sshepard

By Reed Cassady, CFA

Public Perceptions Overlook Economic Reality

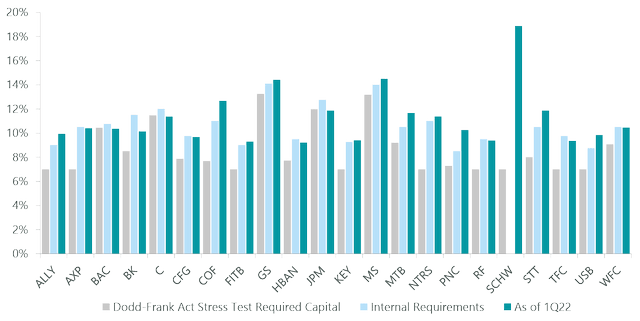

Traditionally, higher interest rates have been a substantial tailwind for banks: their assets typically reprice faster than their liabilities, resulting in improved net interest income and higher earnings. However, despite tailwinds from higher rates in 2022, financials have found themselves caught up in the broad market rout as investor focus shifted from the benefits of higher rates to the potential for a rate-driven recession. The S&P 500/Banks Index, an index comprised of asset management & custody banks, diversified banks, regional banks and thrifts & mortgage finance companies within the S&P 500, declined 18.92% from January through the end of July, compared to a 12.58% decline for the overall S&P 500, as banks suffered from the perception that a recession would offset the positives of higher rates and faster loan growth through increased credit losses and ultimately a deceleration of loan growth. As a recession looms, investors are bracing for bank performance mirroring the Global Financial Crisis (‘GFC’) of 2008 or the stagflationary environments of the 1970s and 1980s. We believe this knee-jerk reaction is misplaced and that many banks are instead being overly discounted versus their underlying resiliency. First, banks maintain much higher capital ratios today than during the GFC and the 1970s and 1980s, and liquidity is vastly improved as well. The layers of regulation and stress testing required since 2008, directly as a result of massive losses and write offs during the GFC, mean that bank balance sheets remain very conservatively capitalized. All of the major 33 banks participating in the Fed’s 2022 Stress Test maintain capital levels in excess of their regulatory minimums despite being subjected to recessionary scenario orders of magnitude worse than the worst financial forecast (Exhibit 1). This scenario includes over two years of severe economic stress, a nearly 40% decline in commercial real estate prices and a 10% unemployment rate. Another advantage of higher capital ratios: if an economic recession were to be shorter or less severe than embedded, these ample reserves offer significant upside through the return of capital to shareholders.

Exhibit 1: Banks Get High Marks in Stress Test

As of June 23, 2022. Source: Federal Reserve, ClearBridge Investments.

Greater bank loan portfolio diversification also provides insulation against the worst a recession can offer. Compared to the period leading up to the GFC, today banks no longer have outsize exposure to areas like construction lending and subprime mortgages, and the exposures they do have are much less risky. For example, stringent regulatory changes in residential mortgages have essentially removed high loan-to-value, low-to-zero documentation and poorly structured home loans from the banking system. Similar changes across many different loan categories have improved risk management: even given similar macro conditions as the GFC, the losses bank portfolios would endure would be a small fraction of those endured during the 2008-2009 recession.

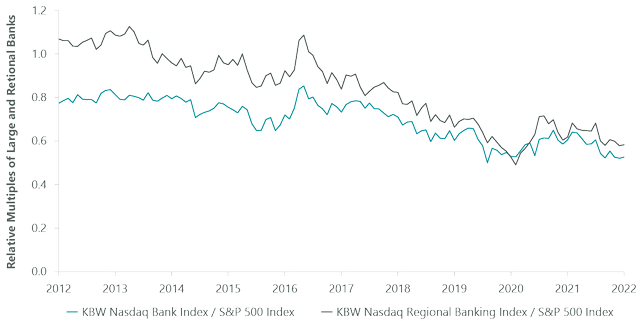

Additionally, we believe strong consumer balance sheets and labor markets remain underappreciated. While periods of high inflation have historically corresponded with higher credit losses, consumer loan delinquencies and charge-offs are more closely linked to the job market. The decline in the unemployment rate to 3.5% in July marks its lowest level since 1969, which we believe will be a tailwind to the financials sector as it argues for lower loan losses if current conditions hold. Consumer balance sheet strength — both higher levels of savings and lower levels of consumer debt relative to incomes before the COVID-19 pandemic — suggest recessionary losses would be much lower in categories like credit cards. As a result, our analysis projects lower credit costs, as well as a shallower and shorter recession, as consumer spending would likely hold up better than in prior recessionary periods. From a valuation standpoint, banks have been disproportionately penalized relative to the broader market. The KBW Nasdaq Bank Index, (BKX) a market cap weighted index of large U.S. banks, is currently trading at 9x forward earnings as compared to 17.1x for the overall S&P 500, while mid and small cap regional banks (as measured by the KBW Nasdaq Regional Banking Index) are only trading at 10x forward earnings (Exhibit 2). In fact, relative to the S&P 500, the BKX is only fractionally higher than the bottom achieved in March 2020 at the height of the pandemic drawdown.

Exhibit 2: Bank Multiples Retreat Amid Recession Concerns

As of Aug. 25, 2022. Source: Bloomberg, ClearBridge Investments.

Resilience Common Across Market Caps

We believe these overlooked positive attributes make a compelling case for owning banks of different sizes and serving unique geographies. New York-based M&T Bank (MTB), for example, is a high-quality regional bank serving the Mid-Atlantic with a leading core deposit franchise. The company’s historically exceptional loan underwriting, combined with its strong capital position, position it well to comfortably absorb any uptick in credit losses while profiting from its low-cost core deposit franchise as it puts excess liquidity to work in higher-yielding loans and securities. So far in 2022, its earnings estimates have risen over 30%, while its earnings multiple has declined over 20%, creating an attractive risk/reward profile. This resiliency is not exclusive to big banks. Western Alliance Bancorp (WAL), a regional mid-cap bank serving California, Nevada and Arizona, is facing elevated scrutiny due to concerns of slowing loan growth, increasing credit losses and a potential decline in its mortgage origination business. However, this view overlooks that the company has spent the last few years de-risking and diversifying its loan portfolio into significantly stronger categories. Furthermore, Western should be able to maintain top-tier growth into a higher rate backdrop, with well contained credit costs, resulting in earnings compounding at a much higher rate than is currently embedded in its market valuation.

Small cap banks are also being overlooked, in part due to their typically greater exposure to commercial and real estate construction lending, which could suffer in a prolonged recession. However, small cap banks such as TriCo Bancshares (TCBK), which operates Tri Counties Bank in California, maintain capitalization levels in-line with larger cap peers. TriCo’s Tier 1 Capital to Common Equity ratio of 11.5% [1] is well above the 7.0% regulator requirement and in line with even the largest banks tested under the Fed’s extensive stress test. Similar to other small cap banks since 2008, TriCo has continued to improve its positioning, having acquired Valley Republic Bancorp in March and continuing to build out a strong, diversified loan portfolio to avoid the consolidated portfolio pitfalls small cap banks faced in prior recessions. While high capitalization and improved credit metrics will not make these banks immune to the challenges that an economic recession would have at a local level, we believe their prudent capital allocation decisions have left them well-positioned to face a potential recession.

Banks Offer Resiliency, Opportunity

As value investors, we believe these gaps between public perception and economic reality are exactly the kind of opportunities that our rigorous research and investment process are designed to capture. We believe investors are erroneously bracing for a devastating recession, which is far from a foregone conclusion. Should the economic downturn be shorter or less severe than feared, the stocks of well-capitalized banks across market caps could see a meaningful re-rating.

Reed Cassady, CFA is a Director and Portfolio Manager for the ClearBridge All Cap Value Strategy.

[1] TriCo Bancshares 10Q, June 30, 2022.

Be the first to comment