It’s a recession when your neighbor loses his job; it’s a depression when you lose your own. – Harry S. Truman

Welcome to the new normal. I asked on my Twitter feed the question whether there would be a melt-up or if this is a sucker’s rally, and a look at the comments tells you all you need to know about sentiment.

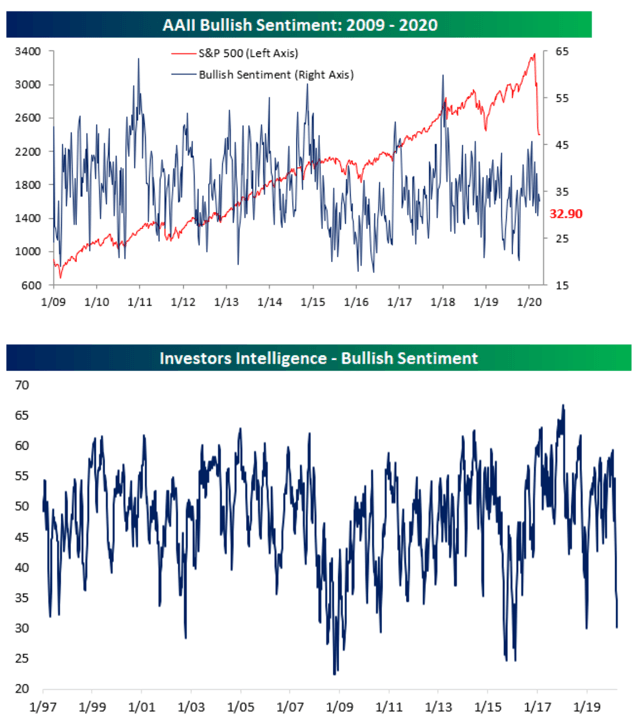

No one wants to commit. I think that means we are in a place where this rally is finding some artificial legs, but given the amount of fiscal and monetary stimulus, it will probably land somewhere in between. And given that I argued March 6 that a melt-up setup was likely coming end of March, it’s now time to evaluate where we are. The actual sentiment readings from AAII’s weekly survey are showing bearish right now, despite the big rally this week, not surprising after a market crash. Only 32.9% of respondents reported as bullish this week, down from 34.4% last week. Bearish sentiment increased to 52.1% from 51.3%. What does that tell us after the largest three-day rally in almost 90 years, since 1931? It could possibly be one to fade in the short term, but there’s good value long term from these levels. That puts us somewhere in between a melt-up and a sucker’s rally.

Source: Bespoke Investment Group

I called this recent rally as partially artificial, and it wasn’t because I thought the algorithmic trading was doing work. Surprise, it was – Virtu Financial (NASDAQ:VIRT) expects to post trading income between $509 million and $519 million in Q1, the highest quarterly income since the company went public in 2015, and more than double the amount from Q1 2019. I think this rally is gaining legs from institutional rebalancing here, given we are so close to the month-end. If you think of it logically, we are coming up to the end of a terrible Q1, at the start of 2020. For example, if you had a portfolio that was 70% public stocks, it likely dropped a significant amount going into the end of Q1. With quarterly rebalancing, what better way to meet your IPS than rebalancing after a 30%-plus drop in the markets – some funds could be buying up to 20% in equities. Rebalancing is a significant factor right now and is being severely exacerbated by illiquidity in these volatile times. That also was clear on the way down, and now, it’s providing some short-term artificial rallies.

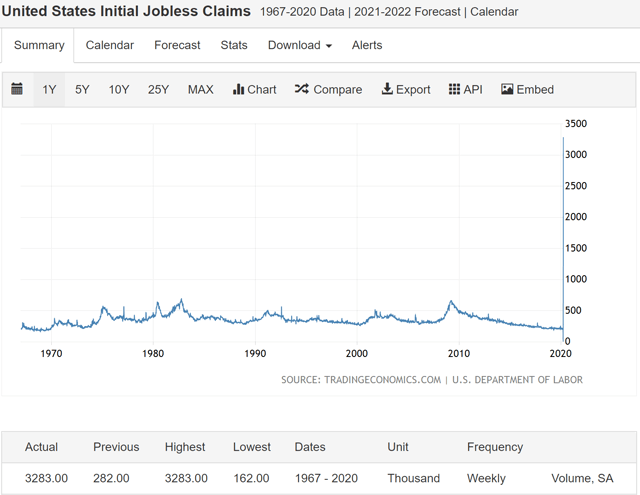

I don’t think that you can discount the rally in full, though. There are several reasons that we should have gotten a bounce this week, given how much fiscal and monetary stimulus is getting pumped into the system. I do, however, want everyone to be mindful that we can quickly retest the lows in the following quarter – I just don’t think it’s likely. The economic data we are about to get is going to be record-breaking bad. If you don’t believe me, take a look at the horrific jobless claims charts.

As I mentioned on The Lead-Lag Report last week, we knew this was going to be bad, but estimates were for around 1.5 million. The number came in at 3.28 million claims. It might get worse, which is a scary thing. In 10 years, when we plug the data into a long-term chart, we’re going to assume our spreadsheets have an error somewhere, as the point is a huge outlier. The previous high in claims was 695K from October 1982, not even a fifth as high as the ones from March 26. We are on the precipice of seeing a 20%-plus drop quarter over quarter for GDP and an unemployment spike that will grab headlines for weeks. It’s going to be ugly, people. For me, that means that a re-test of the recent lows has a decent probability, especially if volatility persists. The shock to the labor market that’s currently underway is unprecedented and is going to be larger than expected. For a consumer economy, that is nothing short of a disaster.

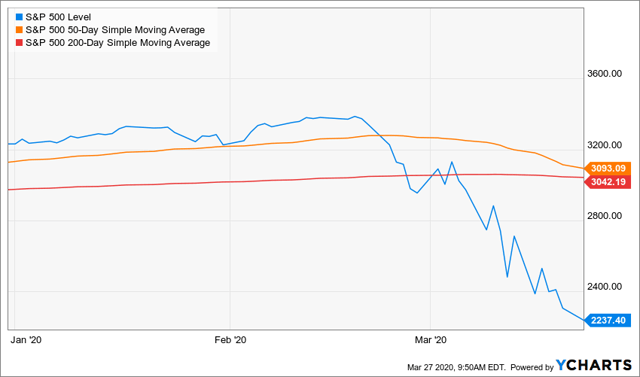

It’s not all doom and gloom, though. I do think that the recent bottom in equity markets is the near-term low, and subscribers to The Lead-Lag Report will get their risk-on signal soon enough after the short-term risk-off trigger flipped Jan. 27 before it was too late. So, if you have been buying before this week’s rally, you can likely remain confident in your call for now. The S&P 500 hit 2191, about 35% lower than its all-time high, and in doing so was extremely oversold and ripe for a bounce. We’ve gotten the bounce, and now, it’s time for those levels to hold. If the rally continues next week, what you want to be in is small caps and high-beta names, as those are likely to drift higher and outperform as the equity markets sound the all-clear. Just beware of the risks as you get into those names, as they generally imply increased leverage and higher risk – something you don’t want to be in if the bottom falls out from the market.

Is this a melt-up or a sucker’s rally? Somewhere in between. Make your portfolio adjustments accordingly, and know your investment time frame and risk tolerance. On the latter, that’s exactly why each of the signals in The Lead-Lag Report, borne out of my four award-winning white papers, isn’t just about risk-on and risk-off, but the time frame under which you’re rotating in.

*Like this article? Don’t forget to hit the Follow button above!

Subscribers were told to go risk-off Jan. 27. Now what?

Subscribers were told to go risk-off Jan. 27. Now what?

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for informational purposes only and Lead-Lag Publishing, LLC undertakes no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.

Be the first to comment