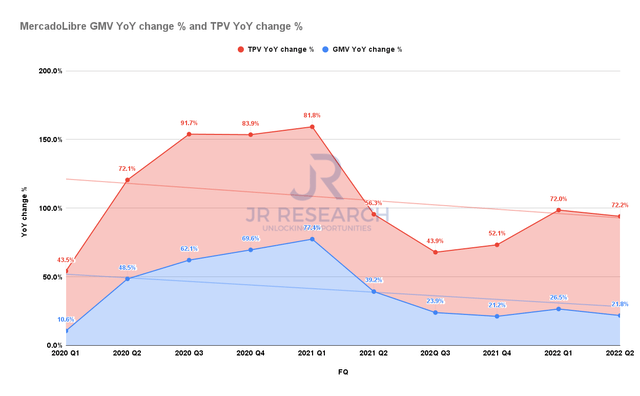

MercadoLibre GMV change % and TPV change % (Company filings)

Therefore, we expect MercadoLibre’s commerce gross merchandise value (GMV) growth deceleration to bottom out by 2023 as Brazil’s inflation rate falls further. In addition, while its FinTech segment continues its rapid growth as its total payment volume (TPV) registered an increase of 72.2% YoY in Q2, its profitability profile is much lower than its commerce segment.

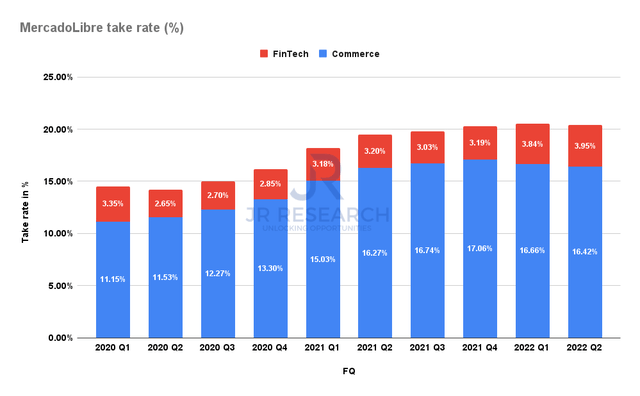

MercadoLibre take rate by vertical % (Company filings)

As seen above, FinTech’s take rate of 3.95% remains well below Commerce’s take rate of 16.42%. In addition, the normalization of e-commerce growth and Brazil’s malaise has also impacted its commerce take rate, as its growth has normalized after notching its highs in Q4’21. However, if the interest headwinds normalize moving forward, we believe it should help stabilize its commerce take rate, as Brazil remains its most crucial profitability driver.

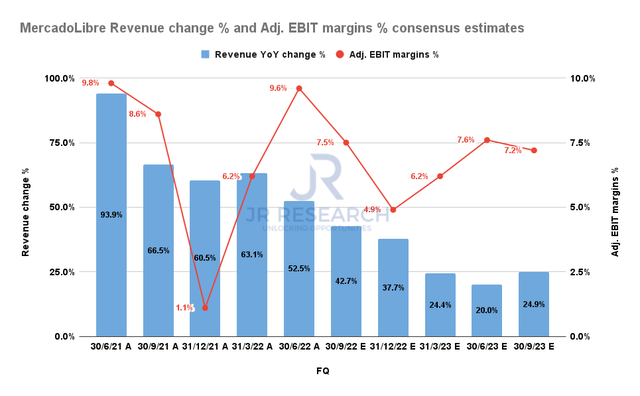

MercadoLibre revenue change % and adjusted EBIT margins % consensus estimates (S&P Cap IQ)

The consensus estimates (bullish) suggest that MELI’s growth momentum should continue to normalize through FY23. We believe the estimates are reasonable, as the Street is modeling more conservatively, given the macro headwinds and challenging comps. As a result, it’s also likely to impact its EBIT margins, which have been volatile over the past few quarters.

Therefore, we believe MELI could continue to experience significant volatility until it can prove the sustainability of its operating leverage. Notwithstanding, we surmise that MercadoLibre had proved the durability of its commerce growth drivers, despite Brazil’s record high inflation rates.

Coupled with its fast-growing FinTech segment, we are confident that MELI has diversified its e-commerce business while broadening its growth drivers and expanding its TAM. Therefore, investors can expect the potential for a medium-term re-rating as Brazil’s growth stabilizes.

MELI’s Valuation Has Been Battered

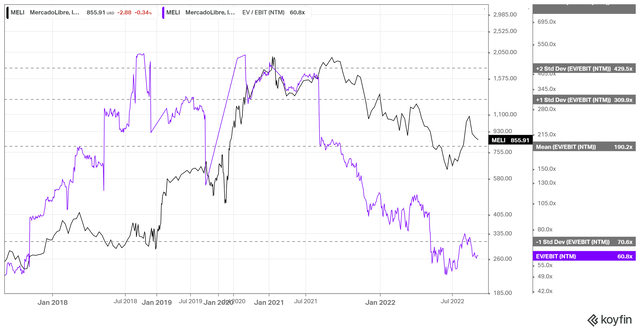

MELI NTM EBIT multiple valuation trend (koyfin)

As seen above, MELI’s NTM EBIT multiples fell below the one standard deviation zone below its 5Y mean in June, as the market de-rated it markedly. Therefore, we deduce that the pummeling in its valuation has reflected its headwinds at its June lows.

While there could still be downside volatility in the near term, we postulate that deep pullbacks should be capitalized upon to add exposure.

Is MELI Stock A Buy, Sell, Or Hold?

MELI price chart (weekly) (TradingView)

MELI has fallen more than 20% from its recent highs, giving up most of its gains in August. However, it has attempted to form a bottoming process above its 20-week moving average (red line) while remaining well above its June lows.

Notwithstanding, the price action has not yet exhibited a validated bottoming process and, therefore, could still be susceptible to near-term downward momentum. However, we are confident that the forward improvement in Brazil’s underlying metrics should help support a medium-term re-rating, given its battered valuations.

Consequently, we reiterate our Buy rating on MELI.

Be the first to comment