JHVEPhoto

I’ve called Marsh & McLennan Companies (NYSE:MMC) overvalued in two separate articles as of now. The company is an appealing one but comes at a price reserved for the “premium reserve” of the stock market. It can be argued that Marsh & McLennan indeed deserves such a premium, but we should remain conservative in our investment approach given the company’s very modest yield and the current state of the market.

It’s time to update on MMC, and see what exactly we get here if we invest in the company.

Updating on Marsh & McLennan

The company, at its heart, is an attractive professional services business. I recently wrote an article on Aon (AON), and this company is in a very similar field. Both are brokers of insurance with asset management.

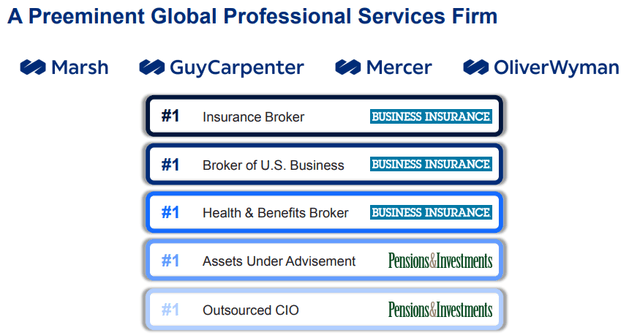

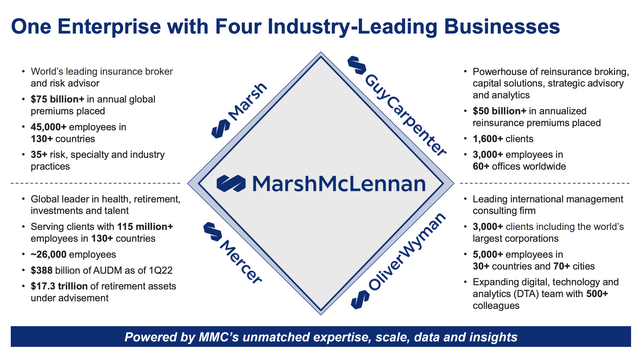

MMC Presentation (MMC Presentation)

MMC has annual revenues of over $17B annually for 2021, is one of the top 125 S&P constituents, has 76,000 employees, and clients in over 130 countries. Over $100B worth of premiums are placed globally, and the company holds over $350B worth of delegated assets under management, with $16T of retirement assets under management.

The company is the advisor to 95% of Fortune 1000 companies.

Its current business segments can be summed up as follows:

- Marsh, the company insurance brokerage and risk management.

- Guy Carpenter, a risk and reinsurance business/intermediary.

- Mercer, working in health, retirement, talent, and investment consulting

- Oliver Wyman, working with management consulting firms.

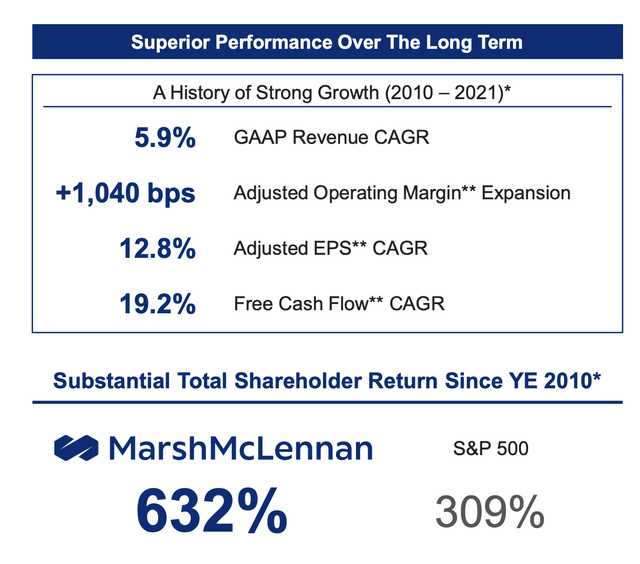

And these overall segments and the business have performed quite well. The company reported a strong underlying overall revenue growth, and actual margin expansion which puts the margin expansion growth record at 14 consecutive years, with a 1500 bps increase since 2008, and a substantial generation of FCF. The company generated $3B worth of FCF in 2021, and the CAGR since 2010 here is 19%.

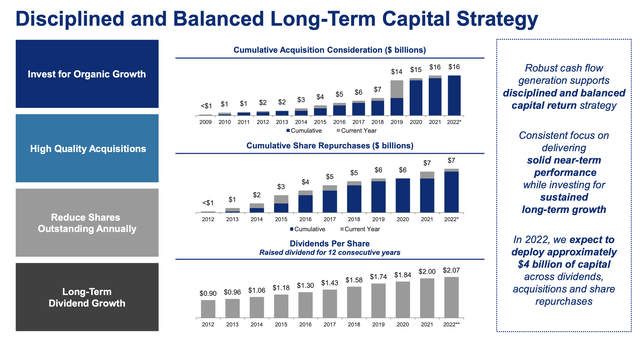

MMC is never, and likely will never be a massively-paying dividend company. It’s more akin to a conservative growth stock, but with a 1-2% yield – at best. The company’s continued prioritization is to invest in the business and, instead of high yields, recognize impressive capital returns over time, driving value.

One of the company’s main appeals is its through-cycle stability, when looking at averages. The company has what we can call durable drivers of demand growth, in insurance and service brokering. Again, similar to Aon. The company has averaged 6-9% CAGR in premiums as well as managed retirement assets over the past 20 years, which is why the outperformance on part of the company is so large.

It’s crucial for companies in MMC’s segment to keep their operations and their processes up to date. And like Aon, MMC should see significant growth from new business areas including Cyber Risk (a $1T market), protection gap issues, ESG issues, Health issues, retirement insurance and savings and the like. The company is actually shifting to a much more future-secure business mix, with Agency now being half of Marsh’s US/CAN segment, a close to-tenfold increase since 2009.

What is driving the company’s impressive margin expansion is a solid, conservative leverage and very cautious approaches to risk. The company also sees continued potential efficiencies being likely, with shared services, expansion on a global scale, alignment of procurement practices for efficiency, automation potential, and scaling investments that will improve scale advantages.

MMC and Aon both operate a very capital-light business model which has the result of generating significant amounts of free cash flow. The company uses this cash through a variety of ways, but dividends isn’t the company’s priority even if it has more than doubled in 10 years.

Instead, the company is reinvesting significantly, M&A’ing, and buying back shares. Take a look.

Even compared to Aon, MMC performs better. The broker-average return on the S&P has, since 2009 and the crisis, been 837%. MMC has returned 914%, which is close to twice the average of the S&P Property & Casualty insurance sector, and more than twice the S&P500.

The company is, and remains, a well-positioned leader in the industry with a proven track record of sustained revenue growth through expertise, enabling it to grow margins and profits as well. The company has a world-sized scale, deep management processes that make sure that things are done efficiently.

Combine this with low capital requirements in today’s macro, as well as best-in-class management and you might ask yourself why I, or other investors, are buying anything else except MMC.

There are reasons for this.

Many of the risks that we see with Aon are also there for MMC. The upside in new growth areas is potentially massive and appealing – yes. But we’re basing this on the assumption of accuracy for the TAM as well as that this will grow as much as the company expects.

In addition to the risk from new growth areas, there is also the simple fact of global macro pressure. While rising rates will ensure that some of the company’s incomes improve and that renegotiation for premiums is likely to be positive, it also comes with wage cost increases, service cost increases, and other factors that the company needs to offset.

And, in MMC’s case, even more than Aon, the company that we’re reviewing in this article is at a multiple that can only be described as “excessive”, even for a business as highly rated as this. Let me show you what I mean.

Marsh & McLennan – The valuation

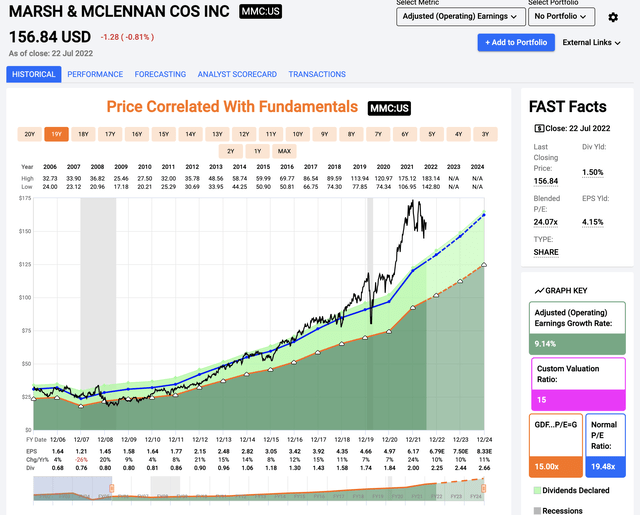

MMC’s valuation is a tricky prospect. I have no argument for the company trading at a premium – 19-22X would be something I could consider acceptable, with a yield of south of 1.8%. At that valuation, the double-digit growth rate presents us with an appealing 15-20% annual rate of return – at least potentially.

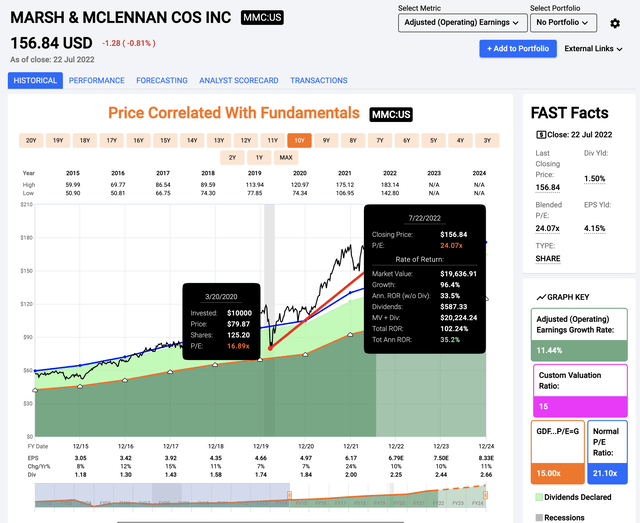

However, since bouncing back from pandemic lows, this company has been on an absolute tear that has left competitors and other companies behind. If you’d invested at pandemic lows of 16.8X, that return would have doubled your money in a little over two years. Not as much as certain growth-type stocks perhaps, but very impressive for a company like this – and indicative of what MMC can give you in safety and returns if you pay attention to the valuation.

However, valuation is a sword that cuts both ways. In low valuation, the potential for upside is great – but at a high valuation, the potential downside can kill your returns – for years, if you’re not careful.

Case in point, MMC. At 24X P/E, even the company’s growth rates of double digits can result only in an 8% annual rate of return if the 22X maximum P/E ratio is held – and I consider this far more likely than the exuberant 23X+ we’ve been seeing.

if we move down to 19-20X, that upside shrinks to as little as 2% annually. You won’t go negative unless it drops below 18X P/E, but all of these numbers account for the double-digit EPS growth the company is forecasting for the next 3 fiscals. This is not a good picture for a DGR investor.

The company is good at hitting targets. I believe 10% annually is more or less in the ballpark of what we will see unless something fundamental changes for the company. This is a business that, over the past 15-18 years has seen a growth trajectory for its EPS that is almost linear. It weathers through thick and thin and even wasn’t disrupted in the least by the pandemic years of 2019-2021. Instead, it grew.

MMC EPS growth (F.A.S.T graphs)

So, the only problem with this business is the valuation – unfortunately, it’s not a small problem. Not at this price.

Again, no argument against fundamentals. A grade credit rating, a high forecast accuracy, solid fundamentals, and every analyst and indication in the book saying that MMC will improve its earnings in 2021 and beyond. Still not enough to pay 24X earnings, in my book. The meager 1.5% yield which is below inflation and is a slow grower also isn’t really an argument here.

Peer comparisons shed further light on the overvaluation here. MMC trades at an NTM TEV to annual revenues of nearly 4.2X, with insurance peers like Aflac (AFL), Prudential (PRU), and MetLife (MET) trading around 1-2X, and P/Es that are less than half of the average weighted P/E of MMC, around 24-26X, depending on what numbers you’re comparing to.

Don’t care about peers/competitors? Look at analyst targets. S&P Global analysts give the company exuberant targets, which call for a range of $130 on the low side to $200 on the high side. Only 5 of the analysts are at a “BUY”, however, out of 16. The average PT from analysts here is $172.88, implying an upside of just north of 10%.

This is a rare stance from me because what I am essentially doing is actually parroting the analysts currently saying that the company is a “HOLD” here. I still believe them to be correct, however, calling the company overvalued.

The difference is the degree of overvaluation to consider here. Me, I wouldn’t buy MMC at anything above $130/share, and even that level would see me being fairly careful.

Thesis

I consider the following thesis relevant for MMC here.

- The company is a world leader in brokering insurance and policies, and with business areas of risk, strategy, and other adjacent businesses, this organization is going nowhere.

- With over 140+ years under its belt, this company is one of the largest out there in its respective businesses, and at a high valuation, this company becomes a no-nonsense “BUY” to me.

- However, at current valuations, I consider MMC no more than a “HOLD” at an overvaluation. I do not see how you can get a positive return from this company.

It’s not a business you should buy here. My 5 investment criteria are…

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has realistic upside based on earnings growth or multiple expansion/reversion.

MMC is a “HOLD” here, and I would caution anyone against investing capital into this overvalued business.

Be the first to comment