da-kuk/E+ via Getty Images

Overview of investment thesis:

As noted here, MMC shows several clues as to the presence of a durable business moat. Its capital-light business and dominant market position, implying relative pricing power, are strengths heading into an inflationary environment. Its performance for 2021 was exceptional, with EPS growing +20% as the fruits of its transformational acquisition in 2019 start to come into view.

The insurance broker market is relatively concentrated, at least in relation to those servicing the major commercial accounts. MMC has been growing mainly through a disciplined acquisition strategy, providing an “exit” to privately held agency and broker operations all through the world. It has consolidated a comfortable market-leading share (as measured by revenues and premiums placed) after the acquisition of JLT in 2019. Going forward, brokerage market share appears to be mostly fixed for the foreseeable future, as the failure last year of the no.1 and no.2 AON-WTW combination to clear regulatory hurdle on competition concerns points to little appetite for allowing further consolidation.

Intuitively, brokers benefit from scale of their networks. The larger the “reach” they have with end clients, the most attractive their placement capacity is with insurance writers. In the same vein, the larger the placement volumes, the more attractive they look to risk managers. This is a relationship business, with a large reliance on personal relationships, based on trust and expertise. Customer accounts then to be sticky.

With this in mind, I want to compare the relative attractiveness of MMC vs its closest rival, the UK-based AON (AON), a company I also like but have never owned.

Size:

Size matters, as stated above, because network effects matter. These relative size comparisons also extend to attracting talented employees, an important differentiator in a relationship-based business such as this. Especially the size of these two vs. the rest of major brokers. For example, by revenue, MMC is larger than no.3, no.4 and no.5 combined.

Marsh has the higher enterprise value $97Bln vs $80Bln for AON. This is underpinned by higher Revenue/EBITDA/Net Income ($20Bln/$5.5Bln/3.1Bln) than AON ($12bln/$3.9Bln/$1.3Bln) on a trailing twelve-month basis.

These comparisons are not exactly apples to apples. Marsh´s numbers include its consulting business, and AON´s profitability was impacted in 2021 due to merger termination fee and related costs. Regardless, the size and scale advantage belong to Marsh.

Size advantage: MMC

Balance Sheet:

Both companies show manageable debt levels. In AON´s case, debt has trended higher recently as it turned its focus to rewarding shareholders with buybacks. An understandable desire after the setback from the failed acquisition attempt.

Net debt is $9.8Bln for AON and $11.4Bln for Marsh. In relation to their EV´s, net debt is slightly higher for AON (12.2% of EV to 11.7%). Coverage ratios are slightly better for AON, given the lower rates in Europe.

Balance sheet advantage: none.

Profitability and returns:

MMC has increased diluted EPS from $2.13 in 2012 to $6.13 last year. For its part, AON earnings of $2.99 improved to $5.55 in 2021. However, earnings surpassed $8 in 2020 for AON, a year that lacked the merger termination fee. Taking the average of $7 (to smooth out the two outlier years), earnings have grown at a CAGR of 10% which is slightly below Marsh’s 12%. This levels of growth are impressive provided that they were delivered during a period of subdued GDP growth and generally soft insurance market conditions.

Profit and growth advantage: MMC, by a hair

Shareholder friendliness:

Dividend yields are low for both. Although 1.2% from MMC is double AON’s paltry 0.6%, they will not drive returns for a long time. This is one of those cases where it is hard to decide if a higher yield is better or worse for the owners. Both businesses have delivered very high returns on invested capital, making one hope that the large retention of earnings continues for many years to come. Let’s instead look at buybacks.

AON diluted shares outstanding in 2012 were 328m and are down to 226m by 2021, a 30% reduction. In contrast, MMC had 552m at the beginning of the same period and ended with 513m (only an 8% reduction). Moreover, AON has accelerated repurchases, albeit using debt, and Marsh has not repurchased meaningful amounts since 2019, choosing to manage its debt load lower after the JLT acquisition.

Advantage: AON

Valuation:

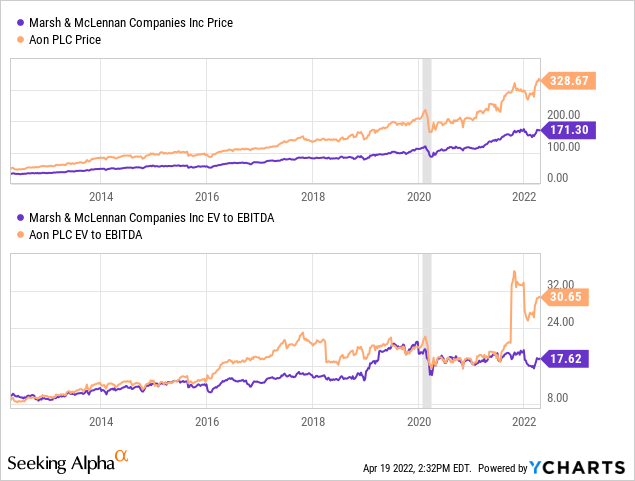

In one word, ouch. Businesses these good rarely come cheap. However, if EPS growth continues to grow at double digit rates, a prospect that is not hard to imagine given i) they have both achieved this in the past decade and ii) insurance markets are hardening relative to recent years; there is no reason for multiples to compress.

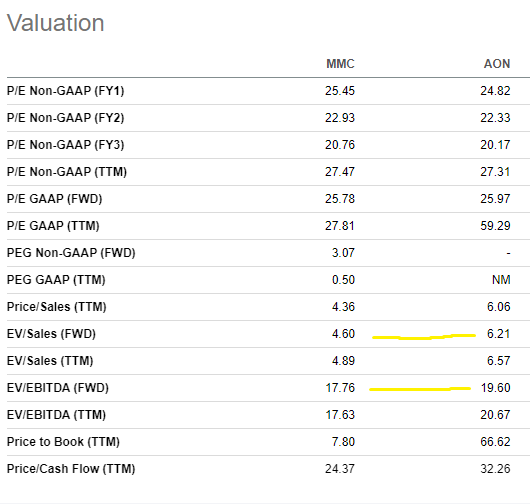

Valuation Metrics (Seeking Alpha)

The market is, not surprisingly, assigning similar valuations to both companies. MMC valuation seems a bit less stretched, especially when looking at price to sales, were the multiple is some 25% lower. Ignore BV ratios. Book Value becomes meaningless due to continued repurchase activity which decimates book equity while harming no one. As is the case especially for AON.

Marsh has and is likely to continue sporting a slightly lower multiple given its consulting business which captures lower margins. On the other hand, this business is less exposed to insurance market conditions and may provide greater stability in earnings compared to AON.

Conclusion:

If it were not for valuation, this race is too close to call. Allowing for valuation, I tend to favor Marsh due to its relatively lower multiples. I warn you this may be due to an unavoidable endowment effect, as I have owned it for more than five years. The main point here is perhaps that both are fantastic businesses, with good prospects despite inflation, and apparently growing moats.

Investing in stocks, we have the advantage that we can choose not to decide. It is ok to own both. Especially when dealing with market share leaders in relatively concentrated industries, why not? In a somewhat similar situation, I hold both S&P Global Inc. (SPGI) and Moody’s (MCO) shares. These two are another pair of moat-builders with pricing power to spare…and a story for another time.

To conclude, as the race for consolidation seems finished (for now at least), focus should return to small bolt-on acquisitions, organic growth and shareholder returns. All of this is happening against a backdrop of improving GDP growth, hardening insurance markets and new risk categories and service opportunities around Cyber/Climate, etc. It should be a profitable time to be a long term owner of either (or both!).

Be the first to comment