Pgiam/iStock via Getty Images

These articles are all about contrary opinion and its power at locating major bear market bottoms. The theory and the components behind the master sentiment index (MSI) are explained in the latter half of this article.

This is a follow-up article to the July 28th article titled, “The Master Sentiment Index (MSI) Signals The End Of The Bear Market”.

Since that article was published the market, as measured by the S&P 500, is exactly the same.

A Wonderful Test

We are at a unique moment in time to test an important concept.

What’s more important when determining market direction – the negative economic factors everyone thinks will drive prices lower, or the statistical fact that so many people believe prices are headed lower? After 50 years of market study, I say it’s the latter. In any event we will all learn something important very soon.

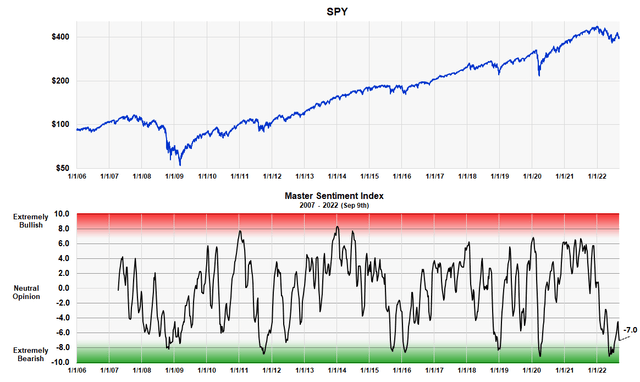

MSI Index 2007 – 2022 (Michael McDonald)

This 16-year chart plots the Master Sentiment Index, which is a composite index made from seven historical sentiment indicators, against the S&P 500 SPDR ETF (SPY). The data is as of September 9th.

The MSI is designed to signal long-term trends; it is not a short-term indicator. It is easy to see the correlation between major market bottoms and extreme levels on this index. As the graph clearly shows the extreme readings during the recent months of June and July were comparable to the extreme readings at every major market low of the last 15 years, including 2008 and 2020.

With the market’s recent rally, the MSI rose slightly but is now back to -7. If you are a contrarian, this is what you want to see in a rally off a bear market bottom – the continuation of bearish sentiment as the market moves higher, especially large increases in bearish sentiment as soon as the market has a slight setback.

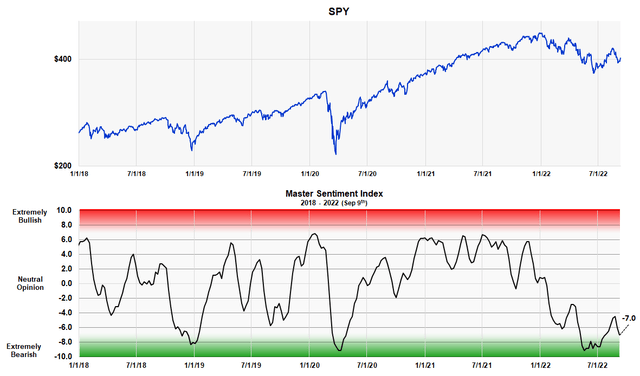

MSI Shorter Term View (Michael McDonald)

The chart above is the same as the long-term chart but plotted from 2018 to present, so it shows more detail.

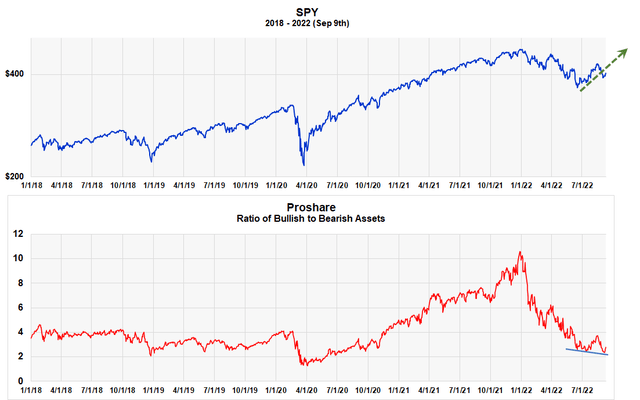

ProShares Asset Ratio

Proshare Bull-Bear Asset Ratio (Michael McDonald)

The ProShares bull to bear asset ratio is another way we measure investor sentiment or expectations. It takes the dollar value in all the ProShares bull funds and divides it by the dollar value of all the bear funds. The graph clearly shows the surge of money into bull funds at the top the market nine months ago.

What’s important now is both the drop in the ratio and the fact that the ratio continues to decline even as the market rallies. Why is this last part important? Because it means that a large number of ProShares investors believe the recent rally was a bear market rally and are buying bear funds. This again is what you want to see if you’re a contrarian. It points to higher prices.

Theory of Contrary Opinion

The theory of contrary opinion states the following: when the vast majority of investors think stock prices will advance, they almost always decline. Likewise, when the vast majority think prices will decline, they usually advance. In other words, prices will move contrary to what investors expect but only when those expectations have reached an extreme.

Notice that the theory does not consider the economic reasons that are making everyone bullish or bearish in its forecast. It simply states that the necessary and sufficient condition for a major market top or bottom is the existence of an extreme level of bullish or bearish sentiment.

Measuring Bearish Sentiment

How do you determine when there is “extreme bearish sentiment?” Since the theory was first formulated by Humphrey Neill in 1954, different ways to “measure” investor opinion have developed. Some are based on investor activity, such as the amount of investor short selling, short interest or put buying.

Other methods are based on market surveys such as the “American Association of Individual Investors” bullish and bearish percent, or the “Investors Intelligence” bullish-bearish advisory ratios. The latter was started in the mid-1960s and history shows it has worked pretty well over the last 60 years at locating market bottoms.

Sentiment indicators worked better at locating and forecasting bear market bottoms than bull market tops. But no one indicator always worked best; one or two seemed to work better in some markets than others. So, it became important to see if the different sentiment indicators could be combined into one composite sentiment indicator in a logical and mathematically consistent way.

Combining individual sentiment Indicators to form a Master Sentiment Index

Combining multiple indicators to form one sentiment indicator is not easy. How do you combine a puts and calls ratio of 1.0 with a 40% Investors Intelligence bearish percent? Everything has to be mathematically consistent. We accomplished it in the following way.

We took each indicator back as far as history allowed (the smallest time period being 17 years) and determined the range of values that contained the highest 5% of its values. Then we determined the range of values that contained the next highest 5%. This procedure was continued in 5% increments down to the 5% band that contained the smallest values. This activity allowed us to put every indicator on the same 21 range scale which was labeled 10 to -10.

We then added each indicator’s position number (10 to -10), which determines where it is historically, and divided the total by the number of indicators in the composite. Out came a composite number between 10 and -10 that represented the average bracket value of all the sentiment indicators.

The MSI Red and Green Zones

The graph at the top of this article is the plot of this number against SPY. As you can see it oscillates between 10 and -10. Large white area in the middle represents periods of time when there is no extreme opinion. The red area on the chart represents when the indicator is getting into the “extremely bullish” range. The lower green band shows when the index is getting into the “extremely bearish” range. There is no sudden demarcation line but a graduated area that shows greater and greater bearishness. The chart clearly shows how the current level compares to levels at major bottoms of the last 16 years.

The MSI Component Table

MSI Component Table (Michael McDonald)

The first column in the table lists the 21 rankings that go from +10 to -10. This is followed by the names of the seven indicators used in the composite with an X showing the current ranking of each. Two of these indicators – the buying of ProShares Short S&P 500 ETF (SH) and the Short position of asset managers in the S&P 500 E-mini futures – were explained in Seeking Alpha articles, “Commitment Of Traders Data Is Signaling A ‘Risk-On’ Moment For Stocks” and “DOG, PSQ, SH: 3 Contrary Opinion Indicators Pointing To Major Market Bottom“. The last column displays the ranking number of the MSI index which on September 9th was -7.0. (At some point we intend to expand the master index to include eight indicators).

We are currently in the process of developing two, shorter-term sentiment indicators that we believe will be very useful at locating shorter-term market moves.

Understanding Why the Theory of Contrary Opinion Works So Well

After 50 years of study and application, I still don’t completely understand why the theory works so well. I know the reasons people usually give for why it works: that at the market top, when everybody’s bullish, there are no buyers left to push prices higher, so they decline. And vice versa at the bottom: after everyone’s turned bearish and sold their positions expecting prices to go lower, there’s no one left to sell so prices begin to rise with just a meager amount of buying.

But there is more to it than this. There’s an economic aspect to the theory that people have either forgotten or are unaware of.

Humphrey Neill’s original 1954 book called “The Art of Contrary Thinking” was not about the stock market but about the economy. It cited numerous times in the first half of the 1900s when the economy went opposite to what everyone expected. When most people expect a recession, they got expansion. When they expected inflation after World War 2, it never came. Which brings us to two silly, little acronyms I coined 25 years ago to explain this – BABES and O’BUCS.

Of BABES and O’BUCS

If contrary opinion is a fundamental theory in predicting stock prices, as I and many others believe it is, then it follows that there must be a BABES and an O’BUCS (I know they’re silly names but stay with me.)

BABES stands for “Broadly Agreed to But Essentially wrong Scenario.” O’BUCS stands for “Occluded But Ultimately the Correct Scenario”. The basic idea of all this is that the economic outlook that is making everyone bullish or bearish must be wrong – there must be some holes in the data or thinking about the data.

In applying the theory, you try to discover the true economic scenario people are missing – finding the O’BUCS idea. Locating the O’BUCS idea is the action of finding today the economic scene that is about to emerge that will explain why stock prices moved opposite to what everyone expected. This is what Humphrey Neill meant in his book. History shows this, more often than not, is the case.

So, what’s the current O’BUCS idea? I believe it’s this. That this sudden jump in inflation is temporary and about to end. Serious, endemic inflation doesn’t start this way; it starts gradually then grows bigger and bigger. Both the suddenness and the size of this current round are clear signs to me of a temporary situation. I think the Fed rate hikes will bring an end to it real fast and even bring about some deflation and they will quickly reverse their actions. By that time the market will be 25% to 50% higher.

Be the first to comment