dima_zel/iStock via Getty Images

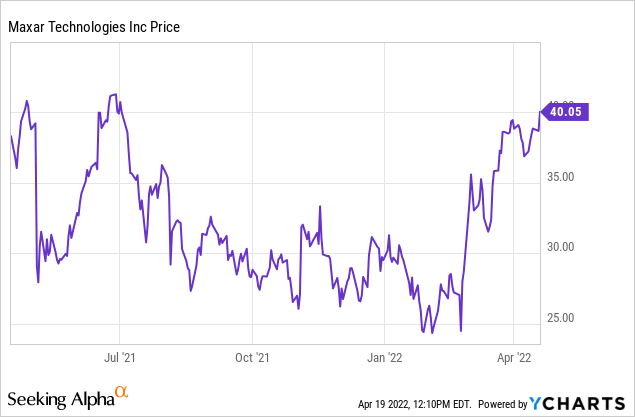

In addition to cybersecurity stocks outperforming the wider technology sector since the beginning of the Russian-Ukrainian conflict on February 22, was Maxar Technologies (NYSE:MAXR), a satellite imagery play whose high-quality images have been widely consumed both by the U.S. government as well as the media.

Thus, investors have rewarded the stock with a 60% upside but it is still below its one-year high, and this thesis aims to provide an answer as to whether there is still further upside. For this purpose, I start by providing insights as to how this Eastern Europe military confrontation is proving to be beneficial.

Importance of commercial satellite imagery

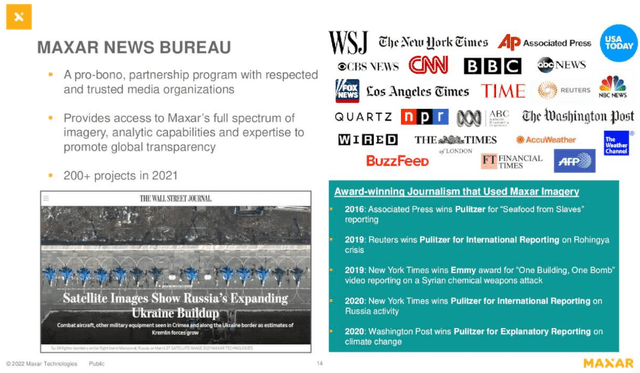

For many of us who have been tirelessly watching this conflict from our TVs or smartphones, some of the most iconic scenes which come to mind are those of a huge Russian military convoy, stretching more than 60 kilometers northwest of Kyiv. The image was taken by one of Maxar’s WorldView constellation of satellites and was published by the BBC, a British news media, one of several of those with whom Maxar’s news bureau has a partnerships program as shown in the slide below.

Company presentation slides (seekingalpha.com)

It is this sort of partnership which have allowed the general public to have access to an area once reserved for intelligence agencies and, equally important, the images provided by commercial plays like Maxar are viewed as being more independent than military sources.

For this matter, new earth observation techniques that can see through clouds and operate at night, enable image analysts to offer near real-time interpretation of battlefield developments. They also reveal to us that governments are no longer the only ones producing high-precision satellite-based data. It is not that Western nations do not have their own satellites, but the data produced is classified, unlike that of private companies like Maxar who can sell them both to the U.S. government and media agencies.

Pursuing further, Maxar’s current success somewhat contrasts with its plight some four months back when the U.S government launched a request for quotes for the Electro-Optical Commercial Layer program in order to encourage more competition and diversify its satellite imaging sourcing. Ironically, the Colorado-based company now faces a capacity crunch since it has only four satellites in orbit. In addition to the government, it is also highly solicited for supplying images to Western allies and news media organizations for such items as troop movements as well as to plan humanitarian aid efforts and help to trace refugee evacuation corridors.

The competition and finances

Now, there is Google Earth (GOOG) (GOOGL), which has the merit of being free, but neither does it have the same level of precision as commercial imaging satellites nor can it penetrate obstacles like clouds, smoke, storms, or fires. However, there are other competitors in the form of BlackSky (BKSY) and Planet Labs (PL). With its constellation of small satellites, BlackSky has also been actively sending images of the war zone and the company aims to operate like a satellite-as-a-service play.

Now, Maxar differentiates itself in terms of quality. Its images bear a high resolution of 30 inches synonymous with more detail and data can be obtained per pixel. It can even simulate the resolution of smaller satellite apertures by using machine learning algorithms to capture details like vehicle models, road markings, or even determine if drivers are manning tanks.

The degree of precision should be augmented with the launch of new Legion satellites which after several delays, are scheduled for June-July this year. One of the reasons for the postponement was the unavailability of airlifting capacity in the form of Ukraine’s Antonov planes for transportation from Maxar’s San Francisco factories to Cape Canaveral. This could be linked to these cargo planes having been destroyed soon after the invasion began.

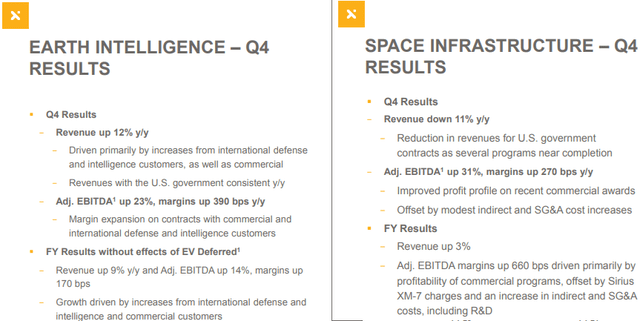

Further Legion delay may adversely impact 2023’s $110 million of EBITDA growth for the Earth Intelligence segment over 2021’s results. Now, this is for next year, and for the last reported quarter, both of Maxar’s reporting segments grew their toplines and bottom lines, and this, despite the Space Infrastructure segment seeing a reduction in government inflows.

Company presentation (static.seekingalpha.com)

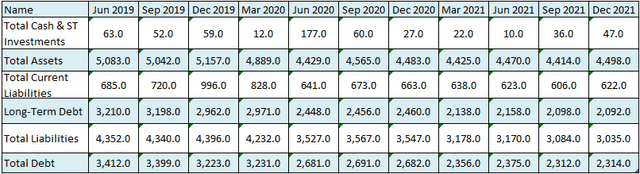

On the other hand, the debt level remains very high at $2.3 billion when considering that total revenues for 2021 were $1.77 billion. Looking at the table below, the amount owed to creditors has actually followed a downtrend since 2019 when it was over $3 billion to a little more than $2 billion at the end of last year. Also, total assets exclude total liabilities by more than $1.4 billion.

Balance sheet – Quarterly (seekingalpha.com)

Now, with fiscal discipline, Capex spending has fallen from $257 million in 2019 to $135 million in 2021, and Maxar generated $294 million from continuing operations resulting in an FCF of $60 million last year. Also, with $47 million of cash, $519 million in the revolver, and $1.83 billion of revenues guided for 2022, the balance sheet should not be pressured. For investors, the $1.83 billion does not include additional Ukraine-related satellite imagery sales and should therefore be adjusted accordingly for valuation purposes.

Valuations

According to an article dated April 6 on Space News, Maxar’s two main government clients, the National Reconnaissance Office and the National Geospatial-Intelligence Agency more than doubled purchases of high-resolution imagery covering the Ukrainian territory since the conflict started. Now, considering that the company receives an annual amount of $300 million from the U.S. government for its high-solution images and archives and that the conflict keeps on lingering, the satellite imagery company could significantly augment its revenues. Also, America’s European allies who are helping Ukraine as well as media outlets are buying pictures.

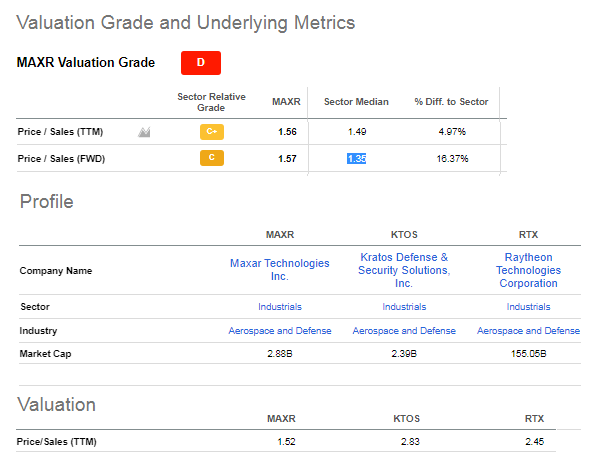

Considering a doubling of the sales to $600 million and adding to the total revenues of $1.77 billion obtained for 2021, I obtain an estimate of $2.37 billion. Now, considering that the trailing price to sales metric which makes use of the most recent fiscal year or 2021’s revenue of $1.77 billion is 1.56x (as per the table below), I obtain a forward P/S (for 2022) of 2.08x (2.37/1.77 x 1.56). This is way above the listed value of 1.57x which considers only a $60 million increase in sales ($1.83 billion – $1.77 billion). Adjusting accordingly, I obtain a target of $50.6, based on the current share price of $38.

Valuation grades and peer comparison (www.seekingalpha.com)

Justifying these higher valuations, a P/S of 2.08x is higher than the median for the industrial sector by a hefty 50%, but when compared specifically with high-profile defense plays like Raytheon Technologies (RTX), and Kratos Defense & Security Solutions (KTOS), Maxar actually looks undervalued as per comparison of the P/S metrics in the table above.

At this stage, some may argue that a company producing images and one producing fighter jets cannot have the same value. Well, I remind them that in present circumstances where the U.S. simply cannot engage its air force, whatever their might to counter hostile targets, it is high-precision images transmitted in a timely manner that are proving to be key for Ukrainian defenders to identify threats as well as eliminate them.

Conclusion

Therefore, Maxar is a buy with a possible 30% upside but, to be realistic, the stock could suffer in a high inflation environment where costs of materials and labor are on the rise. It has the capacity to raise prices but only to some extent due to the competition.

Moreover, there may be potential delays for other Legions as advanced satellite electronics and intelligent optics both make use of semiconductor components, items that have been continuously impacted by supply chain woes. Furthermore, any additional launch delay or an anti-satellite weapon inflicting damages on Maxar’s gear could result in high stock volatility. In this respect, the announcement by the U.S. Vice President that her country was banning anti-satellite weaponry testing may appear to be more of a warning to Russia against any interference in the operations of commercial satellites.

Conversely, positive launch news which is feasible as SpaceX maintains a solid track record of 98.7% could propel the stock into the stratosphere.

Moreover, due to a higher volume of images being snapped at the same spot on the Earth, there are potential margins gains that could improve the bottom line in case the company is not able to take full advantage of the high demand for satellite imagery. It should be the Earth Intelligence segment which already saw EBITDA increasing by 3.9% in Q4-2021 over 2020 thanks to contracts with commercial and international defense and intelligence customers which should benefit from these windfall gains.

Finally, Maxar’s images are proving to be vital pieces of intelligence for the defenders in fighting a much more powerful foe.

Be the first to comment