Ralwel/iStock via Getty Images

Humility means accepting reality with no attempt to outsmart it.”― David Richo

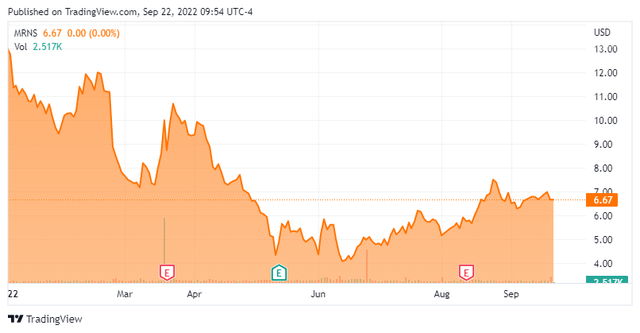

When we last revisited Marinus Pharmaceuticals, Inc. (NASDAQ:MRNS) in May, we recommended it for a small covered call position. That seems to have been a prudent call to this point as the stock is basically trading flat/slightly up to when we last looked at it. Given how poorly biotech stocks have traded in 2022, that marks a victory.

We are circling back today to update the investment thesis around Marinus as the company has seen some positive news flow in recent weeks. An analysis follows below.

Company Overview:

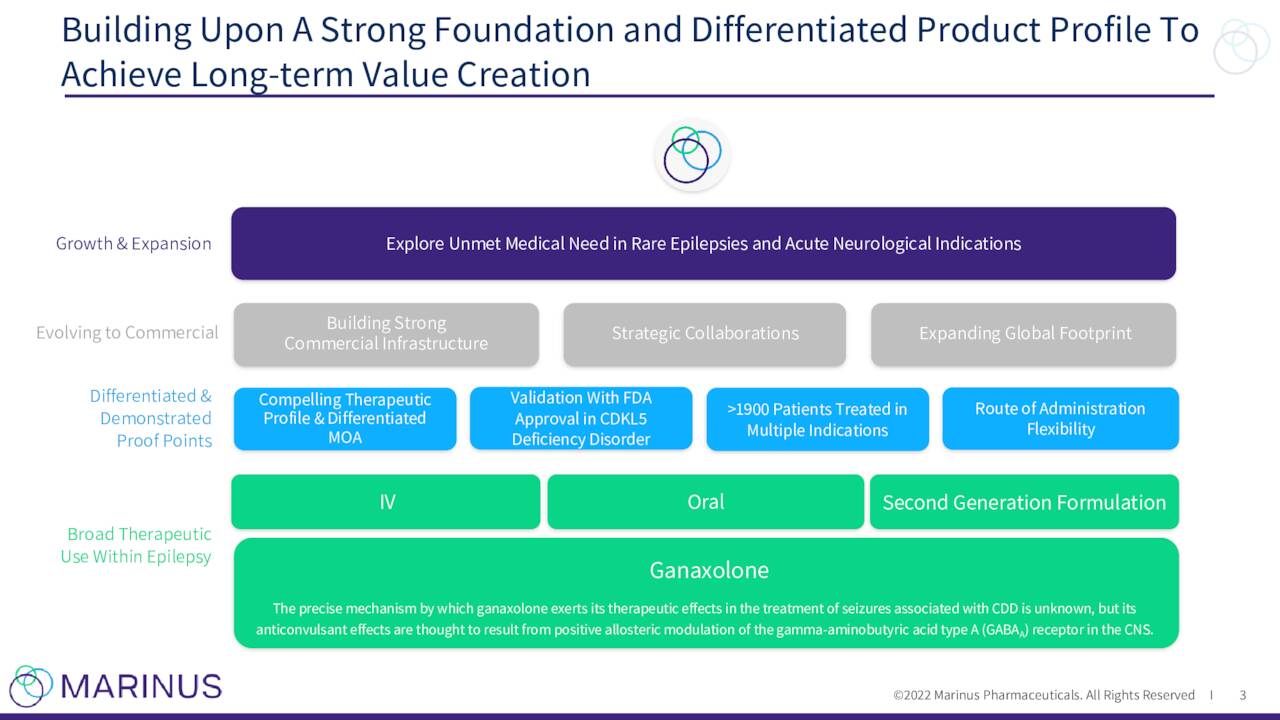

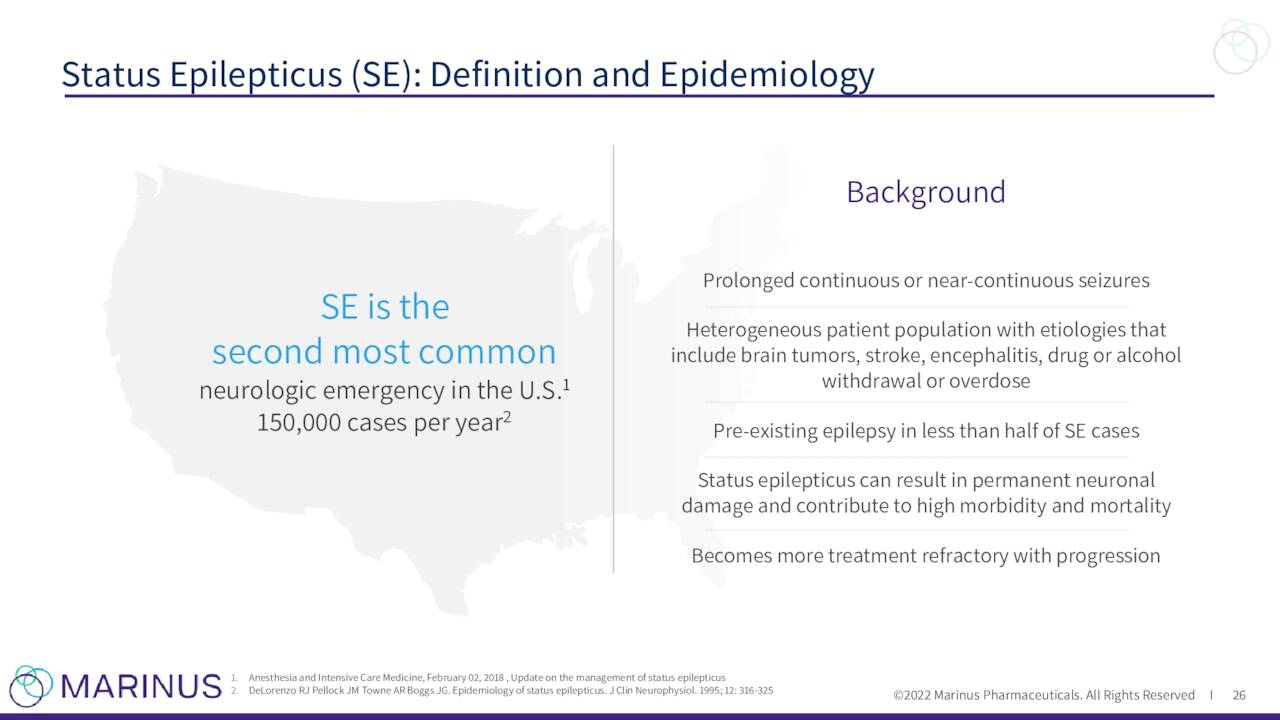

Marinus Pharmaceuticals is focused on the development of therapies for the treatment of rare genetic epilepsies and other seizure disorders. The company is based outside of Philadelphia, PA. The stock trades for around $6.50 a share and sports an approximate market capitalization of $260 million.

May Company Presentation

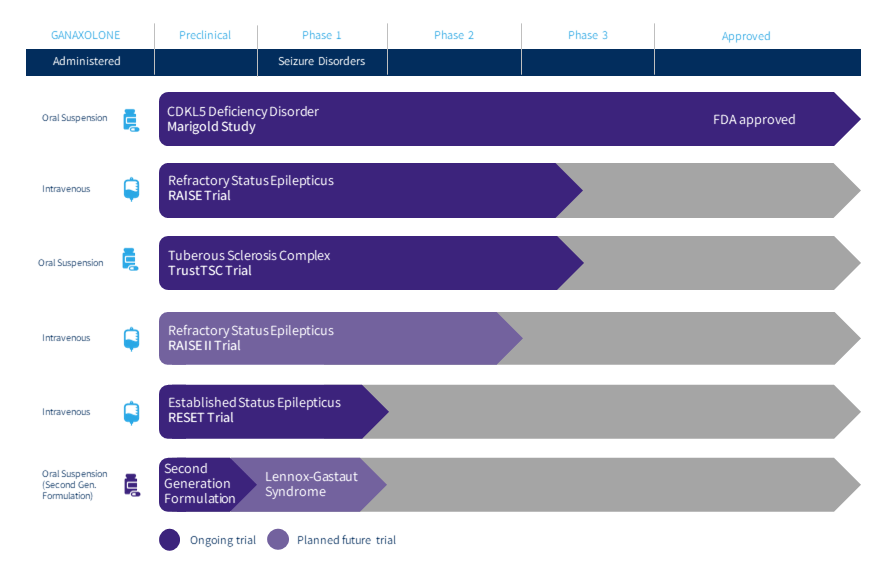

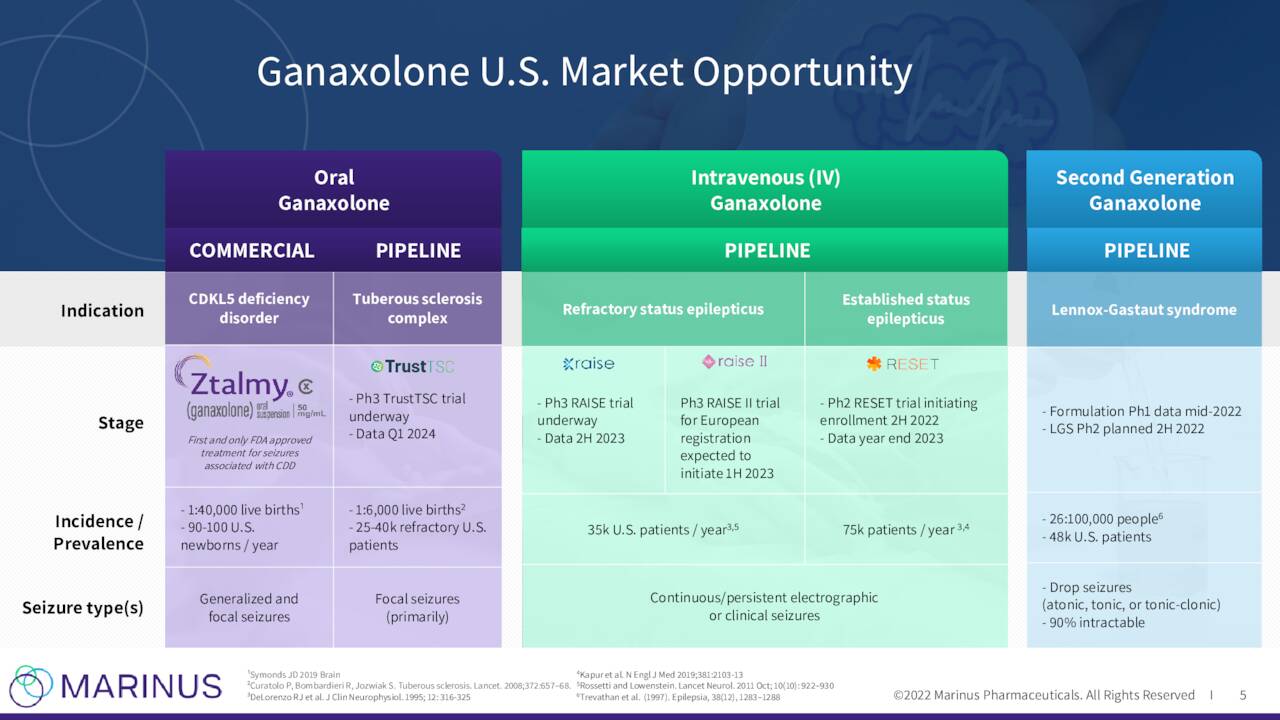

The company has one primary asset under development for multiple indications called ganaxolone. This compound is also known by its brand name Ztalmy was approved this March for seizures associated with cyclin-dependent-kinase like 5 (CDKL5) deficiency disorder (CDD). The marketing application for Ztalmy in Europe is currently undergoing review by the European Medicines Agency or EMA. The company plans to submit complete responses to questions from the EMA in November and they should render a decision in the first quarter of next year.

May Company Presentation

Recent Developments for Marinus:

The priority review voucher Marinus garnered via the approval of Ztalmy by the FDA was sold at the end of August for $110 million. This bolstered the company’s cash reserves substantially and was right in the range ($100 million to $125 million) these vouchers have received in recent years.

In addition, it was announced that Biomedical Advanced Research and Development Authority or BARDA had exercised its first contract option worth ~$12.3M, to support U.S. onshoring of manufacturing capabilities of Ztalmy. That still leaves some $39 million of potential awards under this contract, $21 million in previously approved base-period funding and up to $18 million across two additional option periods.

Company Website

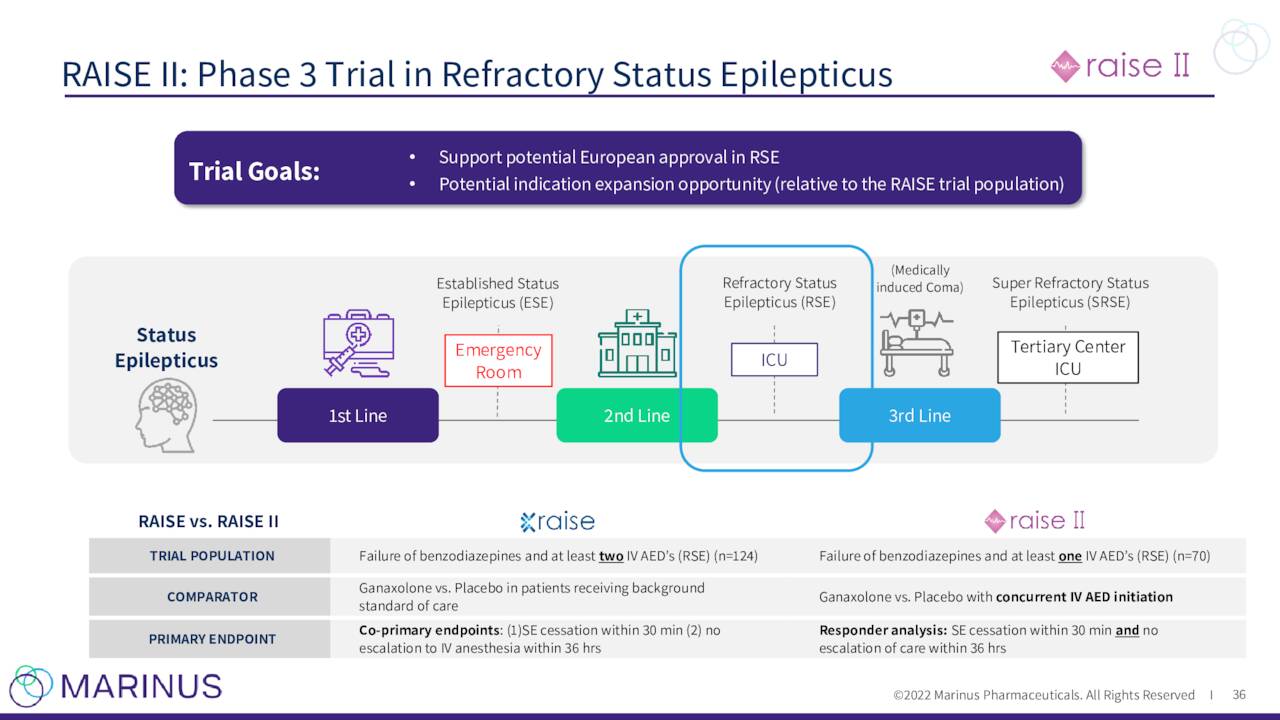

The company continues to advance ganaxolone against other indications. Marinus has a Phase 3 trial “RAISE” to evaluate ganaxolone to treat Refractory Status Epilepticus or RSE. Topline results from this study should be out in the second half of 2023. This study is being funded by BARDA.

May Company Presentation

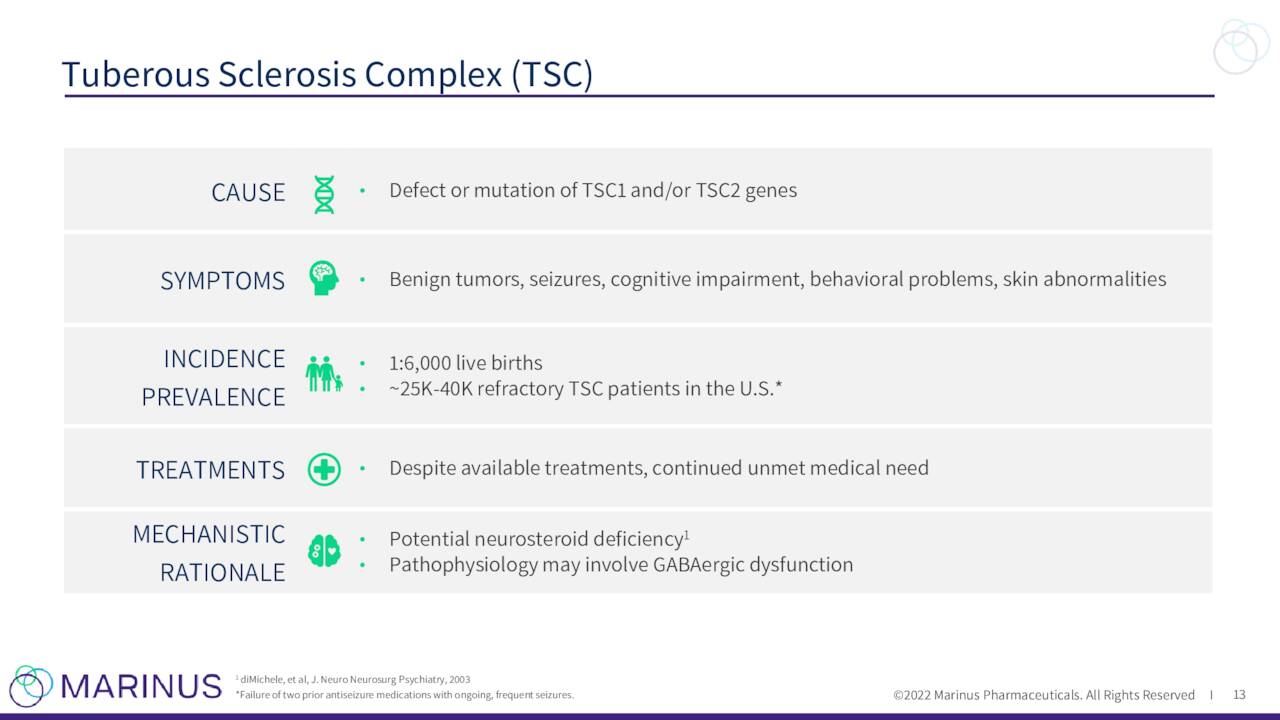

Recently the first patient was randomized and dosed in a Phase 3 trial to evaluate ganaxolone to treat Tuberous Sclerosis Complex or TSC. The study will consist of approximately targeting 80 clinical sites and topline results are not expected until the first quarter of 2024 at the earliest.

May Company Presentation

Results from a Phase 2 study around RSE was published in June and a Phase 3 study for RSE ‘RAISE II’ (for European registration) is expected to begin enrollment in the second half of 2023.

May Company Presentation

A Phase 2 trial ‘RESET’ evaluating ganaxolone in established status epilepticus on track to begin U.S. enrollment in the second half of this year. A Phase 2 trial to evaluate ganaloxone to treat Lennox-Gastaut syndrome is now targeted to begin in 2023.

Analyst Commentary & Balance Sheet:

The analyst community also seems to be turning more sanguine on Marinus’ story. Over the past five weeks, four analyst firms including Robert W. Baird and JMP Securities have reissued Buy ratings on MRNS. Price targets proffered range from $17 to $32 a share.

Approximately five percent of the outstanding float is currently held short. There has been no insider activity in this equity since March of 2021. The company ended the second quarter of this year with just over $90 million in cash and marketable securities on its balance sheet after posting a net loss of $39.4 million in the quarter.

With the receipts from the priority review voucher in hand, management believes current funding levels are sufficient to fund it into the fourth quarter of 2023. Marinus has approximately $70 million of long term debt.

Verdict:

There are a wide range of sales and earnings estimates from the analyst community at the present time. Right now they expect the company to lose just over two bucks a share in FY2022 and over $3.50 a share in FY2023 as the company spends big on the rollout of Ztalmy and advancing its pipeline. Revenue estimates range from approximately $15 million to $60 million next fiscal year. The company had just $1.8 million worth of revenue in the second quarter.

May Company Presentation

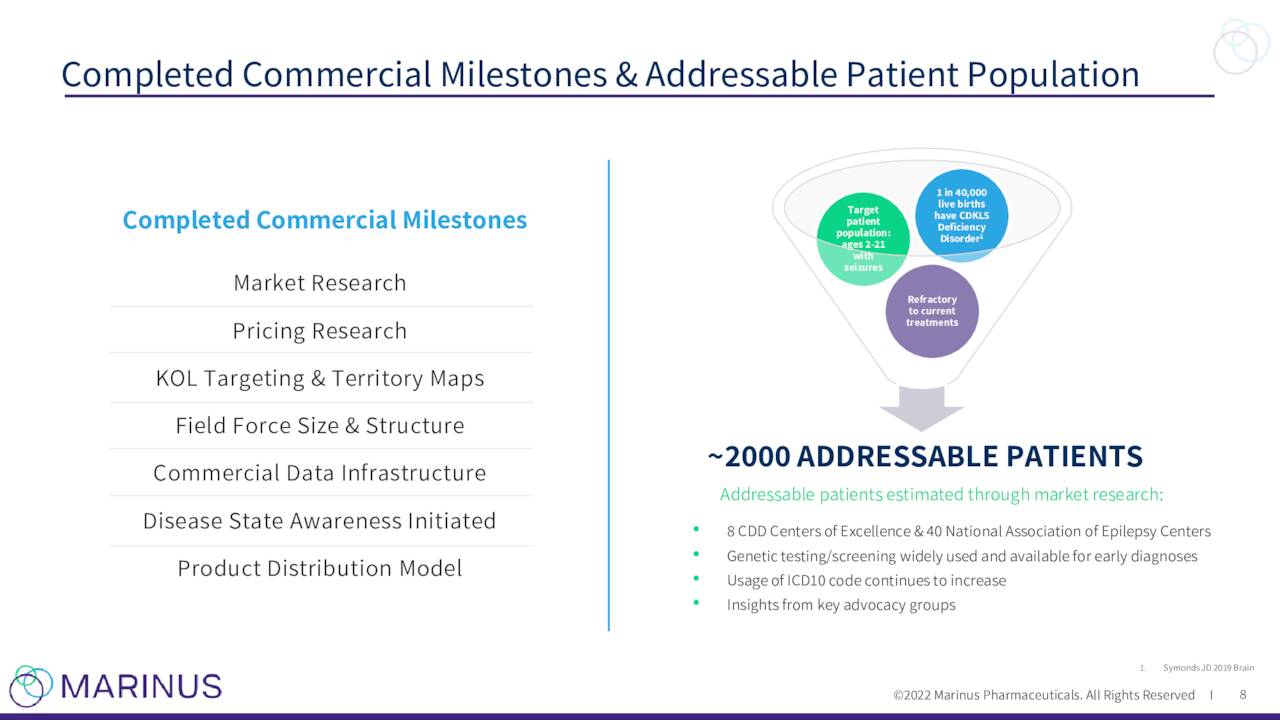

Ztalmy or Ganaloxone has some significant potential across a variety of indications even as its current approved indication has a small target market (approximately 2,000 addressable population). However, profitability for Marinus is still years out into the future.

We concluded our last article around Marinus Pharmaceuticals with this conclusion:

With robust (albeit thinly traded) option premiums, Marinus is currently best played from a covered call angle.

Even with some positive news since then, that still seems the best way to establish a small ‘watch item‘ position in this developing and potentially lucrative story.

There are times when wisdom cannot be found in the chambers of parliament or the halls of academia but at the unpretentious setting of the kitchen table.” ― E.A. Bucchianeri

Be the first to comment