Sundry Photography

Company overview

Marvell Technology, Inc. (NASDAQ:MRVL) is a fabless semiconductor supplier of high-performance standard and semi-custom products with core strengths in developing and scaling complex SoC architectures, mixed-signal and digital signal processing functionality.

- Marvell is a leading supplier of controllers for HDDs and SSDs, fiber optics, Ethernet switches, processors and ASICs for the infrastructure, data center, enterprise, automotive and industrial markets.

- MRVL was founded in 1995, the company has more than 6,700 employees and is headquartered in California, USA.

- Stocks are traded on the NY stock exchange with MRVL ticker and included in the NASDAQ 100 index.

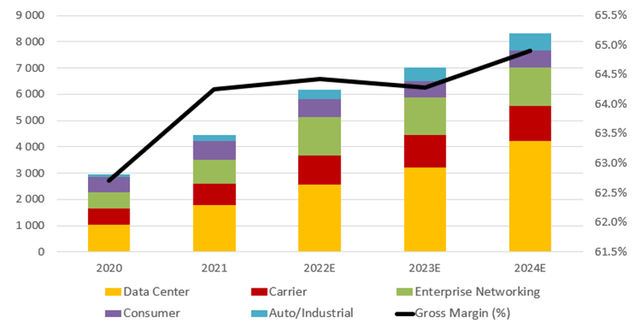

Exhibit 1: revenue segments

Revenue segments (Company annual reports and Bloomberg)

MRVL is heavily insulated from consumer weakness, which is most pronounced in the current macro softness. The growth in the past years was driven by the data center segment. Most of the revenue, around 51%, is expected to be generated by the latter segment in 2024E. Furthermore, the data centers also have the biggest margin among revenue segments.

We would like to point out that this secular growth was provided by structural changes in revenue structure. Not so long ago, the consumer segment occupied 62% of the company’s revenue structure, now it is at the level of 11%.

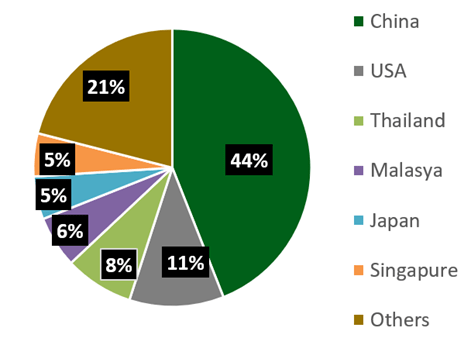

Exhibit 2: revenue segments

Sales geography (Company annual report)

China accounts for around 44% of revenue. That is higher than peers have and poses an immediate threat.

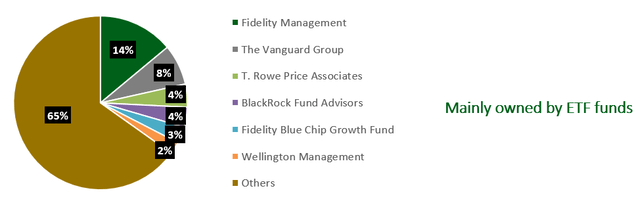

Exhibit 3: top shareholders

Top shareholders (Bloomberg, Analyst research)

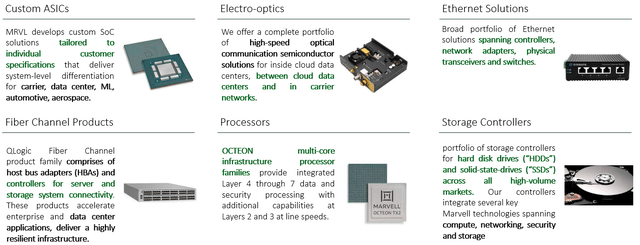

Current product offerings include custom ASICs, electro-optics, ethernet solutions, fiber channel adapters, processors, and storage controllers.

Exhibit 4: product portfolio

Product portfolio (MRVL’s investor day presentation)

Many growth opportunities exist across all target markets

MRVL continues to see robust demand that outpace supply as the adoption of its new products drives extended growth opportunities. Especially for high-complexity custom products with long lead times, supply remains tight.

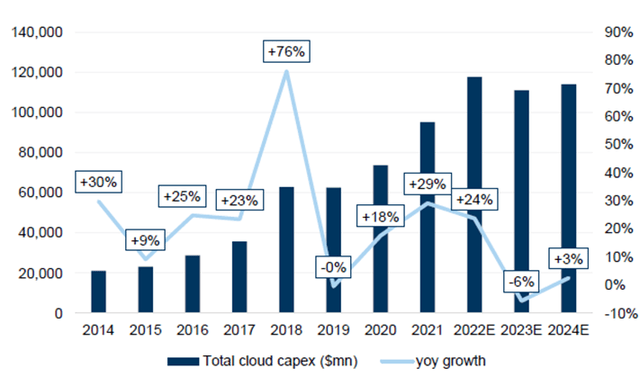

Data Center. Cloud continues to be the main driver as customers add new use cases with AI and ML, increase process automation, and drive deeper relationships with their customers. GS analysts expect cloud growth rates to slow down in the coming years, but this is largely driven by tightening monetary policy and attitudes can change quickly.

Exhibit 5: total cloud capex

Total cloud infrastructure forecast (GS research)

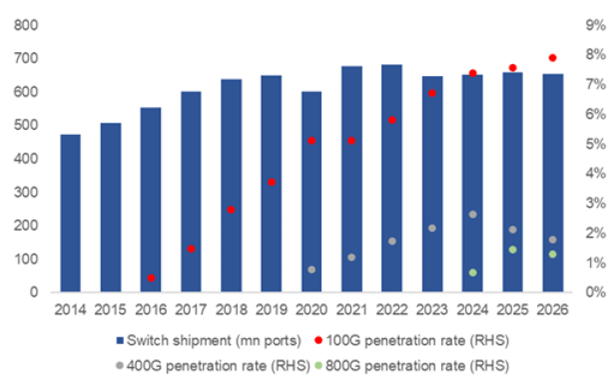

Demand for 200G and 400G modules remains robust, and some customers are beginning to ramp 800G modules for AI clusters. We expect that 100G+ switch penetration rate will improve in the coming years.

Exhibit 6: switch penetration rate

Switch penetration rate (Barclays research)

MRVL expects growth to continue in areas like electro optics, cloud-optimized custom solutions, cloud switching, and the broad data center storage portfolio. Furthermore, Marvell won a custom SmartNIC design at a hyperscale customer, representing the growing demand for custom cloud-optimized silicon.

Auto/Industrial. Although down QoQ, auto grew sequentially, although there was an offset from industrial weakness which is mainly supply driven. Auto strength is driven by adoption of MRVL’s Ethernet products (auto revenue has doubled Y/Y for multiple quarters).

Consumer. Demand from HDD continued to weaken, especially in the consumer segment, due to weak earnings from Seagate (STX) and Western Digital (WDC).

We expect to see HDD weakness in the data center and consumer HDD segment because of issues with STX. Seagate said in its earnings call that the U.S. government has warned the company that it may have violated export control laws by providing hard disk drives to a customer that a source familiar with the situation identified as Huawei Technologies. As a result, the company fell in terms of revenue 35% YoY and has lowered next quarter expectations. Therefore, potentially assessing the impact on Marvell, we do not recommend buying shares until Thursday’s report.

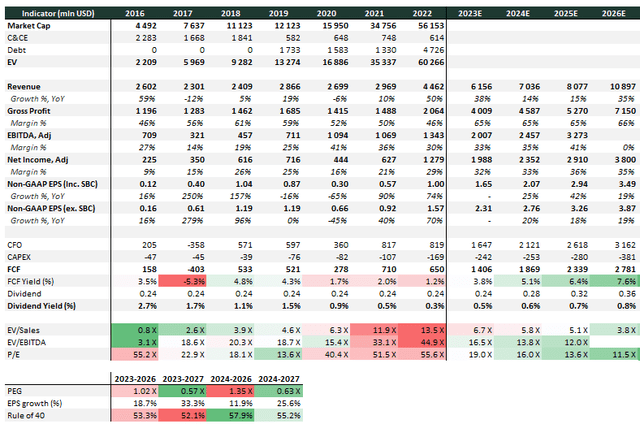

Financials

MRVL has strong financials with robust revenue growth, high margins, and growing share marginality of cloud business.

Exhibit 7: Company historical financials and consensus estimate

Company historical financials and consensus estimates (Bloomberg, Analyst research)

After 3 years full of strategic M&A activities, the company increased Net leverage from 0 to 1.8 X. Despite that, strong free cash flow (“FCF”) generation is expected in coming years, and analysts are expecting management to be more active in stock buybacks.

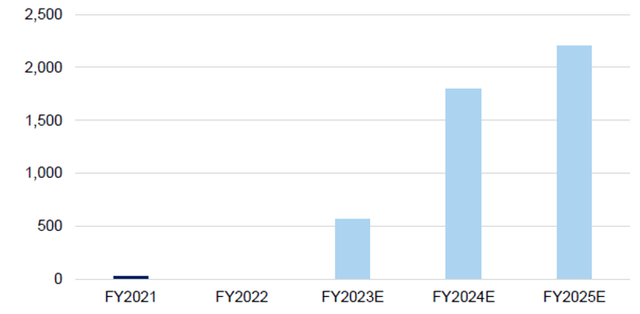

Exhibit 8: Buybacks forecast

Buybacks forecast (DB research)

Valuation & attractiveness

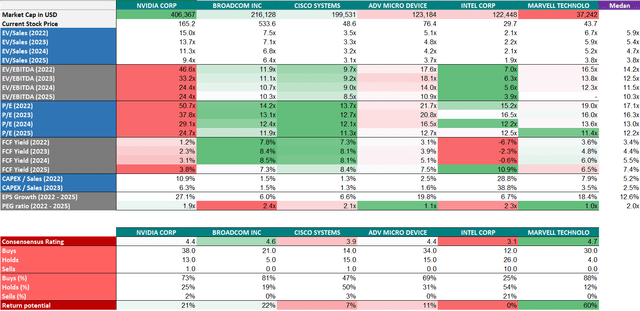

We have compared valuations for the top six cloud infrastructure semiconductor stocks.

Marvell has an attractive forward multiple due to high EPS growth and a significant decline in share price in the last 9 months. On a P/E basis, the stock is trading at 16.0 X (2023) compared to the group median of 16.3 X. All mentioned above is reflected in the lowest PEG multiple (PEG = 1.0 X) among the peers.

Exhibit 9: Relative valuation

Relative valuation (Bloomberg, Analyst research)

Marvell historically traded with a higher premium to the SOX index and peer group, but after the monetary policy tightening started the situation changed.

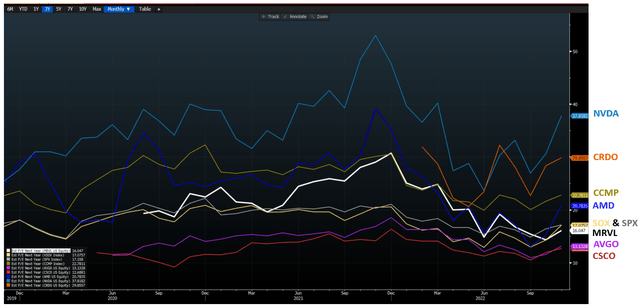

Exhibit 10: Est. P/E Next Year

Est. P/E Next Year (Bloomberg, Analyst research)

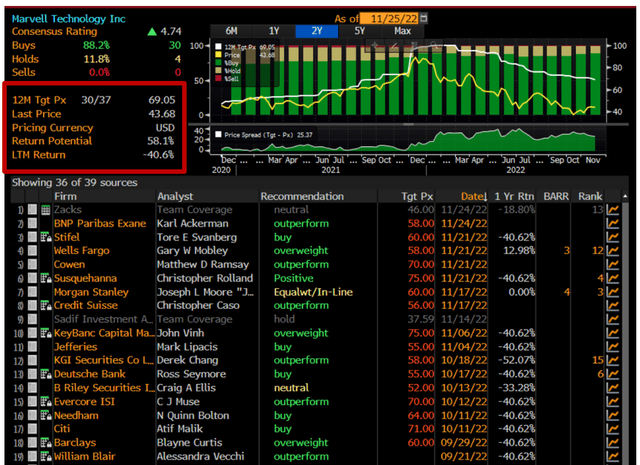

According to Bloomberg, analysts forecast a 58.1% return potential. I should mention that there were a few downward revisions of target prices recently.

Exhibit 11: Analyst recommendations

Analyst recommendations (Bloomberg, Analyst research)

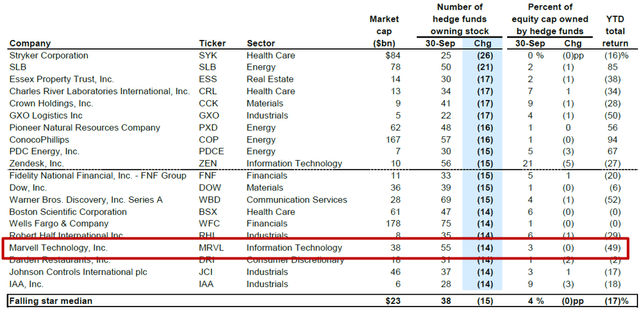

The stock is still popular among investment banks. MRVL is buy rated in CS, BoFA, Needham and Wells Fargo. Furthermore, despite the overall decrease in number, hedge funds still have huge exposure to Marvell’s growing business as you can see from table below.

Exhibit 12: Stocks with the largest decrease in the number of hedge fund owners during 3Q 2022

Stocks with the largest decrease in the number of hedge fund owners during 3Q 2022 (GS research)

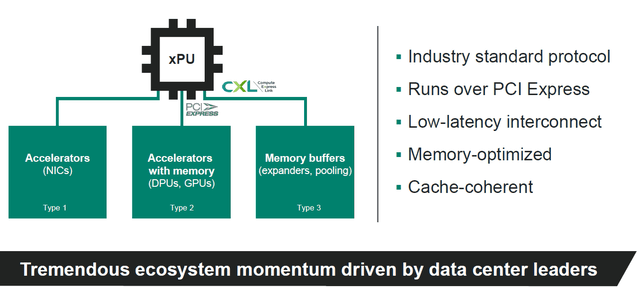

Compute Express Link (CXL)

To be comparative in a high growing market it becomes vitally important to design your own SiC, which Marvell does very successfully to address all customers’ needs according to customer unique requests. CXL helps with the latter a lot, allowing customized solutions in DRAM, memory and accelerators.

Exhibit 13: CXL technology

CXL technology (MRVL’s CXL tech talk presentation)

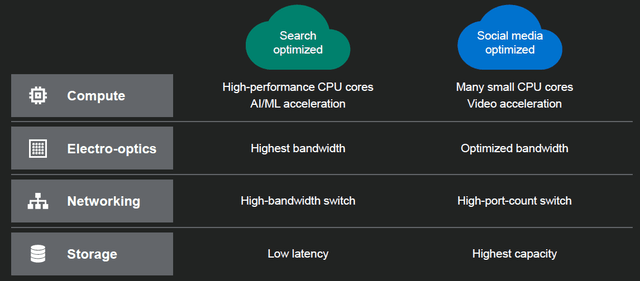

Exhibit 14: different use cases need different approaches

Different use cases need different approaches (MRVL’s CXL tech talk presentation)

Again, MRVL spent time addressing its enthusiasm over CXL, which it believes is the next big evolution in cloud data centers that will enable the company to increase its reach into the memory ecosystem. CXL represents a multi-billion-dollar SAM expansion opportunity for MRVL. While the industry is still in the very early innings, which provides long-term opportunity.

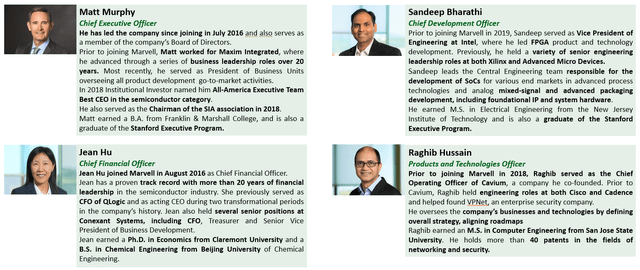

Strong industry expertise

It’s vitally important to understand that MRVL’s management consists of professionals, who have been in business for more than a decade. Such complex technical products are highly dependent on CTO performance who guides the strategic vision for the future of the company. Raghib Hussain built a new Marvell from scratch, a company that has no competitors.

Exhibit 15: Management

Management team (MRVL’s annual report)

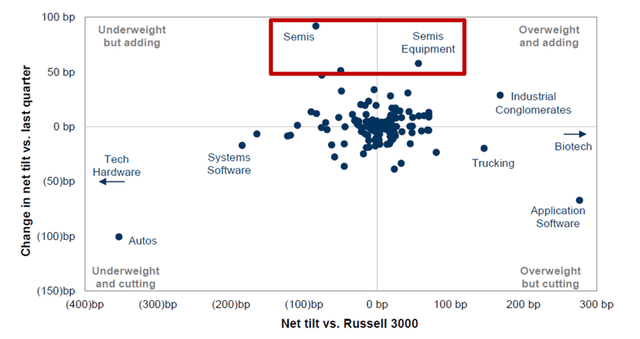

Rotation towards semis

Semis have outperformed the S&P 500 since the middle of October on China reopening optimism and broad cyclical outperformance.

According to the last 13F filings, hedge funds rotated within the tech sector, moving toward semis and away from application software and tech hardware. At the stock level, the largest drivers of these rotations were increased length in NVDA and TSM and decreased length in AAPL and TEAM.

Exhibit 16: Subsector tilts and changes in tilts

Subsector tilts and changes in tilts (GS research)

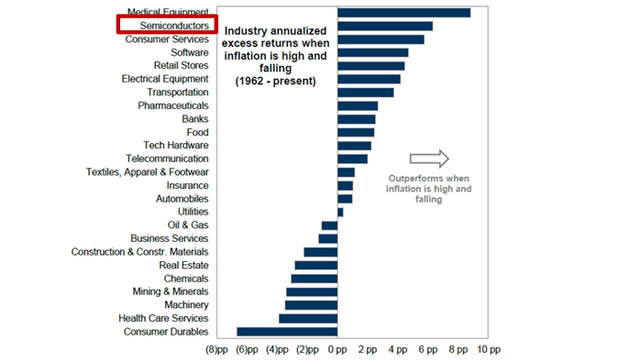

Furthermore, GS identified stocks within industries that typically outperform when inflation is high and falling. These include Medical equipment, Semiconductors, Consumer services, software, and retail stores. Each of these sectors outperformed its industry group on November 10th, the day of the recent CPI release when the S&P 500 jumped 6%.

As we can notice from the chart below, Semiconductors is highly leveraged to outperform in a decelerating inflation environment. In other words, Marvell is well-positioned for the next year.

Exhibit 17: Median monthly annualized industry returns

Median monthly annualized industry returns (GS research)

Investor takeaways

Marvell remains our top pick among fabless semiconductor suppliers benefiting from the continuing date-center & cloud growth and transition to increasing complexity of semiconductor custom design to meet all customer needs. We’re overweight MRVL due to high exposure to long-term secular trends and strong financials, which still provide reasonable upside.

But for now, it is possible to find a better entry point to buy this stock. Marvell’s share price is quite volatile, which provides us with the opportunity to buy in at the new lows, especially after expected mixed earnings, new widespread protests, and rising COVID case numbers in China. All this will likely trigger new supply-chain disruptions and dampen consumer demand, at least in the short term. Thus, we advise to add MRVL stock to the watch list.

Key risks

- Cyclical fears related to Enterprise Networking

- Supply chain dynamics

- Lumpiness in the certain cloud and/or 5G infra projects

- Stock-based compensation dilutes capital

- High China exposure (44% of sales).

Be the first to comment