olm26250

Thanks to the recent pullback in energy prices, there are now numerous attractive opportunities across the energy value chain. Two that look particularly attractive to us at the moment are LyondellBasell Industries N.V. (NYSE:LYB) – a chemical company that also refines crude oil into gasoline and distillates – and Energy Transfer LP (NYSE:ET), a midstream infrastructure business. Both combine freshly deleveraged investment grade balance sheets, high current yields, cheap valuations, and strong payout growth. In this article, we will look at these two stocks.

LYB Stock: Why We Bought Back In

Back on May 20th, we wrote an article explaining Why We Just Sold LyondellBasell Industries Stock. In it we stated:

While we remain bullish on its fundamentals, the stock has generated tremendous returns since we bought it, even as the broader market (SPY) has sold off over that span. As a result, LYB now trades near our Buy Under Price estimate. It offers a decent, but unimpressive, 4% dividend yield, even as other high-yielding opportunities are looking more attractive than ever. We, therefore, decided to sell our LYB shares at a price of $111.43 to lock in very strong 30% total returns in less than half a year (77.76% annualized total returns). We recycled the capital elsewhere into opportunities trading at deep discounts to our fair value estimate and offering yields well in excess of LYB’s 4%.

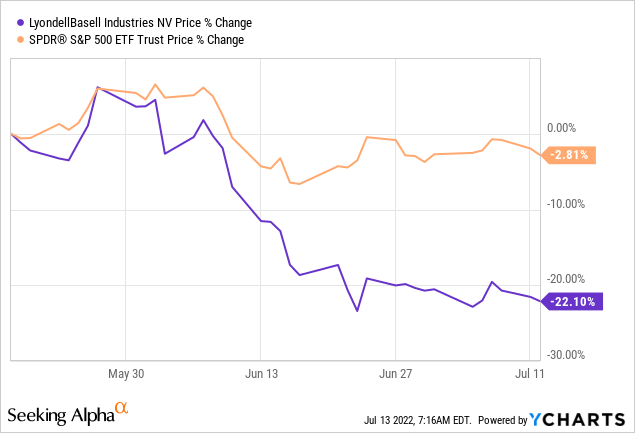

Since then, however, LYB has pulled back sharply and is now back under our Strong Buy target price:

As a result, we recently decided to buy back in.

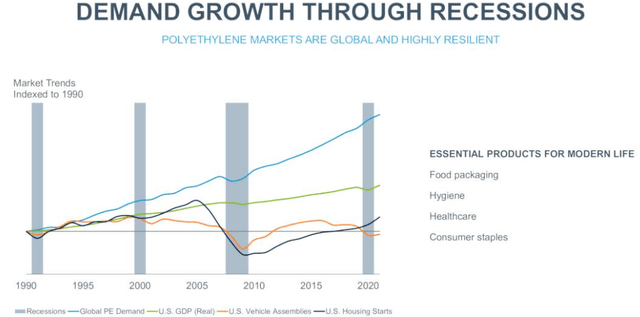

Our thesis on LYB is essentially that it is a leading producer of essential industrial materials, with a diverse cash flow stream that contributes to a fairly stable cash flow profile. In fact, management shared this chart in its recent quarterly report that shows how polyethylene markets are much less impacted than other major sectors during economic downturns as its products are required to produce essential products such as food packaging, hygiene products, healthcare products, and consumer staples products:

Polyethylene Demand (LyondellBasell)

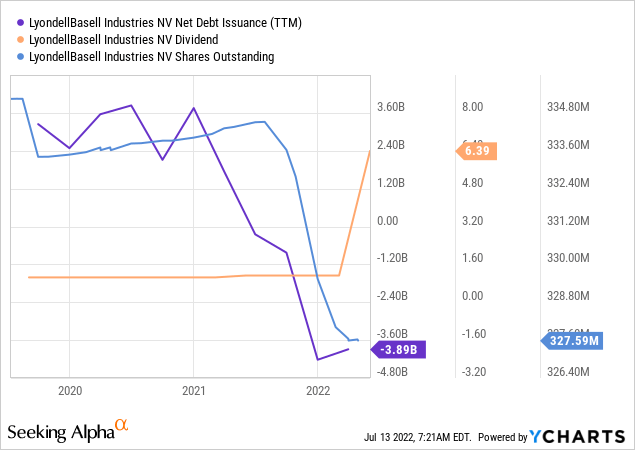

Meanwhile, management has aggressively paid down debt in recent years, has significantly accelerated dividend per share growth, and has begun buying back shares aggressively:

These efforts have resulted in LYB recently receiving a credit rating upgrade to BBB (stable outlook) from S&P and have freed up management to even more aggressively focus on returning capital to shareholders.

Last, but not least, its fundamentals are excellent right now as it recently reported its strongest first quarter since 2015. Over the past twelve months, LYB has generated a whopping $8.6 billion in cash from operating activities with an 88% cash conversion ratio that gives it a 26.9% free operating cash flow yield at its current share price.

This massive cash generation is being allocated in a balanced manner by management into growth investments, further net debt reduction, growing the dividend, and buying back shares opportunistically. In Q1, management repurchased ~2.1 million shares and emphasized on the earnings call that:

we plan to continue rewarding shareholders through a growing dividend and share repurchases.

Management also implied that share repurchases will likely be significant this year, stating:

While I probably won’t give guidance on the level of share repurchase activity that we intend to execute to the balance of the year, what I can say is we expect to generate a lot of free cash flow. It’s not our intention to build any meaningful cash balances on sheet. Therefore, the expectation is that you can expect that we’re going to return copious amounts of free cash flow to our investors.

Given the current share price, we view this as a very prudent idea by management since by virtually every metric LYB looks cheap. Its EV/EBITDA is 4.69x, which is over two turns below its five-year average of 6.82x. Its Price to Normalized Earnings ratio of 5.15x is also well below its five-year average of 8.86x. Meanwhile, its dividend yield of 5.36% is above its five-year average of 5%, its operating free cash flow yield of 26.9% is incredible, and its free cash flow yield of 16.61% is more than double its five-year average of 8.11%.

When you combine what will likely be an aggressive capital return program with its attractive growth projects underway, the total return profile is mouthwatering.

ET Stock: Why We Bought More

Meanwhile, midstream giant ET remains one of our favorite picks in the current environment.

First and foremost, ET is quite recession and commodity price resistant, with only about 10% of its adjusted EBITDA being sensitive to commodity prices and the business posting remarkably stable EBITDA numbers through past recessions and energy price crashes. During the Great Recession, EBITDA increased from ~$1 billion in 2007 to over $1.4 billion in 2009 while distributable cash flow per unit increased from $0.40 in 2007 to $0.55 in 2009. During the energy price crash of 2018, distributable cash flow per unit continued to grow and EBITDA soared by 29.9% that year and grew by another 17.9% in 2019.

While EBITDA did take a 6.1% hit in 2020, this is a remarkably small decline given the massive and unusual headwinds the industry faced that year and how strong its comparables were heading into that year. On top of that, ET rebounded strongly in 2021 by posting new all time highs for EBITDA generation and distributable cash flow per unit.

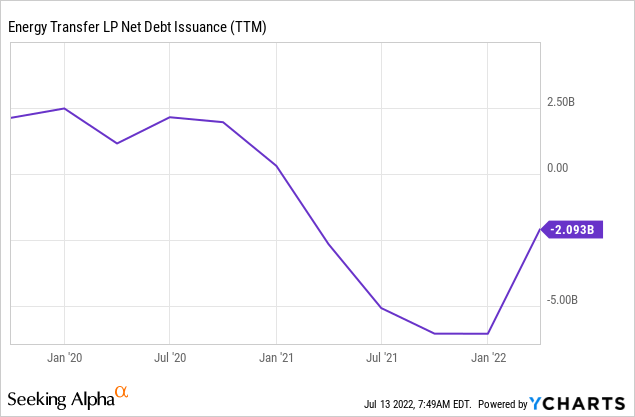

ET also offers a very attractive current distribution yield of 8.26% and management is committed to growing the payout by over 50% in the coming quarters and years to a stated goal of $1.22 per unit per year, which would be a 12.6% yield on current cost. With the balance sheet freshly deleveraged thanks to billions of dollars in net debt reduction over the past year and a half, ET is increasingly being freed up to aggressively return capital to unitholders:

Last, but not least, ET is extremely attractively priced right now. The expected forward distribution yield based on analyst expectations is a whopping 10.1%, above its five-year average of 9.36%, the EV/EBITDA ratio is 7.61x, roughly 1.5 turns below is five-year average of 9.17x, and the free cash flow yield is 17.20% compared to its five-year average of 14.17%. Last, but not least, its distributable cash flow yield of 25% illustrates just how cheap this business really is.

Investor Takeaway

Both LYB and ET play mission-critical roles in the energy value chain and have proven to be fairly recession resistant. Meanwhile, both are extremely cheap right now with operating free cash flow/distributable cash flow yields of 25%+ and have freshly deleveraged balance sheets that free up management to aggressively return cash to equity investors.

We are bullish on both and look forward to receiving the juicy current yields along with aggressive capital return growth in the years to come.

Be the first to comment