JHVEPhoto

Products

Medtronic (NYSE:MDT) registered in Ireland, has 25% dividend tax, became public in 1978. Company works in several segments: Cardiovascular, Neuroscience, medical surgery, Diabetes. Demand for the company’s products continues to grow as the world’s population ages and grows. When we look at medical technology, Medtronic is in a unique position, especially in these volatile times, given its diversified business with a market-leading position in growth markets, robust product portfolio, solid free cash flow, strong balance sheet and a decent dividend.

Medtronic invests in long-term development. In May the company acquired “Intersect ENT”, a global leader in medical technology for the ear, nose, and throat. This acquisition expands Medtronic’s product portfolio.

The total consideration for the transaction was $1.2b. On May 25, 2022, Medtronic and DaVita entered into a definitive agreement with the intention to create a new independent, equally owned kidney medical device company (“NewCo”). The deal is expected to close in calendar year 2023, subject to regulatory approval.

Procedure volumes in most markets had reached pre-pandemic levels by the end of the quarter. One of the largest companies, Surgical Innovations, was negatively impacted by raw material shortages in the quarter. This led to a large backlog of orders and to “medical surgery” revenue being well below expectations.

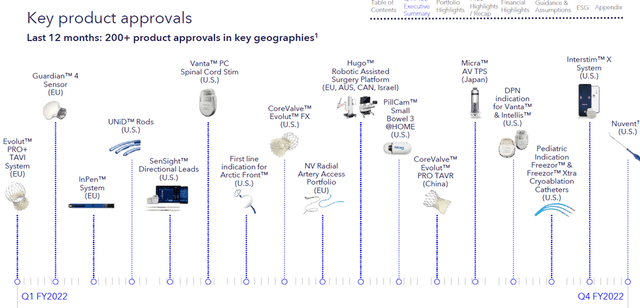

Product backlog (The corporate presentation)

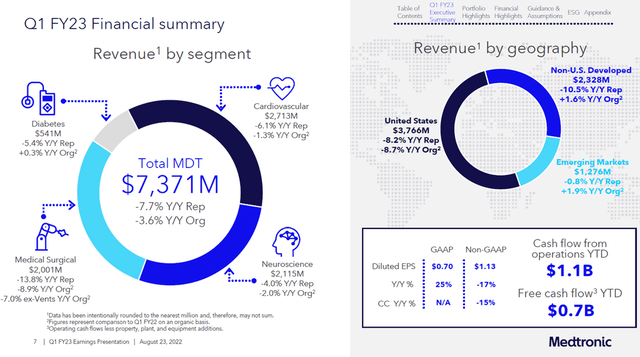

Q1 FY23 results

Medtronic has published its quarterly results – slightly better than analysts’ expectations. Organic revenue growth was higher than expected by 1.4% and EPS by 0.6%. Part of the decrease in revenue for the reporting quarter is the result of changes in foreign currency exchange rates. And the remaining difference, and the biggest factor, is due to problems in the supply chain. This primarily concerns technical resins and packaging. Although the company has already been affected by inflation of transportation costs, it should be noted that the full impact of inflation of raw materials and direct labor costs will weigh on earnings in the next few quarters, when the old inventories will disappear from the balance sheet. However, one must realize that this effect is temporary and could be largely reversed by the end of the year. Overall, management commented positively on supply chain normalization and maintained its full-year forecast for organic revenue growth of 4-5% YoY, but raised the forecast for the negative effect of a stronger dollar to 1.2% of full-year revenue.

Revenue by segment: Cardiovascular – 2.71 b$ (-6.1% yoy, 36% of revenue), Neuroscience – 2.11 b$ (-4% yoy, 27% of revenue), medical surgery – 2.01 b$ (-13.8% yoy, 27% of revenue), Diabetes – 0.55 b$ (-5.4% yoy, 7% of revenue). Considering recent acquisitions, the JV with DaVita will get up to $400m and expect the deal to close in calendar year 2023.

Medtronic needs to repay about $3.8b in 2023, the biggest repayment for the next 10 years. They will probably repay it partly in cash, partly refinancing.

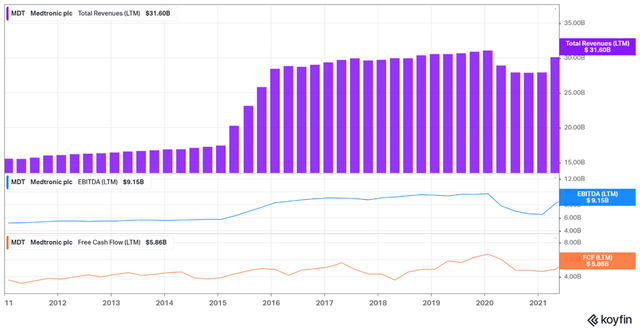

The company financial data (Koyfin)

Q1 23 company financial information (The corporate presentation)

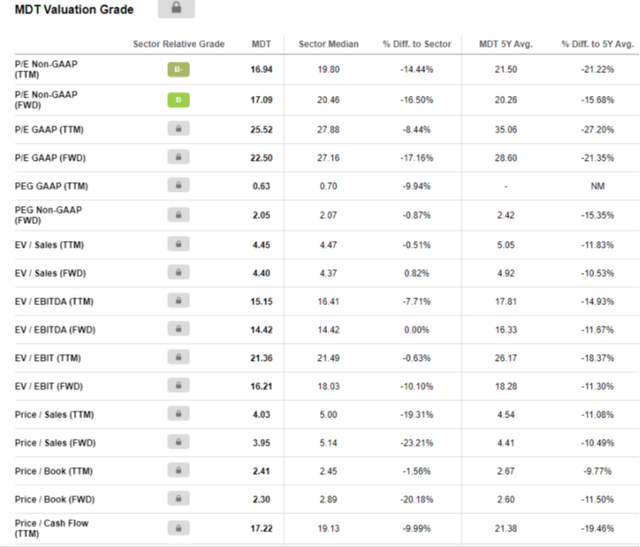

Valuation

On multiples worth 15-20% cheaper than industry average, on historical at 2015-2018 levels, 3-year revenue GAGR of 1% and expect 4-5% this year. Dividend yield of 3% p.a., with a normal payout ratio of 65%. The company has made great strides in organic product development in FY2022, with over 300 clinical trials and over 200 regulatory approvals in the US, Europe, Japan and China.

The company financial data (The corporate presentation)

Main takeaway

In some areas, the company’s position is unshakable, such as seeing strong adoption of an artificial intelligence-enabled surgical planning platform. The company is an S&P dividend aristocrat, having increased its dividend for 45 years. Quotes have fallen 34% from their 2021 peaks and are now trading at 2016-2019 levels. Most of the current problems are temporary and should be resolved within the next two to three quarters, with a very solid pipeline of new developments in the works, which will also start hitting the market later in the year. Accordingly, prices could remain under pressure for a few more quarters, but it is possible that at current levels the market will begin to price in the future improvement in the supply situation. Now is a good time to buy shares, revenue growth will undoubtedly return to the upside.

Be the first to comment