Funtap

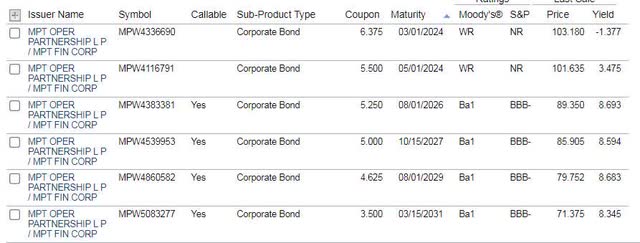

Medical Properties Trust (NYSE:MPW) is a healthcare REIT that specializes in the ownership of acute care hospitals and other healthcare-related facilities around the world. Recently, shares of the company have sold off creating a 9% dividend yield. Comparatively, the company’s debt has also sold off, creating comparative yields in bonds maturing in 2026 and beyond. In fact, the current return on Medical Properties 2026 maturing bonds is nearly 180 basis points higher than the BB corporate yield index. I believe Medical Properties Trust debt may be the better choice for fixed income investors.

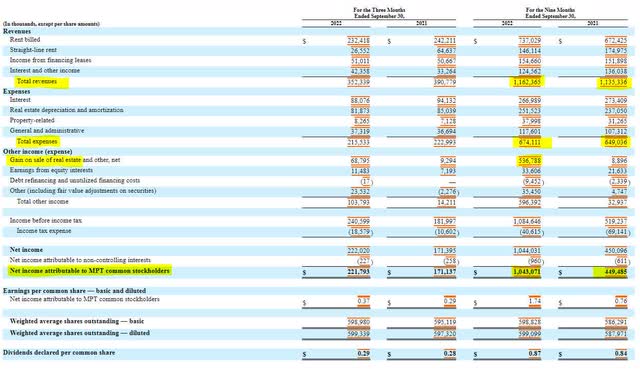

Medical Properties operating results have been steady year over year despite the macroeconomic headwinds. Year-to-date expense increases were offset by year-to-date revenue increases and if we strip out the gain on asset sales, the company’s net income is still approximately $60 million or more than 10% higher than a year ago. While comparable quarter revenues are down, they are offset by other income, which I anticipate will continue to be the case in future quarters (explained later).

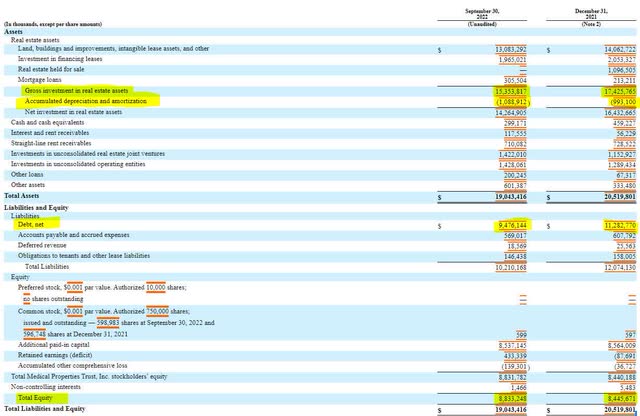

Medical Properties has managed its capital structure very responsibly in 2022. The company has sold assets, reduced its debt comparable to asset sales, and managed to grow shareholder equity by nearly $400 million year to date. It’s important to note that the company’s investments in joint ventures and other operating entities (noted on the balance sheet) have increased and now represent a growing segment of the business.

As for cash flow generation, an important metric to both dividend payments and debt reduction, Medical Properties has managed to maintain its operating cash flow generation year over year. Capital additions are down, likely due to the reduction in assets and/or increase in construction progress. Overall, Medical Properties has generated $310 million in free cash this year after construction and capital additions. While this is a good indicator for bond holders, it is not so much for shareholders.

The company is currently paying approximately $200 million more in dividends than it is generating (over a 9-month period). While asset sales have buoyed Medical Properties ability to fund both its dividend and debt reduction, the company cannot sell assets in perpetuity. Eventually, something’s got to give, and I believe it will be a reduction in the dividend to further preserve cash for debt reduction.

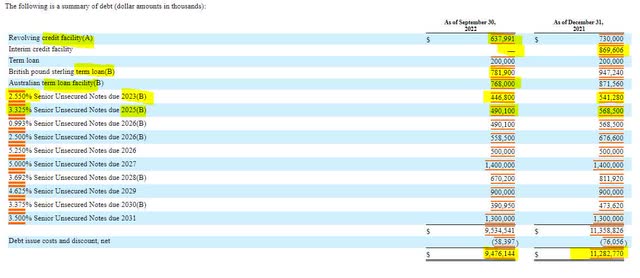

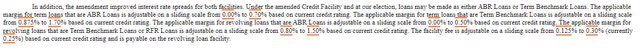

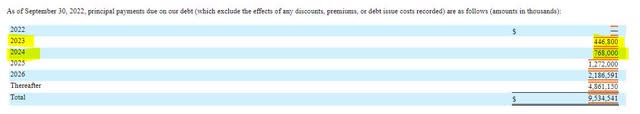

As for the company’s debt composition, Medical Properties has nearly $2.4 billion in credit facility and term loan debt. These loans seem to be at relatively modest interest rates as the quarterly filing’s notes indicate small variables to the base borrowing percentage. The company has a couple of upcoming note maturities in 2023 and 2025 that are modest, however, should Medical Properties use refinancing to pay down that $1 billion in debt, they would be looking at borrowing costs easily in excess of 250 basis points higher. By reducing the dividend, the company could generate the cash necessary to push off its debt maturity wall to the year 2026.

SEC Q3 2022 10-Q SEC Q3 2022 10-Q SEC Q3 2022 10-Q

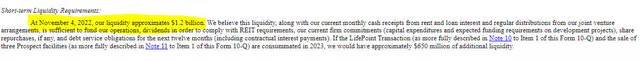

Medical Properties Trust did note in its third quarter earnings that the company has approximately $1.2 billion in liquidity, which would consist of a combination of cash on hand, short term investments, and borrowing capacity on lines of credit. Should its refinancing situation become more difficult, the company could lean into its liquidity to mitigate the burden of refinancing in this interest rate environment.

On a final note, some of what is being termed “asset sales” by Medical Properties are partnership agreements. For example, the significant gain on the sale of assets of $600 million this year was generated from the establishment of a partnership that Medical Properties still retains 50% ownership over. Partial ownership allows for Medical Properties to still receive income from its investment, thus noted in the income statement under “other income.” While this diversification of corporate ownership may lead to more complication, it provides an opportunity for the organization to raise fresh capital.

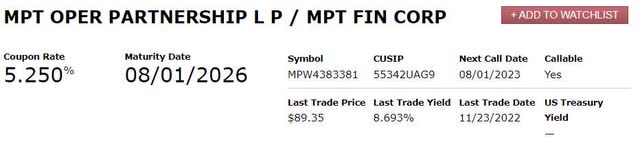

With Medical Properties Trust dividend becoming less sustainable, investors should consider the company’s 2026 notes (or longer duration debt if they prefer). The notes provide similar returns to the current dividend yield with decent income streams (via coupon payments) and the safety of only being compromised in the event of a default.

CUSIP: 55342UAG9

Price: $89.35

Coupon: 5.25%

Yield to Maturity: 8.693%

Maturity Date: 8/1/2026

Credit Rating (Moody’s/S&P): Ba1/BBB-

Be the first to comment