josefkubes

Investment Thesis: I rate Mazda Motor Corporation as a hold at this time based on a decline in sales and low earnings growth.

In a previous article back in July, I made the argument that Mazda Motor Corporation (OTCPK:MZDAY) could see favourable long-term growth prospects, owing to a stronger cash position as evidenced by the company’s quick ratio as well as the rollout of the CX-60 and CX-70 models.

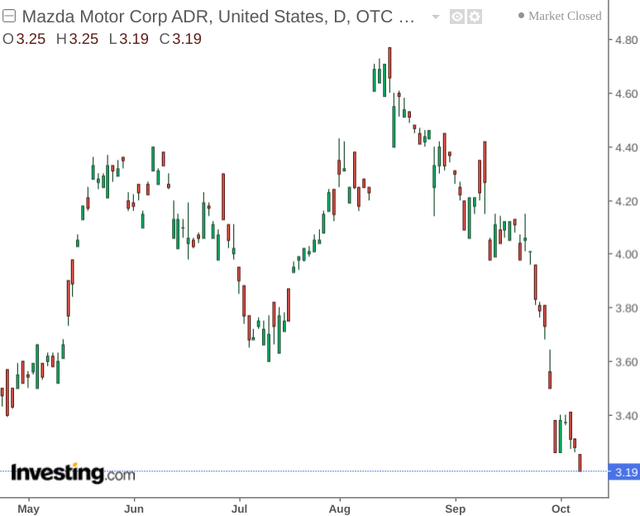

In spite of this, short-term performance has been less favourable – with the stock down by just over 20% since my last article.

The purpose of this article is to assess whether the recent decline in the stock has been justified, and whether we could see potential for a rebound at this price point.

Performance

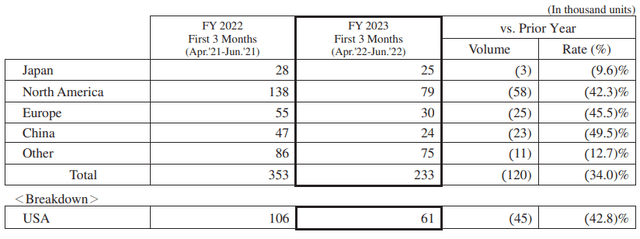

Net sales data shows that from April to June 2022, sales were down significantly on that of the previous year – with the Japanese market having seen a comparatively less decline than that of foreign markets:

Mazda Motor Corporation: Consolidated Financial Results For the First Quarter of the Fiscal Year Ending March 31, 2023

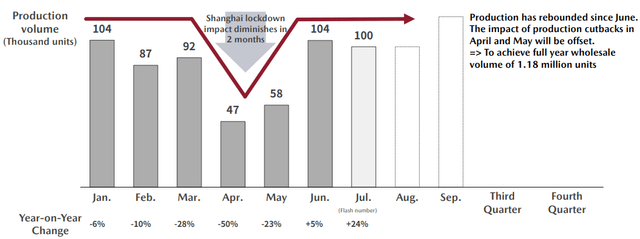

With that being said – sales across China for the time period in question would have been significantly impacted by the drop in production volume as a result of COVID-19 lockdowns earlier this year. According to Mazda, the effects of this have since dissipated and production volume has reached normal levels once again:

Mazda Motor Corporation: Fiscal Year March 2023 First Quarter Financial Results

When looking at the company’s quick ratio (calculated as total current assets minus inventories all over total current liabilities), we can see that the ratio fell from 1.18 in March 2022 to 0.91 in June 2022:

| March 2022 | June 2022 | |

| Total current assets | 1,457,813 | 1,557,356 |

| Inventories | 399,923 | 538,029 |

| Total current liabilities | 898,933 | 1,120,272 |

| Quick ratio | 1.18 | 0.91 |

Source: Figures sourced from Mazda Motor Corporation: Consolidated Financial Results For the First Quarter of the Fiscal Year Ending March 31, 2023. All figures (except quick ratio) provided in millions of yen. Quick ratio calculated by author.

This indicates that Mazda Motor Corporation has less liquid assets available relative to its current liabilities – which could be a concern for investors if sales growth slows – as it would indicate that the company may find it increasingly difficult to meet its short-term debt obligations in the meantime.

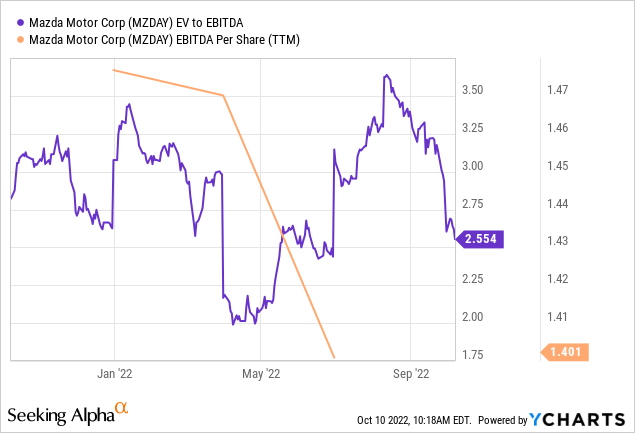

Additionally, we have seen that over the course of the past year – the EV/EBITDA ratio has remained more or less stationary while EBITDA per share has been declining significantly.

ycharts.com

This could indicate that the stock is less attractively valued than previously on an earnings basis.

Looking Forward

Going forward, the stock could come under further pressure in the short to medium-term as a result of declining sales and a concern among investors that the stock is relatively more expensive on an earnings basis at this time.

One significant determinant of whether Mazda can see a significant rebound in net sales is the eventual performance of the company’s newer SUV models.

According to the company, the cumulative order intake for the CX-60 was higher than anticipated – at 6,400 units in Japan and 11,600 units in Europe.

However, we can see that this did not make up for the overall decline in net sales – particularly in Europe.

Additionally, while the CX-50 was reportedly well received in North America in the most recent quarter – this did not prevent the region from seeing an overall decline in net sales. While the upcoming launch of the CX-70 model in North America might be able to make up for this shortfall – it remains to be seen whether such models will be competitive with established automakers in the United States such as Ford (F) and Tesla Motors (TSLA) and whether Mazda can ramp up its production significantly to make up for the ongoing shortfall in net sales.

Conclusion

To conclude, Mazda Motor Corporation has come under significant pressure as a result of declining net sales, with the company’s newer SUV models having failed to substantially increase growth in this regard.

Given this, along with a lack of recent earnings growth – I rate Mazda as a hold at this time. While I do not see too great a risk of downside if sales across China see a recovery and production across other markets can be expanded, I do not see a particular competitive advantage for Mazda that would justify a bullish view at this time.

Be the first to comment