William_Potter/iStock via Getty Images

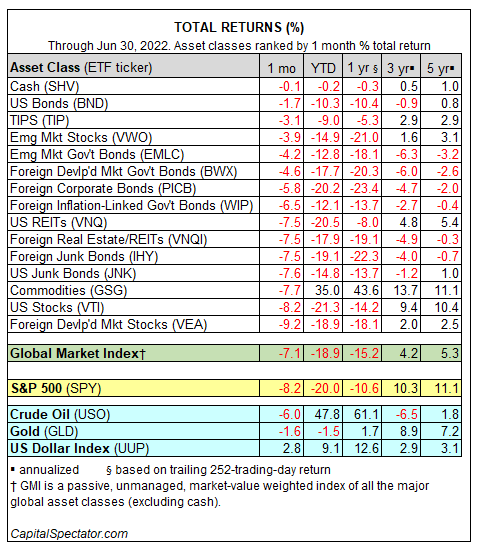

As risk-off messages go, the markets couldn’t be any clearer in June. Losses weighed on every slice of the major asset classes, based on a set of proxy ETFs. Even cash took a hit, albeit a fractional one.

Selling took a toll far and wide last month, with the foreign stocks in developed markets falling the most. Vanguard Developed Markets (VEA) lost 9.2% in June, leaving it in the red by nearly 19% year to date.

US stocks (VTI) suffered nearly as much, and for 2022, the loss in American shares exceeds 21%. US bonds (BND) are nursing lesser losses, but by fixed-income standards, it’s fair to say that everyone’s favorite safe haven looks decidedly risky this year via a 10.3% year-to-date decline.

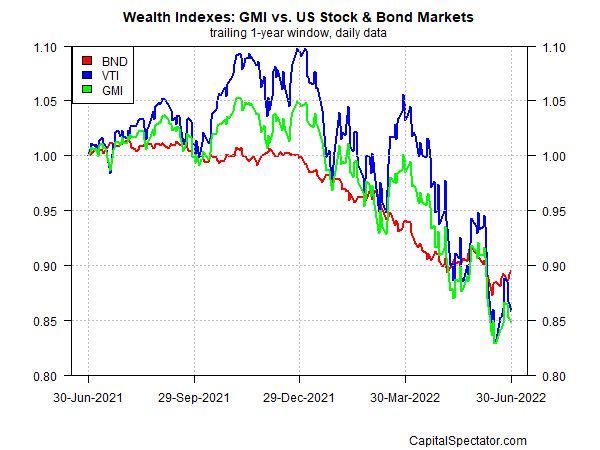

Comparing GMI’s performance to US stocks and bonds over the past year highlights that bonds (BND) are providing some ballast recently, at least in relative terms – an attribute that previously had been in short supply for 2022.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment