As I was researching fintech companies such as Block (SQ), Affirm (AFRM), and Coinbase (COIN), I discovered that these top-notch companies have a common denominator: Marqeta, Inc. (NASDAQ:MQ). Out of curiosity, I dug deeper into the company. I soon found out that the more I read about the company, the more bullish I became. Here’s a deep dive on Marqeta. Enjoy!

Investment Thesis

Richard Drury/DigitalVision via Getty Images

Marqeta is disrupting the issuing-facing side of the payments ecosystem through its modern, cloud-based, open API card issuing platform. As a result of its being the first-mover and a true innovator, many of the largest disruptors in the world today are working with Marqeta to enhance their end users’ payment experience. These disruptors are top dogs in their respective industries – aces in a deck of cards. As such, buying shares of Marqeta is like being a proponent of all these disruptors – holding a deck of aces, so to speak.

Despite all the competition, Marqeta remains the global standard for modern card issuing. Furthermore, its technology, network effects, and switching cost moats should sustain its position as the leader in modern issuer processing.

Shares are trading cheaply. Marqeta, in my opinion, is a Strong Buy.

Value Proposition

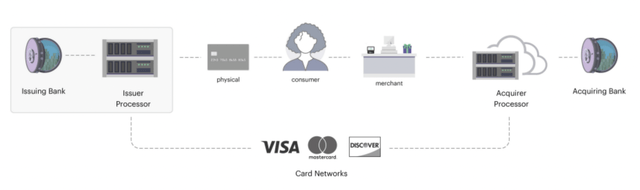

In order to fully understand Marqeta’s value proposition, let’s define some key terms related to the payments industry. In a card transaction, seven parties are typically involved:

- Cardholder: the consumer (individual or commercial) that uses a physical, digital, or virtual payment card to perform a transaction.

- Merchant: the business receiving payment for a good or service from the paying cardholder.

- Issuing Bank: the financial institution that issues a credit, debit, or prepaid card to a consumer either on its own behalf or on behalf of a card program provider. Issuing banks also hold licenses with card networks and therefore, are able to facilitate transaction settlement.

- Acquiring Bank: the financial institution that merchants use to hold funds, manage their businesses, and receive payments from cardholders. It is also known as the merchant bank.

- Issuer Processor: the payment processor that connects the issuing bank with a card network to authorize and facilitate payment transactions. Marqeta is an example of an issuer processor.

- Acquirer Processor: the payment processor that connects the acquiring (or merchant) bank with a card network to facilitate payment acceptance. Branded payment gateways such as PayPal (PYPL), Apple Pay (AAPL), or Stripe may also be involved to facilitate these transactions.

- Card Network: provides the infrastructure for settlement and card payment information. Card networks such as Visa (V), Mastercard (MA), and American Express (AXP) act as the bridge between issuer processors and acquirer processors.

The diagram above shows what a legacy payment system looks like.

With that out of the way, let’s dig into what Marqeta offers to its customers.

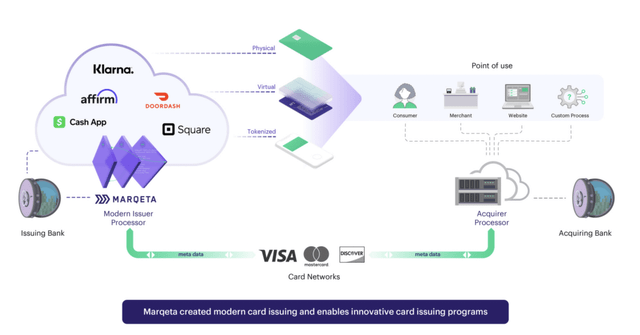

In a nutshell, Marqeta is a modern card issuer and processor, powered by its cloud-based, open API platform. In essence, Marqeta aims to disrupt the issuing side of the traditional payment system.

Mission: To be the global standard for modern card issuing, empowering builders to bring the most innovative products to the world.

Marqeta allows businesses to offer customized payment card products to their customers without having to deal with an issuing bank. Its solutions are highly configurable, scalable, and simple, empowering businesses to launch and manage card programs quickly and efficiently. This avoids an otherwise slow, complex, and costly process were these customers to choose the traditional route of card issuing. This is made possible through its easy-to-use, cloud-based, open API platform, which is integrated with partnering issuing banks and card networks.

Marqeta partners with issuing banks, such as Sutton Bank, to provide card programs to its customers. In addition, Marqeta works with card networks such as Mastercard, Visa, and Pulse, to ultimately authorize, process, and settle transactions between issuing and acquiring banks.

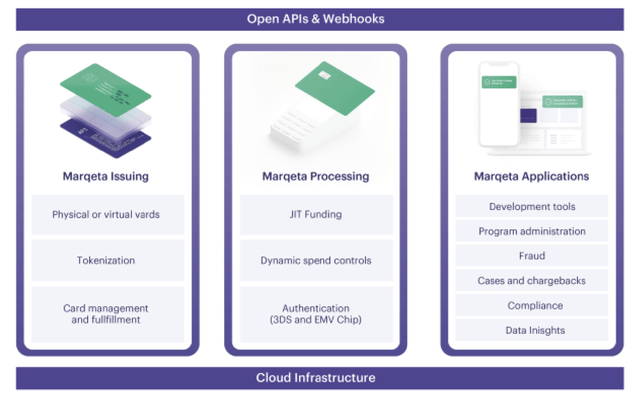

Central to its business model, Marqeta ‘s value propositions fall under three modules: Marqeta Issuing, Marqeta Processing, and Marqeta Applications.

Marqeta Issuing

- Physical or Virtual Cards: With Marqeta’s issuing platform, customers can build, test, and launch custom card programs easily and quickly. Customers can securely embed virtual cards into their apps or create physical debit, credit, and prepaid cards finished with their own branding as well as security features such as magnetic stripe, NFC, and EMV chip.

- Tokenization: In 2020, Marqeta launched its Tokenization as a Service offering, allowing card issuers to securely and instantly provision existing cards into mobile wallets such as Apple Pay, Google Pay, or Samsung Pay. Tokenization is the process of protecting customers’ sensitive data by replacing it with tokens, which are random strings of characters that are useless to hackers. For example, J.P. Morgan (JPM) adopted Marqeta’s Tokenization as a Service to power its virtual card program.

- Card Management and Fulfillment: Customers can configure cards with open API, defining how and where a card can be used. For instance, cardholders may only have the authorization to use a card at a certain location, for a certain amount, or for a certain number of times. Among other things, customers can also order, activate, set expiration dates, suspend, and terminate cards.

Source: Marqeta Website

Marqeta Processing

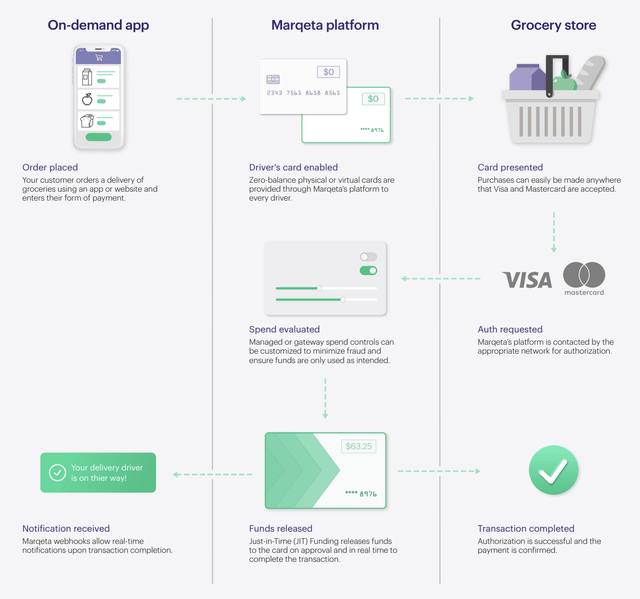

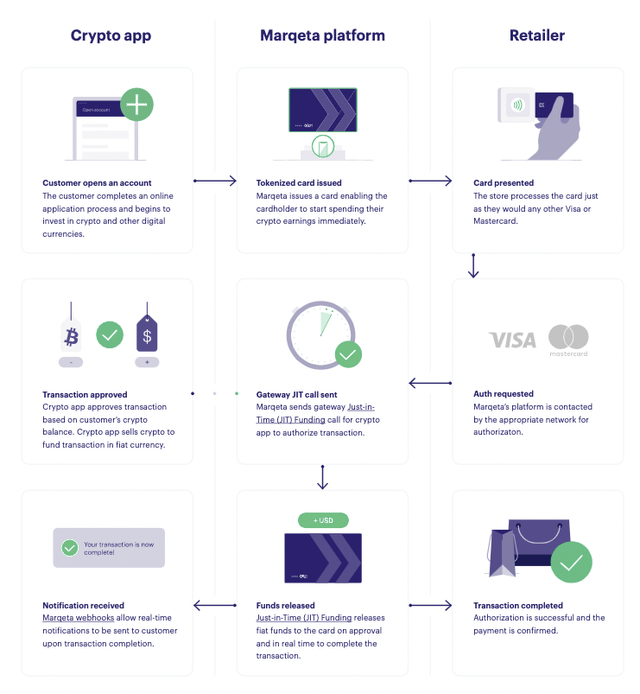

- Just-In-Time (JIT) Funding: Traditionally, cardholders need to preload funds to an amount that satisfies a transaction. JIT funding, pioneered by Marqeta, involves automatically authorizing and funding transactions in real-time. The card maintains a zero balance until the card is approved based on the rules set by the customer. Only then will Marqeta automatically move funds from the customer’s funding source into the appropriate account. JIT funding helps reduce fraud. For example, DoorDash (DASH) uses JIT Funding to only allow Dashers to use their Red Cards to perform transactions at a specific restaurant, for a specific order, at a specific dollar amount, during a specific time window, and when they pick up an order. The below diagram shows the workflow when an on-demand delivery company like DoorDash executes JIT Funding.

- Dynamic Spend Controls: As mentioned in the previous bullet point, customers are able to configure spend controls by setting rules to limit where and how their end users can transact. For example, a company employee can be authorized to purchase food at restaurants in their office buildings during weekdays but not on weekends.

- Authentication: Marqeta’s platform and cards provide a secure way for cardholders to perform transactions. Authentication tools such as PIN, EMV chip, and 3D Secure help minimize fraud. At the same time, real-time notifications via webhooks or push notifications not only provide real-time updates to end users but can also notify them of every transaction that has occurred under their cards

Marqeta Applications

- Development Tools: Marqeta provides developers with a complete set of tools including a private sandbox, APIs, SDKs, widgets, and documentation to build, test, and launch their card programs.

- Program Administration: Customers can manage their card programs, configure settings, monitor transactions, report lost or stolen cards, and more.

- Fraud: Customers can minimize the risks of fraud by configuring dynamic spend controls and defining authentication protocols.

- Cases and Chargebacks: Customers can manage cases, resolve disputes, track chargebacks, and receive automated updates from the card networks.

- Compliance: Marqeta’s solutions are compliant with the Payment Card Industry Data Security Standard (PCI DSS), 3D Secure, and data security and privacy industry regulations, so customers can focus on innovation and customer experience rather than constantly stress about regulation.

- Data Insights: Customers get access to insightful data and reports so they can identify patterns, monitor program details, and more, to make data-driven decisions.

To recap, Marqeta offers an easy-to-use, cloud-based, open-API platform for customers to issue customized card programs for their end-users. With its modern architecture, customers can launch card programs within a few weeks or months, a much better alternative to taking the traditional route: approaching issuing banks and legacy processors like Fiserv (FISV) and FIS (FIS), which could take years and millions of dollars to launch a card program.

In an increasingly digital and constantly changing world, companies can’t afford to waste all those time, money, and energy to launch a card program. That’s where Marqeta comes in.

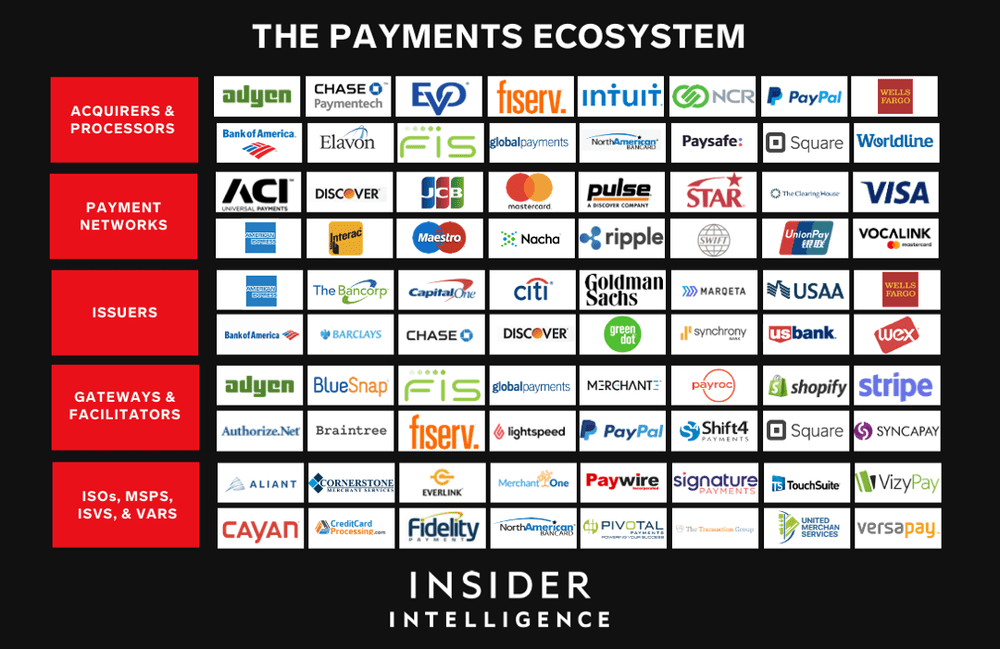

Market Opportunity

Marqeta aims to disrupt the issuing-facing side of the payments ecosystem, which has seen little innovation thus far, compared to the acquiring-facing side. According to Marqeta, there are approximately 300 acquiring banks in the US alone, while there are only approximately 200 issuer processors globally. The diagram below shows some of the major players in the payments ecosystem. Notice how the “Issuer” category is largely dominated by legacy financial institutions while other categories show many other fintech players like Adyen, PayPal, and Square. Marqeta is the only bold disrupter on the issuing-facing side.

Source: Insider Intelligence

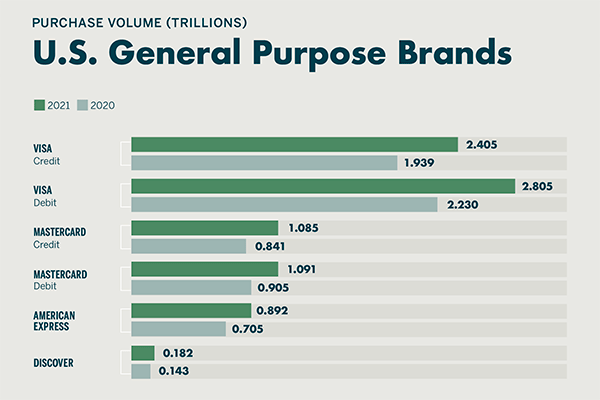

According to a Nilson Report, the card network brands generated $8.5 billion of purchase volume in 2021 in the US, which is up 25% YoY. In FY2021, Marqeta generated $111 million of Total Processing Volume, or TPV, which is just 1.3% of the total volume. Clearly, there is plenty of room for Marqeta to grow.

Source: Nilson Report

Looking at the payment industry as a whole does not paint a full picture of Marqeta’s growth potential. This is because Marqeta serves a specific set of customers, more specifically, customers that are disruptors themselves. These customers are all growing rapidly, which should translate to robust growth for Marqeta as well. Therefore, it makes more sense to evaluate Marqeta’s market opportunity by assessing its customers’ market opportunity.

Digital Banks

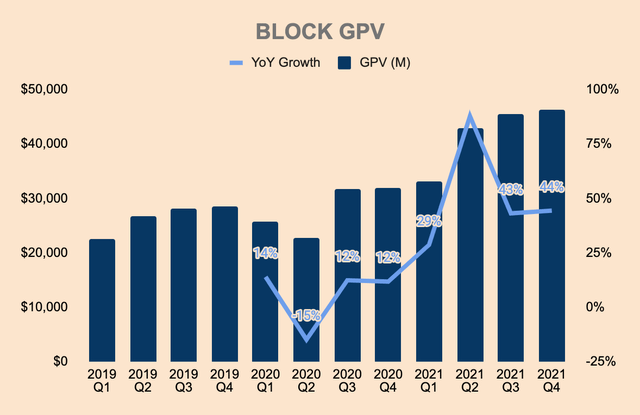

This is Marqeta’s largest customer segment due to Block (SQ) being its largest customer. Marqeta powers Block’s Cash App and Square Card. In FY2021, Block generated Gross Payment Volume of $168 billion, a 49% increase from last year. Block mentioned in their Q4 earnings update that there were 44 million+ Cash App users, with 13 million+ of them being active Cash Card users. As Block’s Square Seller and Cash App Ecosystem grow, so does Marqeta.

Source: Block Investor Relations and Author’s Analysis

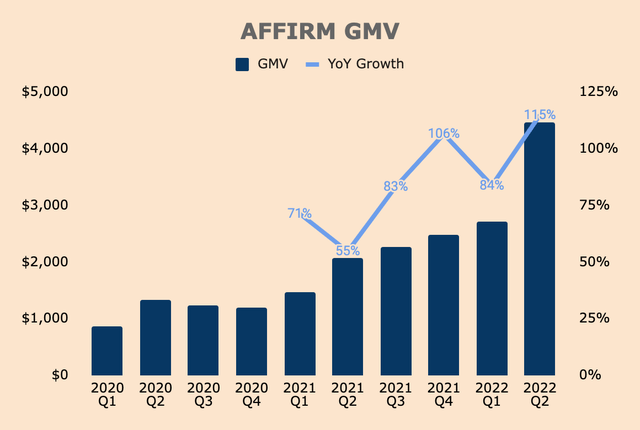

Another customer segment that has seen rapid growth lately is the buy now pay later (BNPL) space. The biggest BNPL players in the world use Marqeta, including Affirm, Afterpay, Klarna, and Sezzle. I recently wrote a deep dive on Affirm if you are interested in learning more about the BNPL business model. Below, you can see Affirm’s Gross Merchandise Value growth, which totals about $12 billion in the TTM, a double from the same period a year ago. It just recently announced a partnership with Amazon (AMZN), which should supercharge its growth. Furthermore, Affirm is close to launching its Debit+ Card, which is also issued by Marqeta. With these developments in mind, Affirm’s hypergrowth will trickle down to Marqeta’s top and bottom line. Not only for Affirm but other BNPL providers as well.

Source: Affirm Investor Relations and Author’s Analysis

On-demand services

These providers, such as DoorDash, are also growing rapidly. Work-from-home trends and the growth of the gig economy spurred the massive adoption of on-demand services. In FY2021, DoorDash processed $42 billion of Gross Order Value. Instacart, a $24 billion company, is also a customer of Marqeta. Uber Eats (UBER) and Uber Freight are also using Marqeta.

Crypto

How about the cryptoeconomy? No problem. Marqeta has it covered. In October last year, Marqeta announced new partnerships with the leading crypto wallets/exchanges, including Coinbase, Fold, Shakepay, and Bakkt (BKKT). They will use Marqeta’s card issuing platform and JIT Funding feature to launch Visa debit cards that allow users to spend their crypto balances at the point of sale. I’m not sure how to quantify the market opportunity in the cryptoeconomy but we can all agree that it can be huge. Really huge. The diagram below shows how Marqeta enables crypto spending.

Corporate card providers and expense management firms

These companies, such as Ramp, Divvy, and Brex, are also working with Marqeta to build their own card programs. Again, these are not small companies – Ramp, Divvy, and Brex were valued at $8.1 billion, $2.5 billion, and $12.3 billion, respectively.

Big Companies

Not only that, tech giants such as Google Pay and legacy financial institutions like J.P. Morgan, Citi Commercial Cards (C), Goldman Sachs’ Marcus (GS), are flocking to Marqeta to power their digital banking ambitions.

These are just some of the industries that Marqeta powers. There are other use cases but I don’t want to bore you with too many details. The point is, the market opportunity for Marqeta is massive. As Marqeta puts it:

You see a card. We see endless possibilities.

Business Model

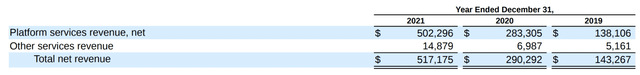

Marqeta separates total Revenue into two components: Platform Services Revenue, Net and Other Services Revenue.

Platform Services Revenue, Net

This area includes interchange fees and ATM processing fees, net of Revenue share payments. Interchange fees are volume-based fees earned on card transactions processed by Marqeta. This interchange fee will then be split among the different players in the payment network, in the form of Revenue share agreements.

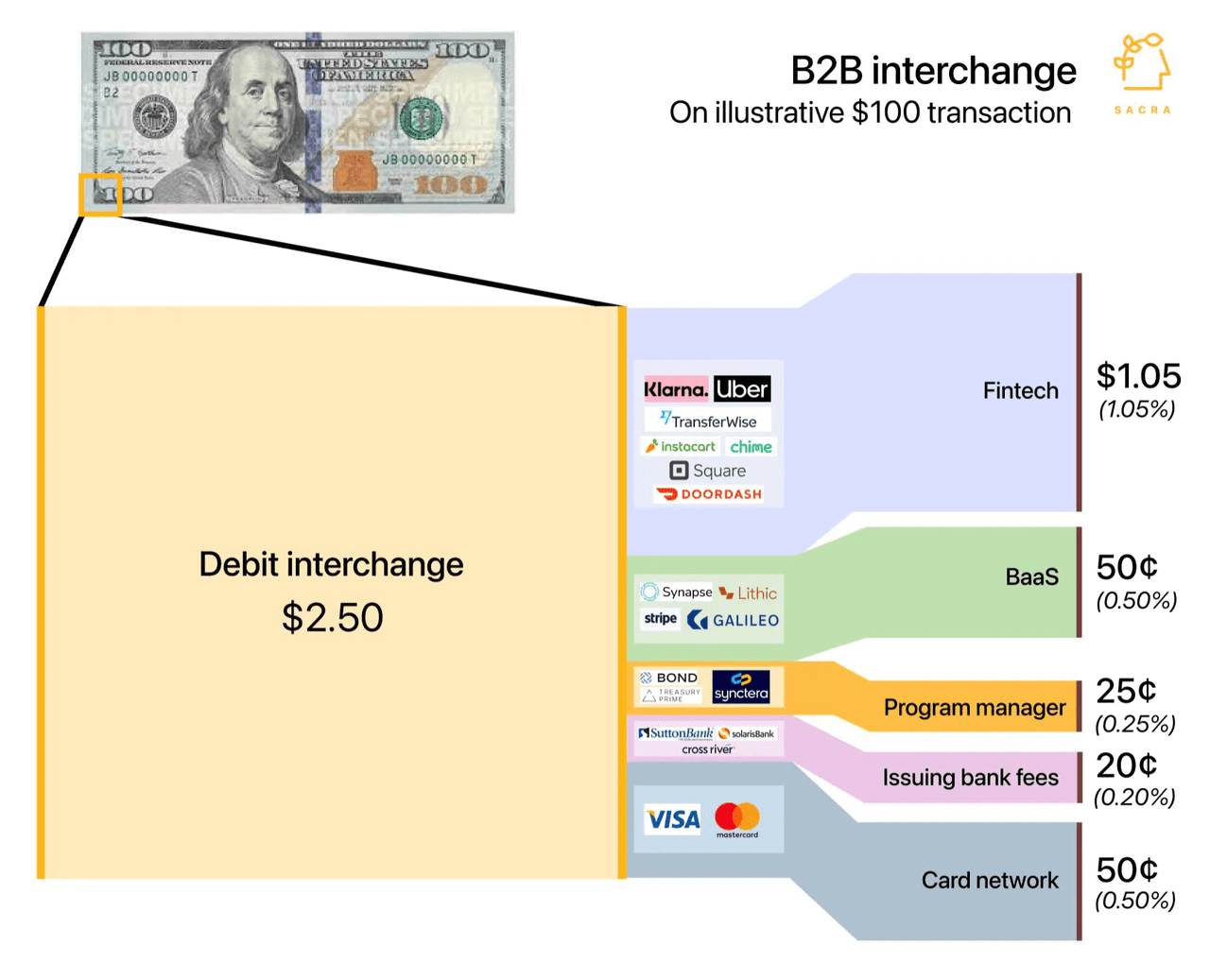

An article by Sacra does an excellent job in illustrating this interchange fees dynamics. Let’s say you want to buy $100 worth of products via the Affirm app. The merchant (not Affirm) pays a percentage of that $100 in debit interchange fees, say 2.5%. This is how the interchange fees will be split among the different players:

- 1.05% of Merchant Discount Rate fee for using the fintech platform (e.g. Affirm, Uber, and Square)

- 0.50% to the Banking-as-a-service provider for processing the payment (e.g. Stripe, Marqeta, and Galileo)

- 0.25% to the program manager

- 0.20% to the issuing bank (e.g. Sutton Bank, which is Marqeta’s partner bank)

- 0.50% to the card network in exchange for using their payment rails (e.g. Mastercard and Visa)

Source: Sacra

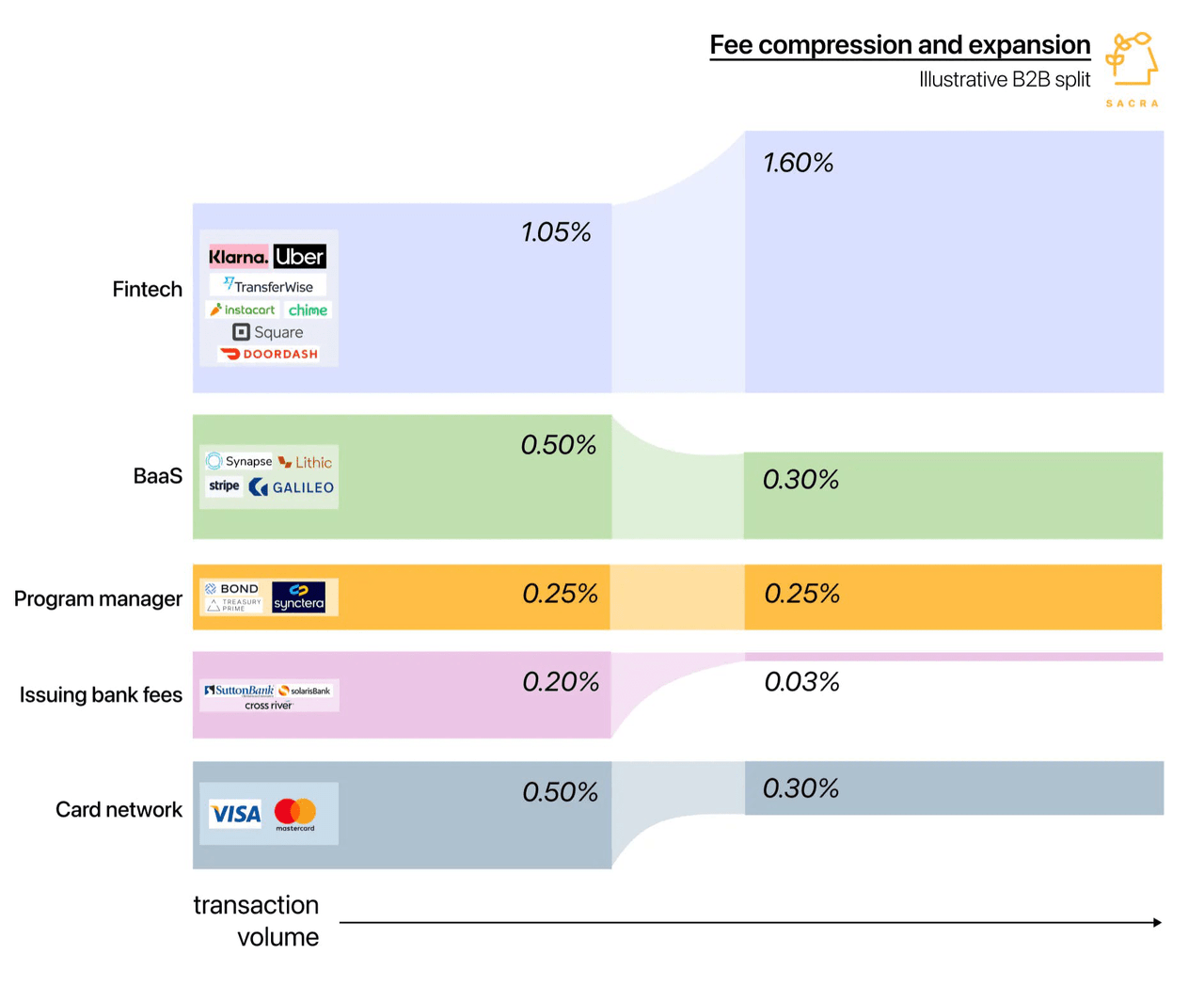

Marqeta employs a usage-based model, so as payment volume increases or decreases, so does Marqeta’s Revenue. This way, Marqeta is aligned with its customers’ growth. In addition, Revenue share agreements may enable a customer to earn a higher portion of the interchange fees if the customer processes higher volumes through Marqeta’s platform. Therefore, customers are incentivized to grow and move as much money as possible through Marqeta’s platform. As you can see in the diagram below, the fintech platforms gain higher fees as volume increases while BaaS providers like Marqeta earn a lower percentage of the interchange fee.

Source: Sacra

You may also notice that the issuing banks and card networks earn lower percentages as well, as volume increases. This is because Marqeta has separate incentive agreements with the issuing banks and card networks as well. As higher processing volume tiers are achieved, Marqeta’s fee as a percentage of processing volume declines. This is reflected in Marqeta’s cost of Revenue, which consists of card networks costs, issuing banks costs, and card fulfillment costs.

Put simply, Marqeta’s business model is volume-based – the higher Revenue share for customers as a result of a higher payment volume is partially offset by lower fees to the partnering issuing banks and card networks. As such, all parties involved are aligned together.

Other Services Revenue

This area primarily consists of card fulfillment fees. The table below shows the different components of Revenue.

Growth

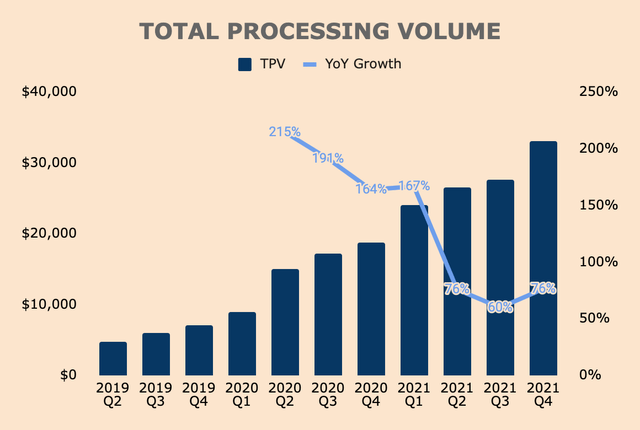

Q4 TPV grew 76% YoY to $33b. This was an acceleration of Q3’s growth of 60%. For FY2021, TPV was $111b, an 85% increase YoY. TPV growth was primarily due to:

- FY2021 TPV for Top 5 customers grew 70% YoY. Square launched Square Card in Canada.

- FY2021 TPV for Non-top 5 customers grew 230% YoY

- BNPL grew 50% sequentially from Q3. BNPL makes about 10% of TPV. Klarna also launched in 13 new European markets in November.

- Expense management also saw increased volume. Divvy, which was acquired by Bill.com (BILL), approached $2 billion in TPV in Q4.

- Total customers were 200+ in 2021, versus 160+ in 2020.

- FY2021 Net Revenue Retention, or NRR, was 175%.

Source: Marqeta Investor Relations and Author’s Analysis

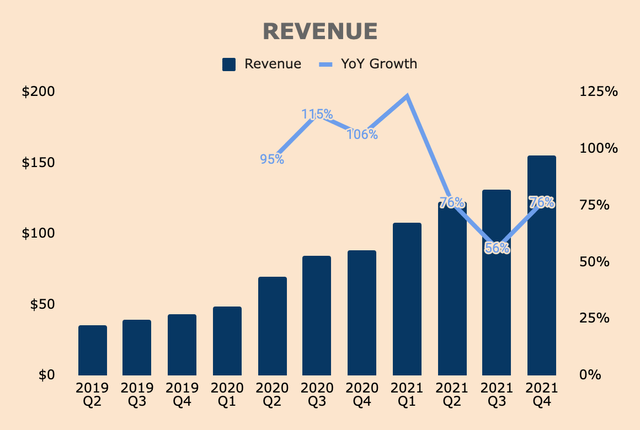

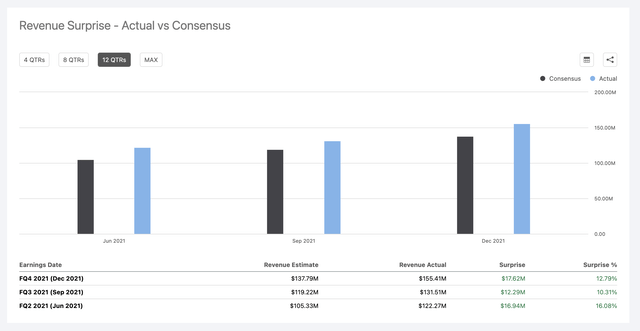

As a result of robust TPV growth, Q4 Revenue grew 76% as well, to $155m, beating analyst estimates by 13%. For the full year, Marqeta generated $517m in Revenue, up 78% YoY.

Source: Marqeta Investor Relations and Author’s Analysis

If you haven’t noticed FY2021 TPV grew 85% while Revenue only grew 78%. This is due to higher Revenue share for customers as they process higher TPV, which again, is netted out of Platform Services Revenue. Nonetheless, Marqeta is showing strong growth on multiple fronts. The company should continue to grow both its top and bottom lines as its disruptive customer base continues to grow as well.

Profitability

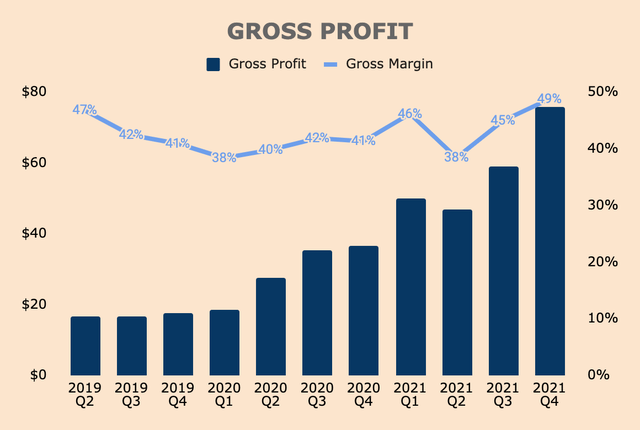

Turning to profitability, FY2021 Gross Profit grew 97% YoY to $232 million. Q4 Gross Margin of 49%, which happens to be above the long-term range of 40-45%. As opposed to Revenue growth, Gross Profit is growing faster than TPV due to three reasons:

- Network fees paid to the card networks only grew 68% due to higher card network incentives for hitting specific volume tiers throughout FY2021. The higher volume tiers were not reached during FY2020.

- Issuing bank fees also grew by a mere 38% as Marqeta pays lower fees as a percentage of TPV as TPV grows.

- Favorable TPV mix during the holiday season.

Source: Marqeta Investor Relations and Author’s Analysis

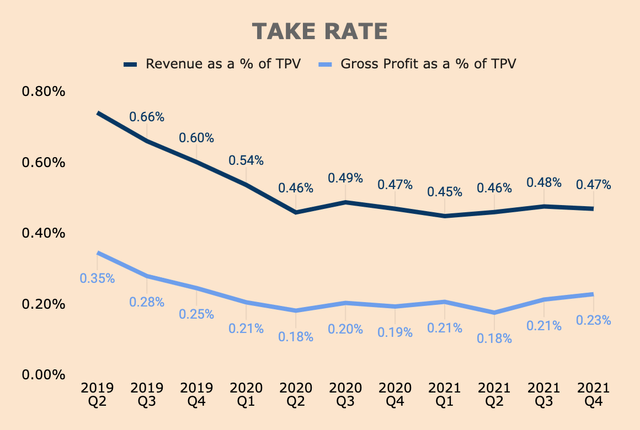

As you can see below, Revenue Take Rate has been declining as Revenue share agreements favor customers as they process higher TPV. The rapid decline in Revenue Take Rate in FY2019 may also be due to Block contributing a larger proportion of TPV. Since then, Revenue Take Rates have stabilized as Block’s concentration continues to drop and TPV diversification positively affects Marqeta.

Source: Marqeta Investor Relations and Author’s Analysis

On the other hand, Gross Profit Take Rate grew slightly over the last few quarters due to higher card network incentives and lower fees paid to issuing banks. In my opinion, Gross Profit Take Rate and Gross Margin are important metrics to watch as it shows the potential for economies of scale – the higher the metric, the better.

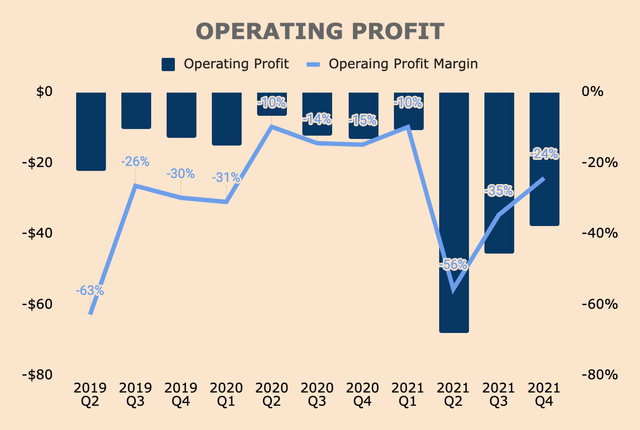

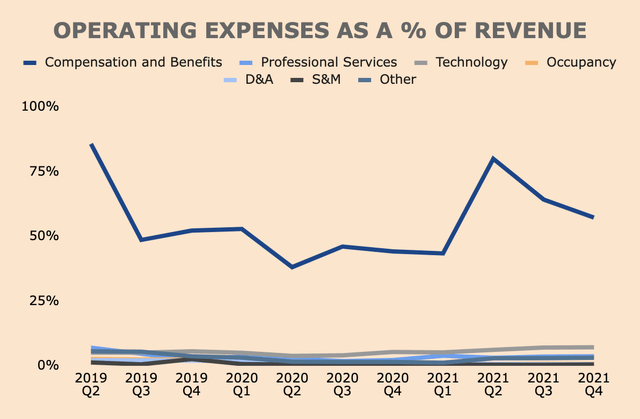

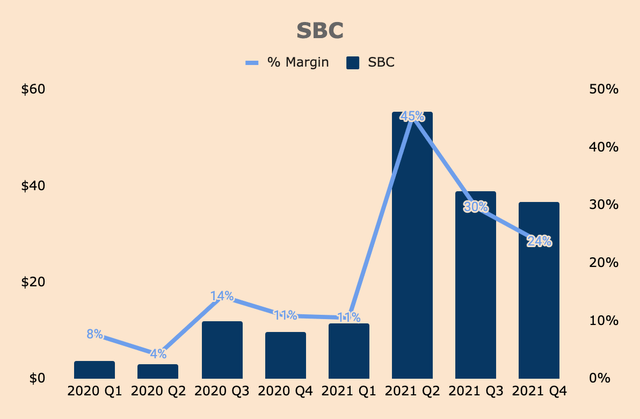

Operating Expenses, on the other hand, grew 139%, to $394 million in FY2021. This is largely due to increased headcount, R&D, and professional services as Marqeta invests more in growth, particularly in expansion to other verticals and geographies as well. As a result, Operating Profit is still negative, pressured by high SBC expenses.

Source: Marqeta Investor Relations and Author’s Analysis

It is important to note that the majority of operating expenses come from Compensation and Benefits. The company dedicates very little capital to Sales & Marketing. Given strong Revenue growth despite low Sales & Marketing Expenses, there’s a lot to like about the operating leverages that Marqeta is getting.

Source: Marqeta Investor Relations and Author’s Analysis

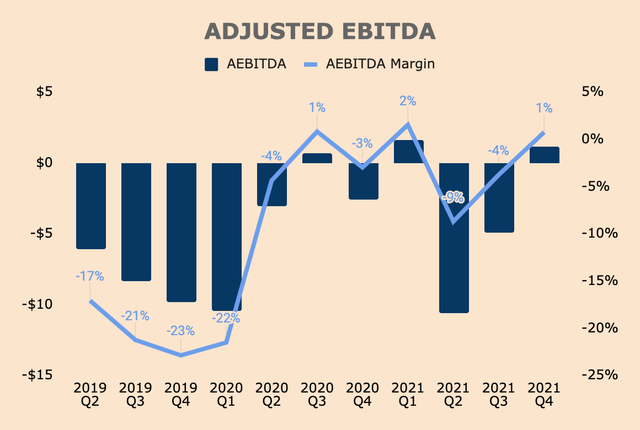

Adjusted for non-cash and one-time expenses, Marqeta is already profitable on an Adjusted EBITDA basis.

Source: Marqeta Investor Relations and Author’s Analysis

All in all, Marqeta’s business is experiencing hypergrowth without incurring massive losses. Margins and Take Rates are also showing strength which demonstrates economies of scale and operating leverage.

Financial Health

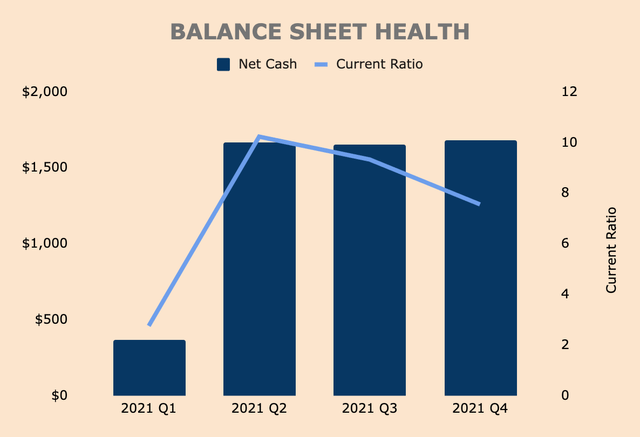

Marqeta has a strong balance sheet with a net cash position of $1.7 billion. This ramp-up of cash position is, of course, due to its recent IPO, which provided net proceeds of $1.3 billion. Marqeta’s Current Ratio is also high at about 8x, which shows high liquidity.

Source: Marqeta Investor Relations and Author’s Analysis

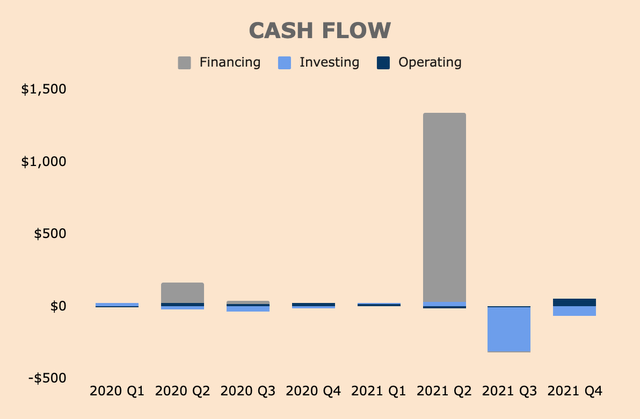

Cash Flow activities are pretty boring. The only major activities were cash provided from the IPO as well as cash used to purchase marketable securities.

Source: Marqeta Investor Relations and Author’s Analysis

Typical of a recently-IPOed company, Share-Based Compensation is unsurprisingly high, but this should trend downwards over time.

Source: Marqeta Investor Relations and Author’s Analysis

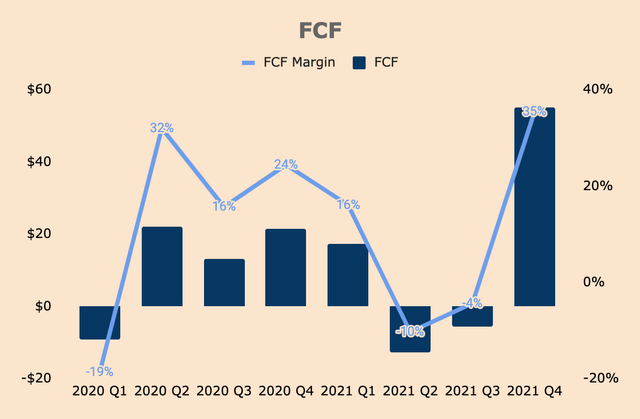

Most importantly, Marqeta is already a Free Cash Flow-positive business, with FCF margins as high as 35%.

Source: Marqeta Investor Relations and Author’s Analysis

In terms of contractual obligations, Marqeta has non-cancellable purchase commitments with cloud-computing service providers and issuing banks of $264 million, payable over the next 5 years. This is easily covered by Marqeta’s high net cash position and FCF.

Overall, Marqeta has a pristine balance sheet with positive FCF that should support the business through an economic downturn or company-specific challenges.

Guidance

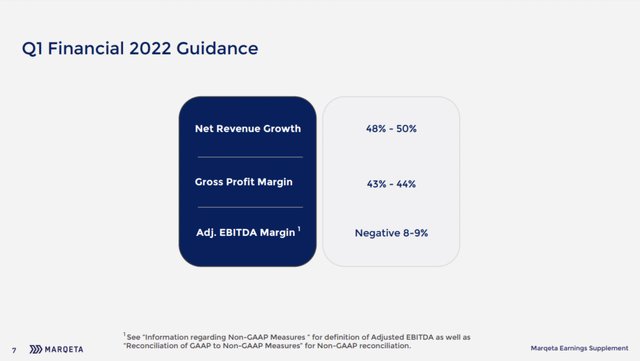

Marqeta issued the following guidance for Q1. Net Revenue is expected to grow by about 49%, which is a large deceleration from Q4’s 76% growth. CFO Mike Milotich highlighted three reasons for the slow down: 1) tough YoY comps due to the government stimulus in the first quarter of 2021; 2) tough YoY comps due to the ramp in BNPL volume; and 3) slow January due to the Omicron virus.

Source: Marqeta FY2021 Q4 Investor Presentation

Gross Profit Margin is also expected to normalize to 43%-44%, down from Q4’s 49% margin, which benefited from higher card network incentives as well as a favorable holiday volume mix.

Furthermore, management expects an AEBITDA Margin of negative 8%-9%, a meaningful drop from Q4’s 1% AEBITDA Margin. This is due to the company reinvesting back into the business to fuel further growth.

In my opinion, management’s guidance proves to be conservative. I expect guidance beats across the board given Marqeta’s track record of beating expectations.

Competitive Moats

Based on my research and analysis, I identified three competitive moats for Marqeta: technology, network effects, and switching costs.

Technology

Marqeta has a first-mover advantage in terms of building a highly-scalable cloud-based, open API card issuing platform. Marqeta has built its platform for almost 12 years, which enables the company to build a large technological moat. Furthermore, Marqeta continues to innovate industry-first features such as JIT funding and Tokenization as a Service, which customers have grown to love. As such, Marqeta is the go-to platform for modern card issuing, as seen by the growing list of disruptors working with Marqeta.

During Marqeta’s Q3 earnings call, CEO Jason Gardner explained why customers choose Marqeta:

So we’re the leader in modern card issuing. Companies like Bill.com choose Marqeta and Uber Freight choosing Marqeta in partnership with our customer Branch because we know scale.

We started this business over 11 years ago. The numbers and the volume that we process is significant. We have busted through scale all the time over the years. So when companies like Bill.com on a scale they think about, okay what about Marqeta’s success in modern card issuing.

We need virtual card issuing capabilities, alongside the ability to see spend data, inject metadata into the transaction set spend controls. It was very much a powerful sort of differentiator for us versus our competitors.

So as you can imagine, when Bill.com goes out to the industry to go build these new products there’s a range of customers that they can talk to, a range of companies they can speak to and they chose Marqeta. It’s not just about one product. And I think you see this with companies like Square and others on our platform. The surface area of our platform is very vast. So as they begin to pick one product, they want to go build, they test that product in market, find success, want to go build other products. They can build that on top of our platform.

Customers choose Marqeta because we’ve seen scale. We know modern card issuing, whether they want to build virtual cards or tokenized cards that fit into Apple Pay or Google Pay or Samsung Pay or they wanted to build physical plastic cards, they’re able to do that based on what we’ve already proven in markets.

So the Bill.com choose Marqeta because of who we are and what we’ve been able to accomplish, absolutely. Are we always a single-source provider when companies come to us? Sometimes. And we definitely see competitors in the market but we’re obviously winning a lot of strong businesses, who believe and trust Marqeta’s platform for their future.

Network Effects

As Jason Gardner mentioned, Marqeta’s platform is built to scale, for scale. As of the end of 2021, Marqeta has issued a total of 493 million cards since inception, with approximately 122 million active cards in circulation, up 115% from 2020. In 2021, the company processed 2.7 billion transactions across the globe, up 70% from 2020. Such scale shows that Marqeta’s platform and ecosystem are growing rapidly.

Not being a robot here, but Marqeta’s customers are disruptors themselves, spanning multiple industries. These customers have network effect moats of their own. For example, as of its latest quarter, Affirm has a total of 11.2 million Active Customers and 168 thousand Active Merchants, which grew 150% and 2,027% YoY, respectively.

As mentioned previously, not only disrupters, but also legacy financial institutions and tech giants are leveraging Marqeta’s technology. Suffice to say, their networks are even bigger than the disruptors.

Marqeta also partners with major card networks including Mastercard, Visa, and Pulse. These card networks have an unmatched scale, with billions of consumers and merchants using their trusted network in every corner of the world.

Put simply, Marqeta enjoys strong network effects with each new customer and card added to the platform. As of December 2021, Marqeta has 200+ customers and counting.

Switching Costs

Twilio has a very similar business model to Marqeta. In my Twilio deep dive, I highlighted why Twilio has a switching cost moat:

Twilio provides the communications infrastructure and software for developers to integrate into their apps or websites. Developing in-house solutions is time-consuming and costly given the overall complexity of building a communications platform from scratch. As such, once customers use Twilio’s solutions, they are hooked into it for the long run as switching providers or building an in-house platform would mean a radical change in the communications infrastructure of the business and how it communicates with customers. That is a major headache that most businesses are unwilling to go through.

The same applies to Marqeta, which manages the payment processing and card issuing infrastructure. Once customers use Marqeta, they are unlikely to leave the platform, which is why Marqeta has a Net Revenue Retention rate of 175%+ in 2021, and 200%+ in both 2019 and 2020.

Valuation

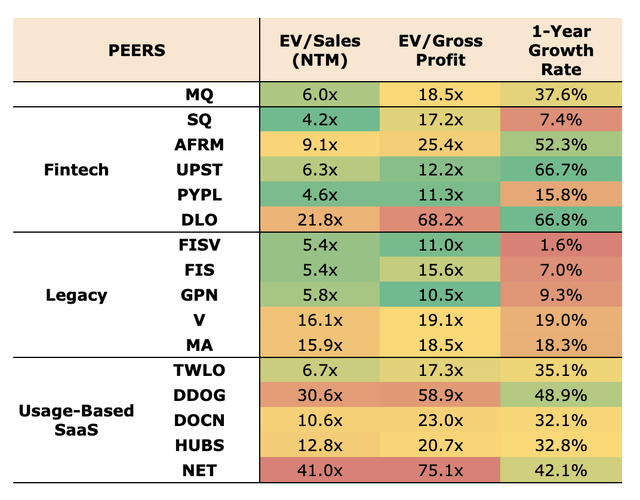

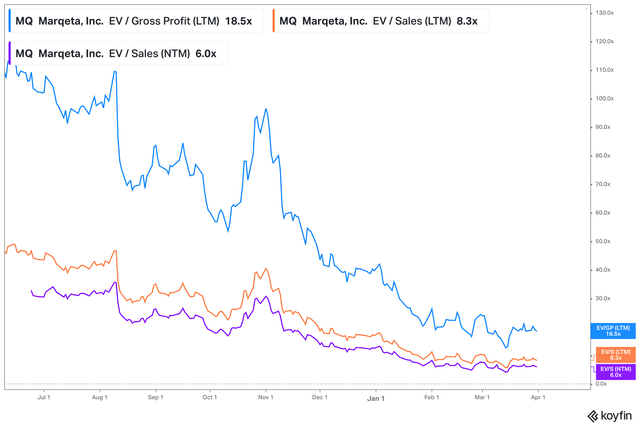

As with all stocks in the growth realm, Marqeta’s stock has seen significant valuation compression over the last few months. Marqeta is currently down 70% from its all-time highs and 60% from its IPO price. Today, the company trades at a market cap of $6 billion with EV/Sales multiples of 8.3x and 6.0x on an LTM and NTM basis, respectively. On an EV/Gross Profit basis, Marqeta is trading at 18.5x.

Those numbers aren’t useful given that Marqeta is a recently-IPOed company, so let’s compare them with peers’ multiples. Below, I’ve included some of Marqeta’s peers, broken down into three different groups: Fintech, legacy processors, and usage-based SaaS.

Source: Koyfin, Seeking Alpha, and Author’s Analysis

You can take a look at the table at your own discretion but I want to direct your attention to the “legacy” bucket. Marqeta has the same EV/Sales multiple compared to legacy processors Fiserv, FIS, and Global Payments (GPN) despite growing 4 to 30 times faster! In terms of EV/Gross Profit, Marqeta is also valued similarly to Mastercard and Visa despite growing 2 times faster. I know these legacy financial institutions have very strong moats and stable cash flows, but Marqeta has real potential to take substantial market share from some of these legacy processors. Put simply, Marqeta is a disruptor growing at a rapid pace but priced like a legacy financial institution. Clearly, there’s deep value in Marqeta at these levels.

It is also worth noting that at today’s EV of $4.3 billion, investors get the chance to buy Marqeta at the same valuation that was set during its private funding round in 2020, despite being a much bigger and stronger company today.

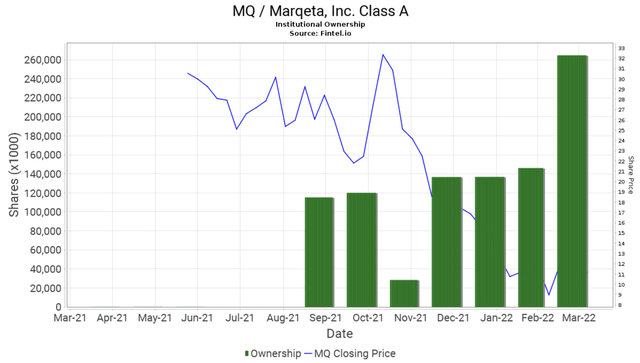

On another note, while retail investors dump shares of Marqeta, institutions have been buying the dip on Marqeta throughout the month of March.

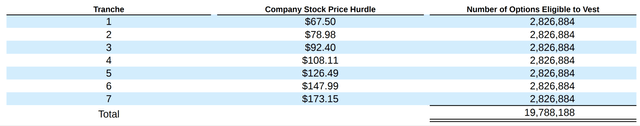

In addition, CEO Jason Gardner’s long-term performance award in the form of performance-based stock options is very much aligned with shareholders’ interests. The performance awards are divided into seven tranches which vest upon reaching a certain stock price hurdle. The highest tranche equates to 15x from today’s share price. This not only shows that management is aligned with shareholders, but they are also in it for the long game.

Marqeta is a high-quality business growing at a rapid pace. The recent 70%+ selloff has brought down Marqeta’s valuation as if it is a slow-growing legacy financial institution. That is far from Marqeta’s entire growth story. With institutions buying the selloff and management motivated to achieve the highest stock price hurdle of $173, maybe it’s an excellent opportunity for investors to scoop Marqeta at these prices.

Catalysts

- More Partnerships: Recently, Marqeta announced several important partnerships, including working with Citi to power its Commercial Cards in over 40 markets worldwide. In addition, Marqeta is also partnering with Plaid to simplify ACH transfers. Plaid has a network of 12,000+ financial institutions. As Marqeta announces more and more partnerships, Marqeta should drive additional network effects and ultimately, increased processing volumes. Here is CEO Jason Gardner on the Plaid partnership:

So it makes it really easy for our customers to leverage Plaid through Marqeta’s platform to go build better experiences. So our business is truly predicated on money in, money out. So money in is ACH, and money out is through card, which is predominantly where we make our revenue.

- Possible Acquisition Target: The recent selloff may provide an attractive opportunity for big-time players to acquire Marqeta. For example, both Visa and Mastercard are already investors in Marqeta, and they certainly have the firepower to acquire Marqeta. Block, a major customer of Marqeta, may also acquire the company and allow it to operate independently, much like how SoFi (SOFI) offers Galileo.

- International Expansion: Marqeta recently achieved certification for Singapore, the Philippines, and Thailand, expanding its global reach to 39 markets. Marqeta also plans to open a new Asia Pacific regional hub in Singapore, one of the strongest economies in South East Asia. In FY2021, Revenue from international customers only makes up 2% of total Revenue.

- BNPL and Credit Cards: As mentioned earlier, Marqeta’s BNPL customers drive over 10% of TPV. BNPL is an attractive alternative for consumers to access credit and its adoption is growing rapidly. Speaking of credit, Marqeta’s recent launch to credit card issuing could be a significant growth driver for the company. Here’s what CEO Jason Gardner has to say about the credit card opportunity:

Earlier in the year, we announced the launch of our credit product which we believe makes us the first modern platform to offer prepaid, debit and credit card issuing services.

After launching our first credit program in Q2 of this year, we continued to onboard new credit card programs with our partner Deserve. The Owner’s Rewards Card by M1 went live last month. It is a unique credit product that offers its clients up to 10% cashback when they transact at brands they own stock in through their M1 investment portfolio and offers them the ability to reinvest rewards in their portfolio. It’s the flexible and innovative card experience we’re excited to enable.

Given that credit is a new offering for Marqeta, I’d like to highlight this for a moment. With 52% of card spend happening on credit in the US, this is a massive market opportunity that is underserved by current technology which has done little to modernize the credit card experience. Therefore, our credit card issuing platform is a critical strategic priority for Marqeta.

Risks

- Customer Concentration: Block makes up 69% of total Revenue in FY2021. Furthermore, Block recently completed its acquisition of Afterpay, which is also a customer of Block, which may increase concentration risks. Sutton Bank also settled 90% of Marqeta’s TPV in FY2021. These concentration numbers are very high and if these customers face a company-specific event of their own, Marqeta’s operations will be significantly affected. In addition, Marqeta’s customers are commerce disruptors and some of them compete with one another. For example, Klarna, Afterpay, Affirm, and Sezzle are all Marqeta customers and they all compete in the BNPL space. If one customer, say Affirm, take 80% of the BNPL global market share, Marqeta may have another customer concentration problem as most of the BNPL GMV now flows to Affirm. Although unlikely, it is an issue to keep in mind.

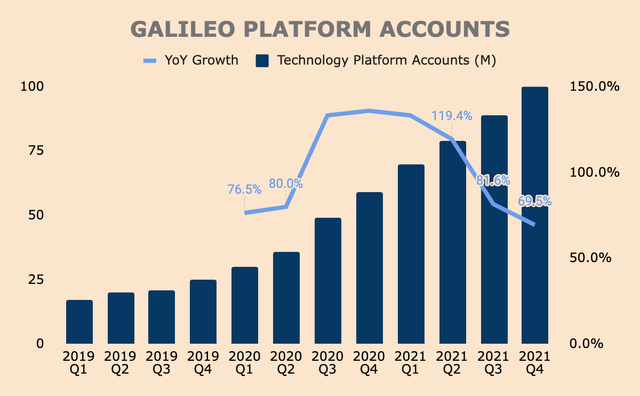

- Competition: While Marqeta is the first modern card issuing platform, the company still faces tough competition. For example, Marqeta competes with legacy processors like Fiserv, which processes much larger payment volumes. In addition, current partners like J.P. Morgan, Goldman Sachs, Citi, Visa, and Mastercard, may also build their own in-house solutions. At the same time, Marqeta also competes with other fintech companies like Adyen and Stripe, which also have an open API banking infrastructure. These are fintech behemoths and they have already launched their own card issuing solutions (Stripe Issuing was launched in 2018 and Adyen was launched in 2019). Another example is Galileo, which was acquired by SoFi. The company offers similar solutions as Marqeta and is experiencing rapid growth of its own, amassing more than 100 million Technology Platform Accounts in FY2021. Galileo serves customers such as Chime, Robinhood (HOOD), Paysafe (PSFE), Revolut, Transferwise, and more. However, Galileo targets smaller companies while Marqeta targets the larger disruptive players. While I don’t see Galileo as a major threat to Marqeta, Galileo’s smaller companies could grow to become tomorrow’s disruptors as well. At the same time, SoFi’s bank charter approval means Galileo could settle payments directly through SoFi, which eliminates the need to partner with issuing banks like Sutton Bank.

Source: SoFi Investor Relations and Author’s Analysis

Conclusion

To wrap up, Marqeta is disrupting the issuing-facing side of the payment ecosystem by offering a cloud-based, open API card issuing platform. While competition is a major threat, Marqeta focuses on serving the most disruptive customers – most fintech players either focus on the merchant-facing side or smaller players. These disruptors are not small-time players. They are like aces in a deck of cards and buying Marqeta is like holding a deck of aces.

In addition, Marqeta’s strong technology, switching costs, and network effect moats – as demonstrated by its relationships with some of the largest disruptors in the world – should protect the business from incoming competitive threats.

After the recent selloff, the risk/reward looks very attractive as valuations compress. More importantly, management is well aligned with shareholder interests. They are in it for the long game and they are on a mission to be the global standard for modern card issuing.

Thank you for reading my Marqeta deep dive. If you enjoyed the article, please let me know in the comment section down below. If there’s a company that you would like me to do a deep dive on, don’t hesitate to share your thoughts as well.

Be the first to comment