monsitj/iStock via Getty Images

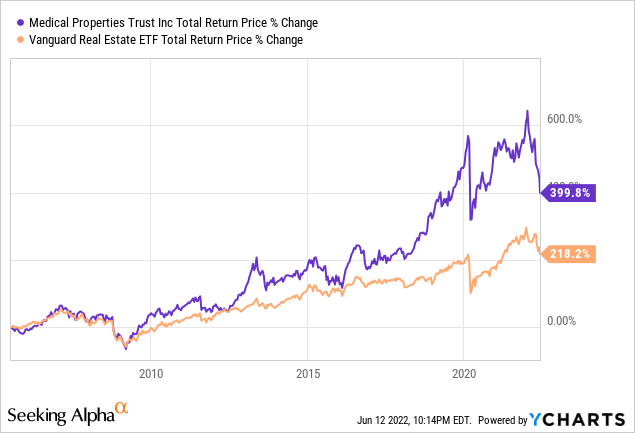

Medical Properties Trust (NYSE:MPW) has a long and illustrious track record of generating outstanding total returns and dividend growth for shareholders. Despite the recent dramatic sell-off, MPW has still crushed the broader REIT sector (VNQ) since going public nearly two decades ago:

A big reason for MPW’s success has been its ability to establish itself as the dominant player in the hospital sector, a highly fragmented sector with limited liquidity for hospital owners. As a result, MPW has benefited from economies of scale and cost of capital advantages while facing limited competition for deals. Furthermore, its experience and global scale give it a knowledge edge in its industry, enabling it to make smarter investments, including in the equity of some of its tenants which have yielded it significant profits.

As a result of these advantages, MPW is able to acquire properties at higher cap rates, at longer lengths, with high occupancy rates and higher NOI margins, with lower CapEx, and greater probabilities of lease renewals than is typically found in many other triple net lease property sectors. On top of that, hospitals tend to be very recession resistant, so MPW is well positioned to weather various economic cycles.

In this article, we will discuss two reasons why MPW is a Strong Buy on the latest pullback.

#1. Medical Properties Trust Is Well-Positioned To Handle Inflation

First and foremost, it is understandable why net lease REITs would decline in a high inflation environment. The general view is that net lease REITs are long-term bond proxy businesses with lengthy terms and small rent escalations. Therefore rising inflation (and corresponding interest rate hikes) make the risk-adjusted value of these leases less valuable. Furthermore, the rising costs to tenants from inflationary pressures may make the leases less safe, especially if we end up heading into a recession.

While these are valid assertions in general, MPW is in many ways an exception to this rule. First and foremost its defensive assets and triple net leases make MPW a strong candidate for weathering a recession like it appears we are increasingly likely headed for. In addition, however, MPW is also remarkably well positioned to weather inflationary headwinds.

For example, its low operating costs and sky high current yield of 7.3% combined with expected mid single digit annualized dividend per share growth rate make it an excellent income investment in an inflationary environment. While it should not see costs rise much, it is likely going to be generating total returns (yield plus growth) well in excess of the inflation rate for the foreseeable future.

On top of that, MPW has leases that include CPI adjustments. In fact, in an environment where the CPI rises by 5%, MPW expects its rent growth to come in at 4.3%, barely lagging the inflation rate. It is also important to note that this 4.3% rent growth rate is on assets and – given that MPW has a leverage ratio of ~40%, the protection against inflation is even greater.

On top of that, management reiterated in its recent earnings call that it believes its tenants are well-positioned to weather inflation as well, stating the following:

An important historical note to recognize, on a cumulative basis, Medicare reimbursements to hospitals have always exceeded inflation… we do not expect inflation to hit only the cost side of the income statement. It will also hit the revenue side…the very long-term history of CMS and other hospital reimbursements staying at least even and frankly over time ahead of inflationary pressures. So we expect even in a relatively steep inflationary environment that we think we’re in now that the revenue — first of all the revenue will keep up with increases. Secondly, hospital operators especially going back if you want to go back to the financial crisis and then again more so with the COVID impact, hospital operators had demonstrated a very strong ability to manage their cost labor and otherwise to maintain their margins.

#2. MPW Stock Is Incredibly Cheap

Last, but not least, MPW stock looks incredibly cheap right now. Its current dividend yield has surged to a mouthwatering 7.3% compared to its five-year average of 6.08%, its price to FFO multiple has fallen to 8.74x compared to its five-year average of 11.35x, its price to AFFO multiple has fallen to 11.08x compared to its five-year average of 13.92x, and its EV to EBITDA multiple has fallen to 13.59x compared to its five-year average of 14.35x.

Meanwhile, growth is expected to be quite strong over the next half decade, with EBITDA set to rise at an 11.1% CAGR, dividends per share forecast to grow at a respectable 4.1% CAGR, FFO per share predicted to increase at a 3.8% CAGR, and AFFO per share estimated to compound at a 3.1% CAGR over that span. We also believe that these growth rates will only accelerate moving forward as high inflation and rising interest rates will combine to boost the same-store NOI due to CPI-linked rent adjustments on MPW’s leases and the expectation that cap rates on new acquisitions will rise in the near future due to rising interest rates.

For a company with the track record, defensiveness, and current yield of MPW, these growth rates are quite solid, making the overall value proposition here very attractive and warranting a Strong Buy rating in our view.

Investor Takeaway

MPW is a defensive, inflation resistant, high yield business that is also growing at a solid clip, with inflation likely to boost growth even more. On top of that, its track record as a wealth compounder is very strong and the valuation is clearly below recent historical averages. As a result, we believe it is an excellent time to buy shares and we may very well do so in the coming days depending on market conditions.

Be the first to comment