gorodenkoff/iStock via Getty Images

A Quick Take On Maia Biotechnology

Maia Biotechnology (MAIA) has filed to raise an undisclosed amount in an IPO of its common stock, according to an S-1 registration statement.

The firm is a clinical stage biopharma developing treatments for various cancers.

MAIA is developing a new approach to treating cancers via telomere disruption technologies.

I’ll provide a final opinion when we learn more IPO details.

Company & Technologies

Chicago, Illinois-based Maia was founded to develop immuno-oncology-based treatments for non-small cell lung cancer, colorectal cancer and other cancer types.

Management is headed by co-founder, president, CEO and Chairman Vlad Vitoc, M.D, MBA, who has been with the firm since inception and previously ‘managed and supported over 20 early, launch, and mature stage compounds, which have included targeted therapies and immune therapies across more than 25 tumor types.’

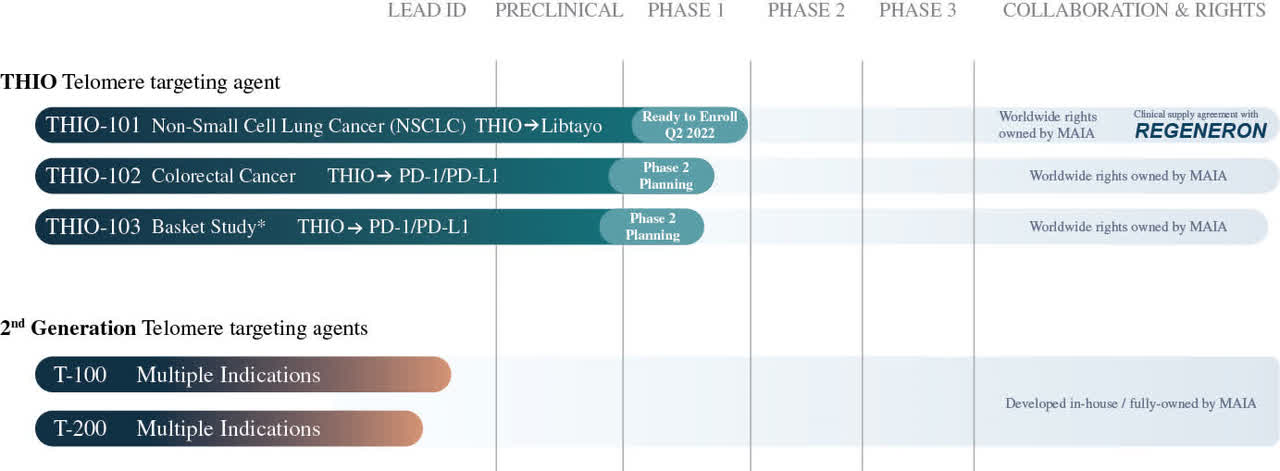

The firm’s lead candidate, THIO-101, is preparing to enter Phase 2 trials for the treatment of non-small cell lung cancer [NSCLC].

Its second candidate, THIO-102, is in Phase 2 trial planning for treating colorectal cancer.

Below is the current status of the company’s drug development pipeline:

Maia’s Pipeline (SEC EDGAR)

Maia has booked fair market value investment of $37.6 million as of December 31, 2021 from investors including individuals including Frank Perabo and Jerry Shay.

Maia’s Market & Competition

According to a 2017 market research report by Grand View Research, the global market for non-small cell lung cancer was valued at an estimated $6.2 billion in 2016 and is forecast to reach $12 billion by 2025.

This represents a forecast CAGR (Compound Annual Growth Rate) of 7.5% from 2018 to 2025.

Key elements driving this expected growth are an increase in air pollution and continued widespread use of cigarettes and other carcinogenic products.

Also, the NSCLC market has a strong pipeline of new treatments being developed by a variety of biopharma firms and major pharma companies which is slated to drive growth in the market in the years ahead.

Major competitive vendors that provide or are developing related treatments include:

-

Merck

-

Regeneron

-

Eli Lilly & Co.

-

Roche

-

Philogen

-

Chiome Bioscience

-

ImmunoGen

-

Vincerx Pharma

-

Macrogenics

-

Byondis

Maia Biotechnology Financial Status

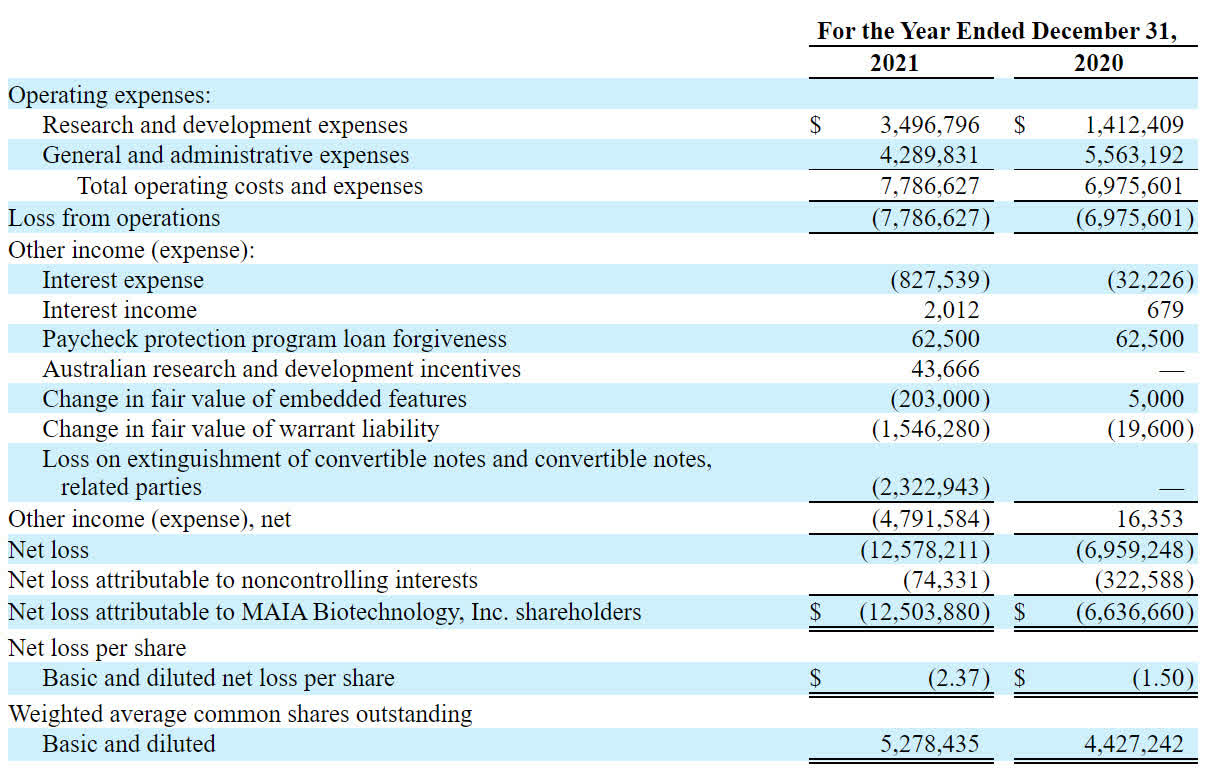

The firm’s recent financial results are typical of a development stage biopharma in that they feature no revenue and significant R&D and G&A expenses.

Below are the company’s financial results for the past two calendar years:

Statement of Operations (SEC EDGAR)

As of December 31, 2021, the company had $10.6 million in cash and $2.1 million in total liabilities.

Maia Biotechnology IPO Details

Maia intends to raise an undisclosed amount in gross proceeds from an IPO of its common stock, although the use of proceeds section details at least $24 million in proceeds usage upon a successful completion of the IPO.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Management says it will use the net proceeds from the IPO as follows:

approximately $10-15 million to fund the planned Phase 2 trial of THIO for NSCLC indication (THIO-101);

approximately $2-4 million to fund the planned Phase 2 trial of THIO for CRC indication (THIO-102);

approximately $3-5 million to fund pre-clinical to IND development for two second-generation telomere targeting compounds;

the remaining proceeds to fund our other research and development activities, as well as for working capital and other general corporate purposes.

The net proceeds from this offering, together with our cash, will not be sufficient for us to fund any of our product candidates through regulatory approval, and we will need to raise additional capital to complete the development and commercialization of our product candidates. We may satisfy our future cash needs through the sale of equity securities, debt financings, working capital lines of credit, corporate collaborations or license agreements, grant funding, interest income earned on invested cash balances or a combination of one or more of these sources.

(Source)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management said the firm is not a party to any material legal proceedings.

The sole listed bookrunner of the IPO is ThinkEquity.

Commentary About Maia’s IPO

MAIA is seeking public investment to fund further development of its immuno-oncology pipeline of cancer treatment candidates.

The firm’s lead candidate, THIO-101, is preparing to enter Phase 2 trials for the treatment of non-small cell lung cancer [NSCLC].

The market opportunity for treating NSCLC is reasonably large and expected to grow at an elevated rate of growth as the global population ages and air quality remains bad in certain regions.

Management hasn’t disclosed any major pharma firm collaborations agreements, although it has plans to enter into strategic collaboration agreements with select pharma firms with relevant immune activating therapies.

The company’s investor syndicate does not include any well known institutional life science venture capital firms or strategic biopharma investors.

ThinkEquity is the lead underwriter and IPOs led by the firm over the last 12-month period have generated an average return of negative (53.1%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

The firm is pursuing novel telomere disruption technologies that it believes has promise to induce cancer specific immune responses by the body to act against immunologically ‘cold’ tumor types that were previously unresponsive to immune checkpoint inhibitor treatments.

This appears to be a relatively new approach to treating certain cancers.

When we learn more details about the IPO’s proposed pricing and valuation, I’ll provide a final opinion.

Expected IPO Pricing Date: To be announced.

Be the first to comment