PM Images

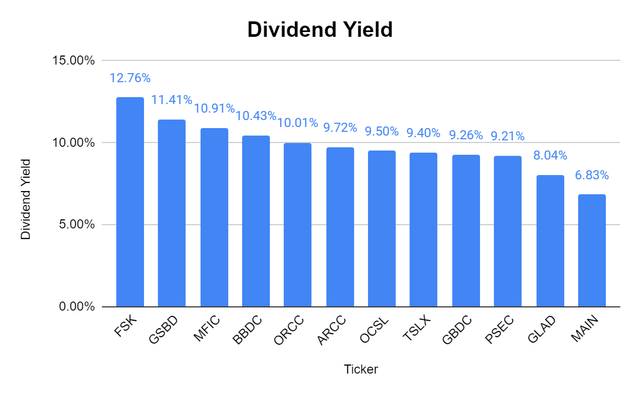

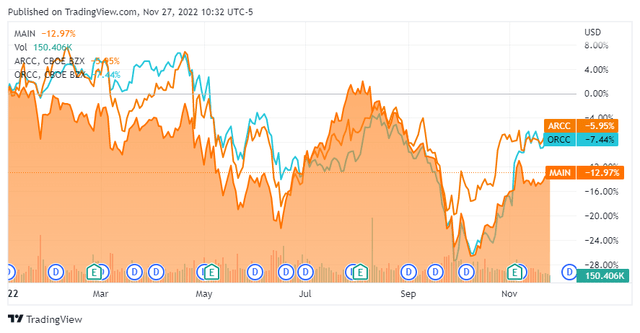

Main Street Capital (NYSE:MAIN) is the 7th largest BDC by net assets, the 6th largest BDC by market cap, and one of the most popular BDCs on Seeking Alpha, with 61,980 followers. MAIN had a strong Q3, beating on the top and bottom line, and declared its 4th supplemental dividend for 2022. From an income standpoint, MAIN has been a printing press as shareholders have received 11 monthly and 3 supplemental dividends YTD, with another monthly and supplemental dividend coming in December. MAIN also increased its monthly dividend slightly, and its current yield is sitting at 6.83%. While I am a shareholder, I am not adding to MAIN as I feel there is a better opportunity in Ares Capital (ARCC) and Owl Rock Capital Corporation (ORCC). BDCs are income investments for me, and I want to pay the lowest multiple on their net investment income, at a discount or close to par level for their net asset value (NAV) while generating a large yield. Don’t get me wrong, 6.83% is a strong yield, but in a rising rate environment where I can get 4.5% from a CD or 1-Year T-bill, I need a larger spread if I am going to take on equity risk from a BDC. MAIN is a solid company, but the valuation isn’t enticing at this level, and I am allocating capital toward ARCC and ORCC for the time being.

Main Street Capital delivered a strong Q3 and is growing its Distributable Net Investment Income (DNII), NAV, and monthly dividends

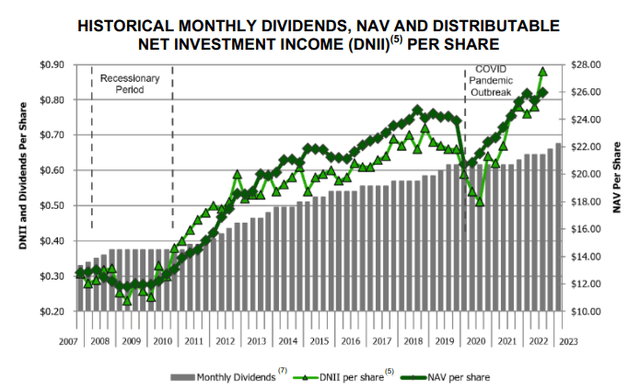

While I am not currently adding to MAIN, I can respect its business progression. In Q3, MAIN generated non-GAAP EPS of $0.88, which was $0.12 above the consensus estimates, and $98.39 million in total investment income, which was a 28.1% YoY increase and $10.79 million better than the consensus estimates. MAIN has increased its NAV by 2.17% QoQ to $25.94, its largest amount since inception. MAIN is generating 124% of its regular monthly dividends in DNII and declared $0.675 per share of dividends in Q1 of 2023, an increase of 4.7% YoY.

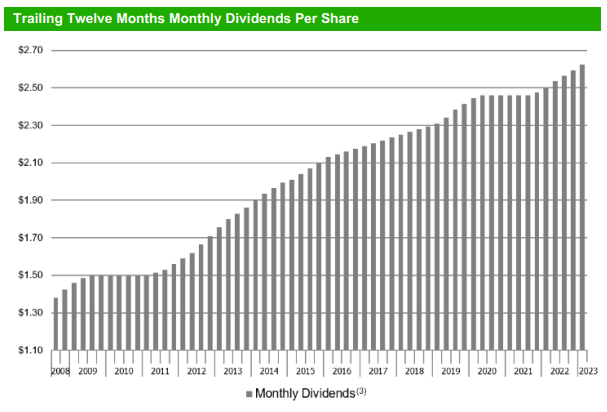

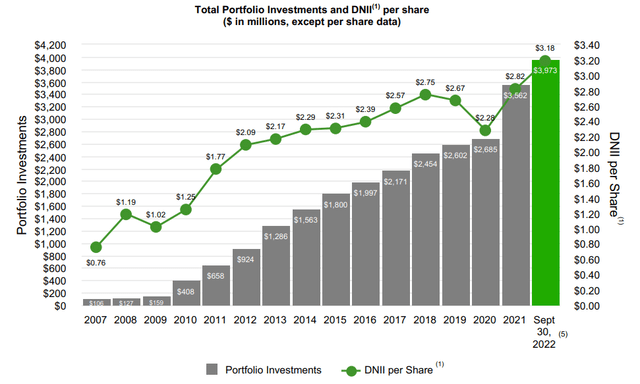

MAIN has a diversified investment strategy, and by investing in MAIN I am gaining access to an investment class that I couldn’t allocate capital toward on my own. MAIN invests debt and equity in lower middle market (LMM) companies that generally produce between $10 million – $150 million in revenue and $3 – $20 million of EBITDA. There is limited competition in this space, and MAIN is able to invest in secured debt with an equity stake in these businesses, which has generated substantial returns over the years. MAIN also invests in private loans through first lien, and secured det. Over the past 15 years, MAIN has grown its investment portfolio by 3,648.11% as its increased from $106 million to $3.97 billion. This has driven the amount of DNII per share to $3.18 from $0.76 over this period.

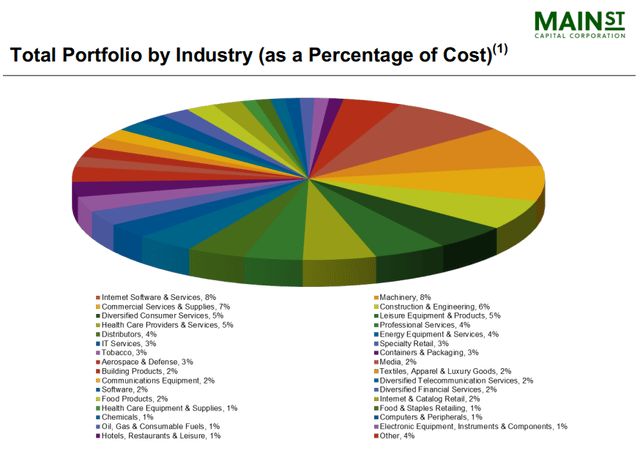

MAIN’s management team has done a fantastic job building its portfolio and delivering continuous income to its shareholders. MAIN’s investment portfolio is made up of 48% LMM, 37% private loans, 9% middle market, and 6% other. MAIN has 75 portfolio companies that make up the LMM section, with the debt yielding 11.8%, of which 99% of debt investments have first-lien positions. The private loan section has 87 investments with an average investment size of $17.5 million, and the debt is yielding 9.9%. The middle market companies account for 33 investments, at an average size of $12.7 million, and the debt is yielding 9.6%. MAIN has structured its entire portfolio where a single industry doesn’t account for more than 8% of the portfolio, creating a vast level of diversification that helps mitigate downside risk.

MAIN’s history is more than enough validation that management has been a good steward of shareholder capital. There is a very good reason why MAIN is one of the most popular BDCs and has the largest amount of followers (61,980) in the BDC space on Seeking Alpha. Since MAIN’s IPO, its share price has increased by 157.60%, as it appreciated from $15 to $38.64. Over the past 15 years, this has been an average annual increase of 10.51%. In addition to the capital appreciation, MAIN has never decreased its monthly dividend, which has grown by 105% since the IPO. By the end of 2022, MAIN will have paid $4.49 in supplemental dividends on its regular monthly dividends. Cumulatively, investors will have been paid $35.16 per share in dividends since the IPO. Without factoring in compounding for investors who have reinvested the dividends, MAIN has delivered an additional $58.77 in value since its IPO price, including $23.64 of capital appreciation and $35.13 in dividends. There is no question as to why long-term investors love MAIN, as it’s been a great investment over the years.

Main Street Capital

Why I believe MAIN isn’t the best BDC for my capital today

There is no question that MAIN has been a great investment, and I wish I had purchased shares when they went public. I have to look at the data today, going forward, and not base my decisions on the allure and history of a company that has already unfolded. I am a shareholder of MAIN, and I am not selling my shares. The monthly and supplemental dividends are being reinvested and compounding. As I look to allocate more capital toward the BDC space, MAINs valuation isn’t right for me. When I look at the yield, NII to market cap, and premium to NAV, MAIN doesn’t get me excited. I will be more than happy to allocate more capital to MAIN in the future if its valuation becomes more attractive. Until then, I am adding to my positions in ARCC and ORCC.

I created a large peer group for the BDCs I track and will compare MAIN against the following companies:

- Ares Capital (ARCC)

- Barings BDC (BBDC)

- FS KKR Capital Corp (FSK)

- Gladstone Investment (GLAD)

- Goldman Sachs BDC (GSBD)

- Golub Capital (GBDC)

- MidCap Financial Investment Corporation (MFIC)

- Oaktree Specialty Lending Corporation (OCSL)

- Owl Rock Capital Corp (ORCC)

- Prospect Capital Corp (PSEC)

- Sixth Street Specialty Lending (TSLX)

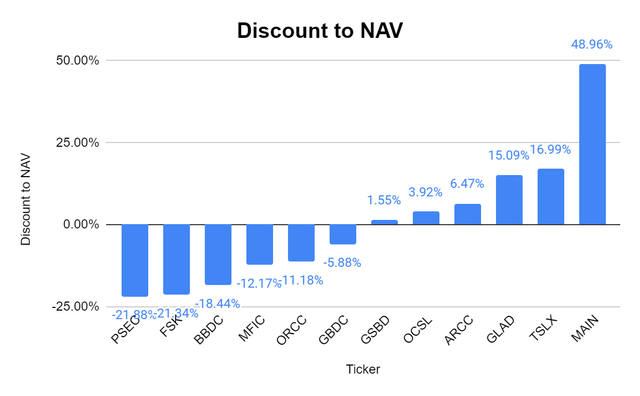

The first thing I look at is the discount to NAV. MAIN is trading at a 48.96% premium to NAV, while the 12 companies have a 0.17% premium average. ARCC trades at a 6.47% premium, while ORCC trades at a -11.18% discount to their NAVs.

Steven Fiorillo, Seeking Alpha

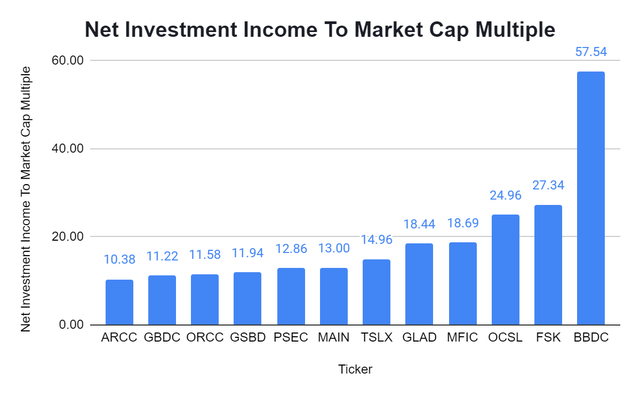

Next, I look at the NII to market cap because I want to pay the best valuation for a BDC’s NII that I can. MAIN is trading at 13x its NII, which is under the peer group average of 19.41x. ARCC and ORCC trade at the lowest and 3rd lowest valuations, and I can pay 10.38x for ARCC’s NII or 11.58x for ORCC’s NII.

Steven Fiorillo, Seeking Alpha

Since these are income investments, the dividend yield matters. This is especially true when I can lock up capital for 1-year in a CD, take no risk, and generate 4.5%. The peer group average yield is 9.79% and MAIN has the lowest yield at 6.83%. ORCC generates a 10.01% yield, and ARCC throws off 9.72%.

Steven Fiorillo, Seeking Alpha

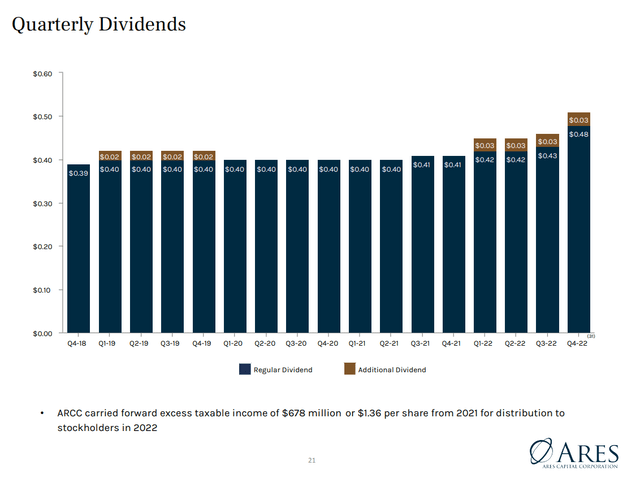

ARCC just increased its quarterly dividend and authorized its 4th special dividend in 2022. ARCC will also look to pay special dividends in the future.

Ares Capital

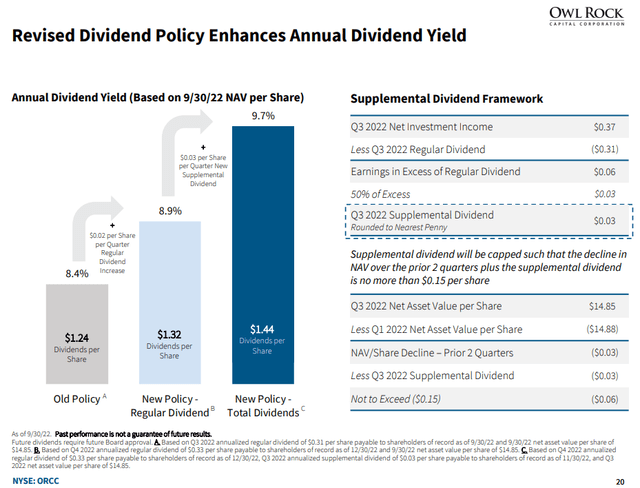

ORCC made a strong dividend announcement that caught my attention. ORCC declared a $0.33 dividend which is a 6.5% increase QoQ, in addition to announcing a supplemental dividend of $0.03. ORCC will also introduce a new quarterly special dividend, so shareholders benefit from increased earnings.

Owl Rock Capital

Conclusion

MAIN has been a great investment over the years, and generated continuous income and capital appreciation for its shareholders. I am holding onto my shares and reinvesting the dividends. Some may not agree with me, but I would get interested in adding to my position at around $30 per share as this would put the premium on MAIN’s NAV at 15.65% rather than 48.96% and increase its dividend yield to 8.8%. Today, I think ARCC and ORCC are more attractive, and while MAIN is a great company, its valuation is a bit too rich for me to add additional shares at this point in time.

Be the first to comment