RichLegg

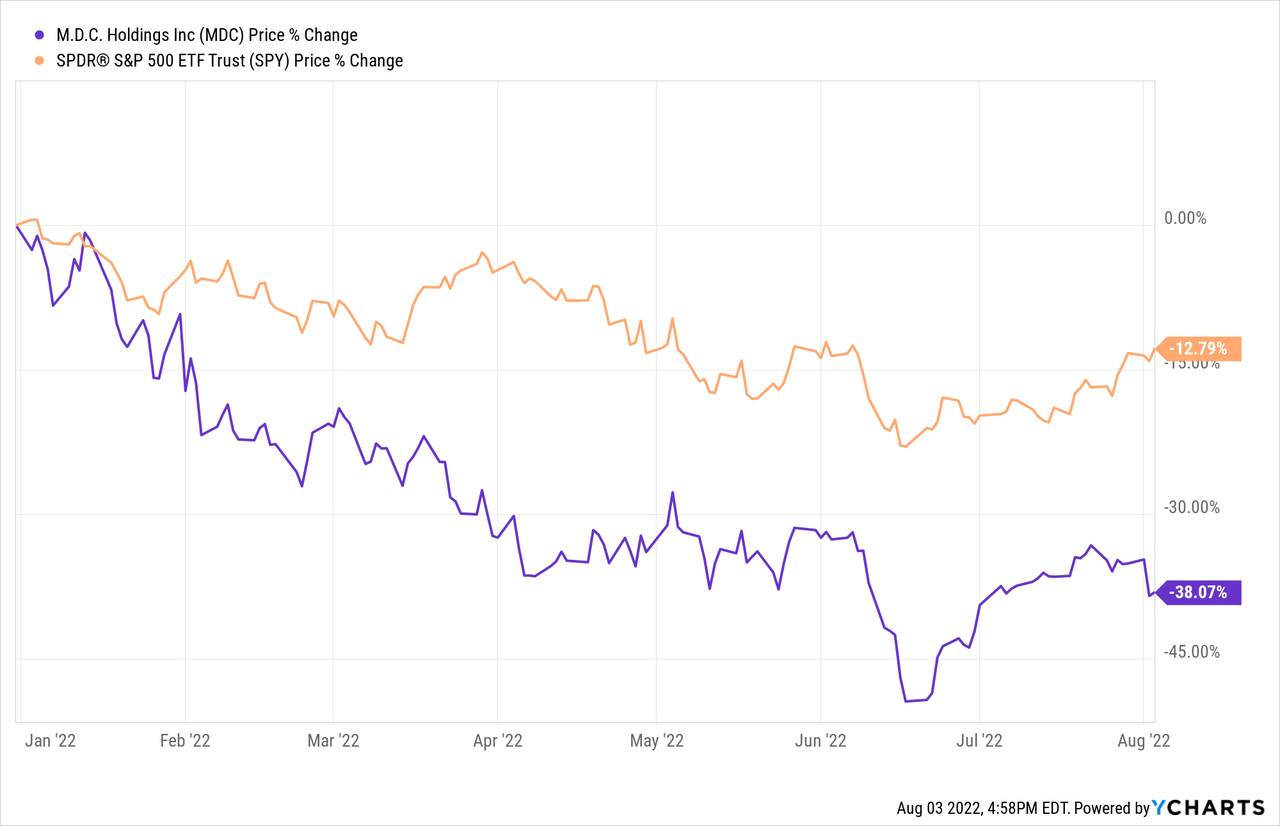

M.D.C’s (NYSE:MDC) stock price has fallen by as much as 38% year to date, substantially underperforming the broader market, which has declined by about 13% in the same time period.

In our opinion, the sell-off is justified due to the current macroeconomic environment. In this article, we will analyse what macroeconomic factors could be primarily shaping MDC’s stock price in the near term, and highlight some of the pros and cons of investing in the firm now.

To start our discussion, we will first take a look at the recently released second quarter financial results.

Q2 Financial results

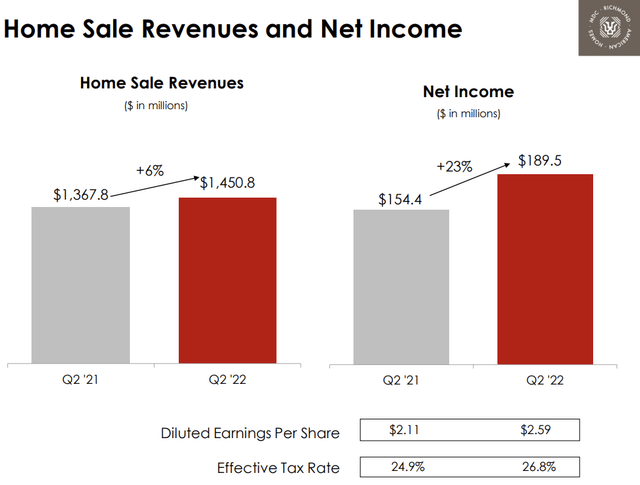

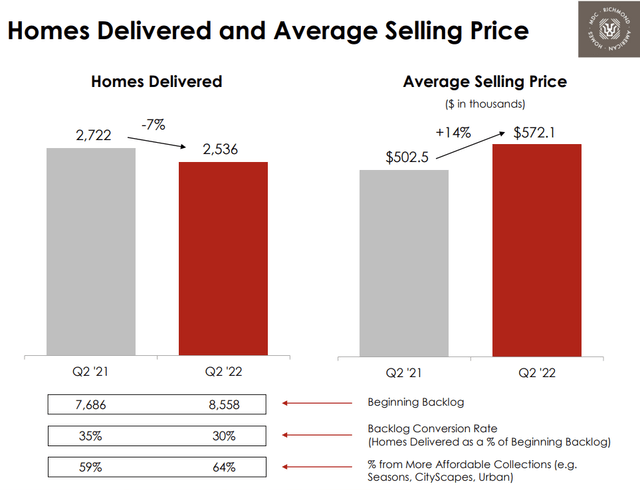

In the second quarter of 2022 home sale revenues increased 6% to $1.45 billion from $1.37 billion. While this figure alone may sound promising, we have to understand that this increase in home sale revenue was primarily driven by the increase in average selling price of deliveries, which were up 14%, reaching $572,000. On the other hand, unit deliveries were down by 7% totaling to only 2,536 units, indicating a significant decrease in demand compared to the prior year.

Revenue and net income (M.D.C.)

Homes delivered and avg. selling price (M.D.C.)

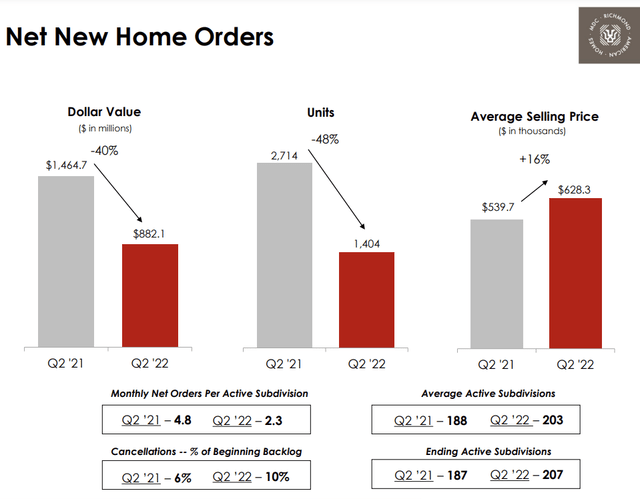

Further, project abandonment expense has also skyrocketed, reaching $15.5 million in Q2 2022 vs. $1.1 million in Q2 2021. This increase in expenses is combined with a 40% decrease in dollar value of net new orders and an increase in the cancellations as a percentage of beginning backlog by 400 basis points to 9.7% from 5.7%.

Net new home orders (M.D.C.)

While we are not particularly impressed by MDC’s financial performance, due to the current macroeconomic environment the relatively poor performance driven by the decreasing demand was expected.

Macroeconomic environment

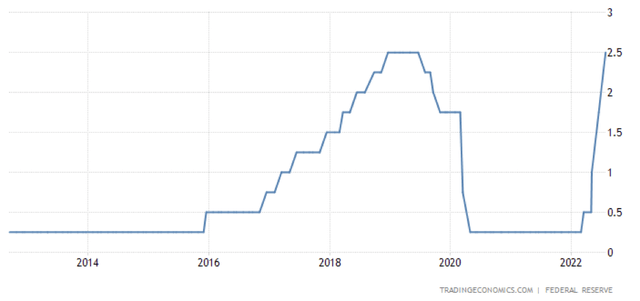

First of all, the rapidly increasing interest rate has begun to make mortgages more expensive and less accessible for many potential home buyers.

U.S. Interest rates (tradingeconomics.com)

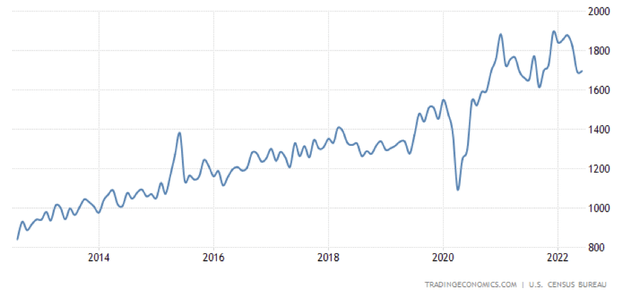

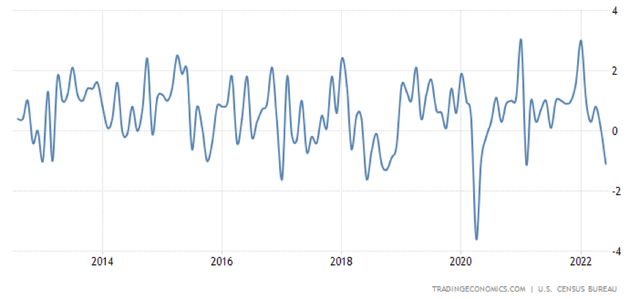

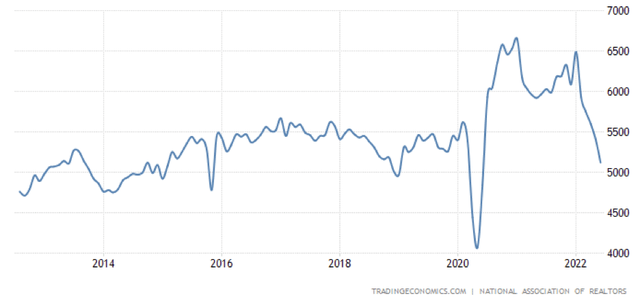

Several economic indicators were in fact pointing to a potentially slowing housing market in 2022, including number of building permits issued, construction spending, existing and new home sales.

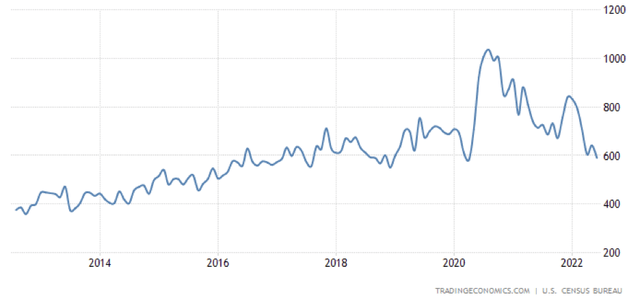

Building permits (tradingeconomics.com)

Construction spending (tradingeconomics.com)

Existing home sales (tradingeconomics.com)

New home sales (tradingeconomics.com)

Other macroeconomic factors, like rising inflation and the unfolding geopolitical tension in the Eastern European region, have also had a significant influence on consumer sentiment. In an environment where consumer confidence is low or steadily declining, potential home buyers may be reluctant to make a purchase that requires a large amount of capital and often a large mortgage. They would likely delay buying a new home until their financial outlook becomes more clear and the environment becomes more favorable for them.

While we expect the macroeconomic environment to remain challenging in the near future for both home builders and home buyers, we need to understand whether the current drop in the share price could be a good buying opportunity.

Pros and cons of investing now

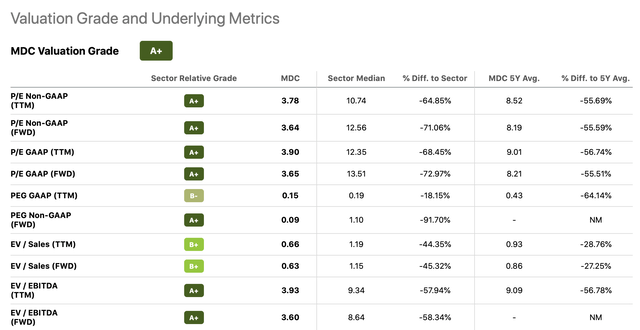

By looking at a set of traditional price multiples, MDC appears to be significantly undervalued compared to both its peers and its own historic average.

The following table summarizes some of the key ratios used for valuation purposes.

Valuation (seekingalpha.com)

We can see that both in terms of price-to-earnings and EV-to-EBITDA the firm is trading at a more than 50% discount compared to the sector median and also to its 5 year average. Despite the challenging macroeconomic environment and a slowing demand, we believe that the current valuation appears to be attractive.

Naturally, however, one of the main questions now is: have we seen the bottom yet?

To answer this question, we will consider two elements:

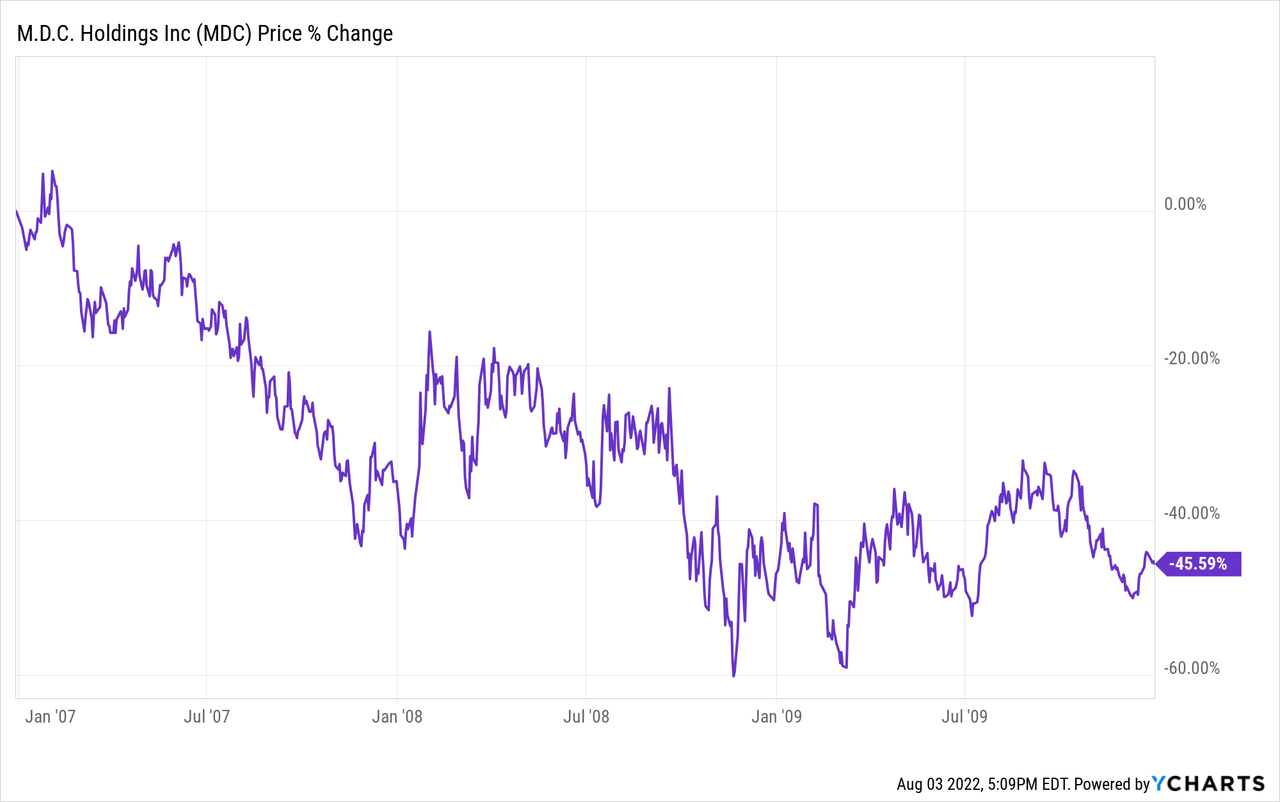

1. Performance during the burst of the housing bubble

The following chart depicts, how MDC has performance between 2007-2010, the period when the housing bubble popped, leading to a financial crisis.

We can see that in this period, at the bottom, the stock price was down by as much as 60% from its peak, reached in 2009. Although, in our opinion, the current situation is not as severe as it was in 2008, we believe that further possible downside risk should not be ignored.

2. Rising interest rates

While interest rates have been already hiked several times, there are still some more ahead. The extent of these hikes are largely dependent on how the inflation rate develops in response to the FED’s actions. As long as the uncertainty remains high regarding the rate hikes, the demand for mortgages are not likely to increase, which could lead to a further declining demand for new housing units.

For these reasons, despite the attractive valuation, we remain cautious about prematurely recommending to buy the stock.

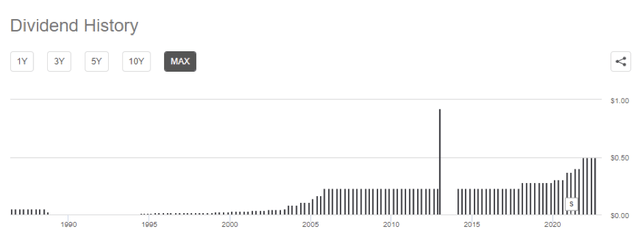

This is not the end of the story, however. Many investors own MDC for its dividends. The firm is currently paying a quarterly dividend of $0.5 per share, which is equivalent to an annual dividend yield of 5.8%.

Dividend history (seekingalpha.com)

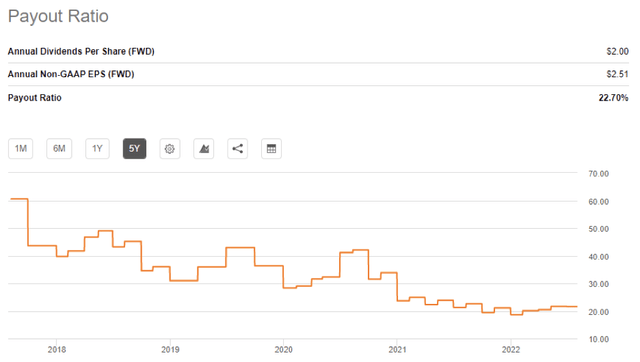

In fact, the firm has been paying dividends each year in the last 27 years. While the payment was constant for a relatively long time, between 2005 and 2018, in the last years the firm has started to increase their payments, which was driven by the improving financial performance. While the dividend payments were increasing, simultaneously the payout ratio was trending downwards. The current payout ratio of 22.7% appears to be safe and sustainable, even if demand decreases further.

Payout ratio (seekingalpha.com)

Due to these facts, we believe that the stock may be suitable for dividend and dividend growth investors, however the above discussed potential downside risk should not be ignored.

Key Takeaways

MDC’s second quarter performance indicated a declining demand for new units, which was however to some extent expected due to the challenging macroeconomic environment.

While MDC’s stock price has declined significantly year to date, and substantially underperformed the broader market, the bottom for the stock price may not yet be in.

On the other hand, the stock appears to be attractive from a valuation point of view and it offers a safe and sustainable dividend of almost 6%.

Currently we rate the stock as “hold”.

Be the first to comment