imaginima/iStock via Getty Images

Introduction

When last discussing Magellan Midstream Partners (MMP), my previous article focused upon how their distribution growth via debt-funded buybacks cannot last forever. This time around, this article focuses upon the biggest challenge coming in 2022 and 2023 for the sustainability of their high distribution yield of 8.59%, which comes about as they now reduce their capital expenditure to the barebones. Since they have also subsequently their released for the fourth quarter of 2021, these will also be reassessed for any material changes.

Executive Summary and Ratings

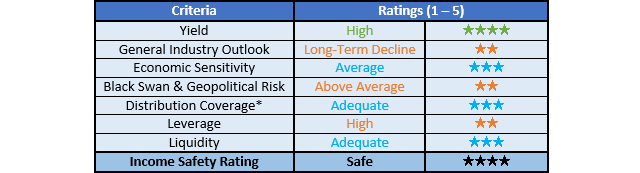

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing distribution coverage through distributable cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

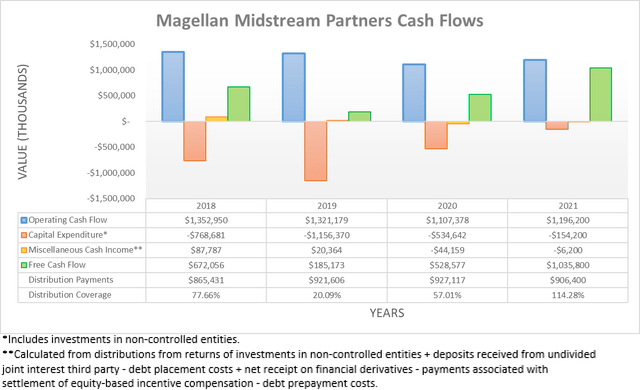

After seeing their cash flow performance stage a solid recovery throughout the first nine months of 2021, it was positive to see this continue throughout the fourth quarter with their operating cash flow ending the year at $1.196b and thus 8.02% higher year-on-year versus their previous result of $1.107b during 2020. When looking ahead into 2022, it seems that their cash flow performance will likely edge slightly lower versus 2021 as their guidance for distributable cash flow is $1.075b and thus 3.85% lower year-on-year versus their result of $1.118b during 2021, as per their fourth quarter of 2021 results announcement.

They are attributing this decrease to their recent divestitures, which were $275.1m during 2021 and forecast to reach a further $435m during 2022. Their operating cash flow should follow a similar path during 2022 given its positive correlation to their accrual-based distributable cash flow, thereby decreasing slightly along with their capital expenditure, as per the commentary from management included below.

“Concerning maintenance capital, we expect to spend around $80 million during 2022, which is very similar to last year’s actuals.”

“Based on projects already committed, we expect to spend approximately $50 million in 2022 on expansion capital.”

-Magellan Midstream Partners Q4 2021 Conference Call.

When their guidance for circa $80m of maintenance capital expenditure is combined with their guidance for expansion capital expenditure of circa $50m, commonly referred to as growth capital expenditure, it sees their total capital expenditure for 2022 at approximately $130m. Apart from being slightly lower than their capital expenditure of $154.2m during 2021, it represents the barebones compared to their previous level of $768.7m and $1.156b during 2018 and 2019 respectively. When this is combined with the likelihood of their operating cash flow edging slightly lower during 2022, it stands to reason that their distribution coverage during 2022 should remain broadly around its adequate result of 114.28% as seen during 2021.

Despite not necessarily posing any risks to the sustainability of their distributions, their thin coverage leaves very little scope for their growth nor the ability to absorb further loss of future earnings. Whilst their unit buybacks can help lower the costs of their distributions, they are coming at the expense of divestitures and debt-funding, which means they cannot last forever as the former merely shrinks the organization and the latter leaves their leverage too high, as my previously linked article discussed.

When thinking further afield into the future, it seems rather concerning that despite making very large investments during 2018-2019, their operating cash flow remains noticeably lower at only circa $1.2b versus its previous results that were over $1.3b during 2018-2019. To be fair, the now infamous Covid-19 pandemic during 2020 did throw a proverbial spanner in the works, although on the flip side, the oil and refined product markets are now running hot but alas, their guidance for 2022 remains below their pre-Covid-19 level.

The concerns become more acute when looking forwards into 2022 as well as into 2023 and beyond with their now barebones capital expenditure providing their biggest challenge yet because with upwards of $1b per annum of capital expenditure failing to produce any noticeable earnings growth, it begs the question of whether their circa $130m of expenditure during 2022 is even sufficient to sustain their earnings.

Even though their continued maintenance capital expenditure should ensure their earnings at least track sideways, the division between maintenance and growth capital expenditure begins to look murky if thinking further into the future. On the surface, it sounds easy to differentiate between growth and maintenance capital expenditure but take the following simple hypothetical scenario for example.

Start by imagining a tiny partnership that leases out ten vehicles, now if one of these requires engine repairs it would obviously be considered maintenance and if during the same year they were to purchase a new vehicle, it would be considered growth since they now have eleven vehicles in their fleet. Although now consider what happens if they scrap their oldest vehicle two years later after reaching the end of its useful life, they are once again left with ten vehicles, which calls into question whether that latest vehicle was really a growth investment.

This very simplified scenario can be scaled up to a larger organization with thousands of assets, thereby highlighting that not every dollar spent on growth capital expenditure will necessarily translate into growth in the medium to long-term. Only time will tell whether their now barebones capital expenditure is sufficient to sustain their current earnings but one aspect that remains known, the fact that their distribution coverage remains thin despite this very low capital expenditure leaves any material distribution growth off the table during the foreseeable future.

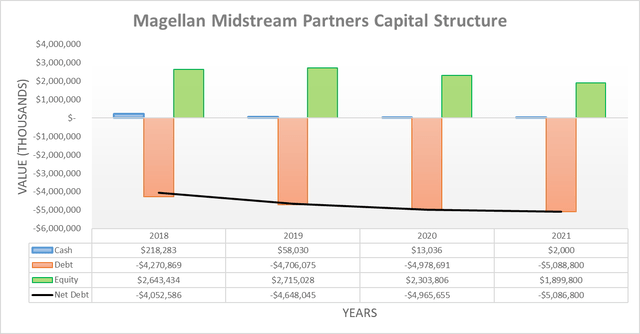

When looking elsewhere, following their solid cash flow performance during the fourth quarter of 2021, their capital structure was essentially unchanged with their most important aspect, their net debt, ending the year at $5.087b and thus within a whisker of its $5.091b when conducting the previous analysis following the end of the third quarter. Since their cash balance and equity also only saw immaterial changes, it would mean that both their leverage and liquidity have also not materially changed, thereby making them rather redundant to reassess and if any new readers are interested in further details, please refer to my previously linked article.

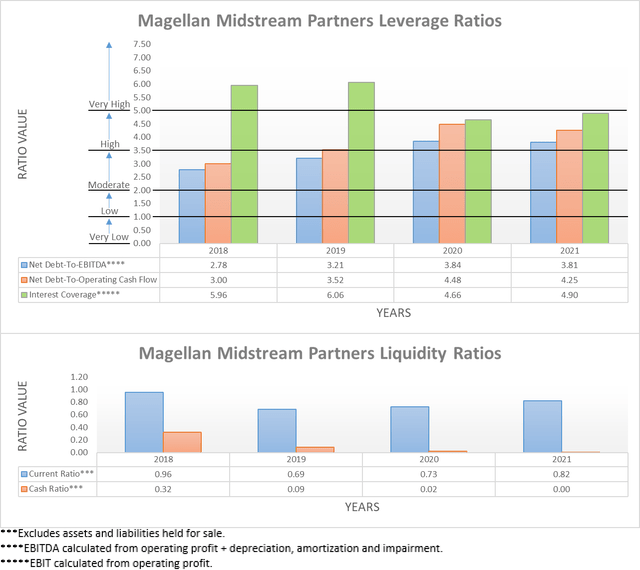

The two relevant graphs have still been included below for reference, which shows that their leverage remains in the high territory with a net debt-to-EBITDA and net debt-to-operating cash flow of 3.81 and 4.25 respectively, whilst their current ratio of 0.82 shows that their liquidity remains adequate.

Conclusion

Despite not having any financial stake, I am still interested to watch how their financial performance transpires across the next two years following their now barebones capital expenditure, which I feel provides the biggest challenge yet for the sustainability of their distributions. Since they at least appear safe for the year ahead and offer a high 8%+ distribution yield, I will be maintaining my buy rating but if their earnings degrade in the coming years, this would likely be downgraded.

Notes: Unless specified otherwise, all figures in this article were taken from Magellan Midstream Partners’ SEC filings, all calculated figures were performed by the author.

Be the first to comment