tibu/iStock via Getty Images

Magellan Midstream Partners (NYSE:MMP) isn’t the first stock you’d think of buying amidst a period of high commodity prices, as its pipelines do not benefit directly from high prices. Yet with the distribution yield hovering around 8.4%, this is a name which may benefit from multiple expansion as its customers use high near term prices to realize long term improvements to their credit metrics. The company has also embraced unit repurchases, a rarity in the midstream sector – and it is the combination of these two factors which may send the stock soaring higher over the long term.

(Important: MMP issues a K-1 tax form. This is typically manageable with tax preparation software but readers should keep this in mind.)

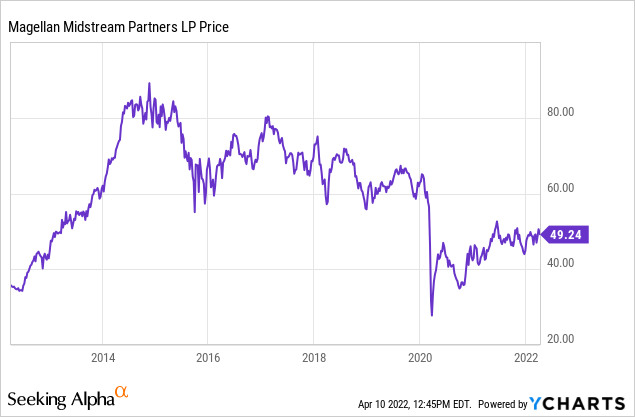

MMP Stock Price

Recently trading hands around $49 per share, MMP has seen its stock trade sideways for the last decade.

The stock has returned 15% since I sold in April of 2021. At that time, I explained my reason to sell as being due to the poor risk-reward proposition, as I viewed the high distribution yield as being more than offset by slow growth and tail-end risk. At the time, MMP had already begun to signal a move towards unit repurchases and lower expansion spending, but I was skeptical at the time. That skepticism has proven misplaced. Even with the stock higher, I am shifting gears and rating the stock a buy as the improved commodity pricing outlook and shift in management capital allocation policy has completely transformed the investment thesis.

MMP Stock Financials

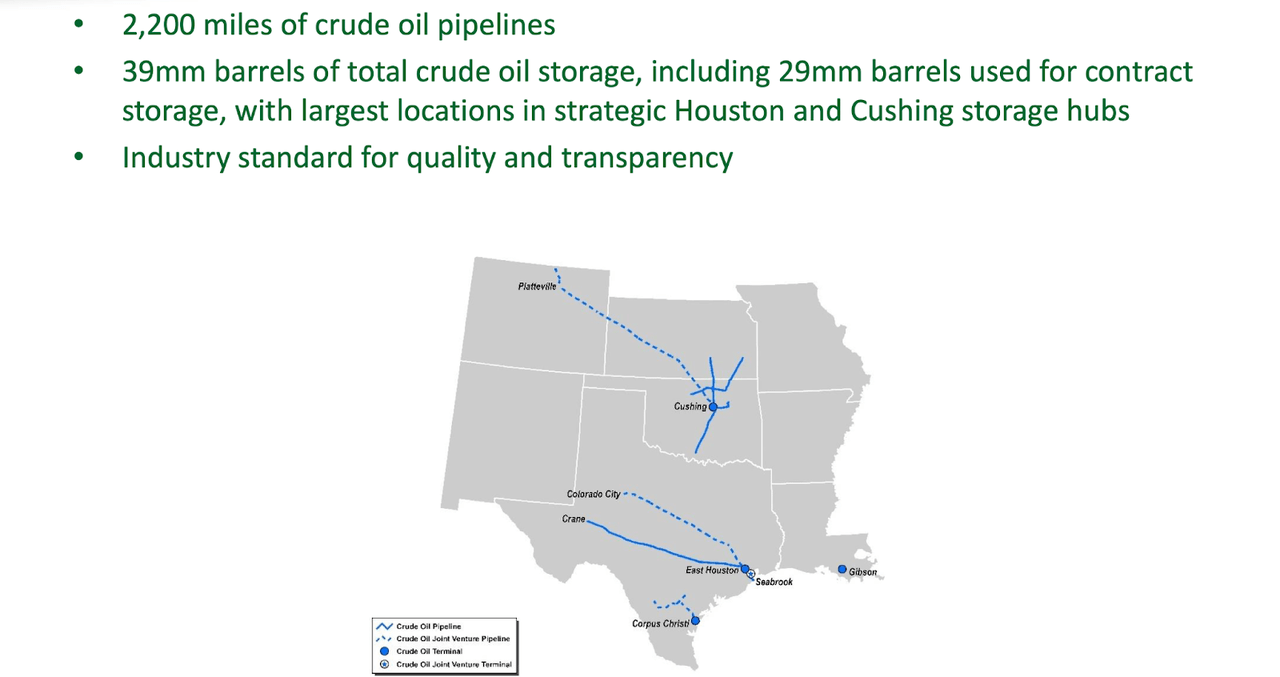

I do not seek to rehash the well known business model descriptions of MMP, so I’ll just state that the company makes money by allowing customers to transport crude oil through its pipeline network.

Magellan Midstream Partners March 2022 Presentation

Let’s get right to the chase. Commodity prices are high – this is well known. What is less well known is the shift in capital allocation policies happening across the midstream sector. Most midstream operators have significantly cut back on expansion plans, as government policies have reduced the ability to start such projects. Operators with high leverage are using these times as an opportunity to reduce leverage – but it is the operators with low leverage which stand to benefit most.

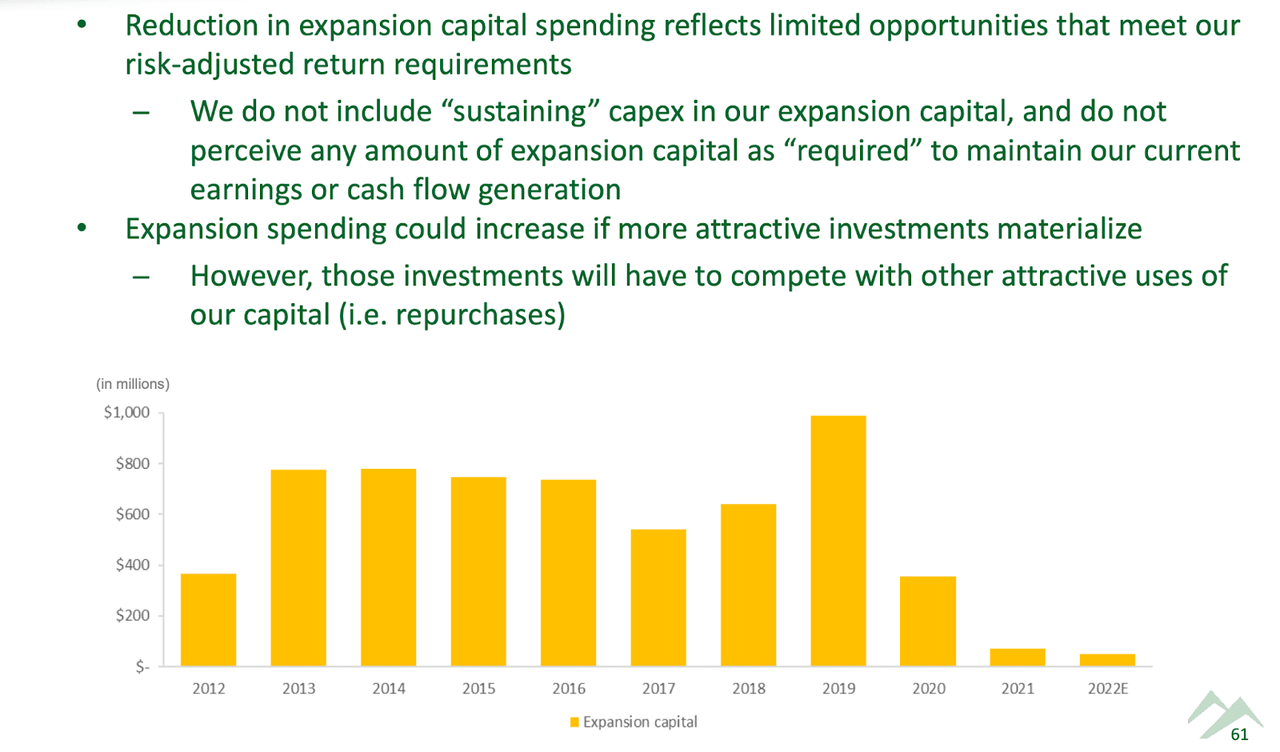

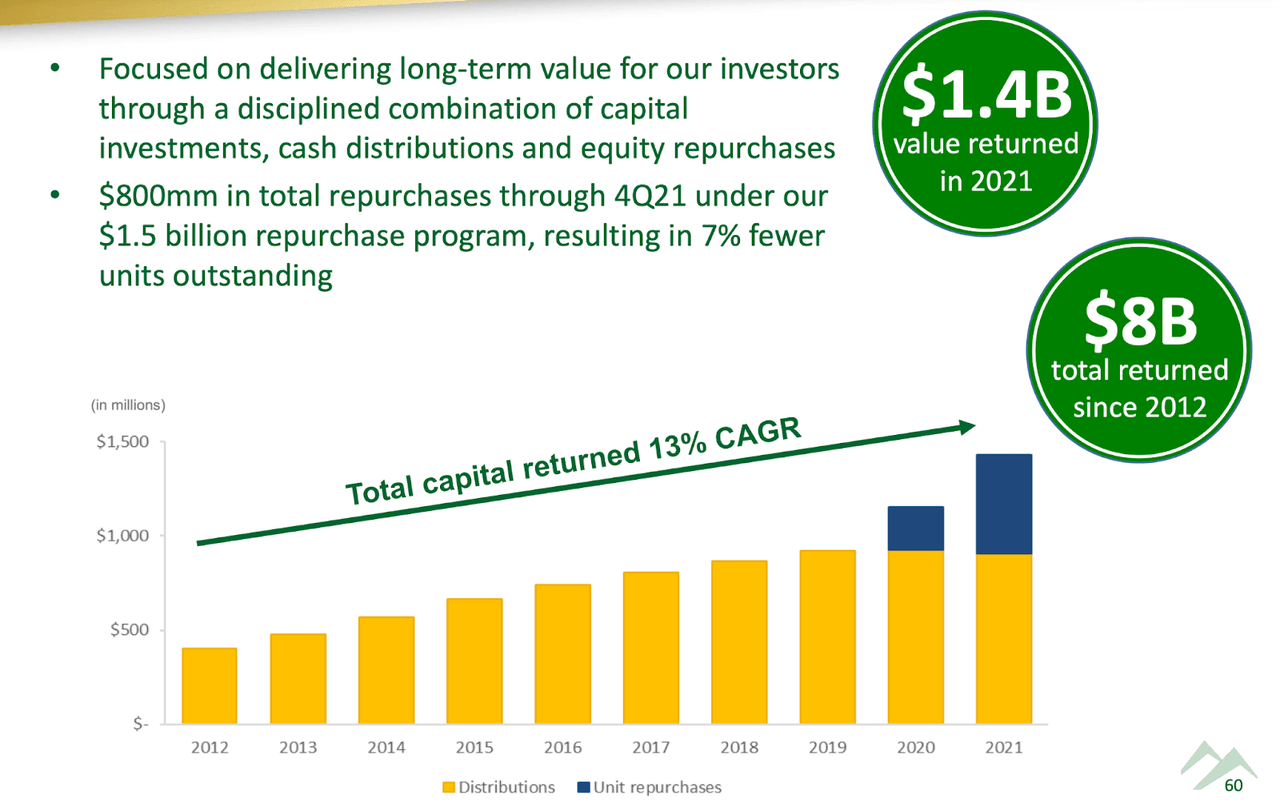

MMP in particular has seen a sudden shift in the investment thesis. Previously, this was a name which had a low 1.2x coverage of its distribution – lower than top tier peer Enterprise Products Partners (EPD). In 2020, MMP reduced expansion capital down to $354.4 million – the company had previously been spending around $800 million annually on growth projects. Combined with $334.9 million of asset sales, this enabled the company to fully fund $927.1 million of distributions with $1.044 billion of distributable cash flow. Historically, distributable cash flow has not been enough to fully cover distributions because of the large outlay for growth projects. In 2021, MMP was even able to fully cover its distribution with distributable cash flow even before accounting for asset sales, primarily because it reduced expansion spending to $73 million. The company has since guided for $50 million of expansion capital in 2022. We can see below that the company has clearly embraced unit repurchases, as it specifically calls out repurchases as being an important alternative to expansion spending.

Magellan Midstream Partners March 2022 Presentation

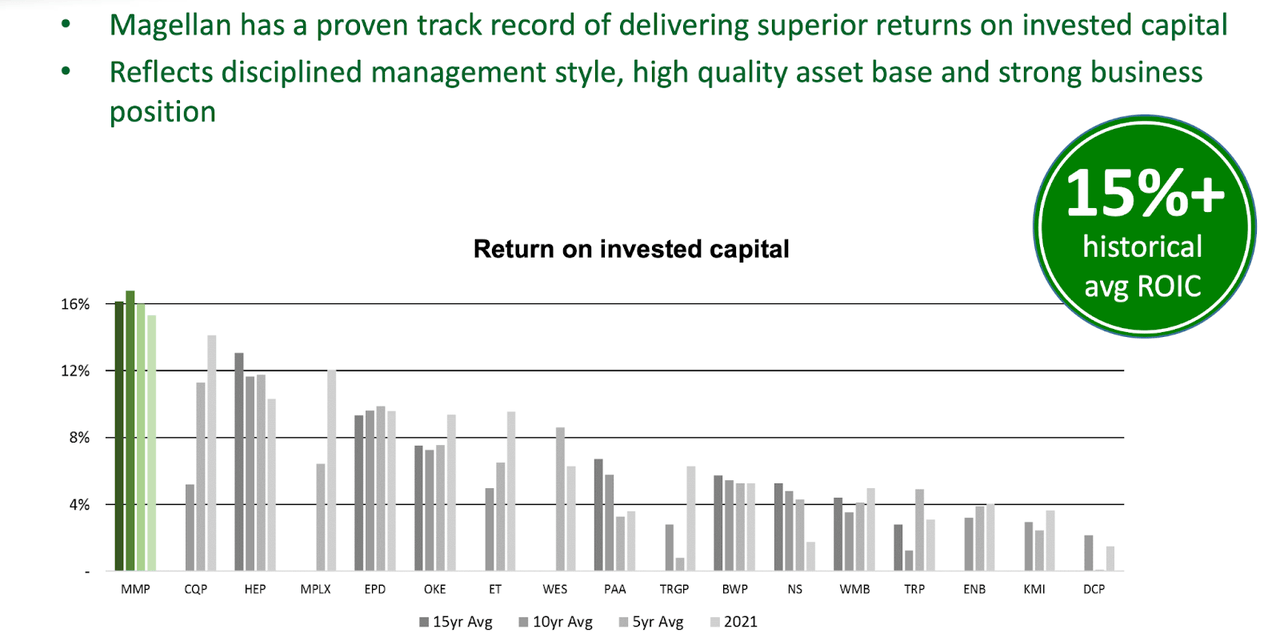

Investors likely have mixed feelings on this development. MMP has historically realized among the highest returns on invested capital, meaning that theoretically investors should have wanted the company to continue spending aggressively on new growth projects.

Magellan Midstream Partners March 2022 Presentation

However, there is no guarantee that the company would be able to realize the same returns in the future. Moreover, while repurchases might not be as accretive as growth projects, they may arguably be more effective in creating unitholder value. MMP had struggled to earn a respectable valuation multiple over the past few years – putting more money in energy-related investments wasn’t doing the trick, even if the company was realizing strong returns on investment. Unit repurchases, on the other hand, represent an efficient catalyst for multiple expansion which is universal across all sectors of the stock market.

We can see below that MMP ramped up unit repurchases in 2021, spending $523 million on repurchases in the year alone.

Magellan Midstream Partners March 2022 Presentation

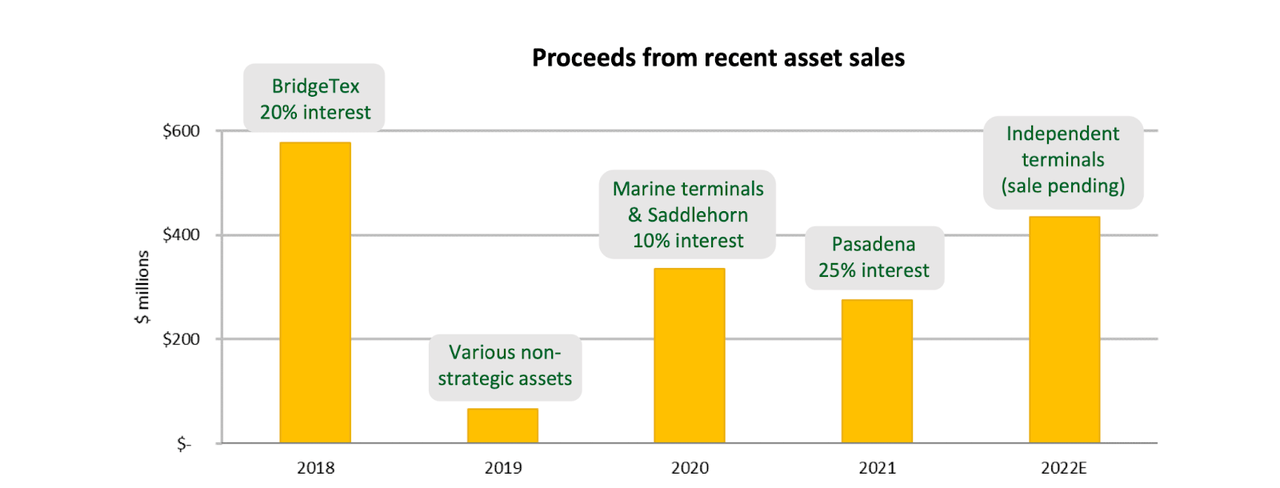

I find it likely that management has emphasized unit repurchases due to the elevated asset sales over the past 2 years. MMP has guided for more than $400 million of asset sales in 2022 as well.

Magellan Midstream Partners March 2022 Presentation

On the conference call, management signaled a willingness to tap debt financing to fund unit repurchases if needed. It is clear that MMP is on board the unit repurchase train, and that has significant impact for unitholders.

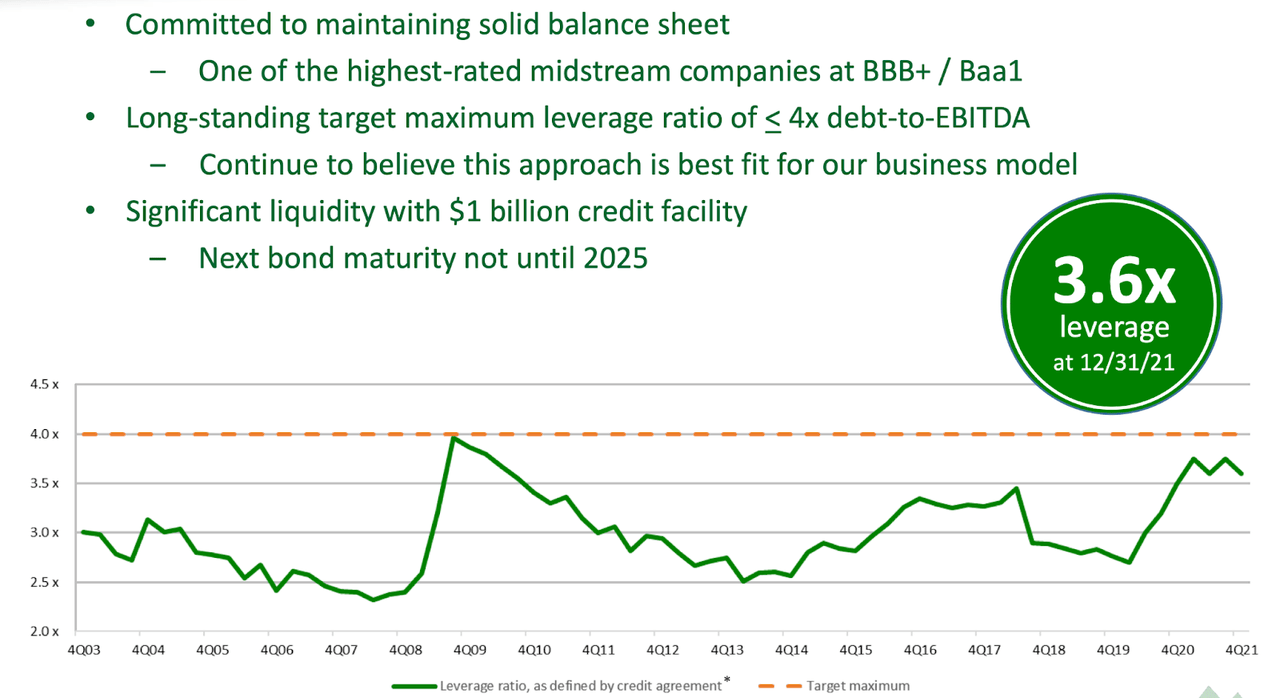

The repurchase has not negatively affected leverage ratios – largely because the company has not spent more on repurchases than is afforded by free cash flow inclusive of asset sales. MMP maintains a low leverage ratio of 3.6x debt to EBITDA. The company’s long term target is 4x debt to EBITDA, leaving some margin of safety.

Magellan Midstream Partners March 2022 Presentation

Is MMP Stock A Buy, Sell, or Hold?

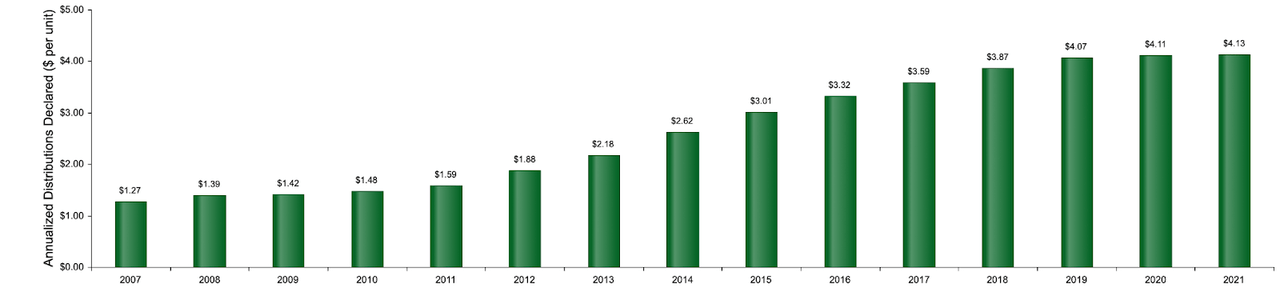

When considering MMP as a potential investment, one might be scared off by the almost nonexistent distribution growth over the past 2 years.

Magellan Midstream Investor Relations website

Yet that misses the picture in my view. With MMP ramping up unit repurchases, distribution growth might not play such an important role in driving unitholder returns moving forward. The stock currently yields 8.43%, signaling great distress. Yet the company has greatly reduced its growth capital ambitions, leading to the distribution to be fully covered. The company maintains a conservatively leveraged balance sheet and has ready access to capital, with no debt maturing until 2025. The unit repurchases are the last piece of the puzzle. Every passing month, the high commodity prices suggests that MMP’s customers are improving their credit profiles as they direct some of the cash windfalls towards reducing balance sheet leverage. So long as MMP is able to sustain some growth, even modest, the ongoing unit repurchases will be quite meaningful at these low valuations. I find it highly unlikely for MMP to continue yielding 8.4% if it sustains growth and is repurchasing units – I challenge readers to find any stock which has maintained some level of growth alongside repurchases and has not eventually realized significant multiple expansion. I can see MMP trading up to a 6.5% yield – representing 23% upside from multiple expansion alone. Throw in the 8.43% yield, and MMP can deliver above-market returns for many years to come.

The main risk here is twofold. First, if commodity prices collapse rapidly, then the thesis regarding improving customer credit metrics implodes. There is also no guarantee that MMP’s customers are prioritizing debt paydown versus returning cash to shareholders or worse, starting new expansion projects. The second risk is if management changes tune and ceases unit repurchases in favor of new expansion projects or external acquisitions. EPD has favored the latter as evidenced by its $3.25 billion acquisition of Navitas Midstream. Unit repurchases is crucial to the multiple expansion thesis. Without multiple expansion in play, my former concerns regarding slow growth and tail-end risk remain largely in play.

With management appearing to be fully on board with unit repurchases and there being little indication of oil prices falling any time soon, I rate MMP a buy and expect multiple expansion to occur over the next few years as the market gives the company credit for improving distribution safety and prioritizing unitholder returns.

Be the first to comment