kynny/iStock via Getty Images

Investment Thesis

Marvell Technology, Inc. (NASDAQ:MRVL) stock has significantly underperformed its peers and the broad market, down more than 50% YTD (at writing). Despite posting a solid FQ1’23 earnings card in May, the market has continued to digest its growth premium.

But, investors should not be surprised as its revenue growth is projected to slow markedly from FY23, with FY22 as its peak. As a result, we believe the market has justifiably battered the diversified semi leader to moderate forward expectations.

Our valuation analysis indicates that the market expects MRVL to continue underperforming even at the current levels.

We have not observed a bear trap (significant rejection of selling momentum) to help stanch its bearish bias. Therefore, the price action signals remain tentative.

Therefore, we rate MRVL as a Hold for now. We urge investors to be patient as we await a better entry point to improve their potential of outperforming moving forward.

The Market Is Lowering Its Expectations On Marvell

Marvell is a high-quality semi-leader with solid profitability. The company is also expected to be less impacted by the headwinds facing its consumer-heavy peers, given its enterprise/data center-focused revenue profile. Marvell highlighted in its Q1 call that “nearly 90% of their revenue came from data-infrastructure projects-not the consumer.”

Notwithstanding, Micron’s (MU) recent earnings call discussed the possibility of a cutback in enterprise spending. It suggested that a potential recession could spur companies to temper their outlook and impact their investments, affecting demand.

Therefore, investors are urged to consider nothing is sacred when the need to preserve cash flow and increase capital buffer takes a higher priority, given the worsening macro headwinds.

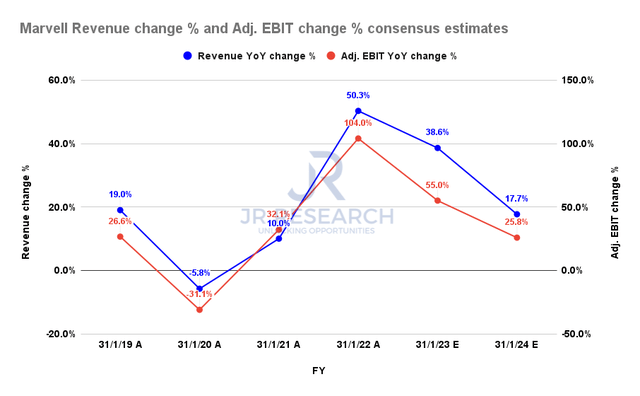

Marvell revenue change % and adjusted EBIT change % consensus estimates (S&P Cap IQ)

Notably, even the generally bullish consensus estimates indicate a marked deceleration in revenue growth from FY23. The Street expects Marvell to post a revenue increase of 38.6% in FY23, down from FY22’s peak growth of 50.3%. Marvell’s revenue growth is expected to normalize further through FY24, reaching a significantly lower 17.7%.

However, Marvell’s inherent operating leverage helps sustain its profitability growth, as seen in its adjusted EBIT growth estimates.

Marvell adjusted EBIT margins % and FCF margins % consensus estimates (S&P Cap IQ)

Furthermore, Marvell is expected to continue improving its adjusted EBIT margins, consistent with management’s long-term guidance of 38-40%. Marvell’s free cash flow (FCF) margins are also expected to remain robust despite the significant deceleration in revenue growth.

Therefore, we believe Marvell’s profitability profile looks excellent, which likely helped spur its bullish momentum over the past two years as MRVL outperformed.

MRVL – Deeply Entrenched In A Bearish Bias

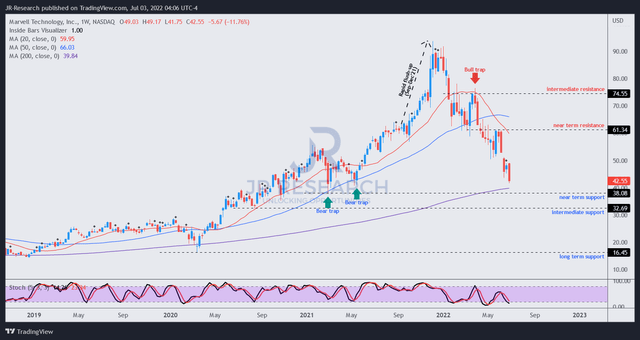

MRVL price chart (TradingView)

Despite the bullish estimates and robust guidance proffered by management, we urge investors to pay close attention to MRVL’s price action.

The rapid flush-up from September-December 2021 drew in buyers rapidly to the top. However, investors are urged to avoid adding to such “knee-jerk” marked-up price action, as they often portend noteworthy tops preceding significant sell-offs.

However, the bull trap (significant rejection of buying momentum) seen in late March 2022 was the one that broke the camel’s back. It ended MRVL’s bullish momentum and reversed it decisively into a bearish flow.

As a result, MRVL has been deeply mired in its bearish momentum with no signs of a bear trap yet. Therefore, its price action remains tentative. The rejection of buying momentum seen at its near-term resistance ($60) was significant and helped shape our valuation model discussed subsequently.

MRVL Could Underperform The Market

MRVL last traded at an NTM FCF yield of 6.15%, well above its 5Y mean of 4.81%. Notably, the market rejected buying momentum (despite no bull trap price action) at its near-term resistance when MRVL traded at an FCF yield of 4.4%.

Therefore, we believe the market expects MRVL to underperform its historical average, moving ahead, which can be easily seen in our valuation model.

| Stock | MRVL |

| Current market cap | $36.16B |

| Hurdle rate (CAGR) | 21.82% |

| Projection through | CQ4’26 |

| Required FCF yield in CQ4’26 | 4.81% |

| Assumed TTM FCF margin in CQ4’26 | 28% |

| Implied TTM revenue by CQ4’26 | $15.1B |

MRVL reverse cash flow valuation model. Data source: S&P Cap IQ, author

Our reverse cash flow valuation model indicates that MRVL is unlikely to repeat its average performance over the past five years.

MRVL posted a 5Y total return CAGR of 21.82%, which we applied as our hurdle rate. However, our model requires Marvel to post a TTM revenue of $15.1B by CQ4’26, which is unlikely based on the current consensus estimates.

Notwithstanding, we used a more conservative FCF margin of 28% to account for a reasonable margin of safety. Therefore, we believe the market is asking for higher FCF yields to account for a lower implied hurdle rate.

Is MRVL A Buy, Sell, Or Hold?

We rate MRVL as a Hold for now.

Given its slowing revenue growth estimates, we believe the market has correctly digested MRVL to moderate expectations. However, its robust profitability is expected to underpin its valuation, despite its revenue growth deceleration.

Our price action analysis suggests that its signals remain tentative. However, we don’t expect MRVL to fall to its COVID bottom and believe a constructive bottom might not be far below. Therefore, we will watch closely for a bear trap price action that can suggest a sustained bottom to reverse its bearish bias.

Be the first to comment