MarketAxess (MKTX), founded in 2000 and a public company since 2004, is an electronic fixed income trading platform. The company generates revenue by providing a liquid market for banks, institutional investors and speculators to buy and sell products traded on its marketplace. Within the fixed income world, MarketAxess is focused primarily on corporate bonds in the US and Europe. Breaking this down further, below is a summary of the general revenue buckets MarketAxess reports:

(Source: 2019 company financials)

When it comes to the exchange industry & exposure to trading volumes, MarketAxess plots near the high end of the group – 91% of revenue is tied to transaction fees on its products, with the other 9% split between Information Services (market data fees) and Post Trade Services (trade reporting and other).

A Quick Note on Competitors

Many in the space like to compare MarketAxess to rival fixed income platform Tradeweb (TW), as they both operate in similar asset classes and benefit from the same macro trends – i.e., interest rate volatility, debt issuance and a changing regulatory landscape. However, upon closer look, there are key differences that separate the 2 companies and their stocks.

Tradeweb offers a much more diverse product suite than MarketAxess, with markets for interest rate swaps, mortgages, credit default swaps, and most importantly, US & EU government bonds (a deeper dive on Tradeweb can be found in one of my previous articles here). The only products where there’s overlap between MKTX and TW is in corporate bonds – where MarketAxess has far larger market share and is the dominant player – and US Treasuries, where MarketAxess is an early entrant with the recent purchase of LiquidityEdge and where Tradeweb has a much stronger foothold. So when you hear headlines or press releases about Tradeweb or MarketAxess “taking share“from competitors, it most likely is not from each other. The bond market is large enough to accommodate multiple competitors that still experience strong growth, at least in the short term.

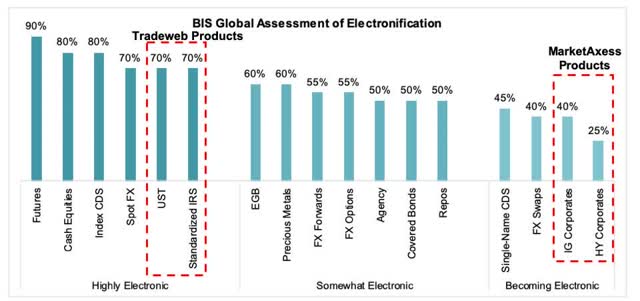

The reason this difference is important becomes clear when you look at the gap in multiples between the 2 companies. Tradeweb, the more diverse platform in the space, sports a multiple of 35x – 40x trailing EPS. MarketAxess sports a multiple almost twice that, historically in the 60x – 70x range. Why the disparity in valuation for seemingly similar companies? The answer lies in the “analog to digital“potential for the products where each company has a major presence. Below chart from the Bank of International Settlements gives more detail:

(Source: Bank for International Settlements, author highlights)

(Source: Bank for International Settlements, author highlights)

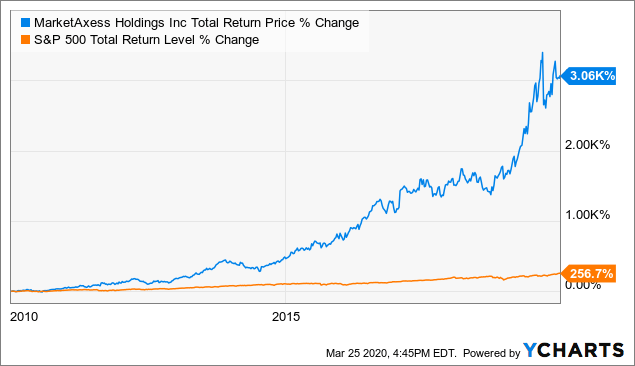

In the past, as markets have become increasingly electronic, this shift has been accompanied by a new entrant (the electronic platform with new technology) taking business from the bilateral market, owned by broker dealers (think big banks trading & making markets over the phone). The new entrant’s revenue grows tremendously as this transition from the phone to the computer screen plays out over multiple years, and margins increase as the technology scales. Tradeweb operates in markets where this shift has largely already taken place, as shown in the above chart with electronic %’s at ~70% for their flagship products. MarketAxess, on the other hand, has the dominant position in markets where the electronic transition is only just starting to accelerate. Investors recognize the enticing setup & are buying into MarketAxess’ future growth story at a premium valuation. This sentiment can also explain why MarketAxess was one of the best performing stocks of the last decade:

Data by YCharts

Data by YCharts

The analog-to-digital story is no joke – it has made many an investor quite wealthy if they buy in early.

What’s next?

With all that setup on the table, the obvious question remains – where’s the alpha? Specifically:

- How much electronic growth is left in the corporate bond space?

- Can MarketAxess execute on this opportunity?

The answer to #1 is a bit complicated. To dive deeper into this, I’ll reference a 2019 academic paper published by Cornell & the Federal Reserve titled “The Electronic Evolution of Corporate Bond Dealers“- you can find the full paper here. Researchers studied proprietary MarketAxess volume data from 2010 to 2017 and shared their findings as it relates to the analog-to-digital transition of corporate bonds.

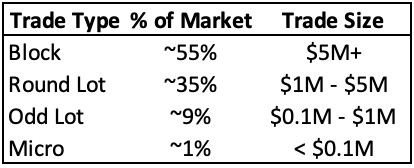

What they found shed some valuable light on the dynamics at play for MarketAxess & the market as a whole. If we split the corporate bond market into 4 categories by trade size, we’ll find volume is heavily distributed towards large trade sizes – block trades ($5M+ notional) and round lot trades ($1M – $5M notional):

(Source: Cornell, Federal Reserve, author estimates)

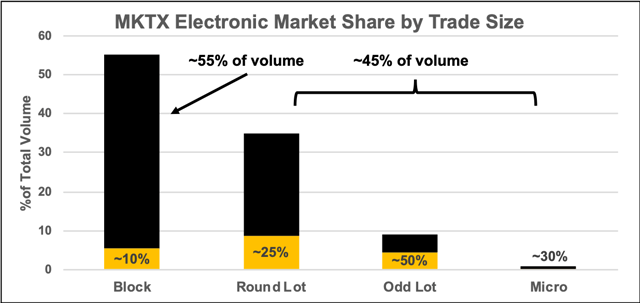

Here’s where it gets interesting – MarketAxess currently has ~20% electronic market share in US High Grade corporate bonds. If we break that share down into the same categories, the paper estimates that MarketAxess has higher market share in smaller trade sizes, and only ~10% share in block trading:

(Source: author estimates, Federal Reserve, Cornell)

(Source: author estimates, Federal Reserve, Cornell)

The reason for this, the researchers describe, is transaction cost disparity. Smaller trade sizes (micro, odd lot, round lot) are where MarketAxess’ value proposition is more clear – transaction costs for electronic trades are modestly lower than voice trading among the dealers. When looking at block trades, however, transaction costs are more competitive – dealers have begun to offer better prices and are generally on par with what MarketAxess is offering.

This research leads me to 2 conclusions:

- MarketAxess still has room to grow market share in smaller trade sizes over time.

- In order for MarketAxess to take share in block trading, new technology needs to make transaction costs more attractive vs. dealers.

Long term, I think MarketAxess will innovate and platform improvements will bring transaction costs down further – so the opportunity still exists to grow revenue by a factor of 3-4x as the company absorbs most of the smaller trades and eventually, many of the larger ones. However, it is not a given that MarketAxess will meaningfully break into block trading overnight or even in the next few years, and this poses a risk to the “100% corporate bond market share is inevitable soon“thesis in the minds of many MKTX bulls. If the dealers maintain any sizable share of the corporate bond market, leveraging longstanding relationships and improving transaction costs, the top end of MarketAxess’ long term revenue estimates comes down, hurting the growth story.

I also have skepticism, like many other investors do on first glance, when thinking about what premium should be placed on the above story. Yes, there is a juicy market opportunity in the electronification of corporate bonds. Yes, MarketAxess is the leader in the space and is poised to capitalize on this shift over the long term. BUT, if it takes 10 years to quadruple market share & revenue, am I willing to pay a ~60x multiple today for that growth?

Since 2009, MarketAxess has averaged ~15% revenue growth per year. Some years saw pretty stellar increases (20-25% growth), others saw less than that (5-10%), but on average you come to ~15% as the analog-to-digital shift started to take hold. If we assume revenue growth can continue at 15% per year into the future, revenue will quadruple in ~10 years. If MarketAxess controls most of the corporate bond market in 10 years, and the analog-to-digital story has played out substantially, I believe their premium multiple will start to come down meaningfully. This long term multiple contraction will hurt future returns even if the company executes on its opportunity. Otherwise, the market must think that the company will take market share faster in the future than it has done in the past, in which case revenue will have to accelerate above the 15% range going forward.

Conclusion

To summarize, I think MarketAxess is a well-run company with plenty of room to grow earnings in an industry that is changing in its favor. The market opportunity is compelling and the company is the leader in the electronic trading of corporate bonds globally. However – investors don’t buy companies, they buy stocks. I like MarketAxess the company, but I think the stock may be ahead of itself at a 60-70x multiple unless revenue growth accelerates in the years ahead. If coronavirus-related whipsaw action in the stock presents a multiple in the mid to high 40s, my interest will increase. Until then, I’m not willing to pay the high price for a growth story that is at this point fully appreciated by the market.

(Submitted March 25, 2020)

If you like this article and want more analysis of the exchange industry, please consider hitting the “Follow“button at the top of this page. Thank you for reading.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article should not be taken as investment or financial advice and is for informational purposes only. Consult a financial advisor before making investment decisions. This article discusses public information sourced from SEC filings and public research papers. Future performance could differ from what is estimated in the article.

Be the first to comment