G0d4ather/iStock via Getty Images

Thesis

Madison Covered Call & Equity Strategy Fund (NYSE:MCN) is a closed end fund focused on a buy-write equities strategy. The fund is fairly compact with only 35 holdings but has a robust three-year total return which currently sits at 58.09%. The fund has a high level of current income as a primary objective and its portfolio is actively managed, thus layering in the management’s team alpha generating capabilities. The fund writes call options on a very large portion of the portfolio (currently 84.8% of the assets) and the average maturity of the options now sits at 38.3 days. Unlike other funds, MCN writes call options on the individual stocks it holds rather than an index. We like this strategy better since it eliminates any type of basis risk between the fund’s holdings and the index. As per its annual report from 2021 the call options were 4.4% out-of-the-money at year end.

As per the fund’s literature “Covered Call strategies, by their nature, are defensive. They are structured to knowingly sacrifice a portion of upside growth potential in order to provide additional downside protection. The Fund pursues these strategies by owning a very high quality portfolio of individual equities and selling equity call options on the portfolio holdings. The Fund provides a total return platform which seeks capital appreciation and a high distribution rate which is primarily sourced from selling call options and realizing capital gains on the underlying portfolio.“

The fund is flat on a year-to-date basis given its high written call coverage which provides a buffer when stocks decline but volatility is high. MCN has historically traded at a very substantial discount to NAV but it’s currently a premium of 3% to the fund’s net asset value. With a robust 0.59 Sharpe ratio and a low standard deviation of 12.5 (both on a five-year timeframe) the fund displays good risk/reward metrics. We like this fund and its performance but the current premium to NAV is not a good entry point. If you’re a retail investor with MCN in your portfolio then we rate it a Hold, while new money looking to enter the fund would be best suited to wait.

Fund Analytics

AUM: $0.16 bil

Premium / Discount: +3%

1 Yr z-stat: -0.9

St Dev: 12.5

Leverage: 0%

Portfolio Call Options: 84.8%

Written Call Strategy: Individual Stocks

Yield: 9.27%

Holdings

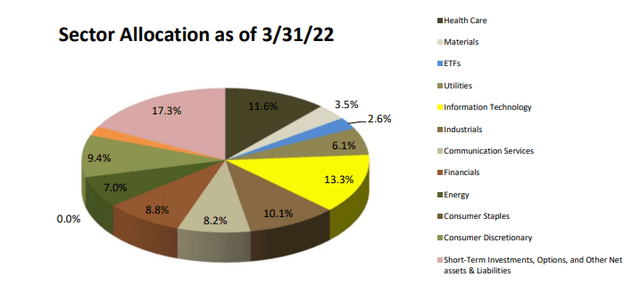

The fund has a balanced sectoral allocation with Information Technology and Healthcare as its top sectors:

Sector Allocation (Fund Fact Sheet)

The fund is not overly concentrated in any name, with the top-10 holdings accounting for only slightly over 33% of the fund:

Top-10 Holdings (Fund Fact Sheet)

As per Morningstar the fund’s portfolio turnover is 178%, which indicates very active trading of the underlying names, but is consistent with the fund’s mandate and strategy statements.

As per the fund’s literature, the selection process for the underlying stocks is very rigorous with the following approach in mind:

“The manager’s bottom-up stock selection process is geared toward investing in companies with very strong fundamentals including market leadership, balance sheet strength, attractive growth prospects, sustainable competitive advantages, predictable cash flows, and high-quality management teams. Purchasing such companies at attractive valuations is vital to providing an added margin of safety and the manager’s “growth-at-a-reasonable-price” (GARP) philosophy is specifically tuned to such valuation discipline.“

The fund’s performance as highlighted in the following section proves that the fund’s trading team has managed to generate significant alpha in the past three years through its stock-picking ability.

Performance

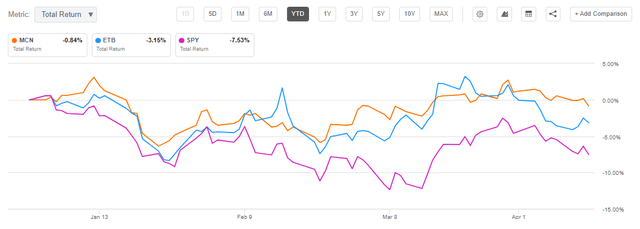

Due to its written call strategy that covers more than 80% of the portfolio, the fund is fairly flat on a year-to-date basis:

YTD Performance (Seeking Alpha)

An encompassing written call strategy generates robust yields when stocks decline and volatility is elevated (rich call premiums), thus buffering underlying stock declines. Basically the delta of the underlying portfolio is smaller on a net basis.

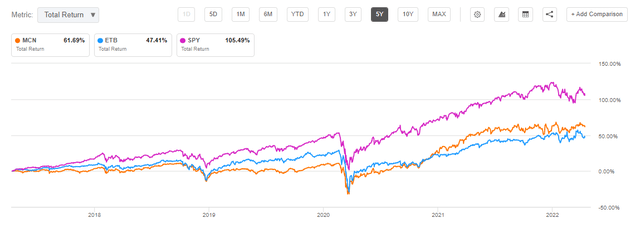

The fund has performed extremely robustly on a three-year time frame, matching the S&P 500 index and beating another very well regarded buy-write CEF, namely the Eaton Vance Tax-Managed Buy-Write Income Fund (ETB):

3-Year Performance (Seeking Alpha)

On a five-year basis MCN lags the index but still manages to outperform ETB:

5-Year Total Return (Seeking Alpha)

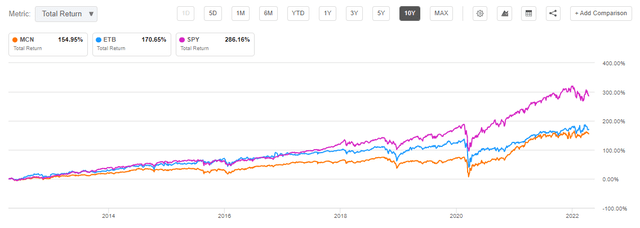

A 10-year performance chart highlights the fact that MCN has outperformed as of late, but on a decades long time-frame it has lagged both the index and ETB:

10-Year Performance (Seeking Alpha)

Its history indicates that the fund’s management team can outperform the competing buy-write funds and match an index performance but the trading’s team performance is not consistent.

Premium / Discount to NAV

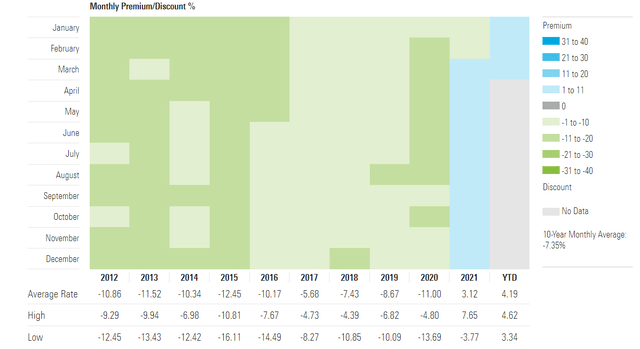

The fund has traded at a significant discount to NAV outside the time frame that started in 2021:

Premium / Discount to NAV (Morningstar)

We can see that historically the fund has traded at a -10% discount to NAV that reverted to a premium in 2021 on the back of a zero rates environment and investors looking for yield.

It’s puzzling that the fund is still trading at a premium to NAV in 2022, but we assign this occurrence to the fact that investors are trying to take advantage of the elevated volatility we have seen in 2022 via buy-write fund strategies.

Distributions

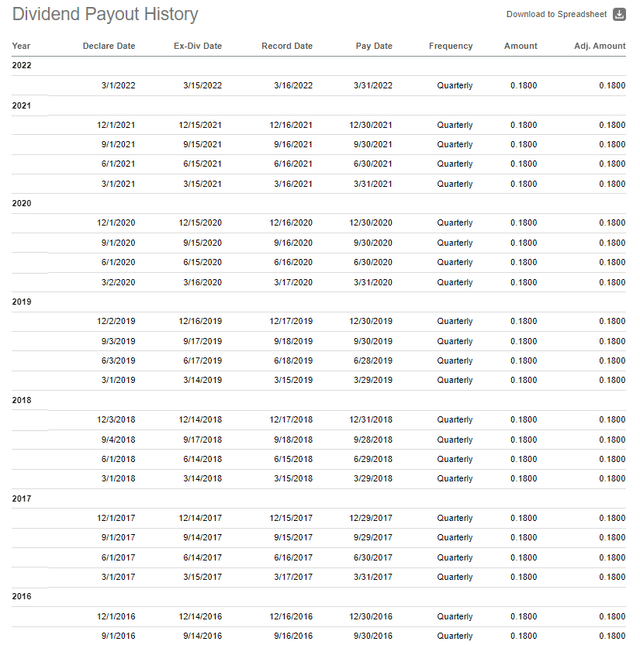

The fund has a very consistent distribution history, having disbursed $0.18 per quarter to investors since 2010:

Dividend History (Seeking Alpha)

As per the fund’s Annual Report the distribution policy is as follows:

“Distributions to Shareholders: The Fund declares and pays quarterly distributions to shareholders. Distributions to shareholders are recorded on the ex-dividend date. The amount and timing of distributions are determined in accordance with federal income tax regulations, which may differ from Generally Accepted Accounting Principles (“GAAP”). These distributions consist of investment company taxable income, which generally includes qualified dividend income, ordinary income and short-term capital gains, including premiums received on written options. Distributions may also include a return of capital. Any net realized long-term capital gains are distributed annually to shareholders. The character of the distributions are determined annually in accordance with federal income tax regulations.“

Conclusion

MCN is an equities buy-write CEF with a very compact portfolio that contains only 35 names. The management team has a very active trading approach to the underlying names and writes individual names covered calls for more than 80% of the underlying portfolio. The fund is flat on a year-to-date basis vs. declines for the S&P 500 due to the high volatility and rich option premiums it generates. The fund has matched the index on a three-year basis but lags on a longer time frame. With a robust 0.59 Sharpe ratio and a low standard deviation of 12.5 (both on a 5-year timeframe) the fund displays good risk/reward metrics. We like this fund and its performance but the current premium to NAV is not a good entry point. If you’re a retail investor with MCN in your portfolio then we rate it a Hold, while new money looking to enter the fund would be best suited to wait.

Be the first to comment