jbk_photography/iStock Editorial via Getty Images

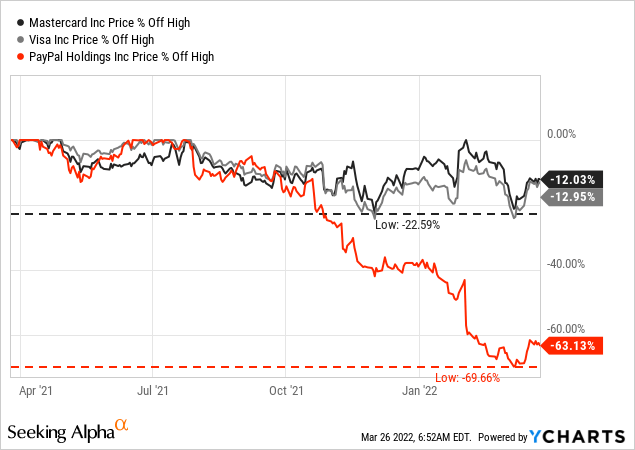

Mastercard (NYSE:MA) is in a sideway range right now and is trading between $300 and $400 since the beginning of 2021. While other payment companies declined extremely steep – PayPal (PYPL) would be an example – the two major credit card companies – Visa (V) and Mastercard – also corrected in the last few months, but not as steep.

Without any doubt, Mastercard is a great business with a wide economic moat. But great businesses are seldom cheap and Mastercard is also an example for a stock that is almost always trading for a premium. Mastercard is one of the stocks that was on my watchlist for several years, but I always considered the stock too expensive – aside from a brief period in March 2020 when I did not react quick enough (and hesitated as I considered a long-lasting bear market likely at that point). And as Mastercard is trading a bit lower once again, we can take a closer look at the stock and business and try to determine if we can buy Mastercard right now.

Fiscal 2021 Results

Mastercard was one of the companies, that got hit by the pandemic as traveling abroad was not possible and one part of Mastercard’s business are the cross-border volume fees. In the first few months when the pandemic started, I assumed that Mastercard might even profit short-term from people buying more online and pay by using credit cards instead of cash, but that turned out to be false and in fiscal 2020 revenue declined 9.4% and earnings per share declined 19.8%.

However, in fiscal 2021, Mastercard could report high growth rates again. Compared to fiscal 2020 with a net revenue of only $15,301 million, Mastercard could grow its top line by 23.4% and report net revenue of $18,804 million. Operating income also improved from $7,220 million in fiscal 2020 to $10,082 million in fiscal 2021 – resulting in 39.6% year-over-year growth. And finally, diluted earnings per share increased 37.5% year-over-year from $6.37 to $8.76.

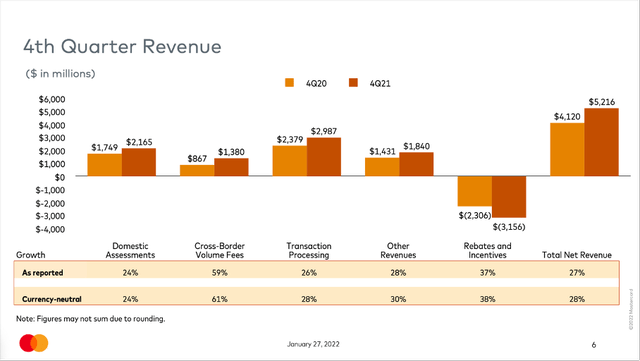

And in fiscal 2021, Mastercard could not only report high growth rates, but revenue as well as earnings per share were clearly above pre-pandemic levels (fiscal 2019 results). When looking at fourth quarter results, we can also see, that all four segments are contributing to revenue growth right now. While “Domestic Assessment, “Transaction Processing” and “Other Revenue” increased between 24% and 28% year-over-year, “Cross-Border Volume Fees” could increase 59% year-over-year. But when considering, that this segment was hit the hardest by the pandemic, it is not surprising to see rather high growth rates right now.

Mastercard Q4/2021 Presentation

Short-term Guidance

You know that I see myself as long-term investor and although I am checking constantly (every few months) on my investments and analyze if the original investment thesis is still solid, I usually start with a “buy-and-hold-forever” approach and my goal is to identify and buy businesses, which I can hold for several decades. When knowing this, it should also not be surprising that I am more interested in mid-to-long-term growth rates and not just focus on a single quarter or single year.

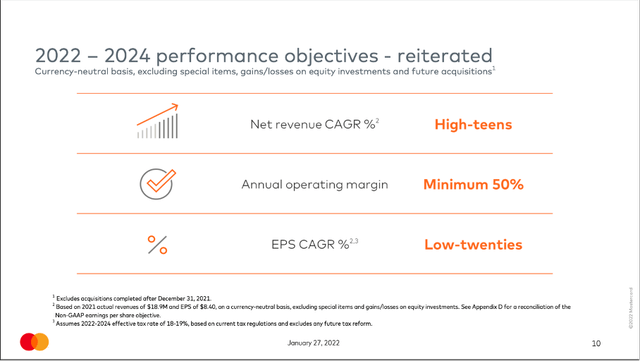

And while we could argue that fiscal 2021 growth rates are just a result of the mediocre fiscal 2020 (which is definitely true), Mastercard is expecting similar growth rates for the next three years. Net revenue is expected to grow in the high-teens and earnings per share are expected to grow in the low-twenties between 2022 and 2024.

Mastercard Q4/21 Presentation

At least for revenue, these growth rates are clearly above the long-term average. Before the pandemic (excluding fiscal 2020 and fiscal 2021), revenue grew about 12% to 13% on average and over the long run, Mastercard is expecting revenue growth to be in that range again.

The Bigger Picture

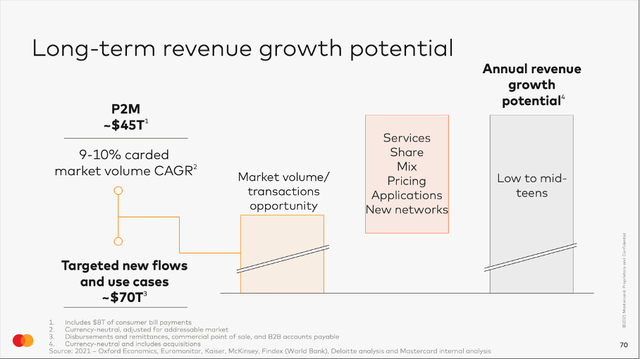

When moving away from the expectations for the next three years and looking at the long-term revenue growth potential, Mastercard is expecting its annual revenue growth potential to be in the low-to-mid teens once again.

Mastercard Investment Community Meeting Presentation

And if Mastercard can achieve this revenue growth over the long run combined with improving margins a little bit and share buybacks, earnings per share can probably grow in the mid-teens over the long run.

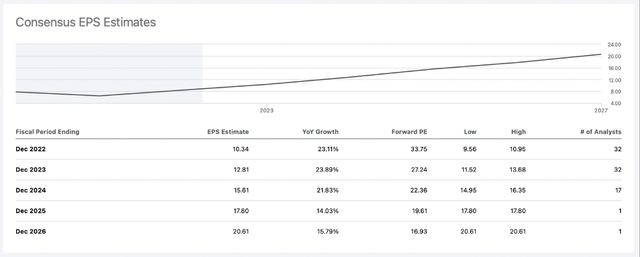

And when looking at analysts’ estimates for earnings per share, we see similar optimistic growth expectations for the years to come. In the next three years, analysts are also expecting earnings per share to grow above 20% annually, followed by 14% and 16% growth in the two years following 2024.

Seeking Alpha

We always must be cautious as growth could slow down, but in case of Mastercard we have several strong hints, that Mastercard will continue to grow with a high pace and in the double digits as there seem to be many different ways to grow for Mastercard: The acceleration of digital payments and buying online will be a growth driver for Mastercard as well as new partnerships and new payments opportunities (like consumer bill payments or business-to-business accounts payable flows).

High-quality Business

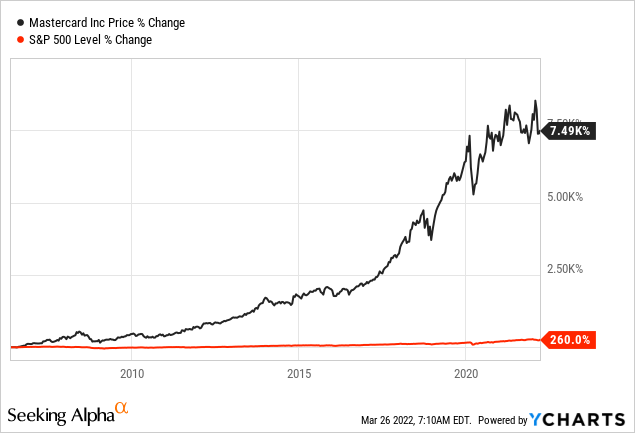

It seems worth repeating once again what a great business Mastercard actually is. We can start by looking at the stock performance since the IPO of Mastercard and see an impressive outperformance of Mastercard. While the S&P 500 increased 260% since the IPO of Mastercard in 2006, Mastercard increased 7,490% in the same timeframe (not including dividends).

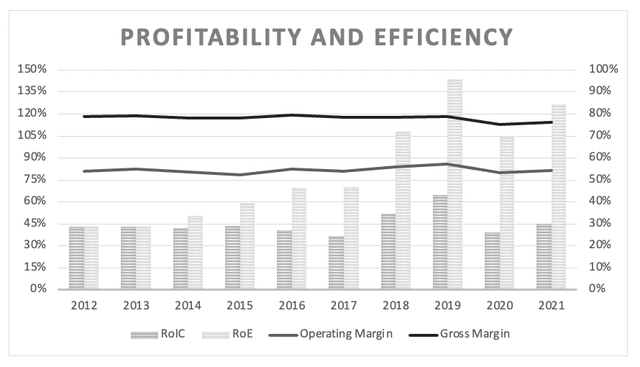

But not only is the stock outperformance is impressive. The fundamental business is also showing several signs of a high-quality, wide moat business. First, Mastercard has an extremely stable gross margin and operating margin. Gross margin declined a little bit in fiscal 2020 and fiscal 2021 – probably due to the pandemic – but we can assume that gross margin will improve again. Operating income declined a bit in fiscal 2020, but in the years before operating margin could improve a bit over the last decade.

Author’s work

Not only stable margins are worth mentioning, but also return in invested capital is extremely high in case of Mastercard. During the last ten years, the lowest RoIC was 36.89% and the average return on invested capital for Mastercard was 45%. These are extremely impressive numbers only a handful of companies will ever achieve.

And finally, Mastercard has an extremely strong network effect, that is generating a wide economic moat around the business. In a past article about Visa and Mastercard – published in July 2019 – I described the economic moat in greater detail and explained why the network effect for Mastercard is extremely strong due to fragmentation and the density of the network:

The network is connecting two very fragmented groups. On the one side, everybody who likes to sell a product or a service and needs a way to collect cash. On the other side, everybody who likes to purchase a product or uses a service and needs to pay for it. Especially, the demand side is extremely fragmented as the users of credit cards are usually individuals with very little bargaining power. The supplying side (the retailers) is not so fragmented and has more bargaining power. In case of Mastercard, the five largest customers are responsible for 23% of total revenue. And as the supplying side is usually the party that is paying the fees, this makes Mastercard’s or Visa’s position a little less dominant. But even those big customers can’t really switch as they still have to offer payment via Visa or Mastercard as otherwise their own customers would eventually shop somewhere else. But they can eventually negotiate lower fees.

Additionally, we can look at the density of the network and I continued:

The network is also a densely interconnected network as it consists of many different nodes (basically everybody who owns a shop or retail store and everybody who uses a credit card). And, the network generates its strength from the fact that every node is almost equally important. Of course, there are some retails that generate a huge part of Mastercard’s or Visa’s revenue (see section above). But the network gets so powerful as everybody can pay at almost every shop, and this makes all the connections in the network equally important. And, this makes it extremely difficult for competitors to attack Mastercard or Visa as it is not enough to copy only a few nodes or connections, but a competitor has to copy a huge part of the entire network in order to offer similar value to buyers and sellers as Mastercard or Visa.

Mastercard has a simple, but great business model and we can assume, that payments will remain a central part of our society and won’t be replaced for decades to come. And the rising Fintech could be a challenge, but it remains difficult to create a similar network.

Valuation

While there is little doubt about Mastercard continuing to perform well and having a sustainable business model, I was rather cautious in the last few years about the high growth rates that are necessary for Mastercard to be fairly valued and often considered the stock overvalued in past articles.

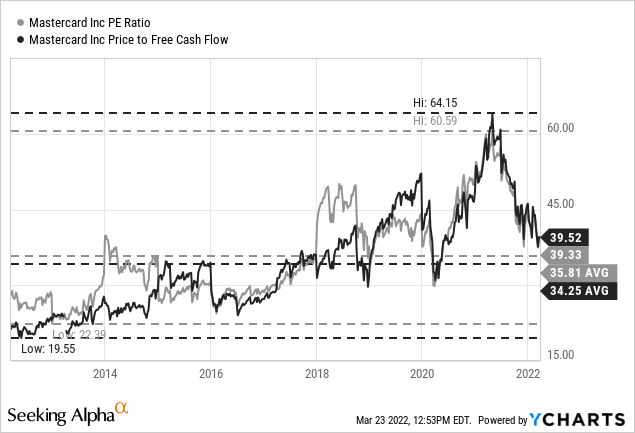

And in the recent past, Mastercard was trading for extremely high valuation multiples. About a year ago, the P/E ratio peaked at 60.6, while the price-free-cash-flow ratio peaked at 64.15. In my opinion a valuation multiple of 50 or higher is hard to justify (even for a business with a wide economic moat and high growth rates) and Mastercard is trading for much lower valuation multiples right now. At the time of writing, Mastercard is trading for 39.5 times free cash flow and 39.3 times earnings. I would still not use words like “cheap” or “bargain” but compared to the previous peaks we are talking about much lower valuation multiples. When looking at the 10-year average ratios (35.8 for the P/E ratio and 34.25 for the P/FCF ratio), Mastercard is almost in line with the 10-year average numbers. It is also worth pointing out, that the P/E ratio and P/FCF ratio got not lower due to a lower P (declining stock price) but mostly due to increasing earnings and free cash flow.

When looking at these metrics we can state, that Mastercard is fairly valued as it is trading in line with past valuation multiples, but a better way to determine if a stock is fairly valued or not is by using a discount cash flow calculation and determine an intrinsic value for the stock. In a first calculation we can be rather optimistic and assume 20% growth for the years 2022 till 2024 (almost in line with analysts’ and Mastercard’s expectations) followed by about 13% growth for the following years till 2032. For perpetuity, we assume 6% growth (as always in case of wide moat companies). As basis we will use the free cash flow of the last four quarters, which was $8,649 million. This leads to an intrinsic value of $427.26 for Mastercard (assuming 10% discount rate and 986 million outstanding shares).

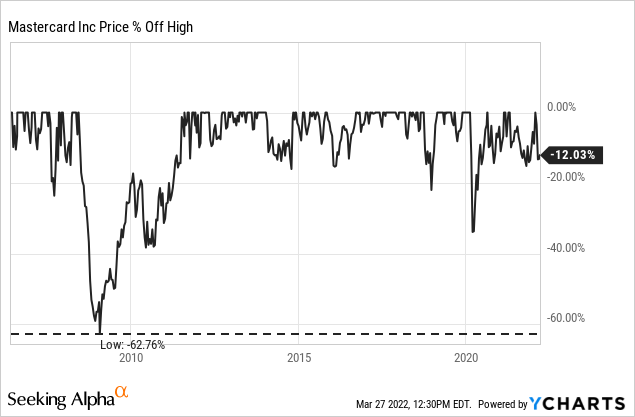

From that point of view, Mastercard is undervalued and could be bought right now, but we also should be a bit cautious about these high growth assumptions as we never know what will happen. And similar to the pandemic, that slowed Mastercard down for several quarters a global recession could also slow the growth rates down (and during the Great Financial Crisis, the stock lost almost two thirds of its value).

On the other hand, we can argue, that 6% growth till perpetuity might be too pessimistic for a business like Mastercard. But I never use a higher growth rate till perpetuity and the reasoning is similar than above – we never know what will happen and while we can make more or less reasonable assumptions for the years to come, it is extremely difficult to see what might happen in 20 or 30 years from now.

Conclusion

Similar to my last article in June 2021, I would be neutral about Mastercard once again. Without any doubt, Mastercard is a great business and a solid long-term investment. But I still won’t buy Mastercard right now.

I regret not buying Mastercard in March 2020 when the stock could have been bought for around $200 and for 30 times free cash flow. To consider buying Mastercard, the stock would probably have to drop below $300 to become interesting and a potential buy.

Be the first to comment