MaximFesenko/iStock via Getty Images

In September 2021, MasterCraft (NASDAQ:MCFT) was trading at 9.7x EV/EBIT broadly in-line with its 5-year average of c. 10x. My view then was that financial performance was driven by an above-average demand for recreational boats, hence company was trading at a peak-cycle multiple. Nothing could really foreshadow what will happen over the following twelve months but at least we didn’t chase growth from that point forward.

Almost twelve months later, market has a completely different colour. Inflation came to replace pandemia and disposable income contraction replaced disposable income expansion. Boating and recreational industries are notoriously cyclical hence the challenge of this thesis lies in determining whether MCFT has the operational flexibility to weather cyclically lower sales.

FINANCIAL PERFORMANCE & RESILIENCE

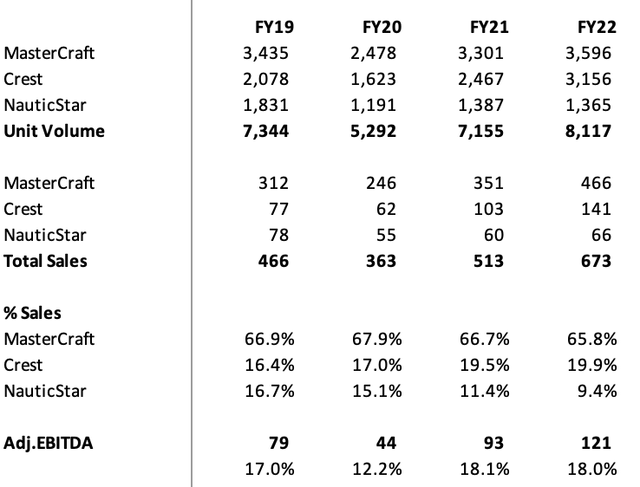

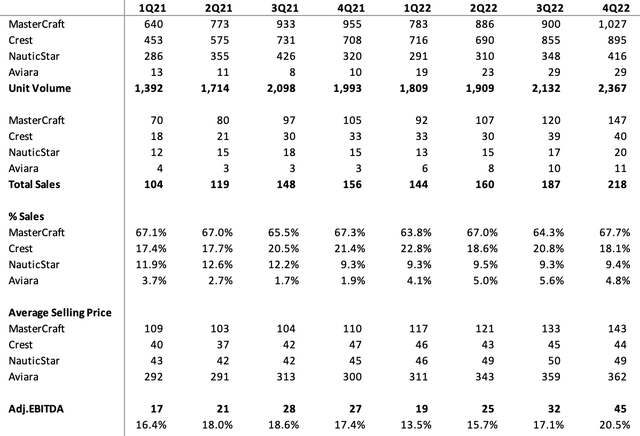

In FY22 MCFT grew sales organically by c. 35% and diluted Adj.EPS by 37% year-on-year. In 4Q22 alone, MCFT delivered 40% sales growth and 80% diluted Adj.EPS. This was the 7th consecutive record-setting quarter and the 6th consecutive quarter of YoY sales growth of more than 25%. I would admit that this is a rather impressive performance.

According to management, performance was constrained by supply chain disruptions and labor shortages. These challenges limited unit shipments and increased inefficiencies. Higher inflation later in the year also created margin headwinds. Operating expenses increased by $30.5m v FY21 to $84.5m mainly due to a $23.8m non-cash impairment related to NauticStar business. SG&A as % of Sales was the lowest since IPO as management continues to prudently manage costs. All looks fine, I think…

Adjusted EBITDA (excluding NauticStar) increased to $121m from $93m. The dilutive impact of NauticStar was 330bps for the year.

Ski/Wake boat market is fairly fragmented with top 5 brands accounted for 75% of the market. High margins and market share stability implies some kind of competitive advantage (protection from new entrants) and rational behaviour (Absence of price war) among competitors. In such market, incumbent companies should remain rational and protect profits in a downturn.

Pontoon and saltwater market is more fragmented with top 5 brands controlling 55% and 32% of the market respectively. While that market dynamic might be less powerful than the Ski/Wake market shares are also significant and should help the respective segments. Crest (Pontoon) and NauticStar (Saltwater) represent 9.4% and 4.9% of FY22 Sales. NauticStar would not even be a problem going forward (loss making segment) since management decided to exit the business.

MARKET SHARE & PRICING POWER

According to the management, MCFT remains a market leader with 21.3% in the Ski/Wake market after gaining 40bps year-on-year. Malibu comes second with 19.3%, Nautique third with 13.9% and Axis Wake Research fourth with 10.5%. Apparently, the ability to ramp up production faster than peers in a limited product availability environment was the key to gaining market share.

What is impressive to see is that these market share gains happened in a price increasing environment. MCFT managed to increase average prices quarter-on-quarter without losing market share. This is quite an achievement. During the FY22 Earnings Call, management stated that MasterCraft pricing is going to be up in mid-single digit range, Crest up in low-teens range and Aviara up in 20% range. That is also a quite confident statement.

We’ve been judicious with our pricing strategy for fiscal 2023 as we seek to match expected cost inflation with price increases to avoid a midyear price increase and the associated confusion and disruption for our dealer and partners and consumers. However, should retail demand continue to slow, the guidance we have provided reflects flexibility to ensure that we can defend our market share while maintaining strong profitability – FY22 Earnings Call

RISKS

Dealers: In FY22, supply chain challenges but robust consumer demand for MCFT’s products, resulted in historic low dealer inventories. Surveys continue to reflect low inventory levels and according to the management, none of the dealers has described inventories as too high. At yearend, dealer inventories were more than 50% lower than FY19 yearend. So in a worst-case scenario, we are entering a downturn with a below average inventory level.

Cyclicality: Neither MCFT nor Malibu were public during the financial crisis hence we don’t really know what a recession could mean for their top line. However we know that boat sales are highly discretionary. By driving parallels from Brunswick Corp and Beneteau (Sailing boats) we know that they lost 65% Sales (Units fell by 32%) and 42% during 2008-09 respectively. Period was marked by high discounts and sales were slow to recover in both cases. Current energy crisis is quite different than 2008-09 financial crisis. Increasing interest rates will slow economy but I’m not expecting a crass of equal magnitude, particularly in the US.

Fiberglass, sterndrive and inboard boat unit demand fell by 30%. This compares to a decline of 47% in the fourth quarter of 2008. For 2009, units fell by an estimated 32%. Outboard fiberglass boat retail unit demand fell 10% in the fourth quarter. This compares to a decline of 41% in the fourth quarter of 2008. For 2009, units fell by an estimated 27%. Aluminum product demand fell 20% in the quarter. This compares to a decline of 27% in the fourth quarter of 2008. For 2009, units fell by an estimated 25%. Based on these preliminary Q4 numbers, industry powerboat unit demand appears to have declined from 203,000 units in 2008 to somewhere between 140,000 and 150,000 units in 2009, over 20% and 26% and 31%. – FY09 Brunswick Corp Earnings Call

CAPITAL ALLOCATION

As announced on August 9, management decided to exit NauticStar business (4.9% Sales) and to concentrate on best-performing, highest-potential business. Exiting a loss-making segment is a rational move and makes me rethink about management’s capital allocation ability. Indeed in September 8, MCFT announced that its NauticStar business was acquired by a subsidiary of Iconic Marine Group.

Management also repurchased 975k shares for $25.5m (Average price at $26,1 per share). This represents only 50% of the $50m share buyback program authorised in Jun-21. Encouraging to see management buying back shares at this level.

VALUATION

Management guides for $580-615m sales (Excluding $60-70m NauticStar Sales) and $105-115m Adj.EBITDA implying an EBITDA margin at 18-19% for FY23. Excluding NauticStar, FY23 sales guidance is 5-9% lower than FY22 hence management is being conservative given the general macro environment. On the bright side, EBITDA guidance shows confidence around company’s ability to remain profitable even after losing sales. Worth noting that despite the 22.1% revenue decrease in FY20, MCFT remained profitable fact that shows some kind of operational flexibility.

…started to see some slowing within that fiscal fourth quarter, where we started to see, I think, early in the year retail was certainly constrained due to lack of inventory, but I think, more on that fourth quarter, we started to see and hear from dealers and consumers, due to some of the economic indicators, that we started to see a slowdown – FY22 Earnings Call

first and foremost, it’s confidence, it’s kind of sentiment. And for the reasons I stated in the response to Joe’s question, I think people are getting more concerned about the economic outlook, and they’re seeing the results reflected in the stock market, which is down substantially this year – FY22 Earnings Call

All things considered, I think that the general pessimism offered an interesting investment opportunity. MCFT could probably generate $60-65m FCF on a normalised basis which could imply more than 80% upside from the current level ($20-21 per share). Operational flexibility, tested during Covid and this initial face of inflation (2H22) adds further confidence around company’s ability to remain profitable under pressure. Floating debt at Base+1.4% is insignificant (0.2x ND/EBITDA) and it will not be an issue going forward. Management is doing the right things by exiting loss-making segments and buying back shares at depressed levels. Without knowing how this thesis will playout I’m happy to wait from this price level.

Be the first to comment