kynny/iStock via Getty Images

Introduction

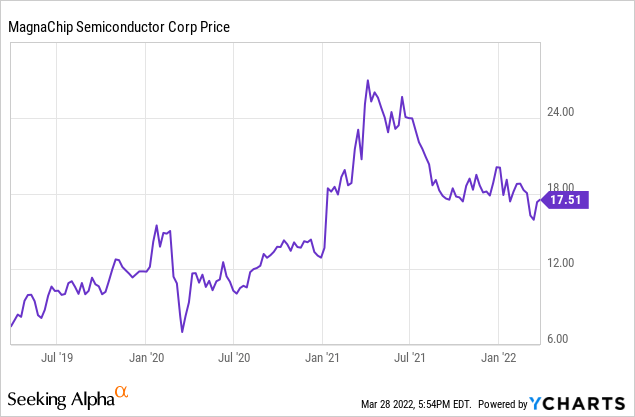

Magnachip’s (NYSE:MX) 2021 was quite volatile as the company was the subject of a buyout offer which eventually fell apart as the buyer was unable to secure all antitrust approvals to acquire this South Korea-based producer of semiconductors. Magnachip walked away with a hefty termination fee which further beefed up the balance sheet. And this means that although the semiconductor sector is facing some tough moments, Magnachip should have no problem at all to weather the current storm.

2021 was a decent year but beware for non-recurring items

In this article I won’t discuss the semiconductor market in depth as there are other authors that are far more knowledgeable on the fine details of this interesting sector. I will specifically zoom in on Magnachip and explain why I have been writing put options on this name for the past three months.

First of all, I wanted to have a look at the company’s income statement. We see Magnachip reported a gross profit of just over $153m, which is an increase of almost 20% compared to FY 2020. Some of the other expenses increased as well, but by just a few percent. In the image below, I have highlighted the $35.5m in non-recurring income related to the failed acquisition. As per the agreement, Magnachip was entitled to a total termination fee of approximately $70m of which just over 70% has already been paid as of December 31st with the remainder payable before the end of this month. The termination fee was booked as a non-recurring merger-related income and has been highlighted in the income statement as it was also offset by non-recurring merger-related expenses. This means the operating income of $83.4m was fueled by these $35.5m in non-recurring elements.

Magnachip Investor Relations

Adjusting the operating income for the merger-related income, the operating income would have been approximately $48m which is still almost 80% higher than in the previous year.

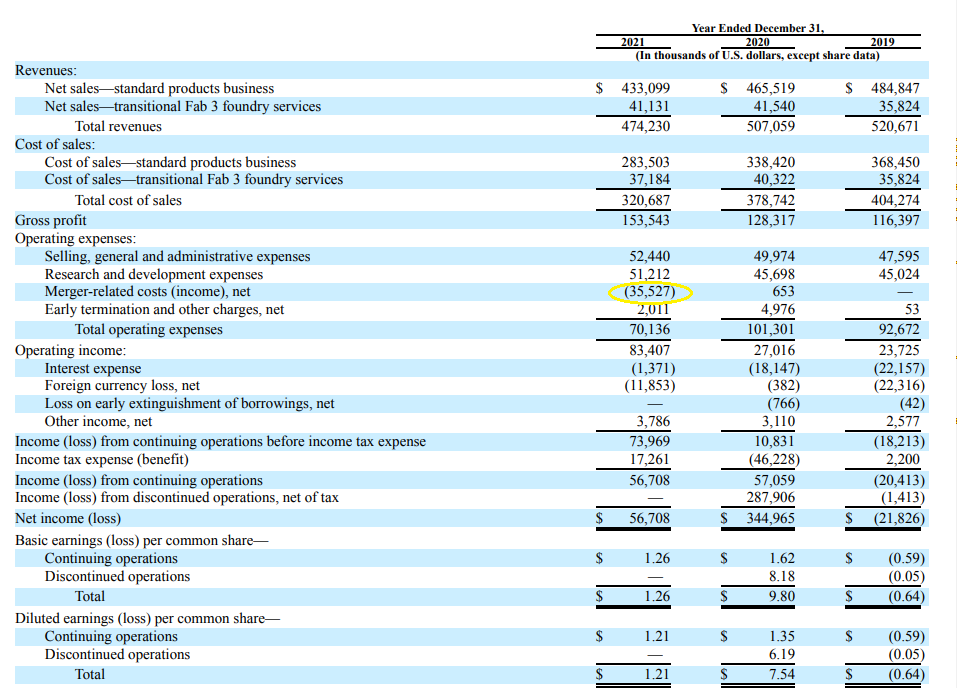

When analyzing the company’s cash flow statement, we obviously have to be careful to exclude these non-recurring items as well.

The reported operating cash flow was $87.7m but this includes a total investment in the working capital position of almost $35m and this should be added back to the reported cash flow statement which results in an adjusted operating cash flow of $122m.

Magnachip Investor Relations

This is where it gets tricky. Magnachip has received $50m from the termination fee and has booked the remaining $19.5m as an ‘other receivable’. Right off the bat you’d think the entire $70m termination fee would have to be deducted from the adjusted operating cash flow again, but that would be wrong. If we are excluding the non-recurring income, we should also exclude the non-recurring expenses related to the merger and that’s why I think it’s more fair to use the almost $36m in net non-recurring merger-related expenses. That would result in about $86m in adjusted operating cash flow. The total capex was $33m resulting in a net free cash flow of approximately $53m on an underlying basis. With approximately 45.8M shares outstanding as of February 14th, the underlying free cash flow per share was just over $1.15. Not bad at all.

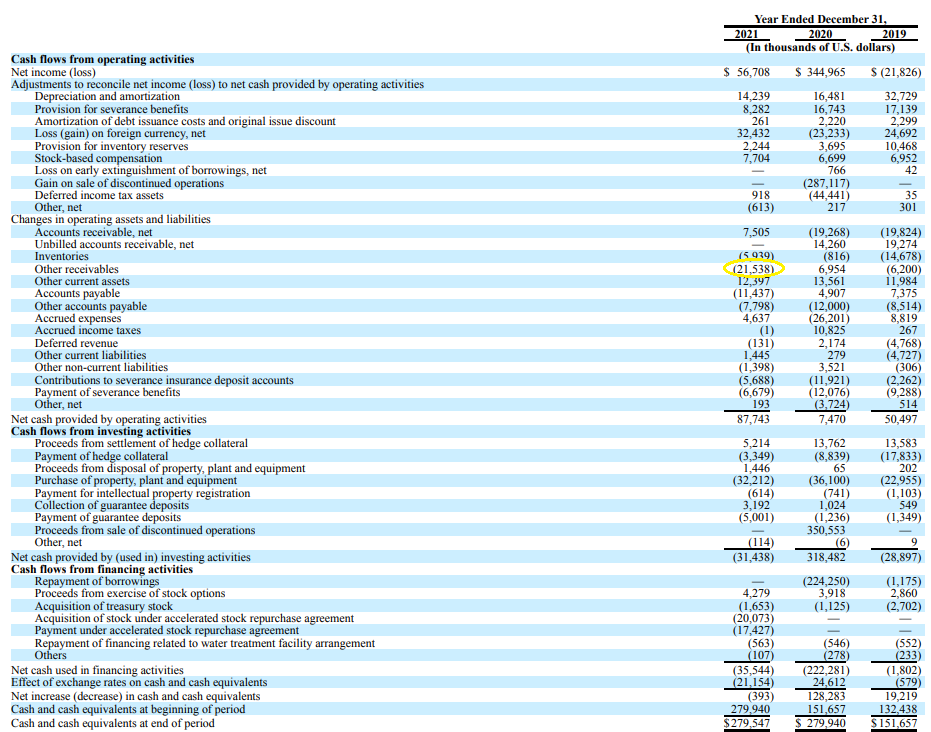

These are tough times for semiconductor companies, but the exceptionally robust balance sheet provides a safety net

While Magnachip for sure doesn’t sound ‘cheap’ when it’s trading at 15-16 times its underlying free cash flow in 2021, one of my main reasons to initiate an option strategy at Magnachip is its exceptionally robust balance sheet.

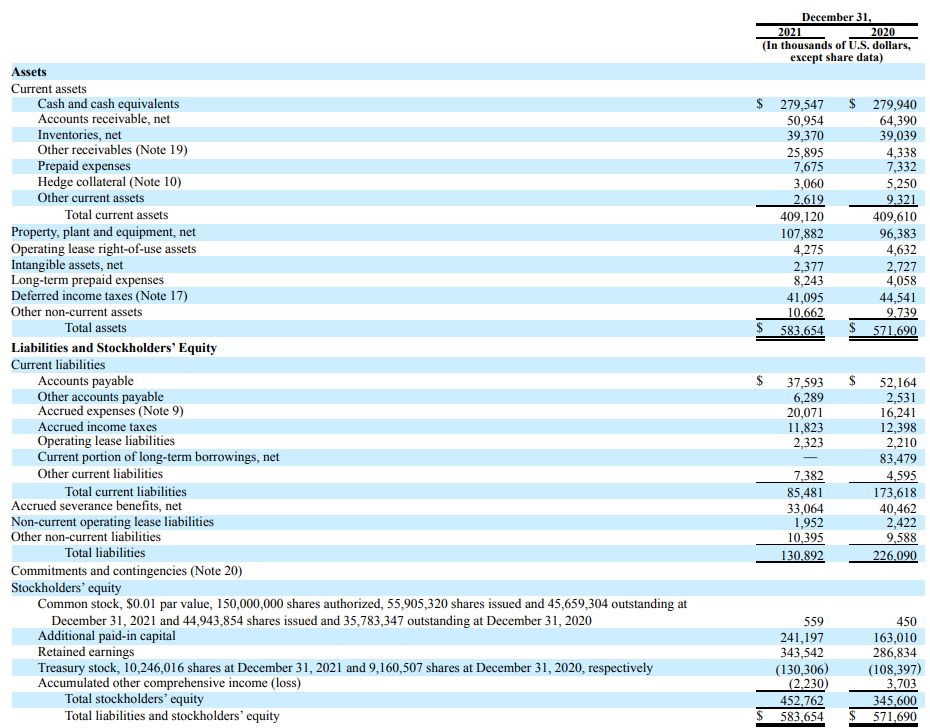

As of the end of 2021 the company had no debt (just some lease liabilities and severance-related liabilities) and almost $280m in net cash. This still excludes the final tranche of the termination fee which was booked as an ‘other receivable’. It’s fair to assume the current net cash position is approximately $300m or $6.55/share.

Magnachip Investor Relations

This means the current share price is backed by a humongous amount of cash as the current net cash position represents approximately 37% of the market capitalization. This means that on an enterprise value basis, an investor is really paying just $11 per share for the underlying cash flow engine, and that’s fine with me.

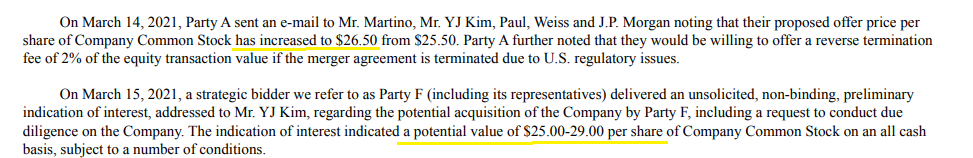

Another reason why I’m comfortable holding the stock if I’d get assigned to purchase the shares at a pre-agreed price is that in the SEC filing related to the 2021 offer made by Wise Road, several other bidders were identified. Just one week before landing on a definitive deal with Wise Road to sell the company for a total consideration of $29/share in cash, several other bidders either made a firm offer or expressed their interest.

Magnachip Investor Relations

This does not mean those bidders will now be back at the negotiation table as the situation has changed and some of the interested parties may have been scared off by the strict antitrust stance. But one thing is quite certain: Magnachip had a lot of eyes on the company and several parties made an offer or were inclined to do so.

Investment thesis

While I usually purely look at companies from a fundamental perspective, Magnachip offers interesting potential to generate returns by writing out of the money put options. I have written a bunch of put options with strike prices of $15 and $17.5 on various expiry dates. At for instance $15 I’d be happy to own the stock knowing that at that point more than 40% of the market cap is backed by the net cash position.

Magnachip is guiding for a free cash flow result exceeding 10% of the revenue by the end of 2023 and this implies the free cash flow result per share will continue to exceed $1. As Magnachip is working on a share buyback program of $75M, the per share performance will only improve from here so I will just continue to write put options and wouldn’t mind if I would be assigned the stock.

Be the first to comment