2Ban/iStock Editorial via Getty Images

The FinTech (Financial Technology) market is growing at a blistering pace, as consumers demand faster payments, frictionless experiences and lower costs. According to one study, the Fintech industry was valued at $112.5 Billion in 2021 and is forecasted to grow at a rapid 19.8% Compound Annual Growth Rate (CAGR), reaching $332.5 Billion by 2028. The number of Fintech Unicorns (valued over $1 Billion) has quadrupled in past 18 months and now totals 241.

Marqeta, Inc. (NASDAQ:MQ) is a modern card issuing and processing platform, which powers many of these Fintech unicorns’ card programs, from Square (SQ) to DoorDash (DASH), Coinbase (COIN) and even Uber (UBER). The company processed $125 billion in payment volume in the trailing 12 months, out of the $847 Billion card based payments market.

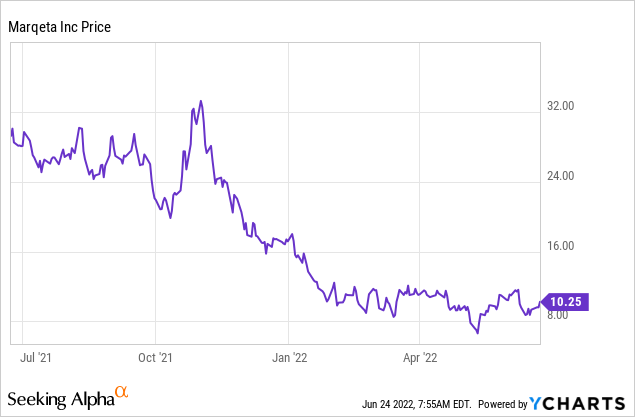

Marqeta was founded in 2010 and struggled to find product market fit until 2015. Since then, they have been growing revenues rapidly, at a 40% to 55% CAGR, which gave them the momentum to IPO in June 2021. The company went public at $31 per share, but since then the stock price has nosedived by 67%. This decline was mainly caused by the high inflation and rising interest rate environment. The macro environment has compressed the valuation multiples for all “Growth Stocks” because their valuation is weighted more toward future cash flow estimates. Despite this decline in share price, the company has had a strong quarter, with revenue growing by over 54%.

The stock is now undervalued intrinsically, according to my discounted cash flow model, while according to the company they are attacking a $30 Trillion total addressable market (“TAM”) across global card payments.

Let’s dive into the business model, financials and advanced valuation for the juicy details.

Modern Business Model

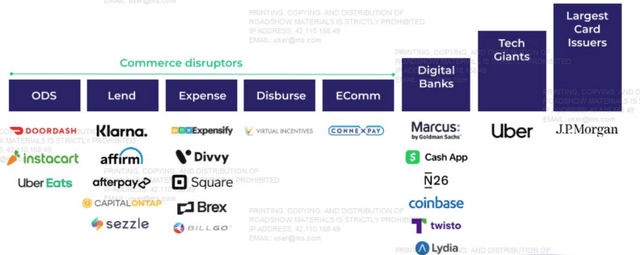

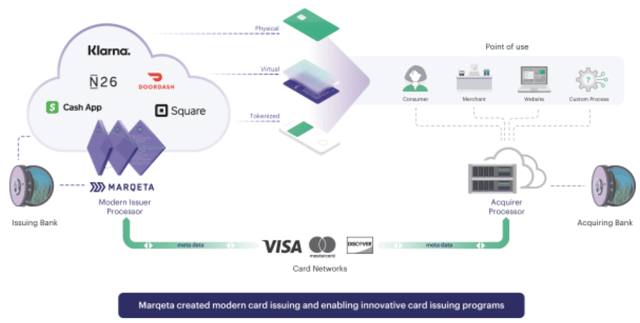

Marqeta is a modern card issuing and processing platform. Traditionally if a company wanted to build a card program, they had to go through incumbent banks. This was a time consuming, archaic and costly process with limited flexibility. Marqeta’s platform uses an Open API (Application Programming Interface), which puts the power of card issuing into the hands of the Fintech Innovators. The goal is to enable their elite Fintech customer base such as Square, DoorDash, Uber, Coinbase, Klarna and more to rapidly launch, globally scale and flexibly manage their modern card programs.

The company offers three main services:

- Card Issuing: This service enables physical, virtual and tokenized cards to be issued. These are the type of cards you see inside your Apple Pay or Google Pay mobile wallet.

- Processing: This involves Authentication of transactions (3DS secure), Spend Controls and even Just in time (JIT) funding, which can free up cash flow for businesses and reduce fraud.

- Applications: The Marqeta platform offers a full dashboard, which allows easy to use monitoring of transactions and configuration of services to suit the business needs.

Marqeta (Investor Presentation)

Customer Case Studies

Square

Marqeta has been working with Square (now called Block) since 2018. They are the backbone of the “Square Card” used with Square’s widely popular Cash App. This enables instant fund access for small business owners, which helps them to improve cash flow and manage business expenses. Square is the largest customer of Marqeta and generates approximately 70% of their total revenue.

DoorDash

A prime example of Marqeta in action is with DoorDash, the online food delivery company. The platform is the backbone of DoorDash’s Red Card Program, which is given to each “Dasher” (Delivery Driver) to pay for orders. The Just In Time Funding means the cards are loaded up with “just” the right amount to pay for an order and spending controls help to prevent fraud.

Doordash Red Card (Marqeta Customer Testimonial)

Coinbase

Coinbase Global is one of the most popular Crypto Exchanges in the world. The Coinbase Card (powered by Marqeta) enables users to spend their cryptocurrency in the real world.

Buy Now Pay Later (Klarna, Affirm, Afterpay)

Klarna is Europe’s leading Buy Now Pay Later (“BNPL”) provider. They used the Marqeta platform to launch a card program in just three months in Australia, whereas legacy technology would have taken much longer. Recently they announced the “Klarna Card” build on Marqeta which enables US Consumers to “buy now and pay later” anywhere with their “Pay in 4” solution both online and in stores. BNPL providers Affirm (AFRM) and AfterPay also use Marqeta’s platform for their virtual wallets and lending services.

JP Morgan

The world’s largest bank JPMorgan Chase (JPM) announced a partnership with Marqeta, for a Virtual Card system for their commercial clients.

Goldman Sachs

Goldman Sachs (GS)) is also partnered with Marqeta, in relation to their Digital banking, Marcus Platform.

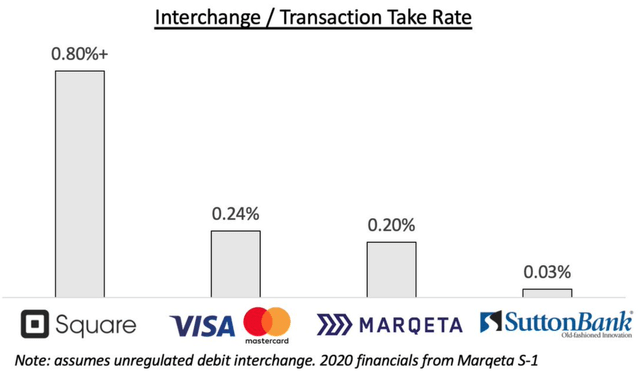

Revenue Model

Marqeta has a usage based model, which is based upon payment processing volume. Their revenue comes from charging Interchange Fees, Platform access fees, Fraud Monitoring services, ATM Fees and Tokenization services. Their revenue model is aligned with the customer’s incentives. As the more creative ways customers can increase payment volume, the more Marqeta and the customer benefits.

Marqeta Interchange fee (S1 Filing Data & James Ho Twitter))

Technical Model

Marqeta’s platform sits in the middle of Fintech Customers, card providers such as Visa, Mastercard, Pulse (Discover) and issuing banks. The unique thing about their platform is their Open API. This is a software engineer’s dream with great documentation, high reliability (99.9%) and even a Sandbox Environment for testing.

Growing Financials

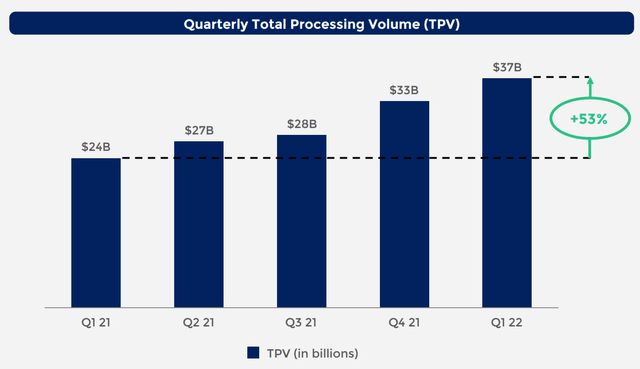

Marqeta generated some fantastic financial results for the first quarter of 2022. Total processing volume (TPV) was $37 billion, up a rapid 53% year over year. While net revenue was $166 million, up blistering 54% year over year.

Processing volume (Q1 Earnings Report)

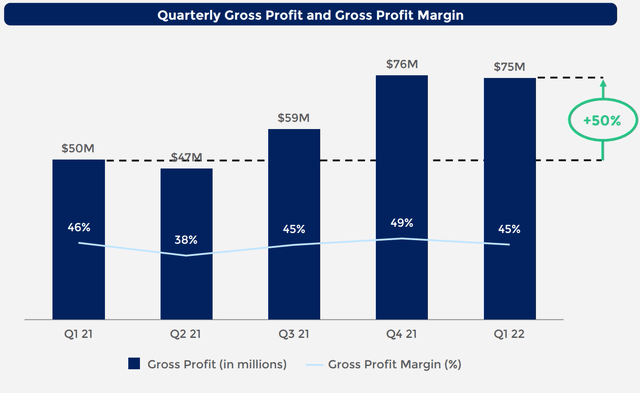

They generated Gross profit of $75 million for the first quarter of 2022, which was up by a rapid 50% year over year, which resulted in a gross margin of 45%. The gross margin was down slightly from the 49% seen in Q4, but still inline with the prior quarters.

Gross Profit (Q1 Earnings Report Supplement)

Marqeta did report a loss of $61 million and Adjusted EBITDA loss of $10 million in the first quarter of 2022. The company’s largest expense was compensation and benefits, which totaled $100 Million. While they invested $11 Million into technology, approximately double the prior year. Marketing expenses came in at $559 million, up only 12% year over year.

The company has a robust Balance Sheet with $1.2 billion in cash and cash equivalents, down approximately 4% from the prior year. In addition to $447 million in marketable securities. An analysis of the balance sheet shows no interest bearing debt, which is fantastic and just $11.6 million in operating lease commitments, presumably for their offices in Oakland, California, London, UK and internationally.

Advanced Valuation

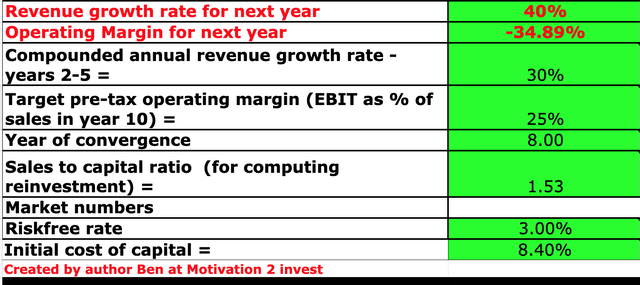

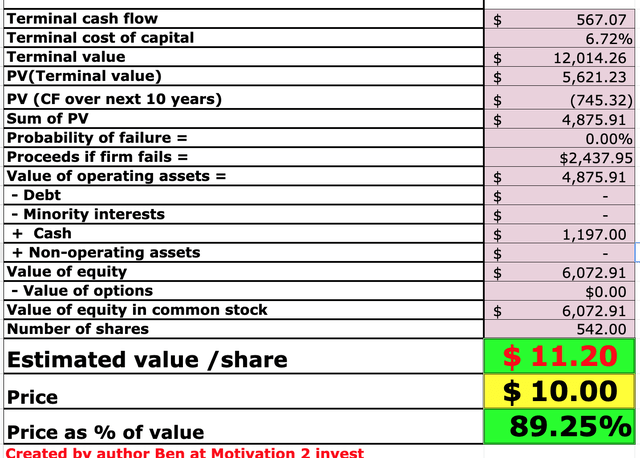

In order to value Marqeta, I have plugged the latest financial metrics into my valuation model, which uses the discounted cash flow method of valuation. I have forecasted 40% revenue growth for next year, which is at the conservative end of the company’s own guidance. In addition, I have forecasted 30% revenue growth for the next 2 to 5 years, which is also fairly conservative based on historic growth rates of 50%+, albeit from a lower revenue base.

Marqeta valuation (created by author Ben Alaimo)

I have forecasted the operating margin to increase to 25% in the next 8 years as the company scales, which is the average for the software industry.

Marqeta valuation model (created by author Ben Alaimo)

Given these factors I get a fair value of $11.2 per share which means the stock is ~11% undervalued at the time of writing.

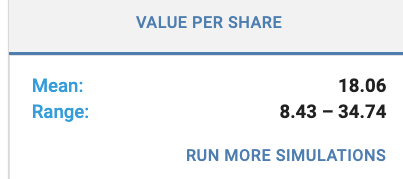

Monte Carlo Simulation

The above valuation is a fairly conservative estimate and thus to give you guys an overview of the range of outcomes, I have also done a Monte Carlo simulation (below). I have forecasted revenue to grow at a range between 20% (0.2) to 60% (0.6) per year for the next 2 to 5 years.

Monte Carlo Simulation 1 (created by author Ben Alaimo) Monte Carlo Simulation 2 (created by author Ben Alaimo)

Given these factors I get a valuation range of between $8.43 in the slow growth scenario and up to $34 per share for the higher growth (best case) scenario. This gives me a mean valuation of $18/share, which means the stock has an upside of approximately 80%.

Risks

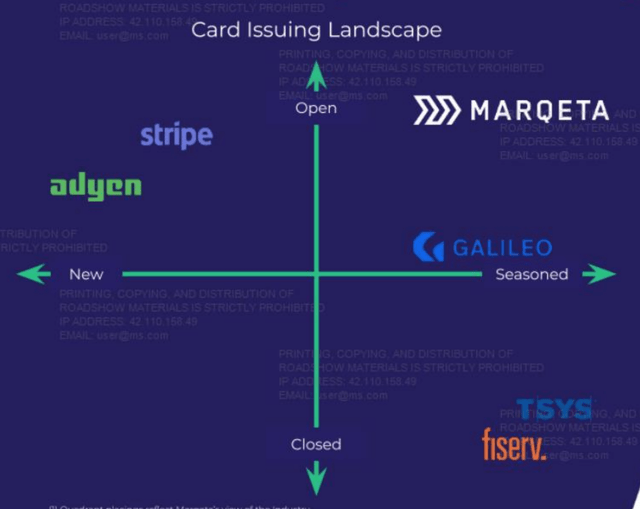

Competition Analysis

Marqeta has a best in class and user-friendly card issuing platform. However, they are not alone in the market. The company’s main competitor in Open API card issuing is Galileo Financial Services, which was acquired in 2020 for $1.2 billion by Fintech giant SoFi. Although a smaller player than Marqeta, Galileo’s platform powers card programs at Robinhood (HOOD), Monzo (own, Paysafe, Transferwise (LSE: WISE) and even European Fintech giant Revolut, which recently valued at $33 Billion.

Other competitors include payments giant Stripe (recently valued at a staggering $95 billion) and offer Virtual Card issuance to customers such as Postmates. In addition, Holland based Adyen (AMS:ADYEN) (OTCPK:ADYEY) often referred to as “the PayPal of Europe” also offers card issuing. The good news for Marqeta is for the other companies, card issuing is just one product line and thus they may not be as focused on capturing market share, which seems to be the case so far.

Competitors (Marqeta Investor presentation)

Square is their largest customer

Square is Marqeta’s largest customer, with their Cash app card. This has been a blessing for Marqeta so far as they have ridden the wave of increasing transaction volume in the cash app. However, if Square’s Cash App Card starts to slow down in usage or they decide to use alternative technology, that is a risk to the company, although there is no sign of this yet.

Consumer Spending may slow down

The annual inflation rate in the US accelerated to 8.6% in May 2022 and has consistently been much higher than the Fed’s 2% target since early 2021. Inflation squeezes the consumer with higher food, Gas and electricity costs. The Ukraine-Russian War has only exasperated rising energy costs and higher interest rates will make mortgage payments more expense for households and reduce surplus income for consumers.

Economics 101 states higher costs equals lower demand. As many of these Fintech companies make their revenue based on transaction volume, less volume equals less revenue. Although I believe this is only a temporary issue (until inflation subdues), it is a still a risk for all businesses.

Final Thoughts

Marqeta is a rapidly growing technology company, which has a best in class system for modern card issues. Their platform is already powering many Fintech disrupters and they are set to continue to grow strong. The recent macro economic climate of high inflation and rising interest rates has lowered the valuation of all “growth stocks.” However, the stock is now undervalued intrinsically and thus looks like a great long-term investment and opportunity for Growth At A Reasonable Price (GARP).

Be the first to comment