jetcityimage/iStock Editorial via Getty Images

Introduction

I have to say that I was very excited to write this article. While I do not own Marathon Petroleum Corporation (NYSE:MPC), I do own its peer Valero Energy (VLO), and I’m a big fan of the industry in general. In this article, I want to cover a number of things. First of all, I want to talk about the crack spread, the reasons why gas prices are so high, and why Marathon Petroleum is such a tremendous income vehicle despite a 2.6%, which is rather low given that we’re dealing with an energy stock. Since my last bullish MPC article in March was published, free cash flow expectations have gone through the roof. The company is now expected to maintain a double-digit free cash flow yield beyond 2022, which is tremendous news for investors as management is keen to distribute as much cash as possible to shareholders through its dividend and share buybacks. On top of that, the company has repaired its balance sheet, which gives it tremendous protection against the next industry downturn, whenever that may be.

Long story short, in this article, I will make the case why MPC is such a great long-term investment for income-oriented and dividend growth investors.

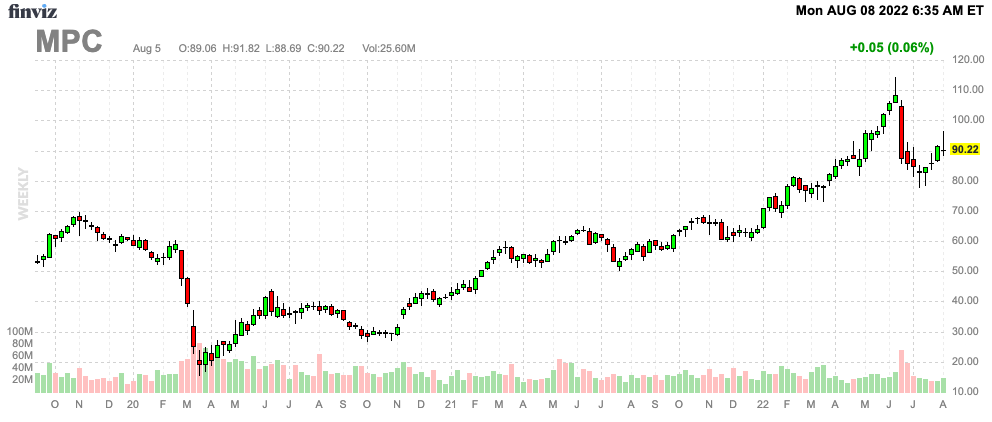

FINVIZ

Why Is Gas So Expensive?

Let me explain one thing first. The only reason why I do not own MPC is that I have “major” (relatively speaking) exposure in Valero, Exxon Mobil (XOM), and Chevron (CVX). I wanted to diversify my exposure first before buying more energy.

With that said, let’s talk about the elephant in the room. Gas prices.

Why is gasoline so expensive?

There are two reasons why that is. Reason one is because oil supply has become an issue as I explained in a detailed article last month. Oil (drilling!) companies rather focus on free cash flow instead of production growth as it protects them against economic downside in a world where politicians wouldn’t mind if oil companies went out of business.

Reason number two is connected to refinery companies.

In my most recent Valero article, one segment was called “The Mighty Crack Spread,” which discussed a major measure of industry profitability: the crack spread.

The crack spread, I have to admit that it sounds incredibly funny, is basically a tool to track refining margins. The 3-2-1 crack spread shows what we can expect in terms of refinery profitability. In this case, 3-2-1- stands for the cost of 3 crude oil future contracts, 2 gasoline futures contracts, and 1 ULSD diesel futures contract. If refined product prices rise faster than the price of oil, refineries make more money when buying a barrel of oil. After all, Valero does not produce oil, it buys feedstock for its operations consisting of “traditional” refining, renewable diesel, and ethanol.

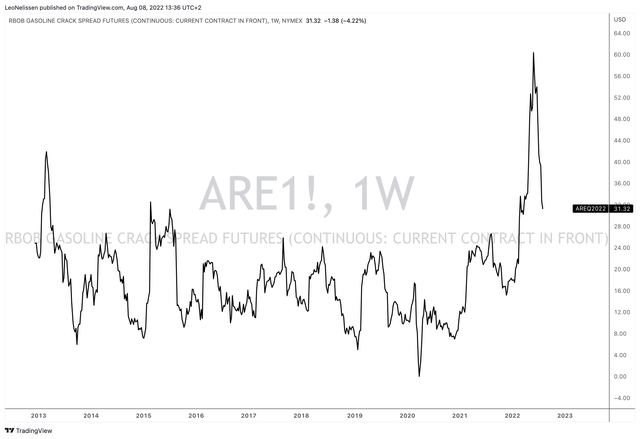

Using CME’s RBOB Crack Spread futures, we see that the spread is still elevated at $31.3 dollars per barrel. This is down from record highs close to $60, but still almost 100% above the pre-pandemic median.

TradingView Crack Spread Futures

In this case, President Biden and related politicians have made the case that energy companies are price gouging. That’s not the case, and I’m obviously not paid to say that.

First of all, while oil supply is an issue, the bottleneck is refining. Let’s assume a fake scenario where the world is suddenly doubling oil production. While that would be a major drag on crude oil prices, it wouldn’t necessarily make gasoline much cheaper. The problem is that a lot of upstream (drilling) oil companies do not turn oil into usable products – they don’t refine it.

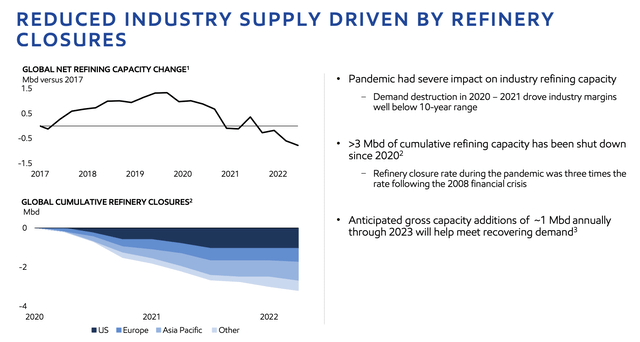

That’s where companies like Marathon come in. In a recent presentation, Exxon Mobil pointed out that global refinery closures erased more than 3 million barrels of daily refining capacity from the market. The pandemic caused an implosion in demand, which caused operators to shut down expensive operations. Bringing operations back online will take time and a lot of money. Let alone the cost of new refineries.

According to the Energy Information Administration (EIA):

The International Energy Agency estimates that global refining capacity decreased by 910,000 barrels per day (b/d) in 2021—the first decline in global refining capacity in 30 years. In the United States, refining capacity has decreased by about 1.1 million b/d since the start of 2020, contributing 184,000 b/d to the global decline in 2021.

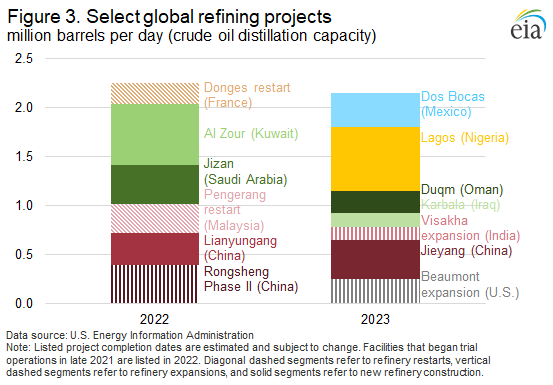

With that said, the recovery in supply will be gradual and slow. This year, the IEA expects capacity to expand by 1.0 million barrels per day and by an additional 1.6 million daily barrels in 2023.

All but one refining project will be outside of the United States. In the United States, Exxon Mobil is expanding Beaumont.

EIA

In other words, unless global economic growth (the demand side) implodes, refinery companies with low capital expenditures and efficient operations are in a fantastic spot to benefit from unusual tailwinds.

That’s where Marathon Petroleum comes in.

Marathon Petroleum – When Everything Goes Right

Marathon Petroleum is one of the world’s largest refinery companies with a market cap of $45.0 billion.

The company operates 13 refineries across 12 states with a capacity of 2.9 million barrels per calendar day of crude oil refining capacity. It also has a majority stake in MPLX, which covers its midstream operations through 112 terminals with 11 billion cubic feet per day of processing capacity.

Marathon Petroleum

The company also has retail operations through its Marathon and Arco brands, which non-US investors may be unfamiliar with. These operations cover 7,100 locations.

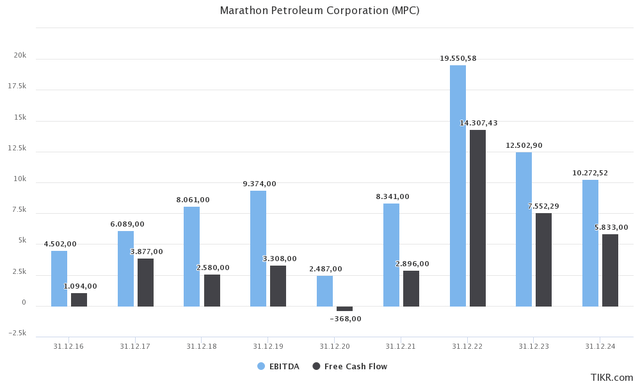

With that said, the company is on track to do $19.6 billion in EBITDA this year, which would be more than a billion dollars above the CUMULATIVE result of 2016, 2017, and 2018. Three years that all benefited from a strong economy.

In its second quarter of this year, the company boosted adjusted EBITDA from $2.6 billion in the prior year to $9.1 billion. All of this came from its refining operations. Midstream contributed just $53 million to this increase.

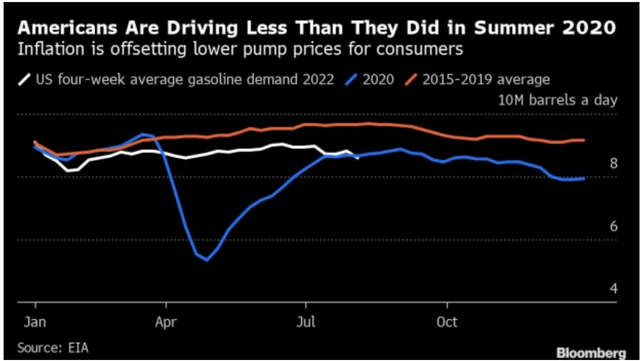

With that said, the main driver of growth is margins (related to the crack spread). Americans are now driving less than they did during the summer of 2020. This, of course, has everything to do with the price of gas and high inflation, which is causing people to cut down on driving.

However, Marathon Petroleum is benefiting from both high volumes and margins.

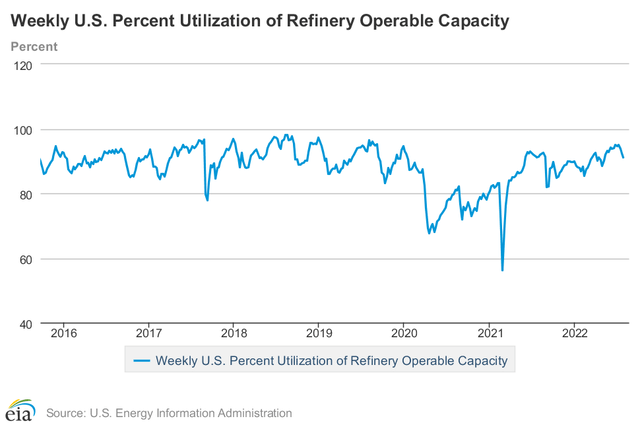

Why? Because the company ran on full utilization in 2Q22. While I do know what “full utilization” means, I still had to look it up as I couldn’t really believe it.

In 2Q22, the company refined 2,887 thousand barrels of crude oil per day. This implies a 100% utilization rate.

In the U.S., the average refining capacity in the past few months was somewhere between 92% and 95% most of the time. Note that that is favorable. Consistent utilization rates close to 100% put too much pressure on operators as it risks neglected maintenance and worn-out operations over time.

Marathon obviously knows this and will reduce throughput volumes to roughly 2.7 million barrels per day in the third quarter. This represents a 94% utilization rate. According to the company:

Utilization is forecasted to be lower than second quarter due to higher planned turnaround activity. Planned turnaround expense is projected to be approximately $400 million in the third quarter with activity spread across all 3 regions.

The best thing is that even though analysts expect margins to moderate in the years ahead, Marathon is still expected to do more than $10 billion in 2024 EBITDA, which exceeds anything it has generated prior to the pandemic. The same goes for free cash flow, which could remain close to $6.0 billion in 2024, which is more than two full years from now.

What this means is a lot of tailwind for its investors.

Marathon Dividends (And Buybacks)

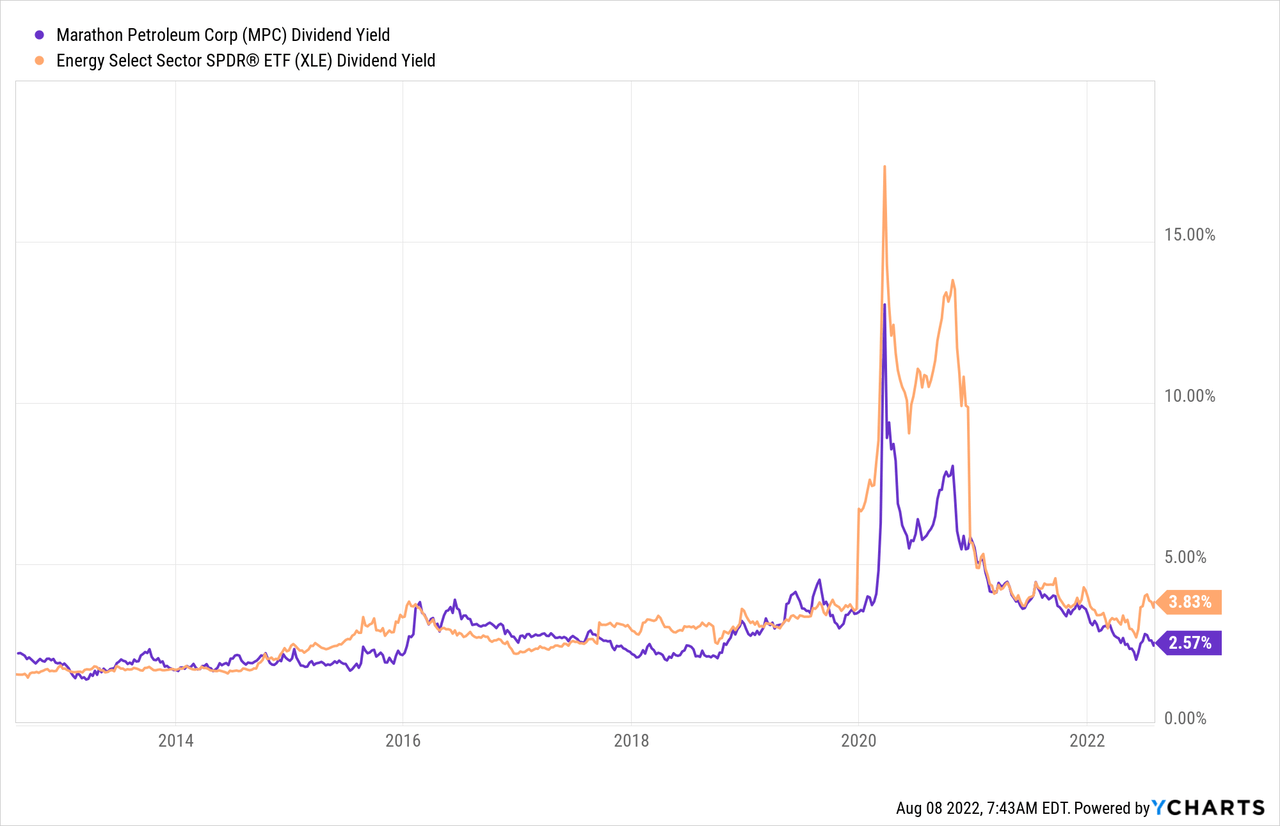

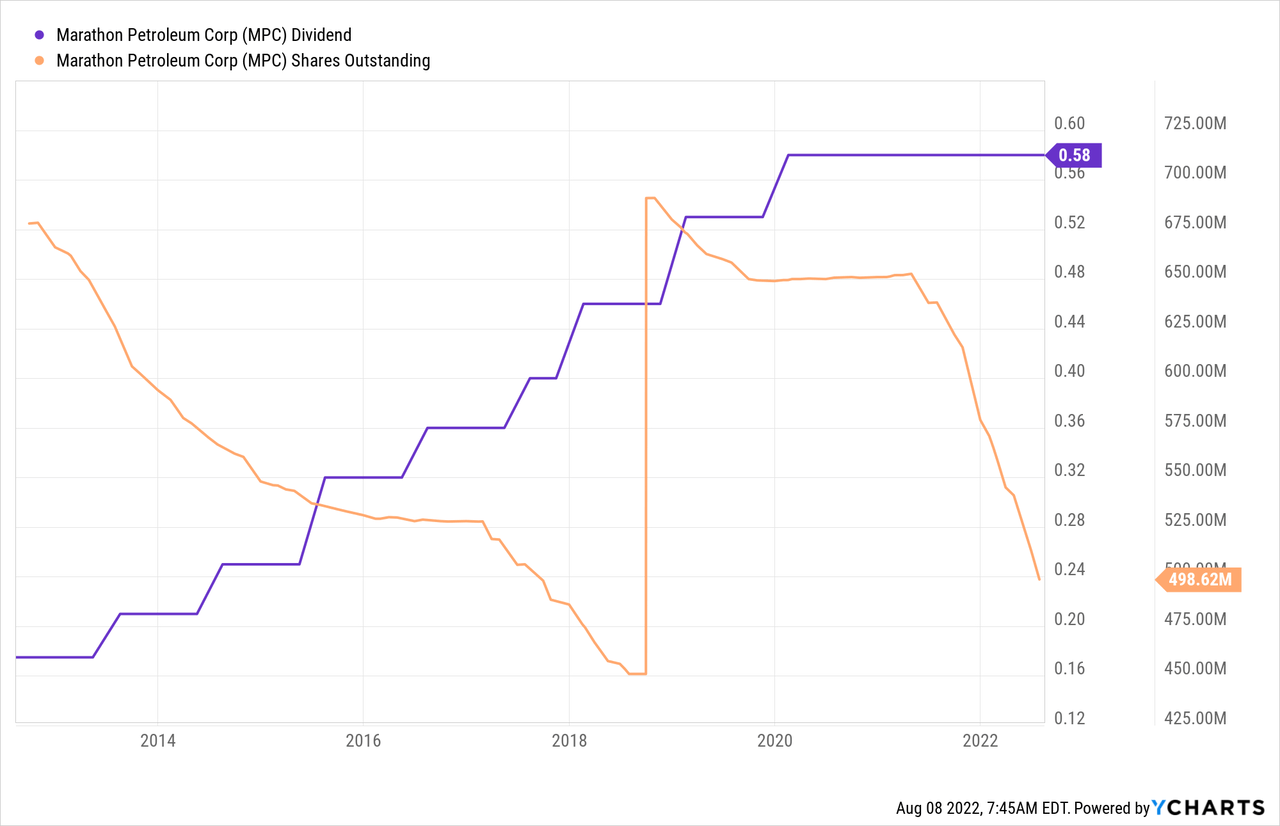

Marathon Petroleum pays a $0.58 dividend per share per quarter. That’s $2.32 per year and 2.6% of the current share price.

That’s not a very high dividend yield considering that MPC is an energy company. Especially in current times, energy is considered the go-to place for high income.

MPC is now yielding slightly more than 100 basis points below the Energy ETF (XLE).

However, that’s where the bad news ends.

MPC is more of a total return play than a high-income tool, which is great for long-term dividend growth investors.

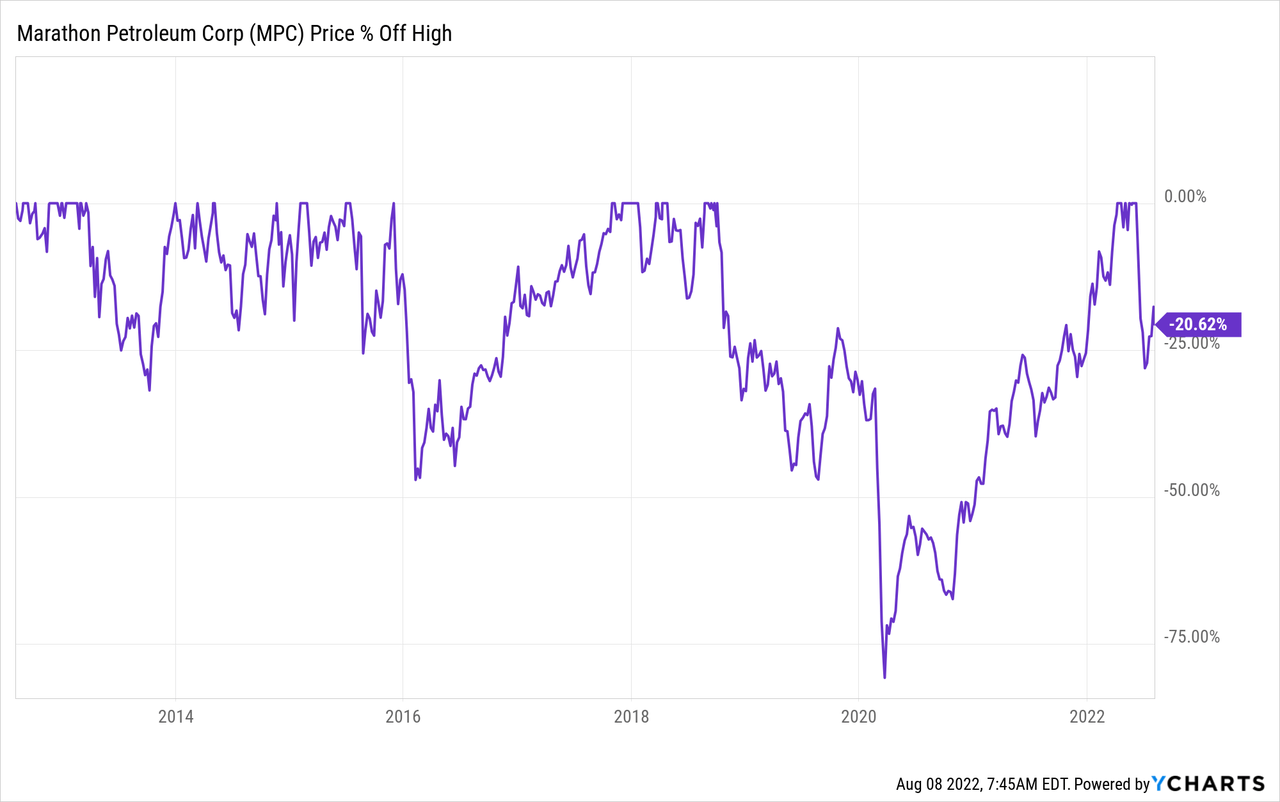

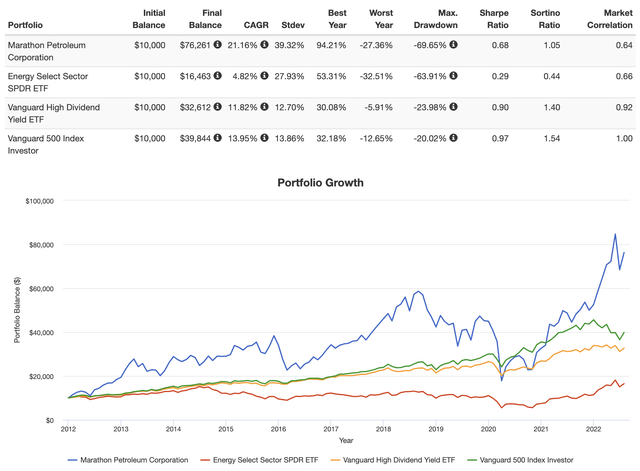

Since its spin-off from Marathon Oil (MRO) – people keep confusing these two – it has outperformed the energy ETF, the S&P 500, and the Vanguard High Dividend ETF (VYM). Yes, it has a much higher standard deviation and the company is prone to steeper sell-offs. However, it has a history of bouncing back quickly, maintaining steady outperformance.

Moreover, the company’s dividend is now roughly at its long-term median, if we adjust for the steep increase during the pandemic sell-off.

While refinery stocks have “always” been a source of great free cash flow, the current environment allows for accelerated dividends, higher buybacks, and debt reduction.

For example, in 2023, MPC is expected to do $7.6 billion in free cash flow (as displayed in the first TIKR chart of this article). This implies a 16.9% free cash flow (“FCF”) yield using the current $45 billion market cap. In 2024, this yield is implied to be 12.9% based on $5.8 billion in FCF. I’m purposely not using 2022 numbers here as these will be a big outlier.

However, while 2022 is expected to be an outlier year, the free cash flow it generates will be a huge win going forward either way.

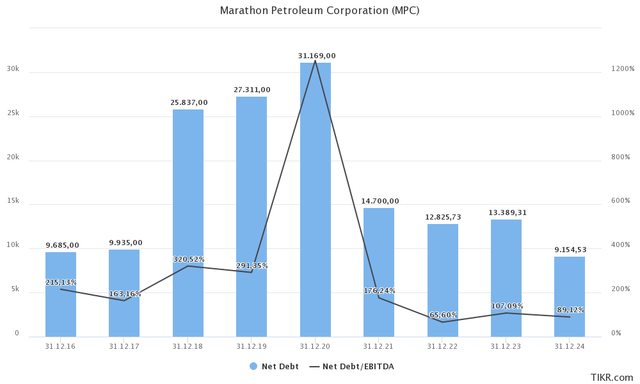

The chart below shows (expected) net debt. Net debt is gross debt minus cash. So, even if the company doesn’t use cash to repay debt but uses it as cash, it still reduces net debt. What we see is that the pandemic caused net debt to exceed $31 billion. Back then, it was close to 13x EBITDA due to an implosion in demand. Refinery companies didn’t have enough money to cover capital expenditures, let alone distribute dividends. Now, major cash tailwinds allow the company to rapidly reduce debt. Analyst estimates expect net debt to fall below $9.2 billion in 2024, which is less than 0.9x EBITDA.

What this means is that high free cash flow expectations are even better as they will end up in investors’ pockets. After all, the debt ratio is already sustainable, which is confirmed by the company’s BBB credit rating. That’s one step below the A range.

As the chart above shows, MPC has a history of aggressive dividend growth. Over the past 10 years, the average annual dividend growth is 20.0%. This includes zero growth in its dividend since the start of the pandemic.

However, shareholders still benefited. The company picked up share buybacks. Buybacks were so high that almost the entire increase in shares due to the Andeavor acquisition has been offset.

Since March 31, 2021, the company has reduced the number of shares outstanding from 652 million to 499 million. That’s a decline of 24% in six quarters.

This decline is fueled by the company’s $15 billion buyback program, which is accommodated by a separate $5 billion buyback program. This includes the proceeds of the $21 billion Speedway sale last year. As of the end of 2Q22, the company still had $2.9 billion left under its $15 billion buyback program.

With that in mind, this is what the company commented on the timing of its buyback program and when it expects to hike the dividend:

[…] we remain committed to a secure, competitive and growing dividend. Our objective has been to complete the $15 billion repurchase program no later than the end of this year. We remain on track to meet this commitment. Upon completion of the program, we will reassess our dividend level.

While I cannot promise anything, I expect a juicy dividend hike in 1Q23 and long-term dividend growth to be in the high-double-digit territory. After all, the company makes too much money to keep saving money. Its balance sheet is healthy and comparing its 2.6% yield to a double-digit FCF yield means there is plenty of upside potential, which will be good news for the total return as excess FCF will be used for buybacks.

So, what about the valuation?

Valuation

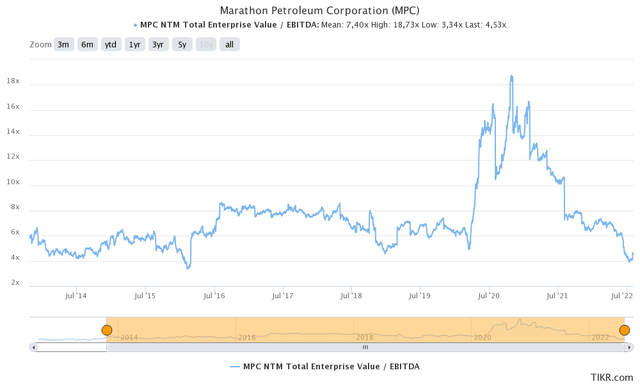

There are two numbers that matter here. First of all, I’m going to use 2023 EBITDA and net debt estimates as these numbers incorporate 2022 debt reduction but not the big outlier in 2022 EBITDA.

Using the $45 billion market cap, $1.1 billion in pension-related liabilities, and $7.4 billion in minority interest on top of $13.4 billion in expected 2023 net debt gives us an implied enterprise value of $66.9 billion.

That’s 5.4x expected 2023 EBITDA of $12.5 billion.

Using 2024 numbers, we’re dealing with lower net debt of $9.2 billion and a more “normalized” EBITDA of $10.3 billion. That would imply a 6.1x EBITDA valuation.

This valuation is attractive as it puts the fair value roughly 40% higher for the next 2 years.

With all of this in mind, please be aware that MPC is volatile. The same goes for all of its peers. While we’re dealing with a tremendous dividend growth opportunity, it’s an opportunity that comes with regular and steep downturns.

While I do not expect that the pandemic sell-off will happen again anytime soon, investors need to be aware that 40% sell-offs are not that uncommon during (manufacturing) recessions.

Takeaway

Marathon Petroleum is in a very interesting spot. The company is down 22% from its all-time high, yet still up 40% since the start of the year. That’s in a year with two consecutive quarters of negative GDP growth and an S&P 500 with a negative year-to-date performance of 13%.

Marathon Petroleum benefits from a high utilization rate, high margins (the crack spread), and the fact that global refinery output is low and unlikely to accelerate above pre-pandemic levels for at least two years.

This is boosting free cash flow and EBITDA to numbers that were unthinkable just one year ago. Now, it’s helping the company to rapidly reduce net debt and boost buybacks.

The 2.6% dividend yield isn’t that exciting. However, the company is set to restart dividend hikes next year as it completes its buyback program this year. If history and its financials are any indications, the dividend will benefit from aggressive hikes that are fully backed by free cash flow.

The valuation is attractive and hints at more upside over the next 1-2 years.

Once investors take high volatility into account, we’re dealing with a tremendous total return/dividend growth opportunity in the energy sector.

(Dis)agree? Let me know in the comments!

Be the first to comment