ipopba

Our Performance – General Commentary

“All else being equal, invest in the company with the fewest color photographs in the annual report.” Peter Lynch

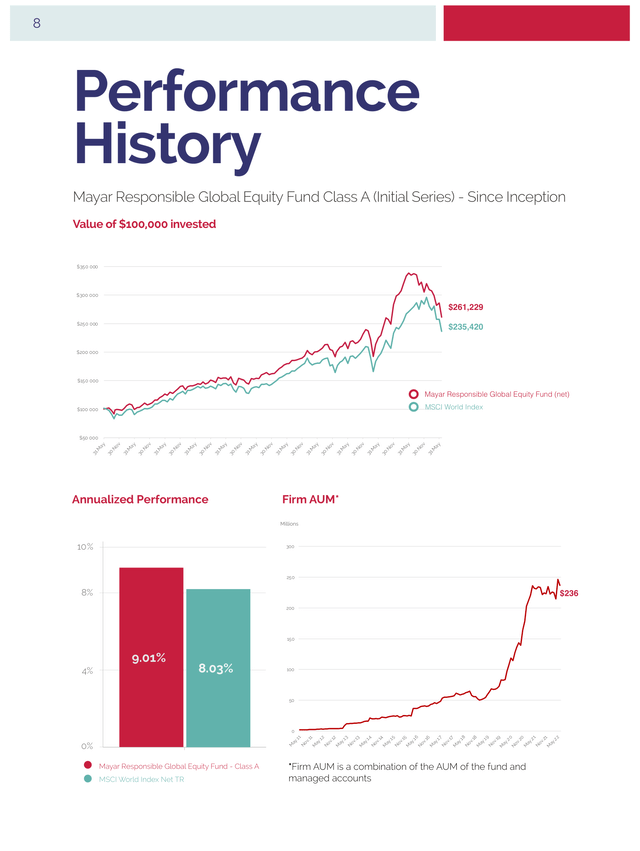

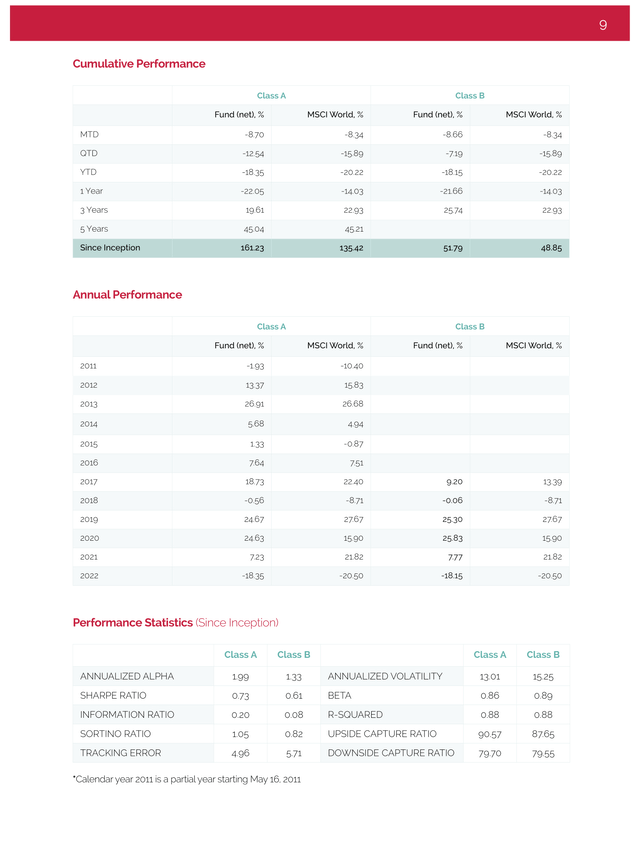

For the three months ending June 30, 2022, Mayar Fund (Class A) was down 12.54% net of all expenses and fees, while the MSCI World Index declined by 15.89% in the same period. Since its inception in May 2011, Mayar Fund has seen a 161.23% increase versus a 135.42% increase for the MSCI. That corresponds to a 9.01% annualized rate of return for Mayar Fund, compared to 8.02% for the MSCI.

At our latest annual meeting I talked about diversification and why I disagree with some value investors including, ahem, Charlie Munger, about the right number of stocks to hold in one’s portfolio. Please do watch my presentation if you have the time, but for now, let me take you through two thought experiments.

Imagine that it’s nine years ago and you’re putting together a portfolio made up of six high-quality stocks. Having studied them, you’re convinced that the underlying businesses are of high quality and will do well over time. Indeed, Johnson & Johnson (JNJ), LabCorp, UPS (UPS), Expediters International, Lowe’s (LOW), and Procter & Gamble (PG) are all high quality businesses.

Then, just as you’re in the middle of pondering how to build a portfolio of these nine stocks, a silver DeLorean suddenly appears in front of you, seemingly out of thin air. A disheveled Doc Brown emerges from the time machine and runs towards you. “Careful my son,” he yells, “I’ve been to 2022; don’t make that mistake or you’ll regret it!” Oh my, you wonder. ”Doc, will one of my stocks underperform in the future? “No,” he says, “none of them will, they’ll all outperform the MSCI World and that’s all I’m allowed to tell you.” He then runs back into the time machine and zooms off.

Once the shock wears off you start to wonder. How can I make a mistake when all six stocks outperform the MSCI World?

You think to yourself, surely constructing a portfolio of these wonderful names, which you now know will definitely outperform the index, must be easy, right?

One option would be to build an equally weighted portfolio made up of these six stocks. If you did that and rebalanced that portfolio annually, your portfolio would have generated a cumulative return of 228% over the following 9 years. A very respectable outperformance over the MSCI’s return of 138%. Congratulations!

Another option would be to follow the extreme concentration advice and build a 2-stock portfolio each with a 50% weight. But because you still want to own all six names, you then switch the portfolio to the next 2 names every 3 years. Surely this should also work, you think. Unfortunately for you, Doc was right. One such combination of the above six names made in a series of 2-stock portfolios, each held for 3 years, would have generated a cumulative return of only 86% over the 9-year period, a massive underperformance compared to the MSCI – and a fraction of what your equally-weighted portfolio generated.

If $10,000 was invested in the equally weighted portfolio, it would have grown to $32,756. Invested in the concentrated strategy though, it would have grown to a mere $18,642 (and $23,793 if invested in the MSCI).

So even though you were right about the quality of these businesses (and Doc told you all of them outperformed in the future) and you held them for relatively long 3-year periods, you ended up with very disappointing results because you concentrated too much into two holdings at a time and therefore got unlucky every time you switched holdings.

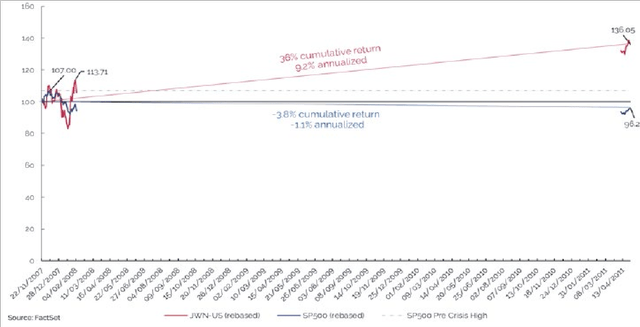

The second thought experiment comes from my own personal experience in the period around the financial crisis. In 2006 I made an investment in the shares of Nordstrom Inc (JWN). Over the following three-and-a-half years, the stock was up by 36%, outperforming the S&P 500 by a very respectable 41.4%. A fund made up of a single holding in Nordstrom would have ranked in the top 1% of all funds in the Morningstar database (see Figure 1).

Figure 1: In hindsight a 100% allocation to Nordstrom in late 2007 would have provided a great return through early 2011.

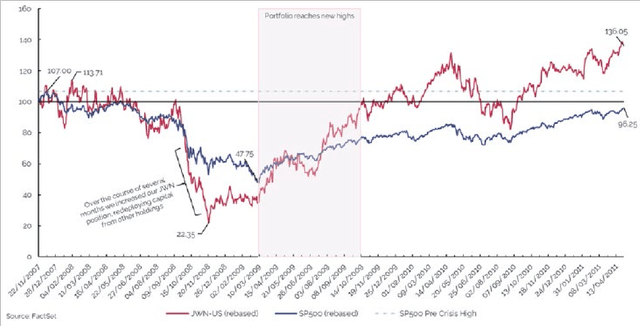

However, Nordstrom stock declined by a very painful 80% during 2008. A single-stock fund would have almost certainly liquidated during that drawdown, taking investors out of the game and ending any hope of them ever realizing the return. But because my portfolio was diversified, it held its value a bit better (it declined by 25% while the market was down by 38%), allowing me to sell some holdings and redeploy money into investments like Nordstrom that had declined severely.

The outcome was that my portfolio fully recovered by the end of 2009 while the S&P 500 took another 4 years to climb back to its previous highs. Diversification not only kept me and my investors in the game but also allowed us to improve our returns by rebalancing our holdings when the market sold off in 2008 (see Figure 2).

Figure 2: From December 2007 to May 2011 Nordstrom returned 36%, outperforming the S&P 500 by 10.3% annually.

Our Portfolio

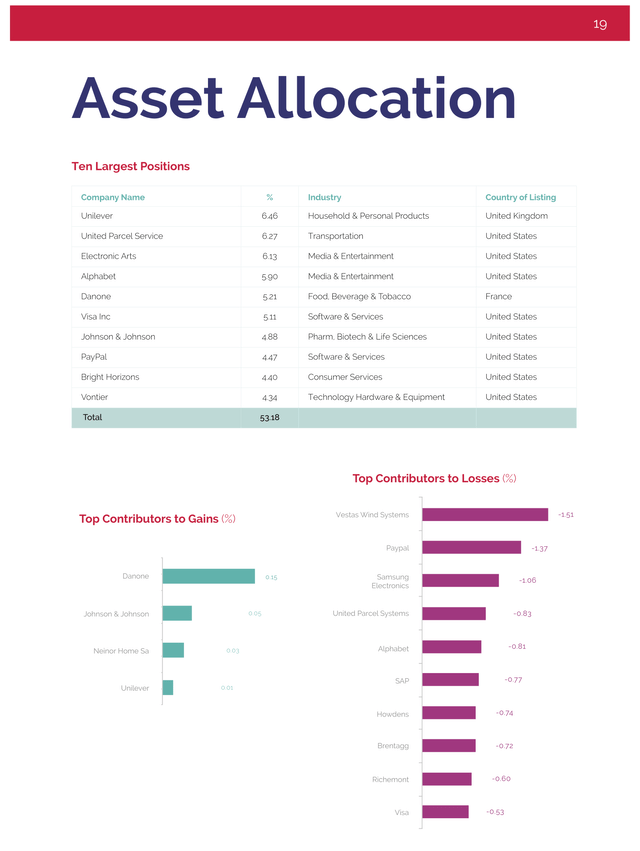

Recent market volatility has given us some excellent investment opportunities this quarter. We initiated a new investment in the shares of Bright Horizons Family Solutions Inc. (BFAM) Those who attended our Annual Investors Meeting on July 6th will have heard Aubrey’s exposition of our thesis. For those who missed it, I recommend watching the playback at www.mayarcapital.com/events.

In short, this is a business we’ve long been interested in owning but were never offered a compelling-enough price until now. The company operates childcare facilities in the US with a sizeable UK business and a small but growing presence in several other countries. Bright Horizons is the number three player in a highly fragmented market and, crucially, it’s the largest provider of employee-sponsored childcare. Many of its centers are currently under-earning as they recover from the pandemic as well as the natural ramp-up in new centers.

We think we have relatively high visibility on its underlying earning power and near-term growth, which has not been priced in by the market. We also believe that the company has strong pricing power – a very important attribute in today’s inflationary environment.

We also added to our existing holdings in Alphabet/Google (GOOG, GOOGL), Brenntag (OTCPK:BNTGF) and PayPal (PYPL) at what we believe are attractive prices. We were able to deploy all our cash and even had to trim our holdings in Johnson & Johnson to free up some capital for these investments.

We sold the last of our shares in Discovery Warner Brothers (WBD) in early April. Luckily, we were able to sell the majority of our long-held holdings in the crazy run-up that accompanied the Archegos Capital debacle in early 2021. We did, however, re-build a position in the stock when the stock went back down and this second go was disappointing.

We weren’t happy with the shift in strategy from the company’s core non-scripted and documentary content—where it commanded a leading position— into the wider media business it dived into with the Warner Media acquisition. We were also unhappy with the resulting increase in debt levels. It was time to take our money and walk away.

Last, but not least, we exited the long-term investment in Henkel (OTCPK:HENKY) that we’d held since 2011. The business—and the stock—did very well from 2011 to 2017 on the back of improving sales and profits. Then, following its acquisition of Sun Products in late 2016, problems began to surface, especially in its North American laundry business. Management struggled as it reached for quick fixes between 2018 and 2019 and was a little slow in recognizing that the problem was much deeper than initially thought.

Management had under-invested in Sun Products brands and was losing market share rapidly in what became a very promotional retail environment. Management had also integrated the acquired business badly, resulting in some serious weaknesses in the supply chain. A turnaround plan was put in place in early 2020 just before the pandemic hit. Henkel, like others, struggled to keep shelves filled during the pandemic.

And just as things started to stabilize, it took another hit in the form of high inflation in input costs. This made a turnaround much harder, especially in Henkel’s value brands where the risk of consumers down-shifting to supermarkets’ own brands manifested as consumers struggled with the higher cost of living.

I was slow to see all the above. Mea culpa. I messed up and take full responsibility for this mistake. I gave management the benefit of the doubt in 2018–2019 and believed they could turn things around. And when the pandemic hit it was very hard to see which of the challenges were COVID-related and which were more structural. While I still think they might have been able to turn things around, the risk of failure and the time and money required to do it would be much higher given the current economic environment.

The Fund and The Company

Mayar Capital ended the quarter with $236.7m in Assets Under Management (AUM).

We welcomed two new members to the Mayar Capital team this quarter. Sophie Hamilton joined our Investor Relations team in April. Prior to that, she spent four years in communications, most recently working as an executive in the industrials team at the financial public relations firm Tulchan. Sophie has also held corporate and B2B roles at the financial services agencies Cognito and Infinite Global. Sophie was awarded the Certificate in Investor Relations from the IR Society last year.

Isobel Digby also joined our Investor Relations team in April. Isobel previously spent seven years in a similar role at a financial advisory company in Ireland. She graduated from Maynooth University in Ireland with a Bachelor of Law degree. She plans to take her CFA Certificate in ESG Investing later this year.

Thank you for your continued support and trust. If you’d like to understand more about the fund, you can now book one-to-one 30-minute Q&A sessions with the IR team by emailing ir@mayarcapital.com with your availability and a member of the team will be in touch.

As always, if you have any questions, please don’t hesitate to reach out to us.

Best regards,

Abdulaziz A. Alnaim, CFA, Managing Director

Business Summaries: Unilever (UL)

Headquarters: London, United Kingdom

Founded: 1885 as Lever Brothers and merged with Margarine Unie. in 1929 to form Unilever.

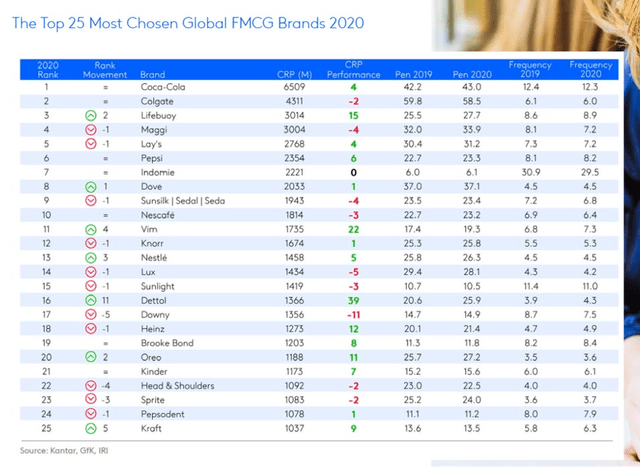

In 1895 the Lever brothers created a new brand of hand soap. Inspired by the growing demand for hygiene products, the Lifebuoy brand of soaps was launched to ‘make health infectious’. 128 years later the Lifebuoy brand continues as a leading soap brand – albeit without the coal tar-derived ingredients list. In fact, the market research firm Kantar ranked Lifebuoy as the global #3 most chosen FMCG brand in 2020, just below Coca-Cola (KO) and Colgate (CL) – an astonishing fact given the age of the brand. While the brand is largely absent from shelves here in the UK, it is a juggernaut in Asian markets, and is the #1 brand in India.

There are two observations about the Lifebuoy story which tell us a lot about Unilever, which is currently our largest holding in the Fund.

The first is the enduring power of brands in the consumer goods market. According to Kantar’s list of most chosen brands, the top 20 global marques have an average age of 116 years, with over half being founded in the 19th century. Fashions come and go, but there is something special about low-cost consumable goods that advantages strong, time- worn brand names.

In that context, then, it is positive that Unilever is arguably the predominant home of such brands. In fact, of the top 20 global brands, Unilever alone owns six, with a further eight brands in the global top 50. In fact, of Unilever’s 400+ brands, over four fifths are ranked #1 or #2 their market. Examples include Dove, Surf, Knorr, Sure and, of course, Lifebuoy.

Lifebuoy’s particular strength in Asia highlights another defining feature of Unilever: its strength in emerging markets. About half the company’s sales come from emerging markets. We think emerging markets have a number of long-term trends supporting growth.

- First, fast population growth supports volumes with more mouths to feed and people to wash.

- Second, rapid expansion of middle classes with greater disposable income supports the premiumisation trend.

- Finally, while we are seeing private labels take share from brands – particularly in Europe – the structure of the retail market in developing markets should see brands continue to support their market share.

The strength of Unilever’s brands translates into strong returns on capital which have been consistently in the 15-20% range over the last three decades. The relative stability of the company’s returns on its capital base underlines the stability in the wider business, as well as the economic value-add the group brings to its customers.

While the “big picture” at Unilever is, we believe, encouraging, it would be remiss not to mention some of the developments which have grabbed headlines over the past six months. The company’s botched (and short- lived) attempt at acquiring GSK’s consumer arm elicited a violently negative response from the investment community. While we were not against the transaction in principle, we believe the investor reaction was indicative of a broader unhappiness with Unilever management.

Indeed, we have great sympathy with Terry Smith, who this year derided Unilever’s search for “brand purpose”. Does Mayo really need a deeper purpose? We are therefore encouraged by the early signs of activism, with Nelson Peltz entering the fray in the spring when he took a 1.5% stake in the company and joined the Board. If he can do what he managed at P&G – spark a reorganization and cut costs – we will be very happy indeed.

Source: https://www.rbcgam.com/en/ca/article/the-future-of-emerging-markets-brands/detail

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment