Rocky89/E+ via Getty Images

A Quick Take On MeaTech 3D

MeaTech 3D (NASDAQ:MITC) went public in March 2021, raising $25 million in a U.S. IPO that priced at $10.30 per ADS.

The firm is developing meat alternatives for various end consumer markets.

Given the company’s regulatory uncertainties and long time horizon before getting to market in the best case scenario, my outlook on MITC’s stock is a Hold.

Company

Ness Ziona, Israel-based MeaTech was founded to develop a three-dimensional bioprinter capable of creating a meat substitute product, cultured meat, as an alternative to industrial slaughter sources.

Management is headed by CTO and CEO Sharon Fima, who has been with the firm since 2019 and was previously founder and CEO of Agama Extreme and has extensive experience in the printing and electronics industries.

The potential benefits of such technology include improving the environment, shortening food supply chain and reducing the potential for zoonotic diseases which are transferred from animals to humans.

The firm currently does not have customers as it is still in development stage for its technologies.

Management intends to pursue an out-licensing approach to monetizing its technology as well as provide ‘associated products, such as cell lines, printheads, bioreactors and incubators, and services, such as technology implementation, training, and engineering support, both directly and through contractors, to food processing and food retail companies.’

MeaTech’s Market & Competition

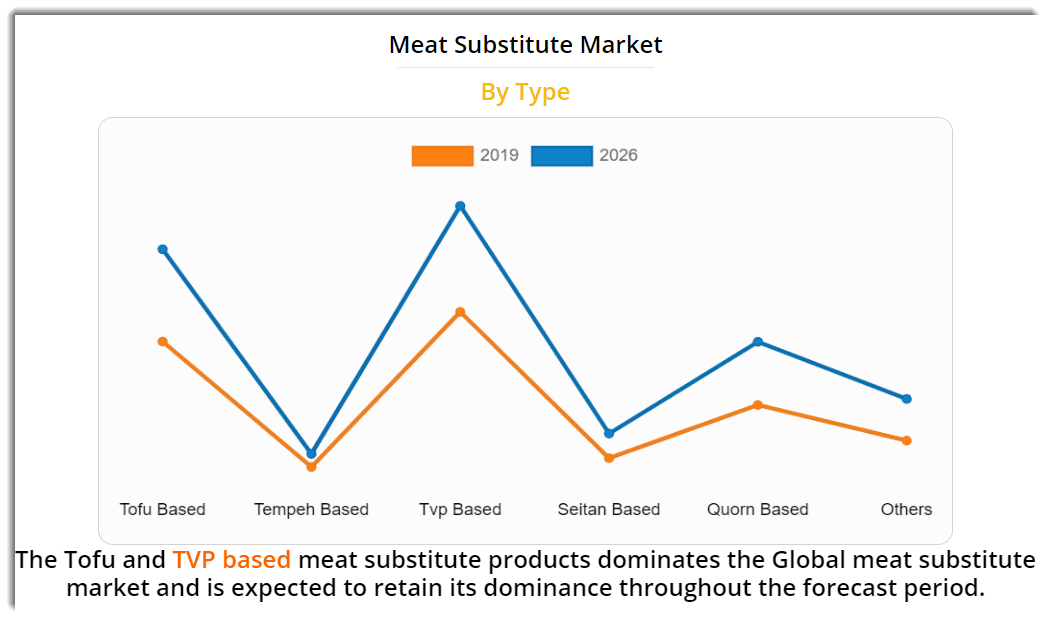

According to a 2019 market research report by Allied Market Research, the global market for meat substitutes is forecast to increase in value to $8.1 billion by 2026.

This represents a forecast CAGR of 7.8% from 2019 to 2026.

The main drivers for this expected growth are a growing awareness from consumers of meat alternatives as healthy alternatives, an interest in reduced environmental impact from animal husbandry and reduced potential for animal to human disease transmission.

Also, as the chart shows below, Tofu and TVP-based products are expected to continue their dominance of the meat substitute market through 2026:

Meat Substitute Market (Allied Market Research)

Major competitive or other industry participants include:

-

Beyond Meat (BYND)

-

Nestle (OTCPK:NSRGY)

-

Morning Star

-

Impossible Foods (IMPF)

-

Kellogg’s (K)

-

Cubiq Foods

-

Eat Just

-

FutureMeat

-

SuperMeat

-

Mosa Meat

-

Memphis Meats

-

Aleph Farms

MITC’s Recent Financial Performance

-

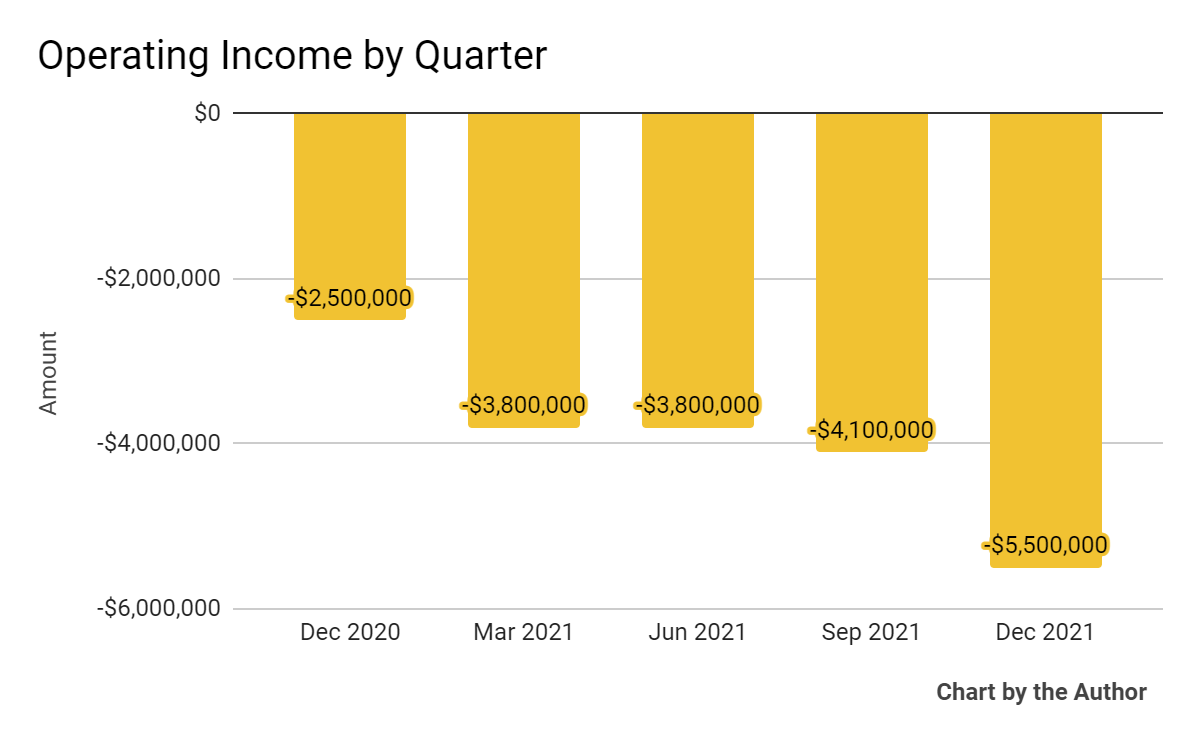

Operating losses by quarter have progressively increased over the past 5 quarters:

5-Quarter Operating Income (Seeking Alpha and The Author)

-

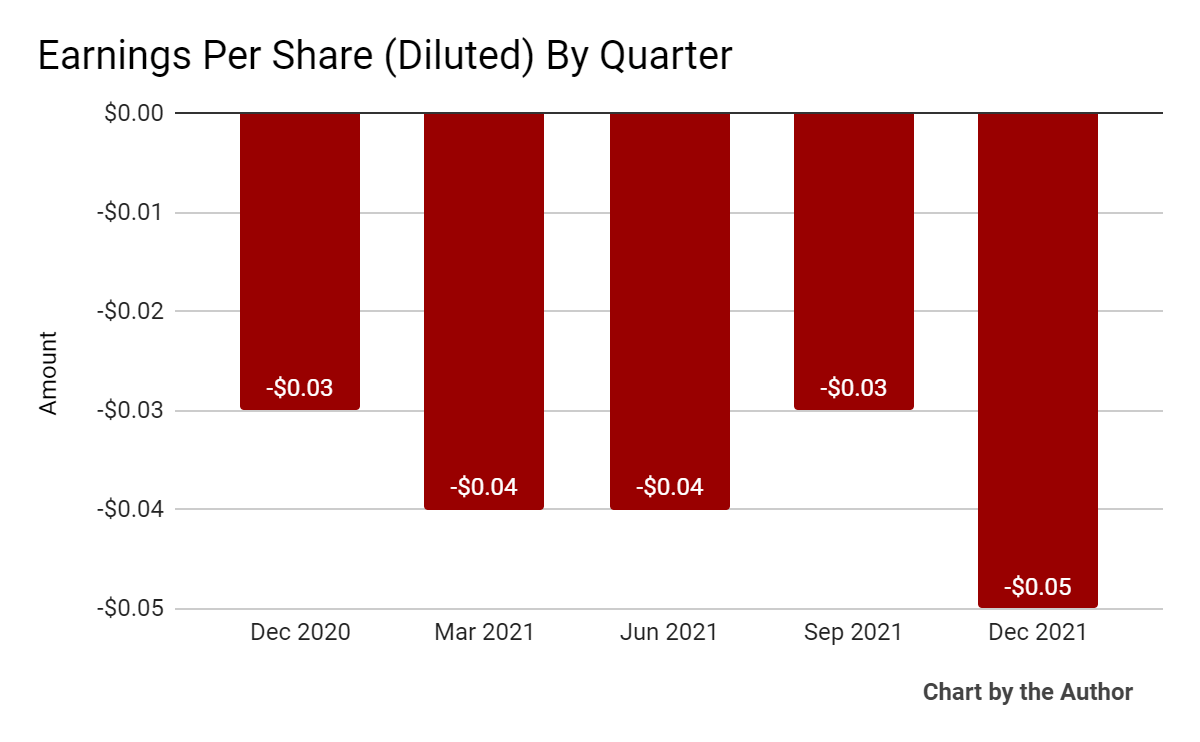

Loss per share (Diluted) has also generally worsened since the company’s IPO:

5-Quarter Earnings Per Share (Seeking Alpha and The Author)

(Source data for above GAAP financial charts)

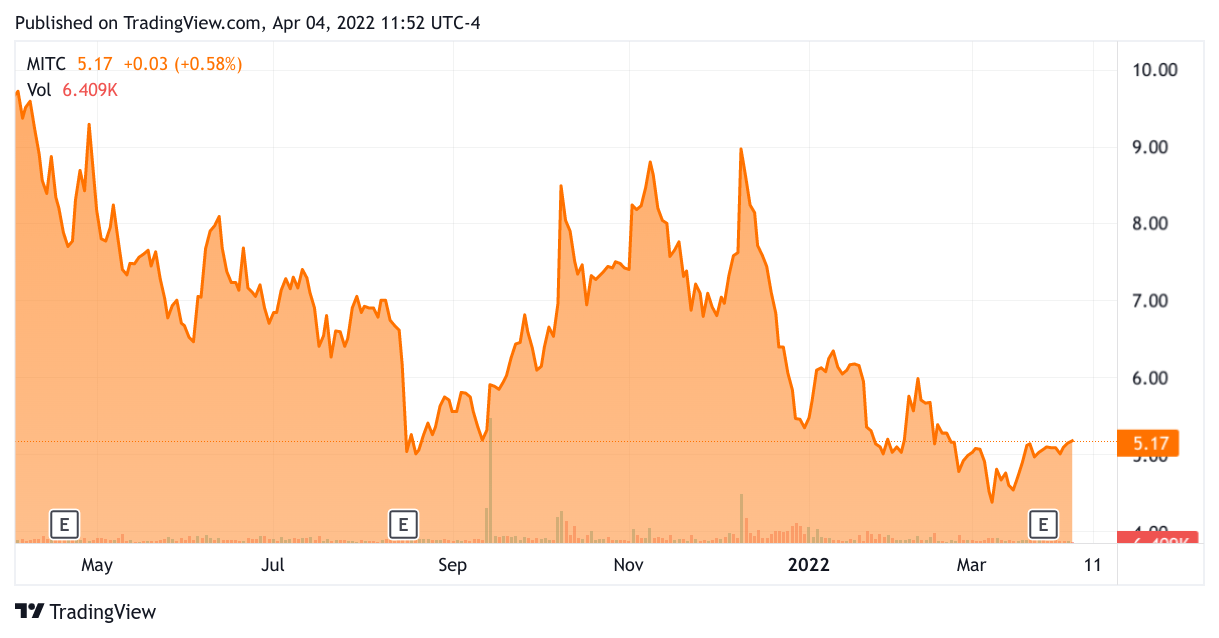

In the past 12 months, MITC’s stock price has fallen 46.4 percent vs. the U.S. S&P 500 index’ rise of 12.1 percent, as the chart below indicates:

52-Week Stock Price (Seeking Alpha)

Valuation Metrics For MITC

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Market Capitalization |

$75,920,000 |

|

Enterprise Value |

$57,000,000 |

|

Enterprise Value / EBITDA |

-3.29 |

|

Free Cash Flow [TTM] |

-$9,660,000 |

|

Earnings Per Share |

-$0.16 |

(Source)

Commentary On MeaTech 3D

In its last earnings call, covering Q4 2021’s results, management highlighted its partnership with Blue Sound Waves Collective, a group backed by noted startup investors Guy Oseary and Ashton Kutcher.

With the relationship, MITC seeks to leverage Blue Sound Waves’ ‘marketing, strategic expertise and broad networks, especially in the U.S.’

Additionally, the company expanded its cultured meat development to include cultured poultry and cultured pork product development through its acquisition of Peace of Meat in February 2021.

In December 2021, the firm announced the successful 3D printing of a 100 gram steak, which it claims was the largest cultured steak grown to date.

As to its financial results, the company remains in pre-revenue stage, with higher operating losses as a result of its continued R&D efforts.

Looking ahead, management intends to push for regulatory approvals in 2022 while signing collaboration agreements with producers and retailers that will lay the groundwork for selling its products to the general public.

However, management did not provide a time frame for doing so, but did say it expects U.S. regulatory approval in ‘about two years in the United States,’ with the EU perhaps taking longer.

The primary risk to the company’s outlook is delays to its regulatory approval process which would necessarily delay its go-to-market activities.

For a company that is still so far away from any revenue, the stock is ultra-high-risk.

Given the regulatory uncertainties and long time horizon before getting to market, my outlook on MITC’s stock is Hold.

Be the first to comment