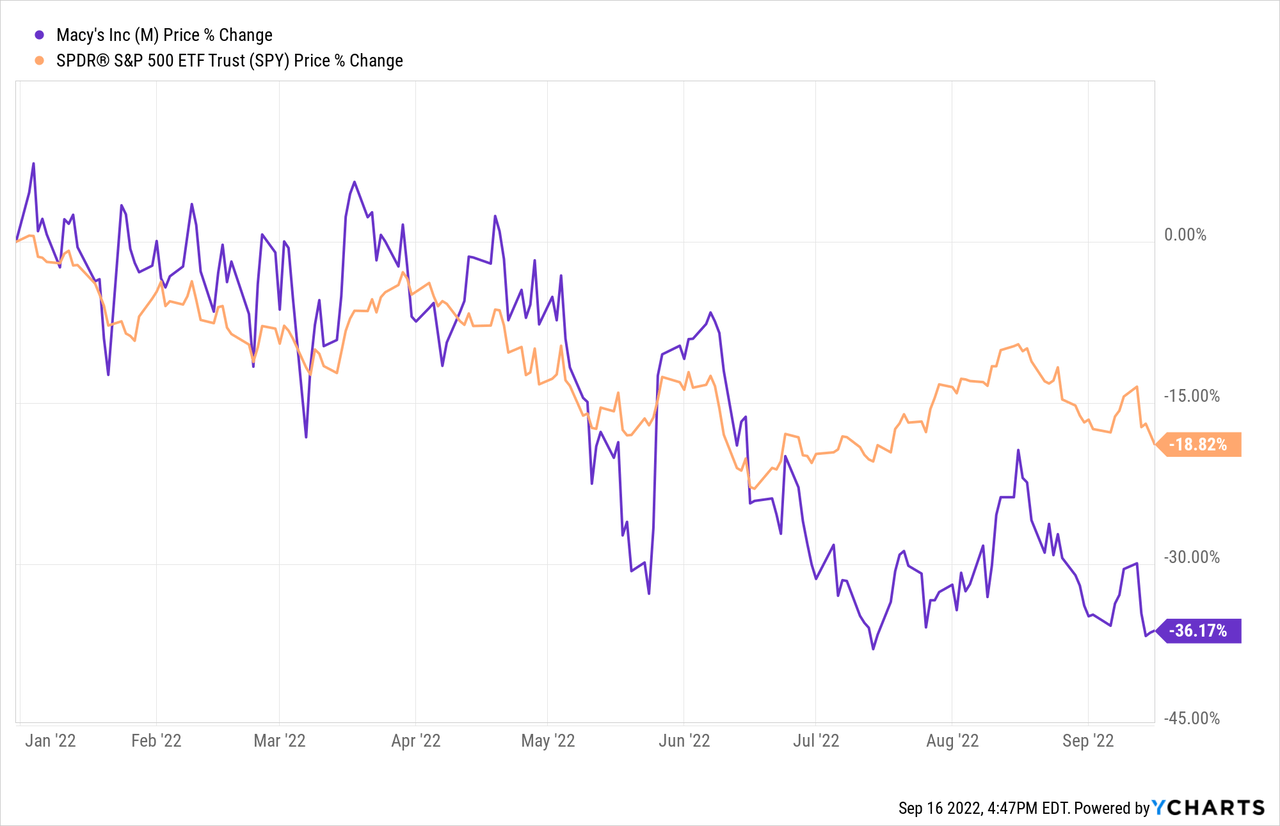

Macy’s (NYSE:M) stock is down by about 36% year-to-date, substantially underperforming the broader market, which has lost slightly less than 19% in the same period.

In this article, we will look at some of the pros and cons of investing in Macy’s business during the current market environment, focusing mainly macroeconomic factors, valuation and the latest earnings report of the firm.

Let us start our discussion with the cons.

Consumer sentiment

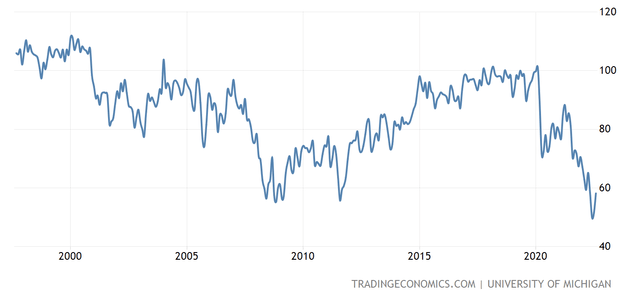

Consumer confidence is a leading economic indicator that can gauge the overall sentiment of the consumers. Low confidence is an indication that people are uncertain about their financial outlooks, which can lead to an increase in savings and coincidentally a decrease in spendings. Consumer confidence is therefore often used to form expectations about the change in consumer spending trends in the near future.

When people decide to spend less and save more, they are likely to start reducing or delaying the purchases of durable, discretionary, non-essential items. At a later stage, the spending on services may also be impacted.

By looking at the chart below, we can see that consumer confidence in the United States has been sharply declining since the beginning of 2020, despite the short uptick in the second half of 2020.

U.S. Consumer confidence (Tradingeconomics.com)

As Macy’s is described as a company that “sells a range of merchandise, such as apparel and accessories for men, women, and children; cosmetics; home furnishings; and other consumer goods”, it is likely to be directly influenced by the low consumer confidence.

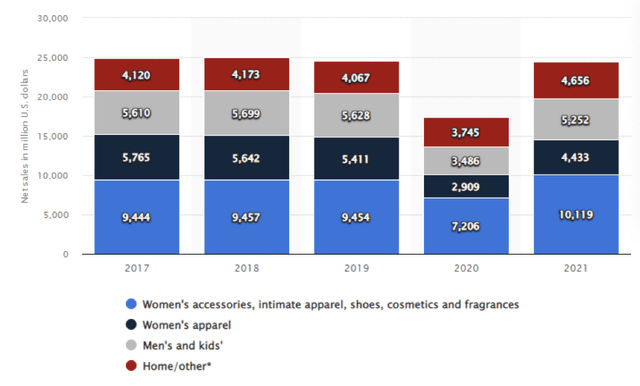

Sales by product category (Statista.com)

While we expect all product categories to be impacted, we see the largest risk associated with the home/other category.

In our opinion, as long as we do not see a material and lasting increase in the consumer confidence levels, Macy’s is likely to keep underperforming the broader market.

Q2 financial results

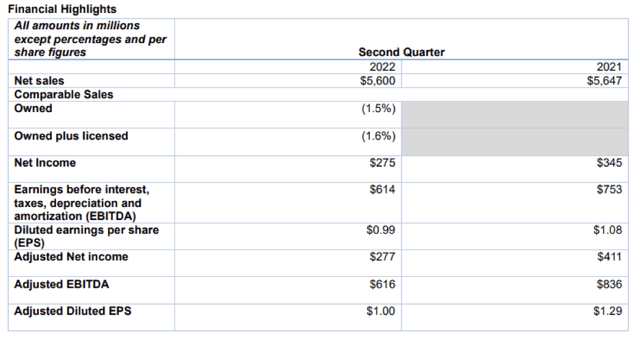

In August, Macy’s has reported their second quarter financial results, which we were not particularly impressed with.

Net sales, EBITDA and net income were all down compared to the same period a year ago. Inventory increased by 7% year-over-year, a tendency that we have seen across many firms in the industry, due to the supply chain issues. The contracting gross margin, driven by “a year-over-year increase in permanent markdowns within the Macy’s brand, largely driven by pandemic-related categories, seasonal goods and private brand merchandise”, is also raising concerns for us.

The firm’s guidance for the rest of the year is also not particularly promising. As we pointed out earlier our concern regarding declining consumer confidence and its potential impact on Macy’s, the firm also increasingly sees this trend as a risk, along with the inventory related issues:

The company’s lower outlook for the remainder of the year incorporates the risk it sees in the continued deterioration of consumer discretionary spending in some of its categories and the level of inventory within the industry, as well as risks associated with a more pronounced macro downturn. This outlook reflects a careful view of the impacts of the pressures faced by the consumer and those placed on the business given the weakening macroenvironment. Additionally, the company’s outlook incorporates the markdowns and promotions it anticipates needing to liquidate aged inventory and further reduce the merchandise category stock to sales imbalances by the end of the year.

Further, by looking at the quick ratio of the firm, 0.11, we believe that the financial flexibility of Macy’s is relatively poor. In a challenging macroeconomic environment, like today’s, we like to invest in businesses that have more cash on hand to potentially better weather the headwinds.

Based on the second quarter results, we believe that there are more attractive firms to invest in right now.

As we would like to remain balanced in our discussion, let us take a look at a few points that we actually like about Macy’s.

Valuation

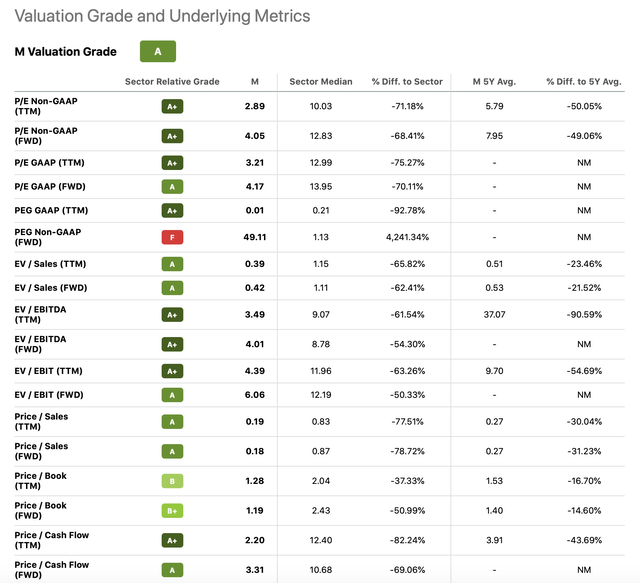

By looking at a set of traditional price multiples, Macy’s stock appears to be significantly undervalued. The following table shows these multiples.

Valuation metrics (Seekingalpha.com)

Both compared to the consumer discretionary sector median and the firm’s own 5Y average, the current multiples are substantially lower. In our opinion, despite the macroeconomic headwinds, such low multiples and such a steep discount compared to the sector may not be justified.

Commitment to returning value to shareholders

Macy’s has been committed to return value to their shareholders, both in the form of quarterly dividend payments and share repurchases, for years.

Share repurchase programs

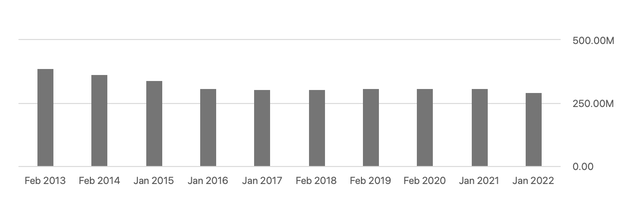

Over the last decade, Macy’s has reduced their number of share outstanding by as much as 30%.

Shares outstanding (Seekingalpha.com)

Last year, the firm has bought back shares for $500 million, while in February the board has approved a further $2 billion repurchase program, stating that “We do expect to have meaningful repurchases over the next several years,”.

To put this amount in perspective, Macy’s market cap currently is $4.5 billion. The $2 billion share repurchase program therefore can have a substantial impact on the stock price.

Dividends

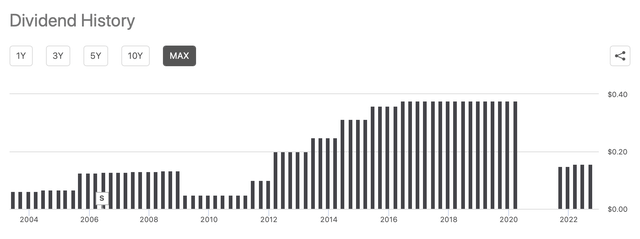

Macy’s has been paying dividends since 2004, with a pause in 2020-2021. Although we like when firms have a long track record of paying safe and sustainable dividends, uninterruptedly, we understand the need for pausing the dividend, and rethinking the capital allocation priorities, as a result of the COVID-19 pandemic.

Dividend history (Seekingalpha.com)

M currently pays a quarterly dividend of $0.16 per share, which translates to an annual yield of about 3.8%. In our opinion, this dividend is safe and sustainable, even if sales and earnings slightly decline, as the current payout ratio is only 11%.

All in all, we like Macy’s approach of returning value to the shareholders.

Key takeaways

The macroeconomic headwinds continue to keep negatively impacting Macy’s business. We do not expect an improvement in the environment for the rest of 2022.

The disappointing Q2 results, including declining sales, contracting margins and inventory related issues, combined with a not particularly promising guidance, are also indicating that there may be further downside risk in the near term.

On the other hand, Macy’s commitment to return value to its shareholders may look appealing, especially as the stock is trading at a significant discount compared to both the sector and its own 5Y average.

For these reasons, we rate Macy’s as “hold”.

Be the first to comment