tomazl/E+ via Getty Images

Introduction

The meme stock fiasco and the death of LIBOR, an index derived from yields in the London Interbank Deposit Market, have awakened securities and futures traders to financial market structure failures. The pressure of events stripped both debt and equity markets of the pretense of efficiency.

Retail securities investors learned that free brokerage does not mean zero trading costs. The meme stock fiasco of January 2021 revealed a very inefficient, expensive, retail securities market structure. Angry retail traders objected when Robinhood denied them the ability to buy the then-hot GameStop shares when the price seemed most attractive. The meme fiasco revealed hidden trading costs and the threat of market failure due to archaic clearing practices.

And in 2021 market regulators ended LIBOR – the index summarizing London-based short-term private sector yields. This meant Eurodollar futures, the largest futures market by volume and a key focal point of private sector debt trading, would also come to an end.

This development exposed the key weakness in the structure of futures markets: these markets’ vulnerability to the failure of the associated spot markets used to settle each contract type. All futures contracts are dependent on the success of a related spot market beyond the futures exchanges’ control.

One obvious answer to the problems of these two marketplaces is to combine the best characteristics of each, creating a single market for retail traders. Turn futures and spot market stovepipes into a single marketplace.

How should we evaluate the structure of a financial market?

In the retail securities markets, there are apparent structural inefficiencies. But how should the structure of this market be evaluated? Standards for market structure as described by the staff of the SEC may be found here. Four desirable qualities:

- Simplicity. A simple structure eases the identification of trading costs and performance measurement.

- Transparency. A transparent structure enables retail traders to compare the efficiency of vendor performance to alternatives.

- Homogeneity. A market focused on a few dominant representative investments provides traders with a summary measure of the forces at work throughout the market.

- Stability. A market should not be vulnerable to collapse under the weight of higher-than-normal volume or a sudden increase in price volatility.

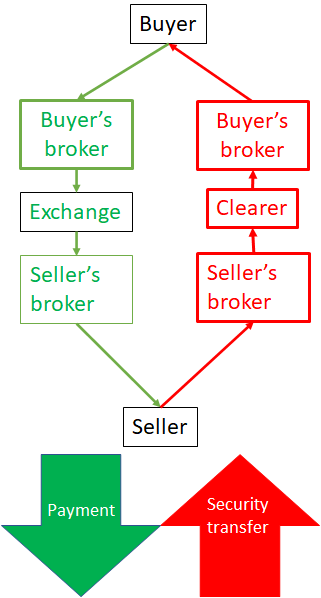

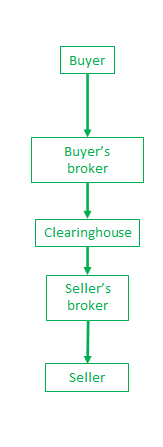

Figure 1 (Author)

How the securities market lost its way

Pre-electronic trading. Before the advent of electronic trading, life was simple, as Figure 1 displays. Payment went from the buyer to the seller (left side of the graph). Then buyer’s security wended its way through an absurdly archaic, slow, expensive clearing system from the seller to the buyer (right side). The inefficient second leg of transactions – clearing – is costlier and for over 99% of investors, unnecessary. Yet it involves more processing and expense than the deal itself.

Despite the inefficiencies of this original market structure, if markets retained this earlier structure following the move to electronic trading, it would be much simpler, more transparent, and more homogeneous now. Nonetheless, this system was never adequate for the needs of the globe’s largest financial market.

Post-electronic trading. Electronic trading produced an enormous improvement in execution speed, but it enabled better-informed market participants to capture a greater share of the benefits from electronic trading than did the retail traders the SEC would like the system to serve. Among the retail-unfriendly effects of insider manipulation of the NMS was a growing number of superfluous exchanges.

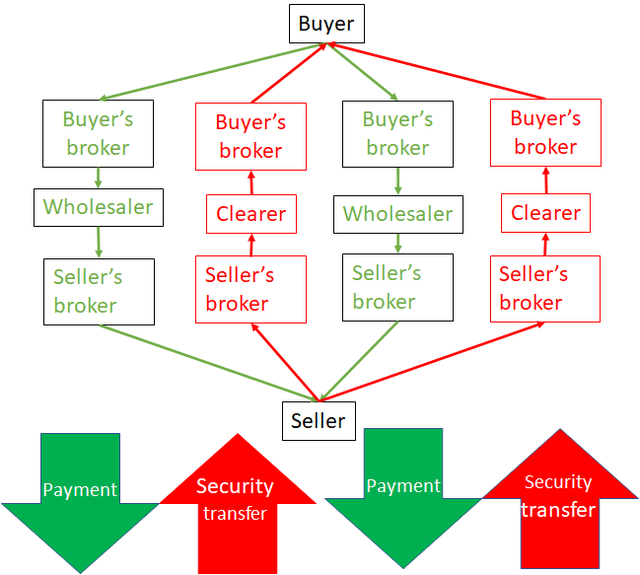

Figure 2 (Author)

Post-RegNMS. Largely because of SEC-induced changes in the National Market System (NMS), the earlier simple system gradually became incredibly complex. Where once there was one securities exchange that traded each security, now there are 15. Figure 2 suggests the multiplication of trading expenses a second exchange brings into the market. Multiply that by 15!

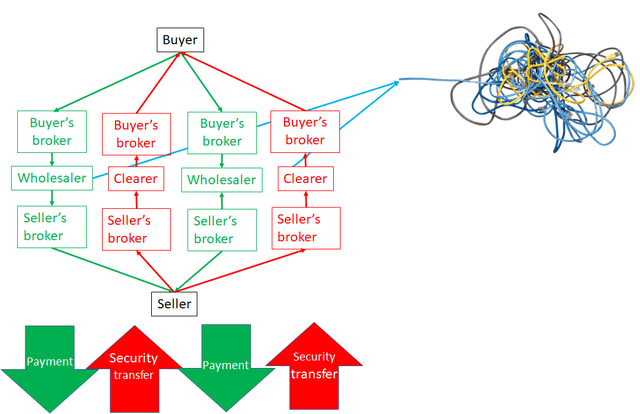

Figure 3 (Author)

Add to these exchanges more than 90 Alternative Trading Systems (ATS). Then throw in OTC transactions of wholesale firms that account for around 40% of total volume and 90% of retail volume on ordinary trading days. Figure 3 is an oversimplified schematic of the current catastrophically complicated system. As the graphic suggests, wholesale traders have replaced exchanges at the center of most transactions. The chaotic network of transactions after the buyer’s order reaches the wholesaler suggests that there is no uncomplicated way to describe the trail from buyer to seller. Hence the complete lack of transparency in retail transactions today.

Retail traders learn the ugly truth

The meme fiasco of January 2021 opened the public’s eyes. Once the darlings of the meme traders, retail brokerage firms lost much of the goodwill they gained when Robinhood introduced commission-free trading in March 2015. The meme stock fiasco dished the dirt that opaque Wholesaler Payments for Order Flow (PFOF) enabled free brokerage. Poorer execution replaced brokerage.

Market structure reform

Enter recently appointed SEC chair Gary Gensler and an SEC-proposed new regulatory world, primarily a reaction to the meme stock trading fiasco. Among the unattractive revelations of the meme stock crisis was the lesson of PFOF’s opaque costs. The SEC has vowed to reform the securities market structure, as explained by Gensler here.

“Payment for order flow can raise real issues around conflicts of interest. As described in the Commission’s settled enforcement action against Robinhood in 2020, payment for order flow can distort routing decisions. Certain principal trading firms seeking to attract Robinhood’s order flow told them that there was a tradeoff between payment for order flow and price improvement for customers.”

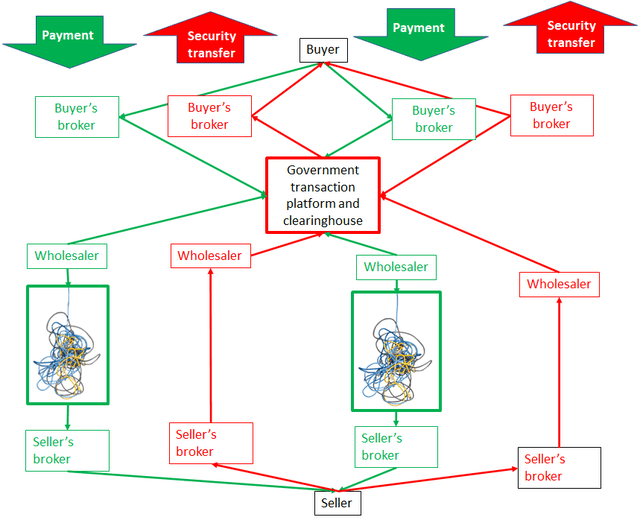

Gensler has proposed a new auction process through which wholesale broker-dealers would bid against each other to win retail traders’ order flows. This auction process adds another layer of complexity to the existing market structure as Figure 4 suggests.

Figure 4 (Author)

This proposed Rube Goldberg machine of an NMS would add yet another layer of cost and complexity.

In summary, the primary problem with the current securities market structure from the point of view of retail traders is its complexity and opacity. Yet the proposed auctions to replace PFOF add another vertical layer to the chain of transactions and doubtless a higher retail cost of trading. Whether Gensler’s plan buries the added cost of this proposal in the retail bid-ask spread as with PFOF or in government subsidies paid by taxpayers, one effect of this proposal is an unquestionably higher cost of transactions. To add a layer of cost in the name of reducing conflicts of interest is a dubious improvement in the well-being of retail traders. Especially if a simpler, less costly change in market structure can eliminate PFOF.

How futures and securities market structures are different

Like Australian plants and animals, futures trading is different from securities trading largely because each evolved in a different environment – serving different customers and trading different products.

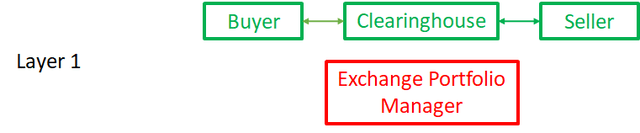

Figure 5 (Author)

The two market systems – securities and futures –have different structures because of this separate evolution. In other words, the difference between the two market structures is an accident of history.

But as the two markets began to trade similar instruments with the introduction of financial futures, combining the two markets to create a single unified market may improve the efficiency of the joint marketplace for both markets’ current users.

Figure 5 displays the current structure of futures markets. Clearing is useless and expensive in the settlement of transactions. It is absent day-to-day in futures markets, eliminating over half the cost of the simpler futures transaction as the graphic suggests.

Futures are ideal for day traders – traders that buy and sell positions that they close before settlement. Stock exchanges sacrifice much of the efficiency of futures exchanges to accomplish goals a futures exchange cannot. Transfer of ownership rights and payment of dividends and interest are the key factors that change the zero-sum game that is futures trading into retail investing that increases the capital stock.

In 1971 informed observers thought trading of financial futures and shares of common stock were vastly different. But over time the two industries have become more alike. The introduction of S&P Futures in 1980 followed by the introduction of passive Exchange Traded Funds (passive ETFs) in the securities markets in 1993 blurred the difference between the two.

But the serendipitous entrance of futures exchanges into financial markets during the 20 years from 1970 to 1990 revealed that the futures market structure was both different from the securities market structure and better in important ways. Futures markets seldom clear transactions (usually once every three months). This difference dramatically reduces the resource cost of a transaction compared to retail securities.

A critical weakness of futures markets

The market event that awakened futures market participants to a weakness in the market structure of futures was the slow lingering death of LIBOR. The dependence of futures’ highest volume contract on the increasingly parochial London wholesale deposit market was a development resulting from post-Financial Crisis bank regulations that restricted wholesale deposit issuance by increasing capital charges associated with them.

The death of LIBOR exposed a general weakness of financial futures, an inability to protect the supply of the financial instrument delivered in the settlement of a futures contract.

Unified futures and securities markets

What characteristics of securities markets would improve futures markets and what characteristics of futures markets would improve securities markets?

Securities market characteristics that would improve futures trading.

- Control of the issuance of the security that settles futures contracts

- Payment to buyers of dividends and interest if they want to bear the cost of this added capability.

- The ability to control the risks associated with futures contracts and their associated securities instruments in tandem.

Futures market characteristics that would improve securities trading.

- Zero clearing costs

- Exchange-listed securities in only one venue

- Margins reset frequently as price risk changes

- No interexchange trading of identical listed securities

Joint trading capability is the key advantage of this hypothetical change. In other words, modify the market structure so that the exchange trades a single instrument either as a futures contract or security at the trader’s option.

Since futures trading is simpler than securities trading, the description begins by redesigning futures markets. To combine futures and securities within a single exchange improves the utility of the market for both day traders and retail investors. This structure layers trading by market function.

Instead of trading distinct instruments divided vertically according to their historical evolution (securities and futures stovepipes), trade a single instrument divided into horizontal layers characterized by the type of user. The top layer of the market structure provides transactions and mark-to-market valuation important to both day traders and retail investors. In the bottom layer, the structure adds costs and benefits of transferring retail traders’ income and dividends.

Consider these three principal functions of trading

- Transfer daily change in market value from one counterparty to the other

- Transfer interest and dividend income to the buyer

- Transfer the other rights of ownership to the buyer. These secondary rights are the costliest rights of trading and are important to activists only. This market structure does not look to serve activists.

Layer one traders receive and pay daily changes in market value at the market close. This market function is both the least expensive to provide and the essence of trading.

Layer one traders are long traders matched with short traders. The long/short designation replaces the buyer/seller designation of counterparties since long and short agree to transfer the change in the value of the investment, not the investment itself. The market structure of layer one is identical to that of futures markets. A futures-style clearinghouse stands between buyer and seller. The clearinghouse reduces credit risk between counterparties and permits futures-style risk-based margins.

Figure 6 (Author)

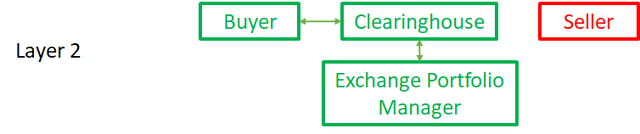

- Layer two traders are buyers only. A buyer seeking level two status will inform her clearing member of her change in status. The greater risk resulting from controlling the entire face value will result in higher margin payments. This layer has a higher resource cost. With the added cost comes buyer collection of the day-to-day value of the investments they trade.

Figure 7 (Author)

Conclusion

Recent market events have revealed shortcomings of the debt and equity markets that serve retail traders.

The meme stock fiasco revealed the clearing failures of the present securities market structure. It also embarrassed retail securities brokers that claimed they were providing free retail trading. The costs were still there despite zero brokerage fees – hidden in poorer execution.

The death of LIBOR revealed the vulnerability of futures trading to exchanges’ inability to assure the availability of the security deliverable in the settlement of futures positions.

The hypothetical unified marketplace described here would solve the problems of both marketplaces. Yet no major financial institutions propose this or a similar change to market structure. It’s a mystery. Perhaps it has something to do with the negative effect of the changes on the income of large financial institutions.

Be the first to comment