Morsa Images/DigitalVision via Getty Images

There is currently an opportunity presenting itself to investors that want to invest in a high-quality U.S.-based healthcare REIT named Medical Properties Trust, Inc. (NYSE:MPW). The trust has a growing real estate portfolio, primarily of hospitals in the United States, and profits from growing funds from operations.

The trust has an appealing funds from operations multiple, and the stock pays a 5.6% yield that is well-covered. The recent stock price decline makes the real estate investment trust an appealing investment for income investors.

International Portfolio Of Hospitals

Medical Properties Trust invests in hospitals, primarily in the United States, but also in countries other than the United States. At the end of the previous fiscal year, the trust’s real estate portfolio was valued at $22.3 billion.

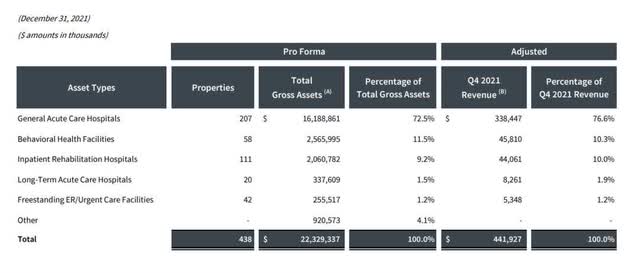

The investment portfolio includes 438 properties, which include general acute care hospitals, behavioral health facilities, inpatient rehabilitation hospitals, and long-term acute care hospitals. The trust profits from the large healthcare market in the United States by concentrating its efforts on that market, which accounts for roughly 60% of total revenue.

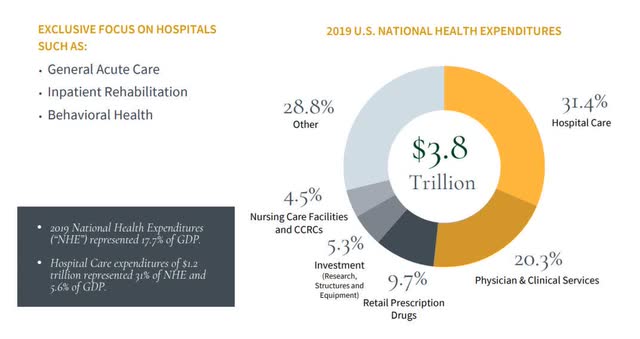

The United States healthcare market is truly massive, with 2019 health expenditures totaling $3.8 trillion. About 31% of that spending goes to hospital care, which is Medical Properties Trust’s primary market.

Portfolio Summary (Medical Properties Trust)

The largest property class in Medical Office Trust’s portfolio, general acute care hospitals, accounted for 77% of the trust’s revenues in the fourth quarter. In terms of assets, they account for roughly 73% of the trust’s real estate asset base. Behavioral health facilities are the second-largest property class, accounting for 12% of trust (gross) assets and 10% of revenues.

Asset Types (Medical Properties Trust)

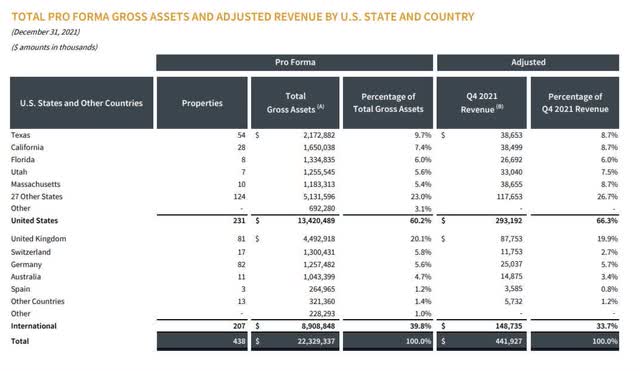

As a hospital provider, the trust leases its properties to operators not only in the United States but also in a variety of other countries, most notably in Europe. Within the United States, Medical Office Properties has significant real estate investments in Texas, California, and Florida, the company’s three largest markets.

Outside of the United States, Medical Office Properties has a strong presence in major European markets such as the United Kingdom, Germany, and Switzerland. Medical Properties Trust’s international presence broadens its diversification and reduces the trust’s reliance on the U.S. market for revenue and cash flow generation.

Assets By State And Country (Medical Properties Trust)

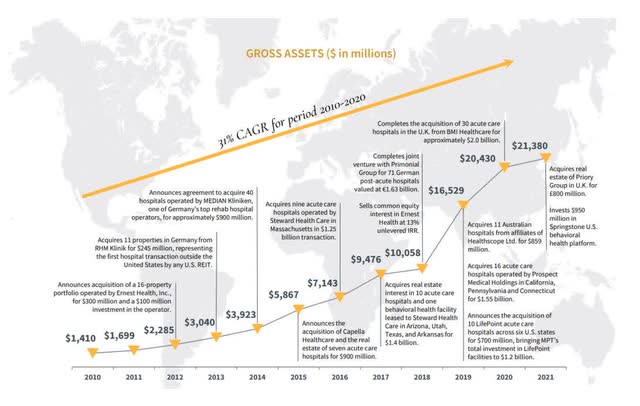

In the last two decades, the trust has aggressively expanded by purchasing new properties and making acquisitions. What began as a small hospital REIT has grown to a company with over $22 billion in assets.

Asset Acquisition Growth (Medical Properties Trust)

Inflation Protection

With inflation recently reaching 40-year highs and February inflation rates reaching 7.9%, investors are understandably concerned about what will happen to their incomes. Inflationary pressures are obviously a major concern for investors. During periods of rising inflation, everyone who receives a fixed income becomes less wealthy.

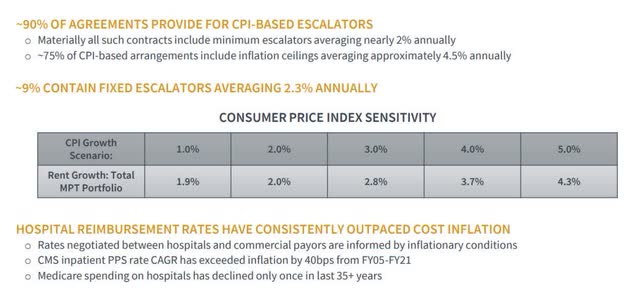

In times of rising consumer prices, the only way to protect oneself is to invest in companies with assets that promise rising income and cash flow. The majority of Medical Properties Trust’s rent agreements (90%) include CPI-based rent escalators with annual minimum increases of about 2%. These rent escalators provide inflation protection, which is a nice added bonus to any investment these days.

CPI-Based Escalators (Medical Properties Trust)

The dividend growth provided by the trust and its asset base also helps to protect investors from inflation, at least to some extent. Medical Properties Trust raises its dividend by $0.01 per share on an annual basis, providing not only predictable dividend growth but also additional protection against inflation on top of rent escalators. The trust’s dividends are funded by its vast and expanding real estate portfolio, which generates more than enough cash to cover the dividend.

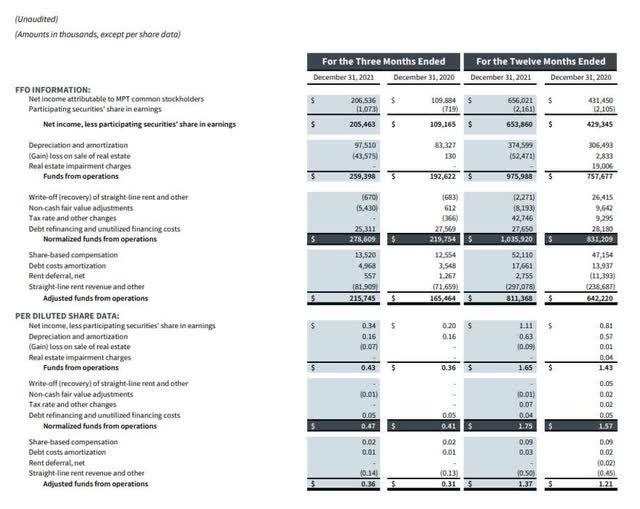

The dividend of Medical Properties Trust is well covered by funds from operations, implying that the dividend is safe and that the trust can afford to increase its payout. Medical Properties Trust earned $1.75 per share in (normalized) funds from operations last year, implying a pay-out ratio of 64%.

Funds From Operations (Medical Properties Trust)

FFO Multiple And Buying Opportunity

In 2022, Medical Properties Trust expects to generate $1.81 to $1.85 per share in (normalized) funds from operations. The forecast assumes a 5% YoY increase in funds from operations in the trust’s portfolio.

As of Friday, the trust’s share price was $20.67, implying a funds from operations multiple of 11.

Given the trust’s large hospital portfolio, high degree of diversification, and growing funds from operations, the multiple is very appealing. The stock yield is 5.6% based on the price of $20.67. Furthermore, in the last two months, the stock has begun to consolidate, allowing investors to purchase MPW at a much lower multiple than at the start of the year.

My Conclusion

The Medical Properties Trust consolidation in 2022 provides an opportunity to purchase the hospital real estate investment trust at a lower funds from operations multiple and a higher dividend yield.

Medical Properties Trust should be considered if investors value receiving high-quality dividend income on a regular basis for two reasons: international diversification and inflation protection. Based on funds from operations, Medical Properties Trust’s multiple is appealing.

Be the first to comment