yangphoto/E+ via Getty Images

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on July 1st, 2022.

Most readers will know I have a focus on income investments. This makes REITs and utilities/infrastructure sectors a natural fit. If I weren’t mindful of wanting to stay diversified, I’d probably have a portfolio split 50% in REITs and 50% in utilities. However, I feel that diversification is important.

With that being said, I wanted to take an updated look at MainStay CBRE Global Infrastructure Megatrends Fund (NYSE:MEGI). This was a newer fund that launched just last year. We touched on more basic details in our original coverage in March. Today, we’ll be taking a look at how the fund has been doing since that time.

In terms of closed-end funds, MainStay isn’t really a big name. They offer one other CEF with their name; the MainStay MacKay Defined Term Municipal Opportunities Fund (MMD). However, they are no small operation as they are a part of New York Life Investments, a New York Life Insurance subsidiary. They have a total AUM of more than $650 billion, while MEGI is a relatively small $1.5 billion of that.

The Basics

- 1-Year Z-score: N/A

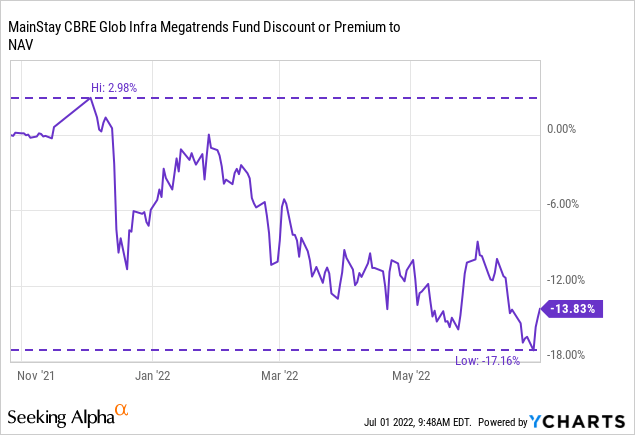

- Discount: 13.83%

- Distribution Yield: 8.18%

- Expense Ratio: 1.23%

- Leverage: 28%

- Managed Assets: $1.512 billion (as of March 31st, 2022)

- Structure: Term (anticipated liquidation date, December 15, 2033)

MEGI is your fairly standard closed-end fund, with the fund “seeks a high level of total return with an emphasis on current income.”

A bit of the fund’s twist compared to other infrastructure or utility funds is a “thematic theme.” They are “focused on the investment megatrends of decarbonization, digital transformation and asset modernization, which are reshaping the demand for infrastructure assets and driving income and growth potential.”

The fund is leveraged up and didn’t waste too much time getting there. When including leverage expenses, the expense ratio comes to 1.32%. This is fairly reasonable considering the global focus of the fund. This is similar relative to peers such as Cohen & Steers Infrastructure Fund (UTF), which comes in at around the same expense ratio excluding leverage.

However, the period was just over a month when looking at the Semi-Annual Report. In the next report, I would expect the fund to come in right around the same expense ratio as UTF at 2.19% or higher. I would expect it to be higher because UTF has most of its leverage in fixed-rate financing.

MEGI, on the other hand, does not have this hedged. Their financing is Overnight Bank Funding Rate plus 0.75%. The fund will be feeling the full force of higher interest expenses on their leverage.

Performance – Discount Widening

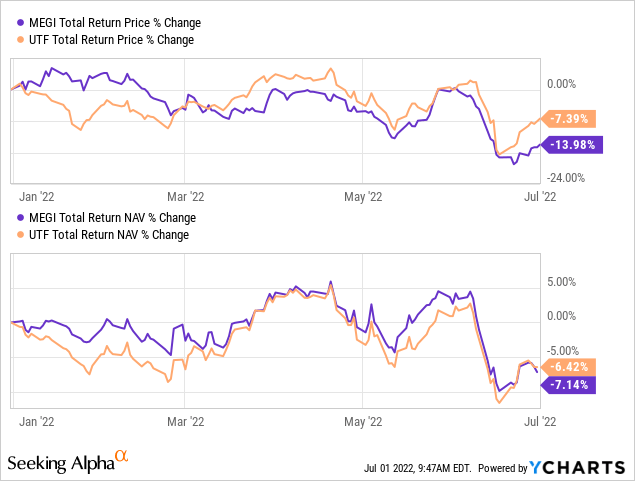

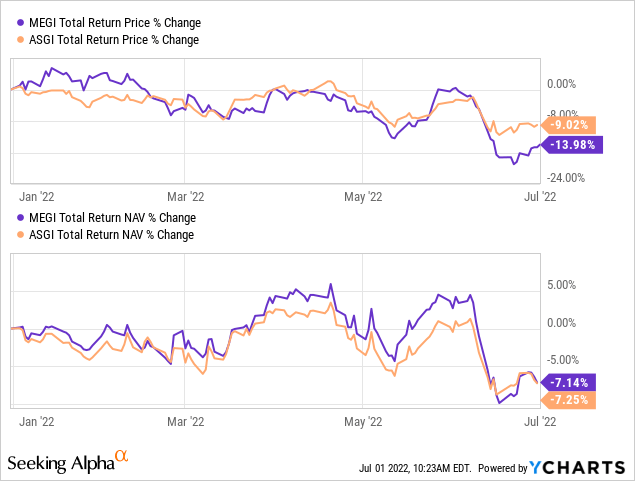

When we first touched on the fund, we saw around a 10% discount. This has since opened up as the fund’s share price underperformed the NAV per-share price. Here’s a look at the YTD total return results. I’ve also thrown in UTF to give us some better context on how MEGI is performing.

Ycharts

As we can see, the fund’s total share price has declined by around 14%. The total NAV return has been significantly less than that. Thus, resulted in the expanding discount we are seeing now.

Both MEGI and UTF are holding up significantly better than the broader markets. This would be thanks to the funds’ energy and utility/infrastructure exposure. Energy is still positive for the year, despite slipping into a bear market along with the rest of the market. Utilities are negative for the year, but holding up materially better.

This could be presenting an opportunity. We are much closer to the widest discount than we are to the premium that the fund touched very briefly. Additionally, for some investors, MEGI is still too new of a fund to consider now.

Ycharts

While the fund is performing similar results as its peer UTF, it has lagged just slightly. That makes it more difficult to consider an unproven fund over something as steady as UTF that we have years of a track record. The biggest argument to choose MEGI would be that the fund’s nearly 14% discount relative to UTF’s only around 1% discount. It means going forward, MEGI has a much better chance of outperforming. That is, even if the fund’s underlying portfolio continues to perform slightly better.

Distribution – Attractive Yield

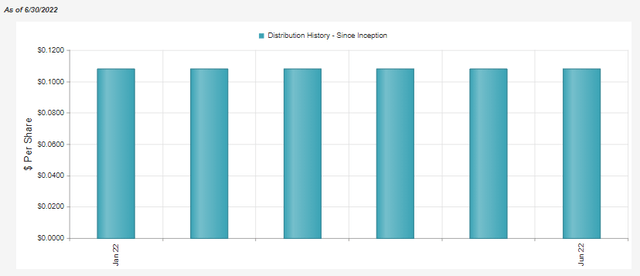

The fund has continued the same monthly distribution that it started with, which is $0.1083 per month. That works out to an attractive 8.18% distribution yield. On a NAV basis, it comes out to a reasonable 6.99%.

MEGI Distribution History (CEFConnect)

Given the decline in the NAV, we wouldn’t say that this distribution is being covered. They will likely require significant capital gains for the year to cover the distributions. With capital gains becoming sparse in this market downturn, this will be something to watch.

On the other hand, I don’t suspect we would see them cut the distribution at this point. I believe because the underlying portfolio is still holding up relatively well, they can keep the current distribution in place for the time being.

Should we start seeing the utility space drop more rapidly through the remainder of the year, I’d be a bit more apprehensive about the sustainability.

MEGI’s Portfolio

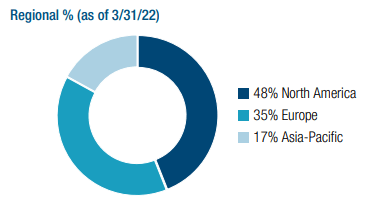

One thing that catches my attention in the fund’s portfolio is the sizeable portion outside of the U.S.

MEGI Geographic Exposure (MainStay)

Even UTF still has around 58% in the U.S. and another 13% in Canada. Global funds have a tendency to still put a large emphasis on holding U.S. positions. Of course, being the biggest stock market in the world and housing a majority of the most internationally recognized corporate names means this makes a lot of sense. It’s sometimes easy to invest just in the U.S. and call it a day. Especially considering that the U.S. market has been dominating in terms of performance for quite a while now.

It’s important to try to avoid this home country and recency bias. There are periods when international markets can outperform. That’s why it is important to continue to try to diversify, at least in my opinion.

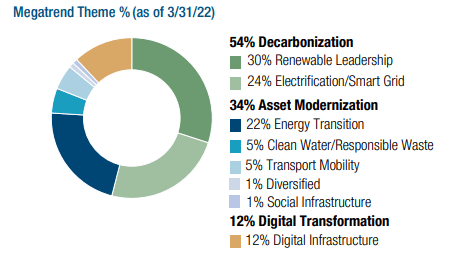

Another attractive characteristic of MEGI’s portfolio is that they are fairly diversified within infrastructure, too. While they are geared towards the decarbonization, asset modernization and digital transformations that make up the “megatrends,” they don’t focus specifically on one area of this space.

MEGI Investment Themes (MainStay)

In another similarity to UTF, the fund is also invested primarily in equity investments but carries a meaningful 14.8% in preferred and corporate bonds. That flexibility of potentially investing up to 20% in the fixed income space can add a bit of diversification for the fund. They aren’t locked into a certain investment style if they feel a more conservative weighting is appropriate.

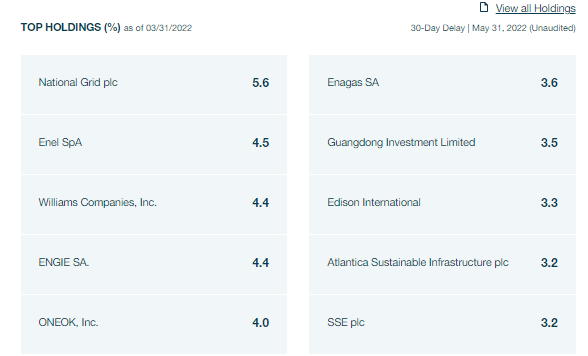

When looking at the fund’s top ten, we can see a clear tilt that is representative of investing outside the U.S. Which is great to see for a global fund, six of the ten are based outside the U.S.

MEGI Top Ten (MainStay)

National Grid (NGG) is a multi-utility company out of the U.K. Enel SpA (OTCPK:ENLAY) is an Italian electric utility company. ENGIE SA (OTCPK:ENGIY) is a French multi-utility company. Enagas SA (OTCPK:ENGGF) is a Spanish gas utility. Guangdong Investment Limited (OTCPK:GGDVF) is based out of Hong Kong and is a water utility. Atlantica Sustainable Infrastructure is another U.K. company, a renewable electricity utility. Finally, we have SSE (OTCPK:SSEZF), a U.K. electric utility.

Besides NGG, these other names trade OTC and have lower volumes. That can present additional risks when a stock trades OTC. That being said, they are certainly names that I wouldn’t probably consider investing in directly. That doesn’t make them bad investments, but that’s where a fund such as MEGI can come in-allowing the managers to invest my global allocation for me.

Conclusion

MEGI is still a newer fund, but the widening discount is certainly becoming quite appealing. The mixture of the portfolio due to the thematic focus of the fund brings up some interesting positioning. If one is looking for a more global tilt, MEGI offers that with most of the portfolio held outside the U.S. On the other hand, we have such a limited track record that it can be difficult to take a plunge into this name. For now, it’ll continue to be a position I’ll watch but not put capital to work in.

Aberdeen Standard Global Infrastructure Income Fund (ASGI) is another similar fund, with a larger focus outside the U.S. as well.

Ycharts

That is one fund where I’ve put capital to work this year. It offers a similar discount at this time. I believe these two could potentially be a great swap pair if the discount opens up more meaningfully in the future.

Be the first to comment