pixinoo/iStock via Getty Images

Investment Thesis

Marathon Oil Corporation (NYSE:MRO) is an exploration and production company for oil, natural gas liquids (”NGLs”), and natural gas.

Marathon Oil is in a very strong position to benefit from oil prices staying around $80 WTI and gas prices above $3/mmbtu. Anything above this threshold, and this becomes a home run.

As it stands right now, investors paying 6x free cash flows will get around 16% return of capital via share buybacks and dividends.

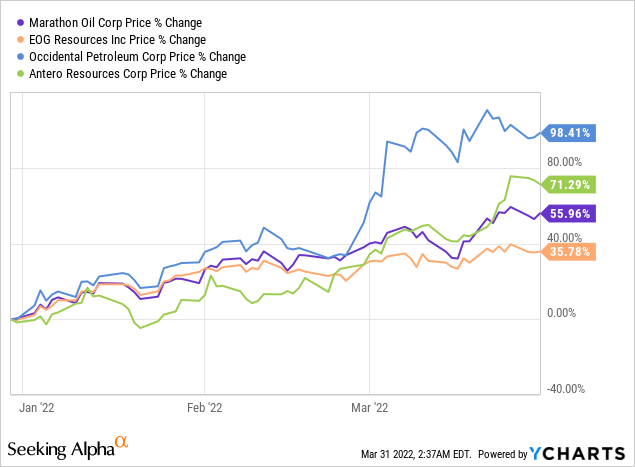

Investor Sentiment is Hot

As you can see above, the E&P sector is hot right now, with many stocks having already started their climb higher. However, I believe that this upward climb isn’t finished yet. We are still very much at the foot of the mountain. And that there’s a lot more upside still to come.

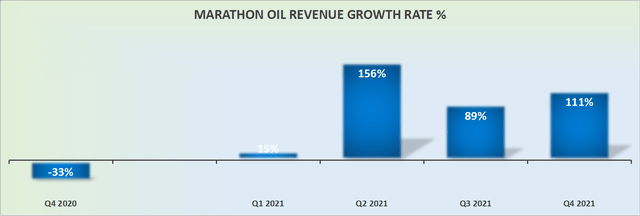

Revenue Growth Rates Will Remain Strong Near-Term

Marathon Oil revenue growth rates

Oil and gas stocks have had a seriously strong twelve months. However, since investors have shunned this side of the market for so long, there’s been a massive period of underinvestment.

This has led to only the strongest balance sheets and lowest-cost operators surviving. This is survival of the fittest on the Street.

Consequently, investors coming to this space now are in a sweet spot. While the sanctions against Russia put the spotlight on this space and acted as an accelerant, the message here is clear. These dynamics were already underway before the Russian sanctions. And that’s what many investors fail to understand.

The Russian sanctions only exasperated what was already happening. Similarly, even if the Russian sanctions were to be removed tomorrow morning, this wouldn’t kill this bullish thesis.

What’s more, realistically, sanctions are incredibly sticky. They are so easy to be put on. But they are seriously difficult to be removed. On that basis, Marathon Oil is going to continue to be a great investment.

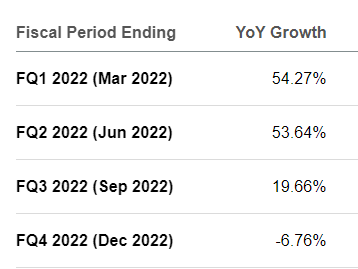

Marathon Oil revenue consensus

As you can see above, near-term, analysts following this company are expecting to see a period of strong growth.

However, in the later parts of the year, analysts expect Marathon’s top line to revert back down to lower growth rates. And do you know why?

Because everyone is assuming that there’s going to be demand destruction. There has to be. Things can’t be sustained at these levels for long.

Well, as a consumer, I can sympathize with that point of view. But as an investor, with my rational and objective hat on, I can tell you that they can.

Getting enough oil to meaningfully lower the WTI prices will take more than a few months. You need to hire people, find oil, get permits, get funding, get the oil out of the ground, etc. This all takes time. It’s not like some code can be written overnight by two hackers in a garage and deployed.

Why Marathon Oil? Why Now?

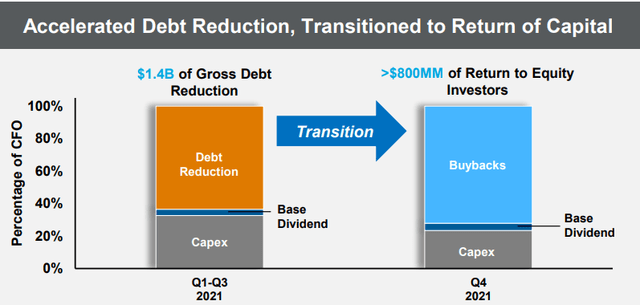

Marathon Oil is an exploration and production (”E&P”) company. As touched on already, it only survived the previous few years by being incredibly focused on its debt reduction program.

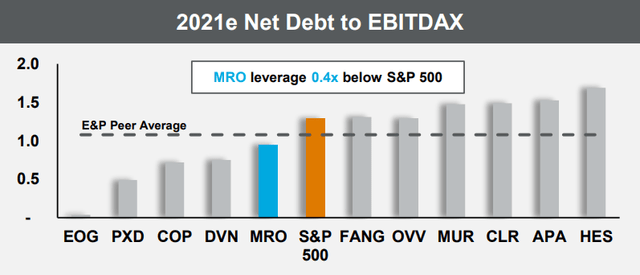

Marathon Oil Q4 2021 investor presentation

It has now exited Q4 2021 with a net debt position of roughly $3.5 billion. For a business that’s clearly generating a lot of profitability, this is an easily manageable debt profile.

Marathon Oil Q4 2021 investor presentation

As you can see above, Marathon’s debt profile is amongst the best of its peers. That being said, all its peers have reasonably strong balance sheets too. Obviously, as I already touched upon above, if you want to survive decades of underinvestment, you have to operate in a very lean manner. There are no two ways about it. Survive or die.

Oozing Free Cash Flows

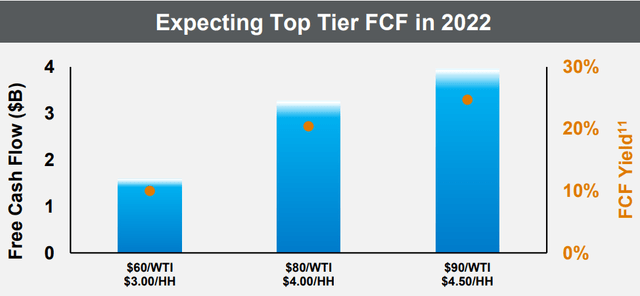

Marathon Oil Q4 2021 investor presentation

At $80 WTI and $4/mmbtu, Marathon Oil expects to deliver more than $3 billion of free cash flow.

Furthermore, Marathon’s capex for 2022 is expected to be around $1.2 billion. Since, Marathon Oil expects to return a minimum of 40% of cash flows from operations to shareholders, assuming oil prices of $60 WTI or higher, we should expect to see $1.7 billion of capital return to shareholders.

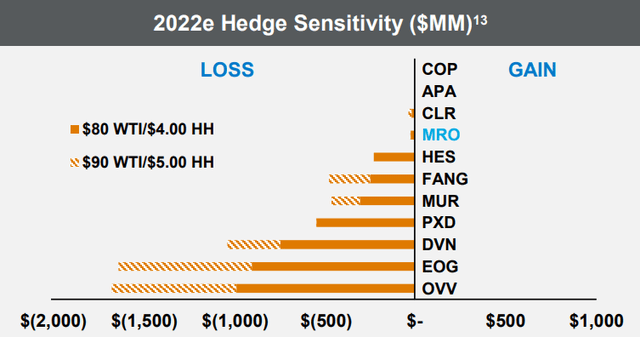

Marathon Oil Q4 2021 investor presentation

More importantly, Marathon runs a hedge-less book. What that means is that if the price of oil was to stay higher than $80 WTI and $4/mmbtu, then it is able to participate in this upside unhindered.

On the other side of the equation, what if WTI and gas prices fall through the floor?

Marathon oil contends that its business can report free cash flow breakeven below $35 WTI, assuming $3.00/mmbtu. And looking up gas prices we are far from this:

As you can see above, gas prices at the moment are higher than $5/mmbtu. In fact, we haven’t seen $3/mmbtu since last year, way before the European crisis added accelerant to this whole sector.

MRO Stock Valuation — Still at 6x Free Cash Flow

If we were to assume that WTI prices stay above $80 and gas above $3/mmbtu, we are going to see Marathon report more than $3 billion of free cash flow this year. This puts the stock priced at 6x free cash flow.

Obviously, we have to keep in mind that nobody is expecting WTI to stay high into 2023. That’s not happening. There will be a meaningful contraction in the WTI price. How much? That’s anyone’s guess.

But look around other spaces outside of commodities. You aren’t going to find many sectors that are priced at less than 15x forward free cash flow. And 10x free cash flow, with clean balance sheets? Forget about it.

What about single digits to free cash flow? Welcome to commodities.

And did I mention the capital return program that Marathon has for 2022?

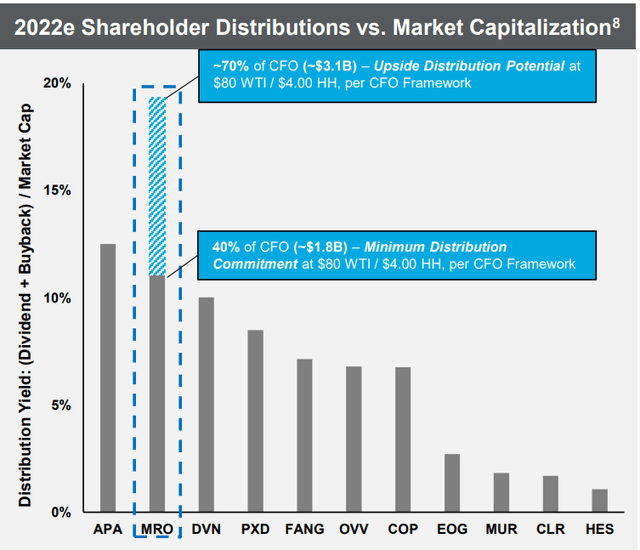

Marathon Oil Q4 2021 investor presentation

As you can see above, if WTI stays at $80 and gas at $4, investors are going to get up to 16% return of capital this year via mostly buybacks, with less than 2% of the return coming from dividends.

The Bottom Line

I believe that the market is looking at the fact that these shares have moved higher quickly and everyone is price anchoring to lower price points from last year and assuming that this trend is overdue a breather.

However, for as long as these companies have huge pent-up demand, constricted supply, and are priced at single-digit free cash flow multiples, the odds of this investment working out favorably are good.

I don’t own any share in this name, but I certainly have exposure to this space. I’ve selected a peer, that’s not to say that the peer is better. I don’t think it makes a huge difference. All these players have the same risks and rewards. It’s a case of picking one and sticking with it. Whatever you decide, good luck and happy investing.

Be the first to comment