jir

Investment Thesis

- Mastercard’s (NYSE:MA) operating income grew from $4.5 billion in 2Q21 to $6.0 billion in 2Q22, an increase of 33%. The company’s 2Q22 results provide proof of its strong and robust business model and shows that it’s on track in regards to growth.

- The HQC Scorecard confirms that Mastercard is attractive in regards to risk and reward: At this moment in time, the company achieves an overall rating of 74/100 points. The Scorecard indicates that Mastercard is rated as very attractive in the categories of Profitability (100/100), Economic Moat (89/100), Growth (88/100) and Expected Return (80/100).

- In my opinion, Mastercard is a strong buy: the company has strong competitive advantages (such as its brand image, reliable payments network as well as its broad network within the financial service industry), a strong competitive position (proved by its EBIT-margin of 56.70%) and has shown strong results in 2Q22.

Mastercard’s Results In 2Q22

Mastercard increased its net revenue from $8.7 billion in 2Q21 to $10.7 billion in 2Q22. This is an increase of 23%. At the same time, the company’s operating income grew from $4.5 billion in 2Q21 to $6.0 billion in 2Q22, resulting in an increase of 33%. Mastercard’s operating margin went up from 52.3% in 2Q21 to 56.0% in 2Q22.

The growth of Mastercard’s net revenue, its operating income and operating margin when comparing its 2Q22 results with 2Q21 are indicators of the company’s strong and robust business model and show that it’s on track in terms of growth. Mastercard’s CEO Michael Miebach said the following in regards to its 2Q22 results:

“We had strong revenue and earnings growth again this quarter, as overall consumer spending remained robust and cross-border volumes grew 58% versus a year ago. Increasing inflationary pressures have yet to significantly impact overall consumer spending but we will continue to monitor this closely. We have a well-diversified business model and the demonstrated ability to deliver strong operating margins through up and down cycles.”

Mastercard’s Valuation

Discounted Cash Flow [DCF]-Model

In terms of valuation, I have used the DCF Model to determine the intrinsic value of Mastercard. The method calculates a fair value of $435.70 for the company. The current stock price is $347.63, which results in an upside of 25.30%.

Mastercard’s Average Revenue Growth Rate [FWD] of the last 5 years is 13%. I assume a Revenue Growth Rate and an EBIT Growth Rate of 12% for the company over the next 5 years. Furthermore, I assume a Perpetual Growth Rate of 4%, since I expect Mastercard to grow above the United States’ Average GDP Growth Rate of 3%. I’ve also taken into account the company’s current discount rate [WACC] of 7.5% and its Tax Rate of 15.7%. Moreover, I used an EV/EBITDA Multiple of 27.3x, which is its latest twelve months EV/EBITDA.

Based on the above, I calculated the following results:

Market Value vs. Intrinsic Value:

|

Market Value |

$347.63 |

|

Upside |

25.30% |

|

Intrinsic Value |

$435.70 |

Source: The Author

Relative Valuation Models

Mastercard’s P/E [FWD] Ratio

Mastercard’s P/E Ratio is 34.44, which is 8.58% below its average P/E Ratio of the last 5 years (37.67). This provides us with an additional indicator that the company is currently undervalued.

Mastercard In Comparison To Some Of Its Competitors

|

Mastercard |

Visa (V) |

American Express (AXP) |

PayPal (PYPL) |

|

|

Sector |

Information Technology |

Information Technology |

Financials |

Information Technology |

|

Industry |

Data Processing and Outsourced Services |

Data Processing and Outsourced Services |

Consumer Finance |

Data Processing and Outsourced Services |

|

Market Cap |

342.37B |

440.29B |

121.64B |

111.67B |

|

Employees |

24,000 |

21,500 |

64,000 |

30,900 |

|

Revenue [TTM] |

20.86B |

28.08B |

47.96B |

26.39B |

|

Operating Income |

11.83B |

18.95B |

10.14B |

3.69B |

|

Revenue Growth Rate 3 Years [CAGR] |

9.93% |

8.03% |

7.71% |

17.32% |

|

Revenue Growth Rate 5 Years [CAGR] |

12.80% |

9.59% |

9.01% |

17.55% |

|

Gross Profit Margin |

100.00% |

97.33% |

68.10% |

43.47% |

|

EBIT Margin |

56.70% |

67.48% |

– |

14.00% |

|

Return on Equity |

151.18% |

39.85% |

31.20% |

10.11% |

|

P/E GAAP [FWD] |

34.44 |

30.37 |

16.46 |

61.96 |

|

Dividend Yield [FWD] |

0.55% |

0.70% |

1.28% |

– |

|

Payout Ratio |

19.02% |

20.83% |

19.49% |

– |

|

Dividend Growth Rate 5 Years [CAGR] |

17.58% |

17.84% |

8.22% |

– |

|

Consecutive Years of Dividend Growth |

10 Years |

13 Years |

0 Years |

– |

|

Dividend Frequency |

Quarterly |

Quarterly |

Quarterly |

– |

Source: Seeking Alpha

The High-Quality Company [HQC] Scorecard

“The HQC Scorecard aims to help investors identify companies which are attractive long-term investments in terms of risk and reward.” Here, you can find a detailed description of how the HQC Scorecard works.

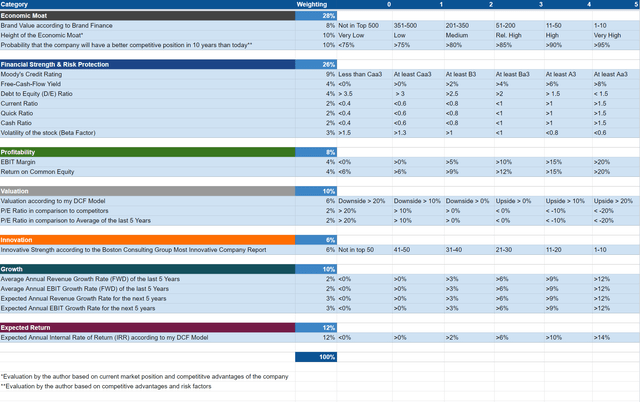

Overview Of The Items On The HQC Scorecard

“In the graphic below, you can find the individual items and weighting for each category of the HQC Scorecard. A score between 0 and 5 is given (with 0 being the lowest rating and 5 the highest) for each item on the Scorecard. Furthermore, you can see the conditions that must be met for each point of every rated item.”

Mastercard According To The HQC Scorecard

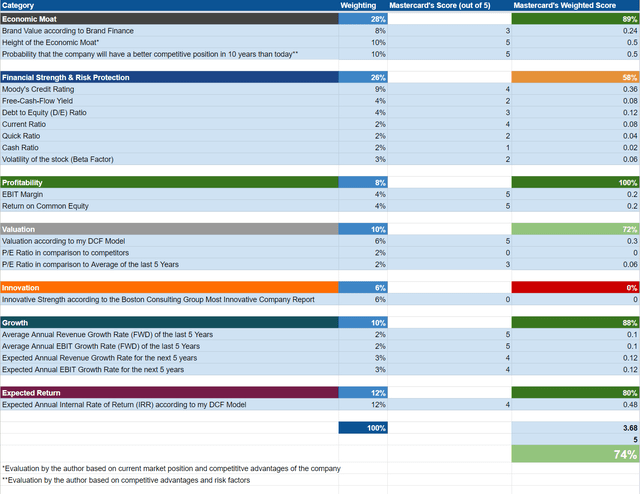

According to the HQC Scorecard, Mastercard’s overall score is 74 out of 100 points. This means it can be classified as an attractive investment in terms of risk and reward.

The Scorecard rates Mastercard as very attractive in the categories of Profitability (100/100), Economic Moat (89/100), Growth (88/100) and Expected Return (80/100). In terms of Valuation (72/100), it’s rated as attractive. The company gets a moderately attractive rating for Financial Strength (58/100).

Mastercard’s 100/100 rating in terms of Profitability is a result of its high EBIT-margin of 56.70% and high Return on Equity of 151.18%.

The impressive Growth rating is due in particular to the company’s high Average Revenue Growth Rate [FWD] (13%) and its Average EBIT Growth Rate [FWD] (14.66%) of the last 5 years as well as the company’s expected Revenue and EBIT Growth Rate for the next 5 years.

Mastercard only achieves a moderately attractive rating in terms of Financial Strength due to the company’s relatively low Quick Ratio (0.79), Cash Ratio (0.53) and its relatively high Total Debt to Equity Ratio (231.25%).

The company’s attractive overall rating (74/100) as according to the HQC Scorecard strengthens my belief that it’s currently a strong buy.

Risk Factors

One of the main risk factors I see for Mastercard is the competition from alternative payments systems and new entrants. Many providers of alternative payment systems, which in some cases are partners or customers of Mastercard, have developed systems that focus on online activity in ecommerce and mobile channels. Examples are PayPal (PYPL), Alipay and Amazon (NASDAQ:AMZN). These are all financially strong companies, and the increasing level of competition they provide could have a negative effect on Mastercard’s revenue and profit margins.

Another potential risk factor I see for Mastercard would be a global recession. In times of declining consumer spending, its revenue would be affected negatively, which could result in declining profits and profit margins for the company. However, I think a global recession would only have a temporary impact on its operating results. Therefore, I don’t see this as a strong risk factor for investors with a long-term investment horizon.

The Bottom Line

Mastercard’s excellent results in 2Q22 demonstrates a strong and robust business model and shows that the company is on track in terms of growth. My DCF Model (for which I assumed a Revenue and EBIT Growth Rate of 12% for the next 5 years), shows an upside of 25.30% for the company.

A strong brand image, its reliable payments network, as well as its broad network within the financial service industry provide the company with strong competitive advantages over its rivals. These advantages contribute to an economic moat that makes it difficult for new competitors to enter into Mastercard’s business segment.

The company’s high EBIT-margin of 56.70% is an indicator of its strong competitive position within the payment industry. Its average annual dividend growth rate of 17.58% over the last 5 years in combination with its low dividend payout ratio of only 19.02% indicates that an investment in Mastercard is particularly appealing for dividend growth investors.

The HQC Scorecard validates that Mastercard can be considered as a high quality company. As according to the HQC Scorecard, it is rated as attractive in terms of risk and reward (achieving an overall rating of 74/100). The Scorecard rates Mastercard as very attractive in the categories of Profitability (100/100), Economic Moat (89/100), Growth (88/100) and Expected Return (80/100).

In summary, I would like to highlight that Mastercard’s strong competitive advantages, its high EBIT-margin of 56.70%, high dividend growth rate of 17.58% over the last 5 years and low dividend payout ratio of only 19.02% contribute to my strong buy rating on the Mastercard stock.

Be the first to comment