ensar zengin/iStock via Getty Images

McCormick & Company (NYSE:MKC) has a stellar track record for growing its sales and dividend payments. But, the company faces multiple short-term challenges, from lower volumes to increased inventory and margin pressure. Anybody looking to add McCormick to their portfolio should be patient.

Price increases bolster sales

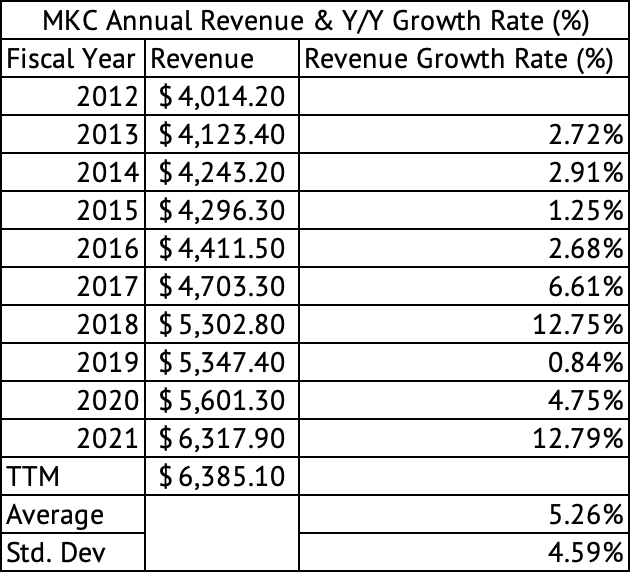

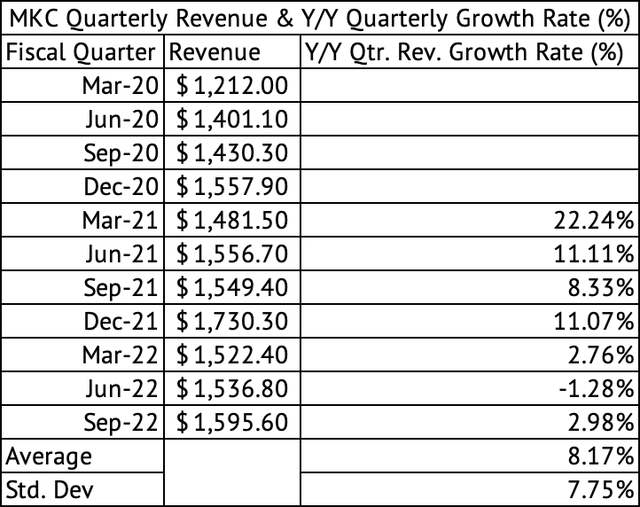

Over the past decade, the company has grown its revenue at an average rate of 5.2% with a standard deviation of 4.5% (Exhibit 1). In the last few quarters, the COVID lockdown increased demand for the company’s products, with y/y quarterly sales growing by an average of 8.1% (Exhibit 2). Still, the variability in sales increased along with it, with a standard deviation of 7.7%. The excess demand during the COVID pandemic has faded, with sales growth dropping below 3% in 2022.

Exhibit 1:

McCormick Annual Revenue and Y/Y Growth Rate (%) (Seeking Alpha, Author Compilation)

Exhibit 2:

McCormick Quarterly Revenue and Y/Y Quarterly Revenue Growth Rate (%) (Seeking Alpha, Author Compilation)

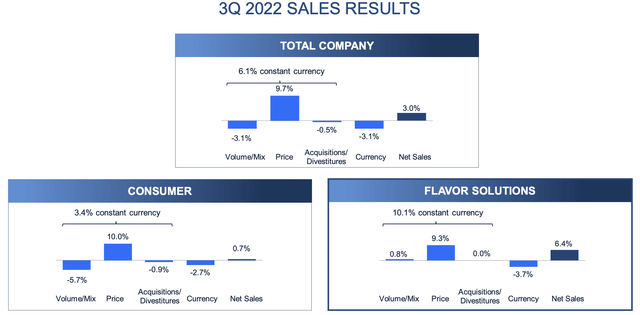

Price increases have helped the company keep pace with inflation. In Q3 2022, the company increased prices by 9.7% but saw volume decline by 3.1% (Exhibit 3), and in Q2 2022, prices increased by 6.8%, accompanied by a drop in volume of 6.6%.

Exhibit 3:

McCormick Q3 2022 Sales Results (McCormick & Co. Investor Presentation)

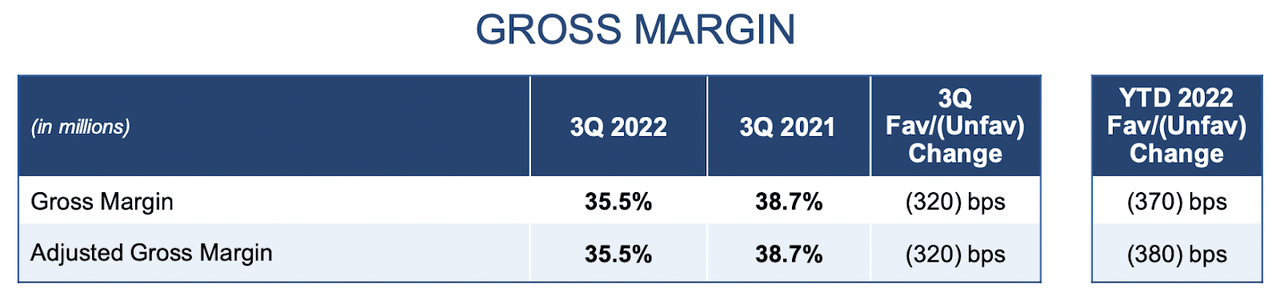

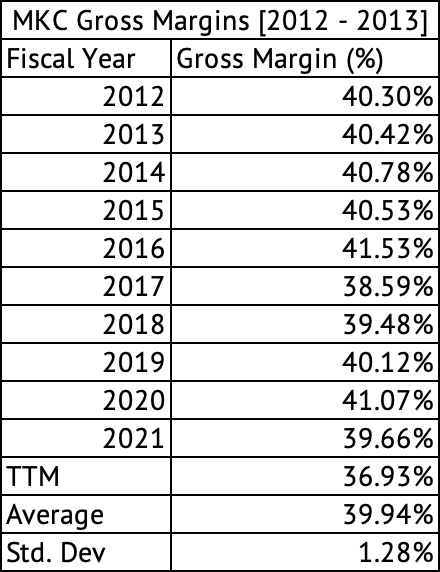

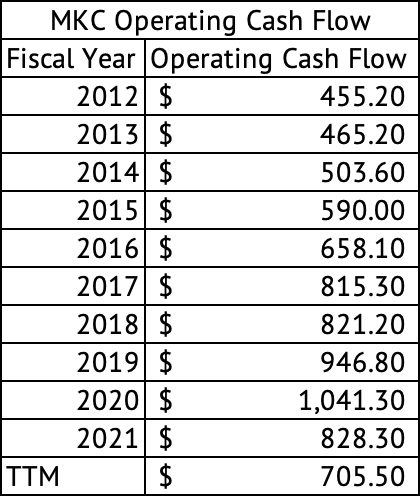

Gross margins take a hit

Cost pressures, a strong dollar, and supply disruptions are wreaking havoc on margins. In Q3 2022, the company saw gross margins dip to 35.5% (Exhibit 4), its lowest level in the past decade, and a 320 basis points decrease from Q3 2021. For the fiscal year 2022, the company saw its gross margins drop by 370 basis points compared to the previous year. Since 2012 the company’s gross margins have averaged 39.9% (Exhibit 5).

Exhibit 4:

McCormick Q3 2022 Gross Margin (McCormick Investor Presentation)

Exhibit 5:

McCormick & Co. Annual Gross Margin (%) (Seeking Alpha, Author Compilation)

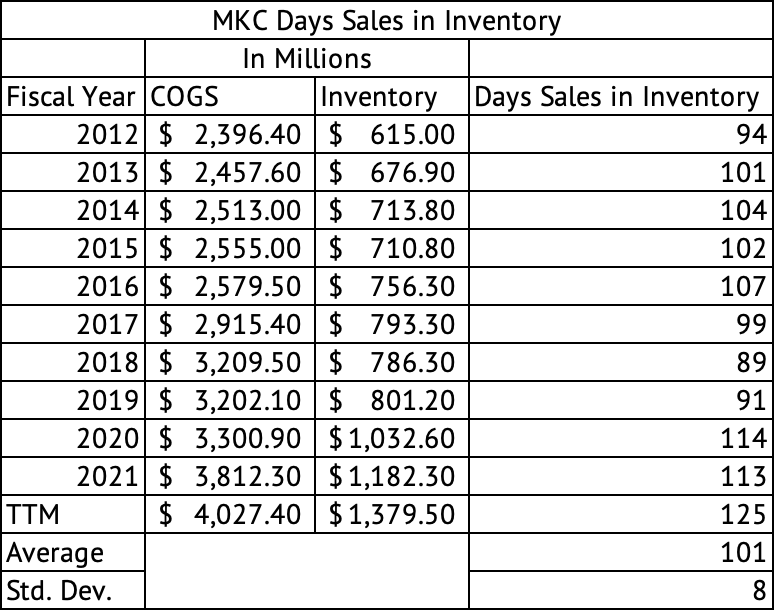

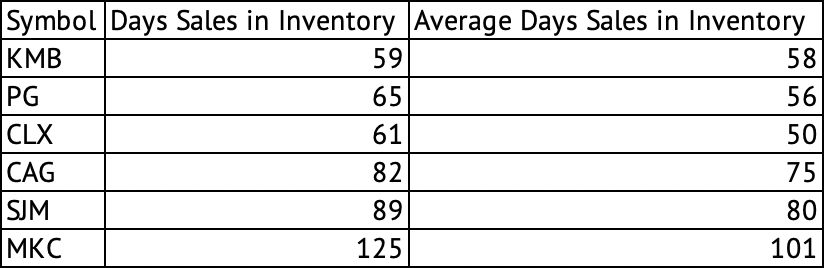

A massive increase in inventory

The company carries an enormous amount of inventory on its balance sheet. In the trailing twelve months [TTM], the company held $1.37 billion in stock (Exhibit 6), its highest level in the past decade. This inventory amounts to 125 days’ worth of sales. This is the highest level for the days’ sales in inventory metric among a group of consumer staples companies (Exhibit 7). No other company on that list carries as much inventory as McCormick, and none comes close to having 100 days’ worth of sales in stock. But, at this time, all companies on the list (Exhibit) are carrying over their average in inventory.

Exhibit 6:

McCormick & Co Days’ Sales in Inventory (Seeking Alpha, Author Calculations)

Exhibit 7:

Days Sales in Inventory for KMB, PG, CLX, CAG, SJM, MKC (Seeking Alpha, Author Calculations)

The company’s operating cash flow for the twelve months has dropped to $705 million, its lowest level since 2017 (Exhibit 8). The increase in inventory was the primary cause of this operating cash flow reduction.

Exhibit 8:

McCormick & Co Annual Operating Cash Flow (Seeking Alpha, Author Compilation)

Below-average dividend yield

The company offers a low dividend yield of 1.8%, barely higher than the yield of 1.7% provided by the Vanguard S&P 500 Index ETF (VOO). The 1-year US Treasury offers a much higher 4.7% yield. The company’s current dividend yield is lower than its average over the past five years, at 2.5%. The payout ratio is a moderate 54%. The company has grown its dividend by an average of 9.2% over the past five years and has continuously paid a dividend for 36 years.

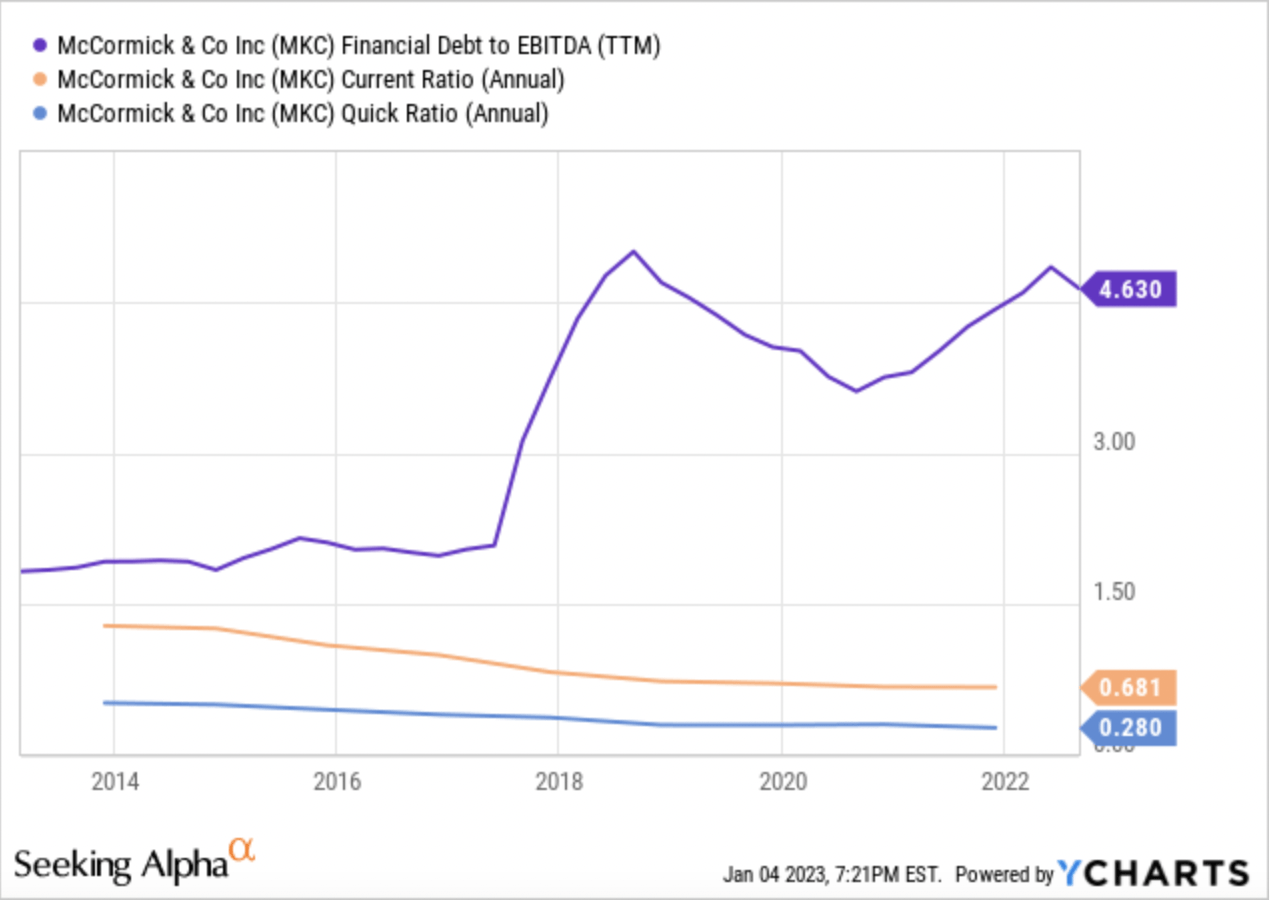

The company paid $388 million in total dividend payments in the past twelve months is easily covered by its operating cash flows of $705 million. Since 2017, the company’s debt-to-EBITDA ratio has hovered above 3x, standing at 4.6x. The company has low short-term liquidity, measured by quick and current ratios (Exhibit 9).

Exhibit 9:

McCormick & Co Debt-to-EBITDA, Current, and Quick Ratios (Seeking Alpha)

The company carried short-term debt of about $1.45 billion and long-term debt of $3.9 billion. Given the high debt load, the company has to prioritize debt repayments. The company has been refinancing its debt and has to pay a higher interest rate. For example, in 2020, the company issued $813.5 million in debt while repaying $257.7 million; in 2021, the company issued $1 billion in debt while repaying $600 million.

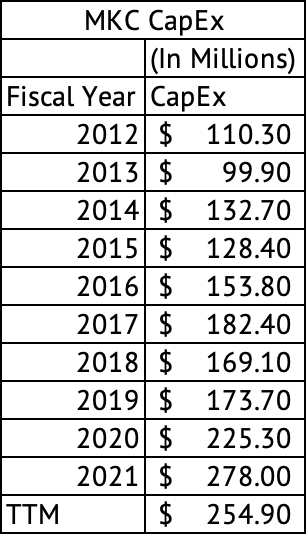

McCormick has a long track record of performing well under different circumstances, but the CFO, Mike Smith, has an unenviable job managing a tight liquidity situation in a tumultuous economy. The company has to strengthen its balance sheet to ensure it can wither any storm. The company spent over $200 million in CapEx in 2020 and 2021 (Exhibit 10). When the company works through this inventory and demand stays strong, its cash flows should improve and ease some pressure on short-term liquidity. The company should have three top priorities for its operating cash flows – dividend, capex, and debt repayment.

Exhibit 10:

McCormick & Co. Annual CapEx (Seeking Alpha, Author Compilation)

McCormick is overvalued

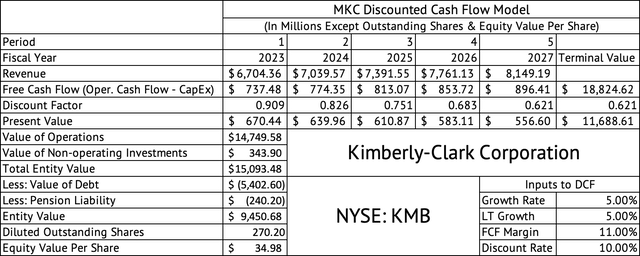

The current rate environment makes many leveraged companies look overvalued. A discounted cash flow model will have to use a higher cost of capital due to the increase in risk-free rates and the debt taking a bite out of the company’s present equity value since the company has over $5 billion in total debt, which reduces the value available to the shareholders.

A discounted cash flow model assuming an optimistic 5% growth in revenue, 11% free cash flow margin, and 10% discount rate yields an equity value of approximately $35 (Exhibit 11). As the company pays down the debt and brings its debt-to-EBITDA ratio to about 2x, its equity value should increase, assuming it can continue growing and maintain good margins.

Exhibit 11:

McCormick & Co Discounted Cash Flow Model (Seeking Alpha, Author Calculations)

The company is trading at a trailing GAAP PE of 32.6x and a forward GAAP PE of 30.9x, an overvaluation compared to the rest of the market and when compared to its 5-year average of 21x. It is more overvalued than companies with better margins and cash flows, such as Microsoft (MSFT), trading at 25x, and Alphabet (GOOG) (GOOGL), trading at 18x.

Investors may be better off avoiding the overvalued consumer staples sector. Individual investors can hold on to consumer staples companies and continue generating income from dividends. Large, sophisticated investors and traders can buy and sell stakes in seconds, but individual investors may need more time or resources to trade actively. But investors looking to buy McCormick or other consumer staples stocks may be better off patiently waiting.

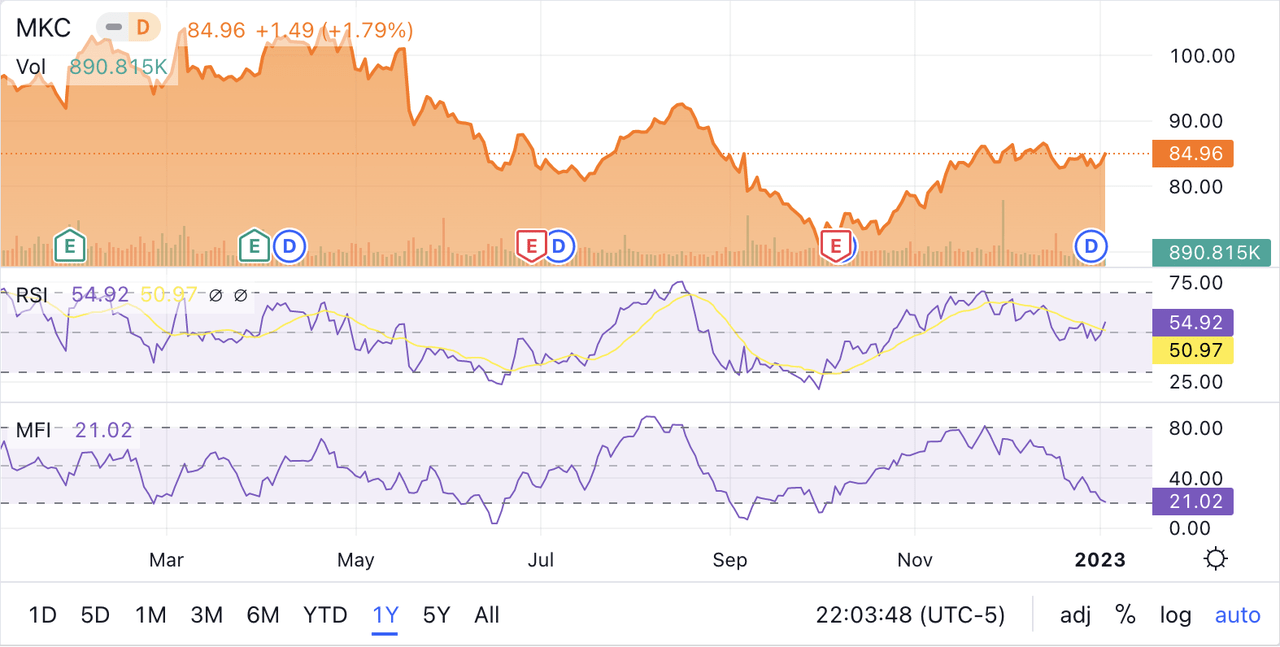

McCormick’s price performance and momentum

McCormick has declined 11% in the past year, while the Vanguard S&P 500 Index ETF fell 19%. In the past three months, the stock has performed exceedingly well under challenging market conditions returning 15.2%. But this upward move may have lost steam, with RSI and MFI technical indicators trending lower over the past month (Exhibit 12). Also, the stock may go lower in the short term, given the high inventory, substantial margin erosion, too little cash flow, and high debt. The economic uncertainty may keep this stock from selling off, given its haven status, protecting a portfolio during a recession.

Exhibit 12:

McCormick & Co RSI and MFI Technical Indicators (Seeking Alpha)

McCormick & Co has bolstered its sales by increasing prices. But volumes have declined, and the company faces margin pressures, high inventory levels, and lower cash flows. The stock is overvalued. Investors who own the stock may be better off holding the stock for the long term. New investors may be better off waiting for a lower valuation and a higher dividend yield.

Be the first to comment